Investment Thesis

monday.com Ltd. (NASDAQ:MNDY) has a lot going for it. On the surface, the stock is not cheap. I estimate that monday.com is priced at approximately 37x forward free cash flow.

However, the business has no debt and more than $1.2 billion of cash and cash equivalents. But crucially, the business is still growing at approximately 30% CAGR not only this year, but probably in 2025, too.

Altogether, there’s a lot to like here. As such, I believe that in the coming few months, investors will look back to $225 per share as a bargain price.

Rapid Recap

In my previous analysis, back in March, I said,

Essentially, this is the bear and bull case. The bear case notes that monday.com is facing consistent deceleration in its revenue growth rates. While the bull case highlights that notwithstanding its decelerating revenues, the business is rapidly becoming increasingly profitable so that its valuation is cheaper than it appears at first glance.

This insight, when taken together with the fact that just over 10% of its market cap is made up of cash, means that paying 35x forward free cash flows is a fair entry point for investors.

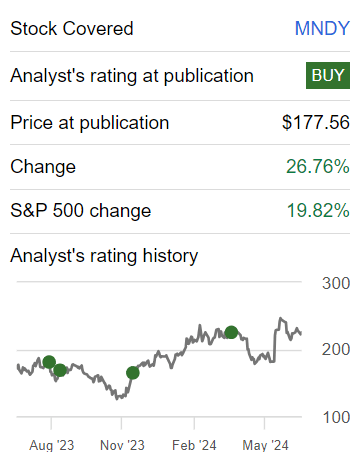

Author’s work on MNDY

As you can see above, monday.com is a stock that I’ve been bullish on for some time. Now, looking ahead, I remain bullish. Even though, its share price has been rather volatile.

Why monday.com? Why Now?

monday.com helps businesses organize and manage their work. It provides tools to streamline workflows, and enhance team collaboration.

monday.com near-term prospects appear strong. monday.com has had success with recent adjustments in its pricing model. The new pricing, implemented in waves, has shown positive results in terms of customer retention and churn rates, indicating a strong value proposition, I’ll discuss this in more detail momentarily.

Also, the introduction of new products like monday Sales CRM and monday Dev has been met with enthusiastic adoption, further driving account growth and expanding their customer base.

Later in 2024, features like AI Automations, Smart Columns, and AI-Powered Templates are expected to integrate AI into daily workflows, providing users with advanced tools to improve efficiency.

Next, I’ll discuss a contentious consideration.

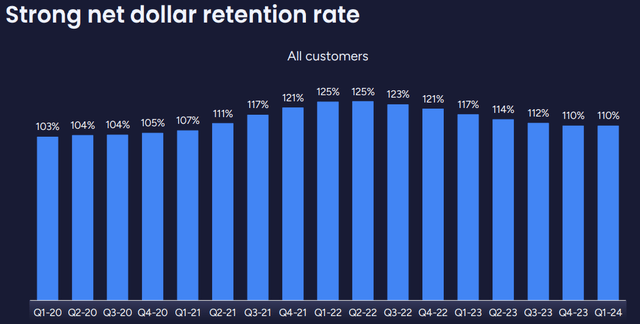

MDNY Q1 2024 presentation

The graphic above is likely to put off many investors. Why? Because it shows that MNDY’s net dollar retention rates have been trending down since 2022, despite pricing increases being flowed through to its customers. But I actually welcome the fact that net retention rates are coming down. Allow me to explain.

I purposely avoid companies that have strong DBNRR (net retention rates or similar variants). This may sound odd. But here’s the thing, I know from experience that pricing power only takes you so far.

All those companies that rely on gouging customers’ bills each month with consumption-based revenues have broken business models. It’s the same as Blockbuster with late fees versus Netflix (NFLX) with binge-watching. Which business did better in the end?

Or look at Snowflake (SNOW) for another example. It is the king of consumption business models. You don’t want your business to have its customers running out each month looking for alternative services.

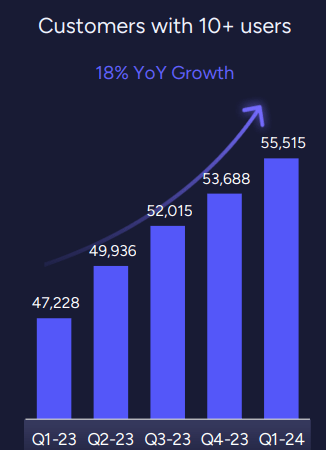

What you want to back are companies with the graph like this one:

MDNY Q1 2024 presentation

Numerous customers growing at more than double digits y/y.

Given this background, let’s now discuss monday.com Ltd.’s fundamentals.

Revenue Growth Rates Still Points to 30% CAGR

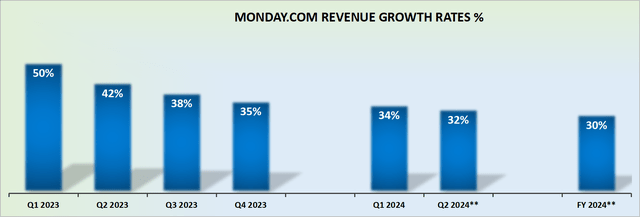

MNDY revenue growth rates

Many software companies have kept their guidance unchanged since early in 2024 or even sometimes pulled in their revenue growth rate guidance. For example, MongoDB (MDB) or UiPath (PATH). But not monday.com.

On the contrary, monday.com raised their guidance by 200 basis points. This is a business that is evidently still in hyper-growth mode. Hyper-growth means companies growing at more than 30% CAGR.

And what’s more important here, is that next year, as its comparables ease up, this portends monday.com having easier comparables, allowing 2025 to deliver yet another year of 30% CAGR.

Given this context, I believe that practically any valuation, within reason, can be forgiven.

MNDY Stock Valuation — 37x Forward Free Cash Flow

Monday’s free cash flow margin is expected to compress slightly in 2024, down from around 28% reported in 2023 to approximately 26% or 27%, a 100 to 200 basis points compression on its free cash flow margin relative to 2023.

This natural. After all, monday.com holds more $1.2 billion of cash and cash equivalents and nil debt. Thus, monday.com should be doing everything in its power to extend its market share. The time to optimize its free cash flow potential isn’t yet.

Furthermore, in my previous analysis, I said,

[…] there appears to be sufficient juice left in this young business for it to end up delivering approximately 30% free cash flow margins as a forward run rate at some point in 2024.

Even if the year as a whole doesn’t quite reach 30% free cash flow margins, there’s enough momentum in the business that it could deliver 30% free cash flow margins at some point in 2024 or early 2025.

Consequently, I believe that monday.com could at some point in 2024 be on a forward run-rate of delivering $300 million in free cash flow.

We are not even halfway through 2024, and monday.com already guides for close to $250 million of free cash flow. Consequently, I’m inclined to believe that my original estimate was in the right ballpark. At some point in the coming few months, monday.com will be on a path to $300 million of free cash flow.

This leaves monday.com priced at 37x forward free cash flow. A business with no debt, strong balance sheet, and growing at 30% CAGR. This is a bargain.

The Bottom Line

monday.com is reasonably priced at 37x forward free cash flow due to its robust financial health, substantial growth prospects, and solid market position.

With no debt and over $1.2 billion in cash, the company is well-equipped to continue its expansion and innovation efforts. Despite its premium valuation, monday.com is projected to maintain a 30% CAGR through 2025, driven by successful product launches, effective pricing strategies, and increasing customer adoption.

Given these factors, monday.com Ltd.’s current valuation reflects a fair entry point for investors.

Read the full article here

Leave a Reply