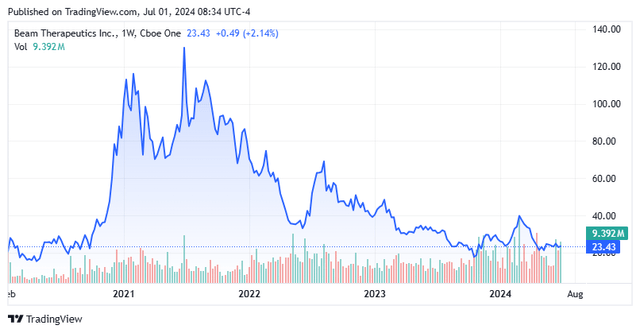

Our last look at Beam Therapeutics Inc. (NASDAQ:BEAM) occurred in February 2023. We concluded that article saying the stock at most merit a small “watch item” position for speculative investors. The shares have fallen since then, as they have for most gene editing concerns. This is not that surprising given that most paradigm shifts in biotech (EX, stem cell therapy, CAR-T) also seem to take much longer to develop than initially hoped. Given it has been nearly a year and a half since we peaked in at this developmental firm, it seems a good time to circle back to Beam Therapeutics. An updated analysis follows below.

June 2024 Company Presentation

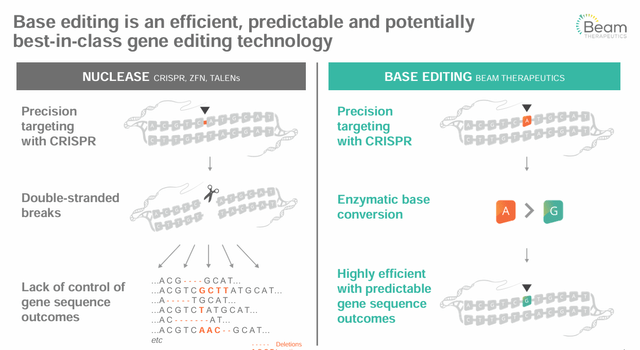

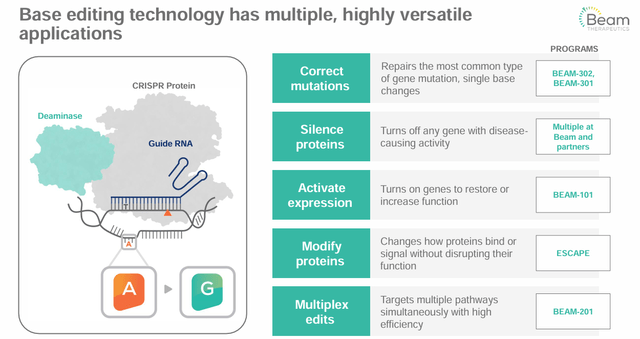

Beam Therapeutics is headquartered in Cambridge, MA, right outside of Boston. The company is focused on developing precision genetic medicines through base editing. The stock currently trades for just over $23.00 a share and sports an approximate market capitalization of $1.85 billion.

June 2024 Company Presentation

Pipeline Developments:

June 2024 Company Presentation

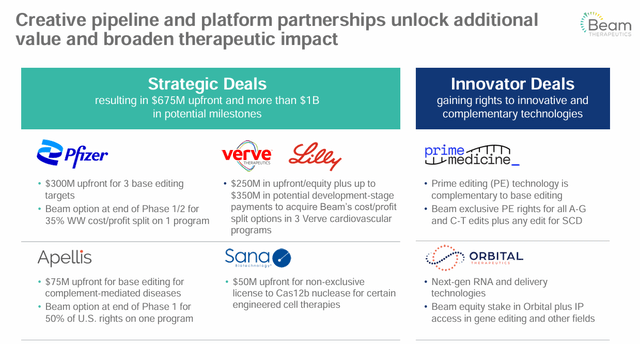

The company has a significant collaboration partnership with drug giant Pfizer (PFE) that provided a $300 million upfront payment when it was signed early in 2022. The company has other less lucrative partnerships and in October 2023 sold its opt-in rights to Verve Therapeutics’ (VERV) gene therapy programs to Eli Lilly (LLY) for a potential $600 million, of which Beam received one third upfront payment and a $50 million equity investment.

June 2024 Company Presentation

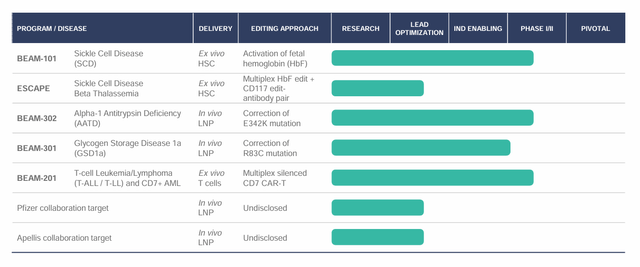

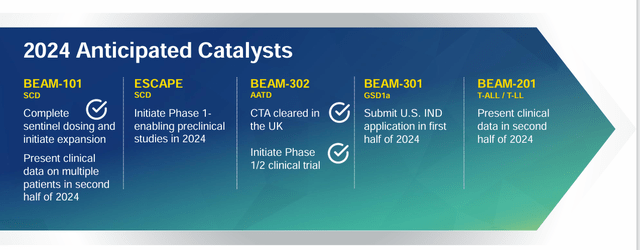

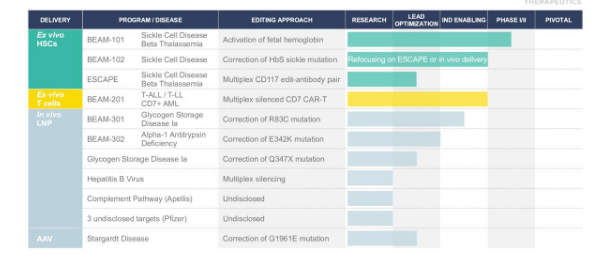

The company is advancing several “shots on goal” within its pipeline. That said, the pipeline remains quite early stage. In 2024, Beam Therapeutics has several milestones on the horizon. However, they involve kicking off early-stage studies, one IND application and disclosing data from early-stage trials.

