Investment Rundown

The share price for The Shyft Group, Inc. (NASDAQ:SHYF) has come down heavily over the last couple of months from the peak of $33 per share. I still think it sits at a very expensive level and even if there is a lot of fundamental demand for the company going forward I am still quite pessimistic about the actual performance that the company may be able to have. Backlogs remain very high and right now sit higher than the market cap.

Even if the backlogs are high for the business, they haven’t been able to maintain a high level of it in actuality. It’s down over 50% from last year. Sure it may have translated into significant sales for the business, but it’s clear proof that the market is demanding far less from SHYF right now and their customers are holding capital very tight. This puts into question the future performance of the company. The p/s of the business may be under 0.6 on an FWD basis, but I am still quite concerned with their ability to capture more backlog growth, and perhaps the p/s will go up significantly, and in turn, lend the share price down. I don’t like the current market conditions that the company is in and will be rating it a sell until I see markable improvements.

Company Segments

SHYF is a manufacturer specializing in specialty vehicles catering to the global recreational vehicle industries. The company operates efficiently across two distinct segments: specialty vehicles and fleet vehicles and services. Within the specialty vehicles segment, SHYF is known for its expertise in manufacturing truck bodies and providing valuable final assembly services. This niche focus allows them to deliver high-quality products tailored to the unique needs of their customers.

In the fleet vehicles and services sector, the company excels in crafting commercial vehicles designed for diverse applications. These vehicles find essential roles in industries such as beverage and grocery delivery, mobile retail, and construction. SHYF’s dedication to innovation and precision ensures that its fleet vehicles meet the rigorous demands of these sectors.

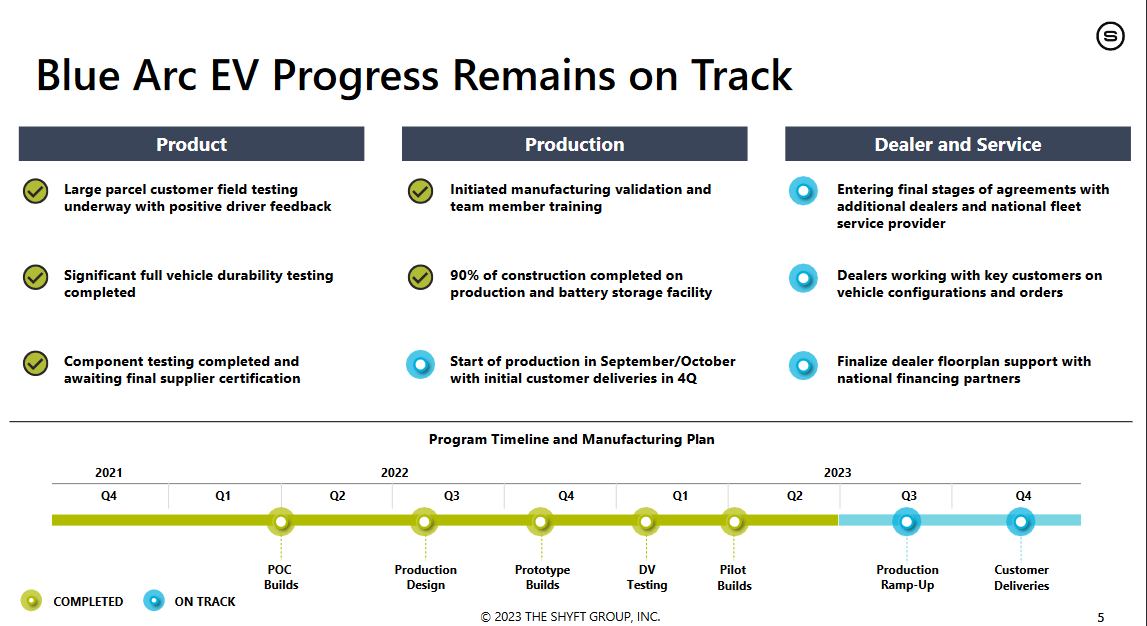

Company Projects (Investor Presentation)

The company seems to look quite favorable on its current position as they are ramping up production levels in some areas and in Q3 the dealer and services segment will see boosts for example. With the first customer deliveries expected in Q4 of 2023. The company has grown very well because of the improvement going into deliveries in the last couple of years. Last-mile delivery has had a lot of investments go into it and I think this will continue. One of the massive delivery companies is Amazon, Inc. (AMZN) for example, which apart from just offering a marketplace to purchase from, also deals with deliveries as well.

