Used-car dealer Carvana (NYSE:CVNA) has seen a sharp upward revaluation of its shares in the last couple of months which has been driven in part by improving operating fundamentals that included a change in the margin trajectory and cost improvements. While the company has been driving a strong restructuring, that has resulted in gross profit per unit momentum, I believe that the valuation at its current level is unjustified and that investors buying in at the current valuation level are likely overpaying for the company’s revenue potential. As a result, I believe the risk profile remains overall unfavorable for investors!

Previous rating

I rated Carvana a sell in February due to growing bankruptcy risks and negative margin trends, especially regarding the company’s adjusted EBITDA margins: Short Squeeze Trap. The used-car company has seen a dramatic decline in demand following the a surge in used-car prices during the pandemic. Higher interest rates have also made it more expensive to buy a car which has additionally weighed on demand. However, because the firm has managed to institute an aggressive cost-cutting program which resulted in a narrowing of EBITDA losses as well as a growing gross profits per unit, I am upgrading to hold.

Significantly improving margin trends for Carvana in the first two quarters of FY 2023

The used-car market consolidated in FY 2022, resulting in a massive expansion of Carvana’s EBITDA losses and in a huge deterioration in the margin picture with EBITDA margins and gross profit per unit sold declining. In FY 2023, against my earlier expectations, however, the situation has considerably stabilized and improved for the company as it cut costs, optimized its staffing and deployed technology to establish a more efficiently-run enterprise. As a result, Carvana has managed to benefit from a significant expansion in its EBITDA margins as well as gross profits per unit sold.

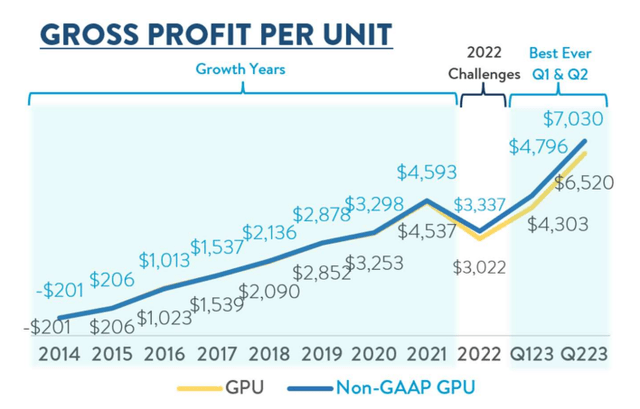

In the second-quarter, Carvana reported a gross profit per retail unit/GPU, on a non-GAAP basis, of $7,030, showing a 111% increase since the end of FY 2022. Gross profits per unit sold also steadily increased in both the first and the second-quarter of FY 2023 and resulted in record GPUs for the used-car dealer.

The increase in gross profit per retail unit was due to a number of factors such as lower inbound transportation costs, but chiefly because of lower average days to sale (meaning quicker turnover): average days to sale declined from 130 days in Q1’23 to 91 days in Q2’23 and the company projected a further drop to 65-75 days in the third-quarter. In other words, chances are that the used-car dealer is going to post a sequential increase in gross profits per unit sold in the third-quarter as well.

Source: Carvana

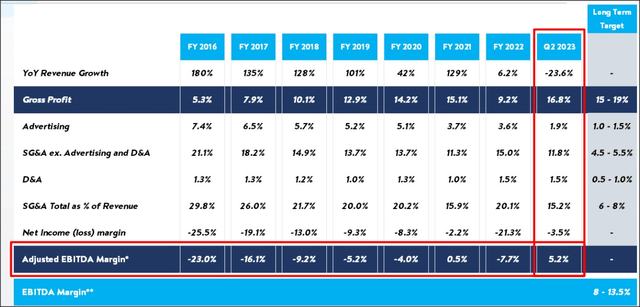

Carvana is now also well on its way to achieve its long-term EBITDA margin range of 8.0-13.5%. The company managed to turn its EBITDA margin around in the first six months of FY 2023, largely due to aggressive cost cuts in the selling, general and administrative expense category. In the second-quarter, Carvana achieved an adjusted EBITDA margin of 5.2% which is a huge improvement over the negative EBITDA margins of FY 2022.