June 2024 Company Presentation

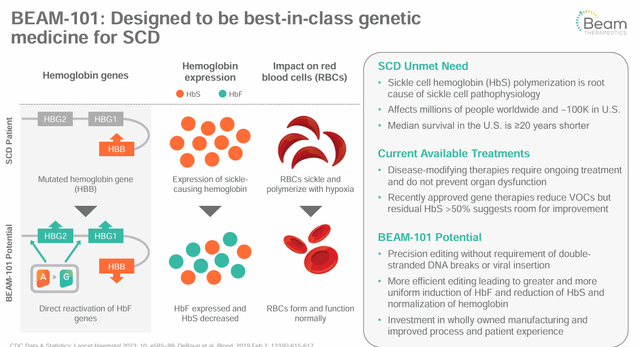

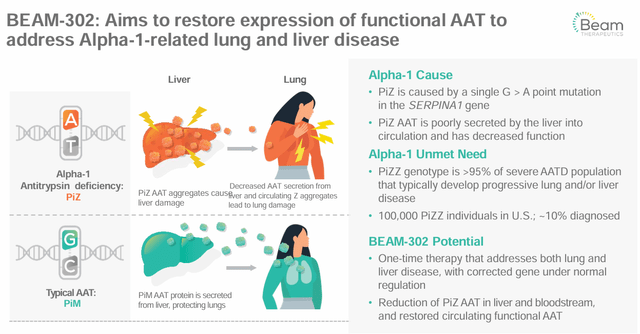

The company’s most lucrative potential assets remain BEAM-101 targeting Sickle Cell Disease and BEAM-302 being evaluated as a potential curative therapy for Alpha-1 Antitrypsin Deficiency, and a Phase 1/2 study is scheduled to kick off before yearend for that asset. The expansion cohort from a Phase 1/2 Trial for BEAM-101 was recently initiated as well.

June 2024 Company Presentation June 2024 Company Presentation

Analyst Commentary & Balance Sheet:

Since Beam Therapeutics posted its latest quarterly results on May 7th, the view from the analyst community is quite split. Five analyst firms, including JPMorgan and Wells Fargo, have reissued/assigned Buy ratings on Beam Therapeutics. Price targets proffered range from $45 to $56 a share. Meanwhile, RBC Capital ($35 price target), Leerink Partners ($27 price target), Barclays ($33 price target, down from $42 previously) and Canaccord Genuity ($42 price target) have all maintained Hold ratings on the stock.

Company officers have sold just under $7 million in the stock collectively so far in 2024 with the CEO being responsible for approximately for two thirds of those disposals. A beneficial owner also reduced their stake in the firm by just under $28 million worth of equity in February of this year. Beam Therapeutics ended the first quarter with approximately $1.1 billion in cash and marketable securities on its balance sheet after posting a net loss of $98.7 billion for the quarter. Management has stated this is sufficient to fund all planned operations into 2027.

Conclusion:

Seeking Alpha

Beam Therapeutics remains a somewhat intriguing play in the gene editing space. Analyst opinion remains mixed on the company’s prospects, but Wells Fargo did put the company on its fairly lengthy potential buyout “list” in May. The stock is trading right at five-year support levels.

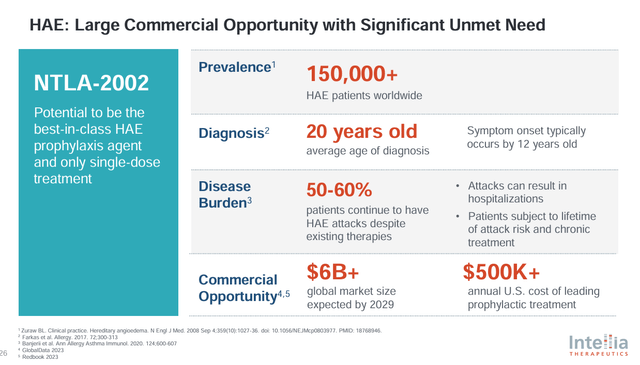

Intellia Therapeutics June 2024 Corporate Presentation

That said, Intellia Therapeutics (NTLA) which also appeared on Fargo’s May potential acquisition list, remains my favorite stock in the gene editing space. The company has a potential curative gene therapy for HAE that could be approved by 2027, and I last highlighted this name in late February.

January 2023 Company Presentation

Beam Therapeutics Inc. has a cash-rich balance sheet, but is burning cash at a prodigious quarterly rate, advancing several candidates. The challenge is that development is proceeding at a somewhat glacial pace, and there hasn’t been that much progress (see above) from our last look at Beam Therapeutics. Of note again, this is not unusual in the gene editing space. I would become more interested in BEAM once the company had advanced at least one candidate into pivotal trials. Until then, the stock continues to merit only a small holding for patient and risk-tolerant investors.

Read the full article here

Leave a Reply