Markets They Are In

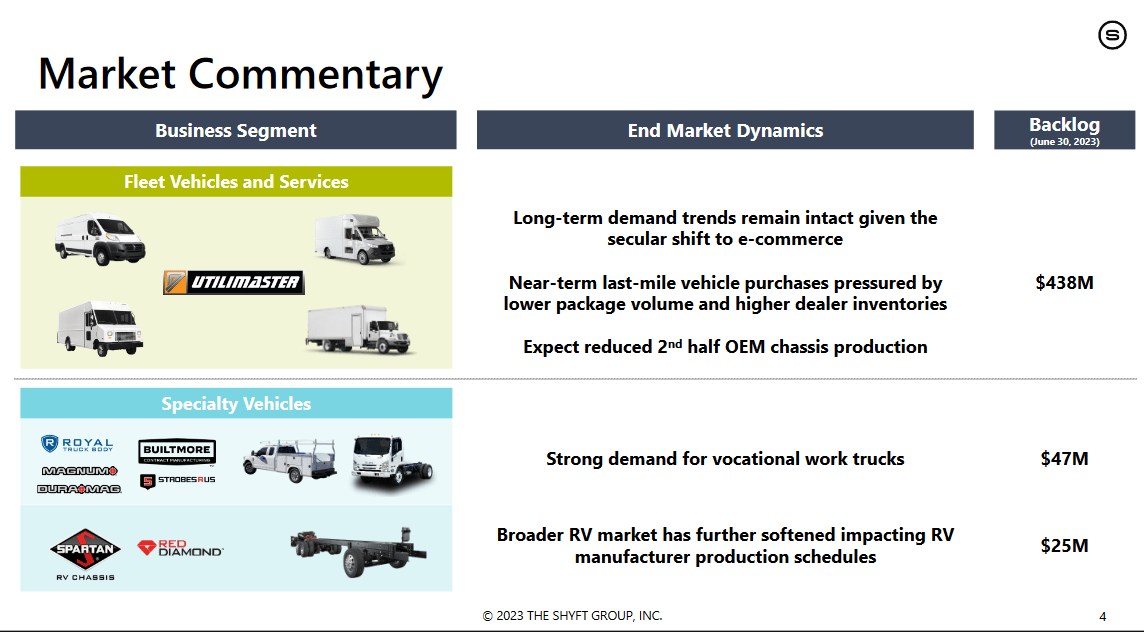

Market Overview (Investor Presentation)

Looking at the markets that SHYF is in it seems to be in their favor right now as the backlogs are growing steadily. The largest segment is the fleet vehicles and services, with a backlog of $438 million right now. The main growth driver the company is citing is the long-term demand for deliveries as the boom of e-commerce continues in the country. In the smaller segment which is more focused on niched vehicles the production and demand are still very much present. The company has a combined backlog of $72 million here. I think that this part of the business could see a ramp-up if the interest rates go down. The reason I make that parallel comes from the fact that when rates are high spending usually goes down for companies as it’s more expensive. But when the interest rates are lower it goes up instead. Some of that spending will go into increasing the efficiency of the business and that could be adding work trucks and specialty vehicles to the lineup.

Earnings Highlights

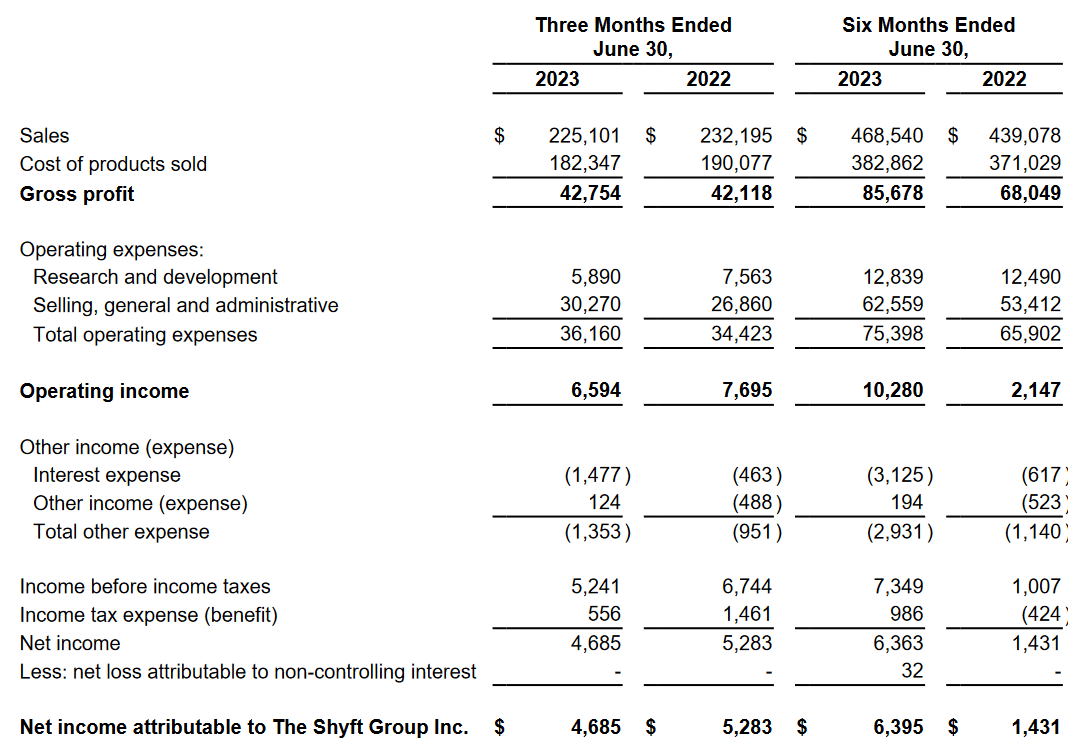

Income Statement (Earnings Report)

Going off the last income statement from the company there are some shifts that I find worrying. The first one is about the lack of sales growth for the business and the increase in the selling, general, and administrative side of the business. This ultimately led to an operating income decrease of over 16%. With interest expenses heavily up too, the company is looking to trade at quite a premium right now.