Source: Carvana

Headwinds going forward

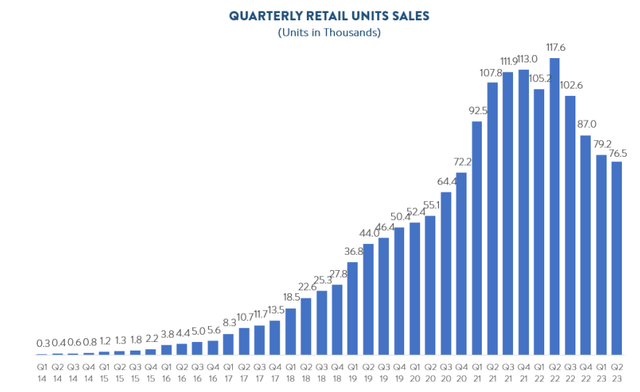

While margins are on an uptrend, retail unit sales and revenues are still in a consolidation. In the second-quarter, retail units sold declined 3% quarter over quarter to 76,530 and revenues were down 23.6% to $2.97B (but up 14% sequentially). If retail unit sales continue to fall, the margin recovery may be put at risk.

Source: Carvana

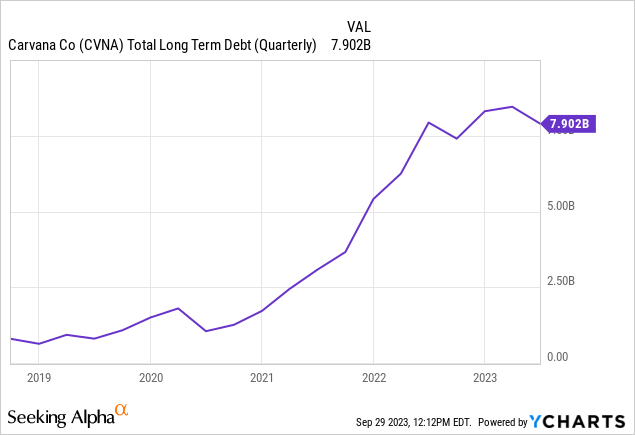

Carvana has also seen a steep increase in its long-term debt/leverage as the company restructured its business. The company owed almost $8B in long-term debt whose service can be expected to weigh greatly on Carvana’s cash flow going forward.

Carvana’s valuation

As much as I like Carvana’s fundamentally improving margin situation as well as improving unit economics (sequentially growing gross profit per unit sold), I believe the valuation has run ahead of the company’s fundamentals at this point and is not attractive.

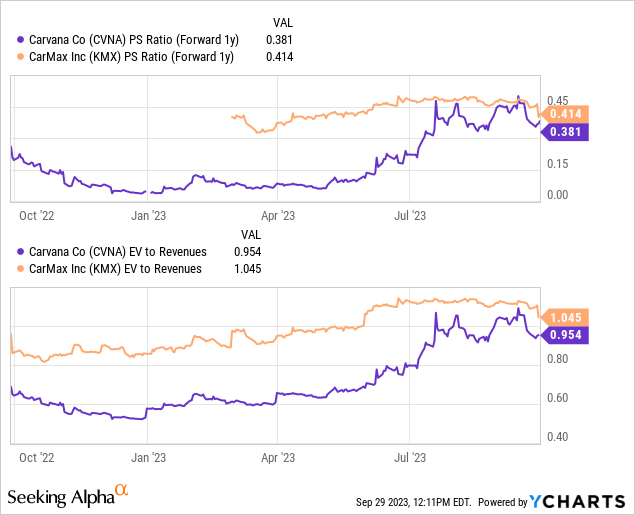

Carvana is currently valued at 0.38X FY 2024 revenues which is a high valuation factor considering that Carvana is not expected to be profitable in the near term (Seeking Alpha-provided consensus estimates imply that Carvana is expected to report a per-share profit of $0.50 in FY 2026). CarMax (KMX) is already profitable and offers investors a less-risky way of investing into the used-car market. Considering that Carvana also owes a ton of debt, I believe the risk profile remains unattractive for investors.

Risks with Carvana

Carvana will have to prove that it can sustainably grow its adjusted EBITDA margins as well as expand its gross profits per retail unit sold going forward. Recent margin gains have been achieved chiefly due to an aggressive cut down in expenses. The company, however, has clearly managed to reduce the risk of a bankruptcy which is why I am upgrading Carvana to hold.

Final thoughts

Carvana has managed to do something that I didn’t think earlier was possible: it effectively took the risk of bankruptcy off the table and has worked diligently towards a cost restructuring that has resulted in a significantly improved adjusted EBITDA margin trajectory. The fact that Carvana managed to drive its adjusted EBITDA margins from deeply negative territory to +5.2% in Q2’23 and closer to the minimum range of its long-term margin target (of 8%) is a positive development and something that I clearly did not think was possible. While I am upgrading Carvana to hold due to reduced bankruptcy risk and improving margin trends, I don’t consider shares of the used-car dealer to be a buy due to the company’s high debt load and top line pressure!

Read the full article here

Leave a Reply