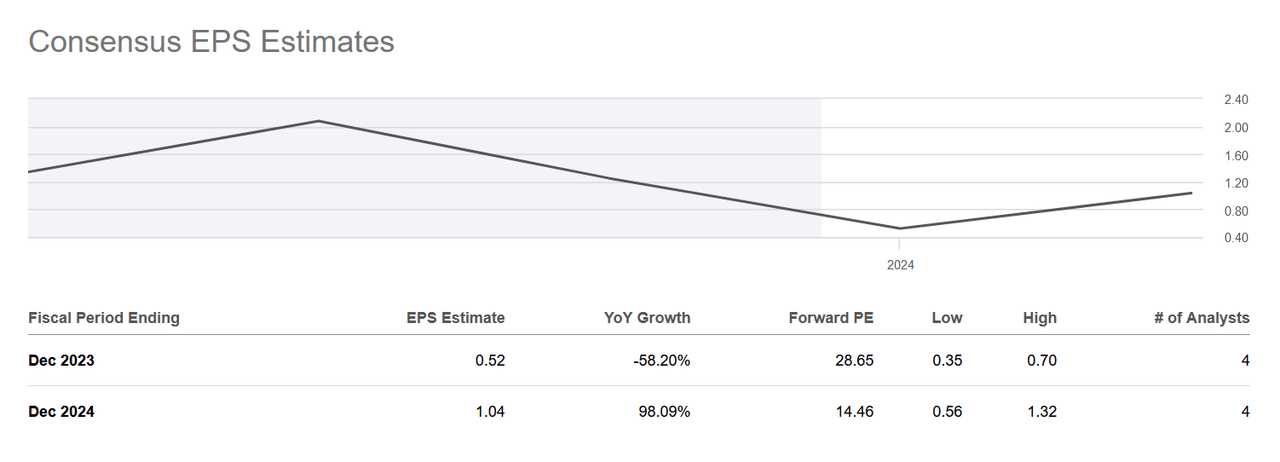

EPS Estimates (Seeking Alpha)

The EPS estimates suggest that SHYF could recover quite well over the coming years and still deliver a strong set of growth to the bottom line. But I remain very skeptical as the company is still lacking growth in the backlogs of the business and that puts a lot of risk to the future revenues and earnings of the business. If there are no improvements here SHYF will continue to trade at a significant premium and exhibit too much of a risk in my opinion.

Risks

The quarterly operating performance of SHYF is subject to a variety of influential factors. These include the timing and volume of customer orders, the completion of product inspections, and customer approvals, as well as any occasional restructuring measures undertaken by the company. In particular, delays in deliveries or shortages of essential materials required by SHYF’s operations can hurt the company’s earnings. These challenges can disrupt production schedules, affect customer relationships, and potentially lead to valuation compression as investors react to the temporary setbacks.

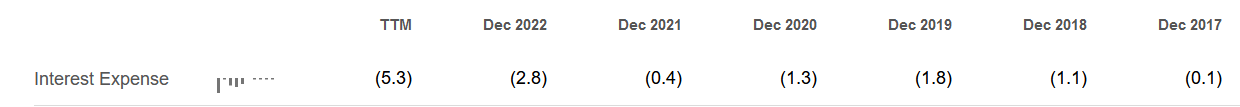

Interest Expenses (Seeking Alpha)

The rise in interest expenses for the company is also putting some more risks into the investment thesis of the business I think. The company hasn’t made any significant additions to its debt position in the last 12 months, so this is purely a result of higher interest rates. I think that it will weigh on the earnings results of the company in the short term. The reason I have it as a risk is also because of the risk that if SHYF doesn’t see a build-up in the backlogs the earnings potential goes down heavily and the interest expenses remain the same, possibly resulting in negative earnings even. At this point, the share price would likely fall very quickly.

Final Words

Even if the demand has been great for SHYF in the past, the company is still faced with having to improve some of the fundamentals of the business, like backlogs. Being a company that essentially produces a product, in this case, a vehicle, and then sells this it needs to have strong backlogs to make future revenues and earnings more predictable. If they lack on this front the future price of the business may be heavily constricted to the more overvalued side instead. I don’t like the risk/reward scenario here and will be rating SHYF a sell instead.

Read the full article here

Leave a Reply