Comstock (NYSE:CRK), like all natural gas E&Ps is facing tough comps going through 2023. I firmly expect this to be a short-term challenge as new LNG export capacity will be coming online through the QatarEnergy-Exxon JV for the Golden Pass in the 2H24. There are a few benefits including their low leverage, superior cost structure, the addition of their pipeline unit, their 4.75% dividend yield, and their 12% FCF yield, which I will cover throughout this report. I provide CRK a BUY recommendation with a price target of $11.02/share.

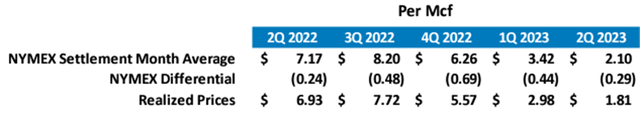

One of the strongest values Comstock brings to the table is their low cost of production. Their cost to operate a well sits at $1.14/Mcfe, 29% lower than their peer average. This low cost of production provides Comstock with a tremendous amount of safety when compared to their competitors, especially in times of low gas prices such as 1H23. Much of their efficiencies derive from their ability to drill longer horizontal wells with an average lateral length of 10,887 for their 21 wells drilled throughout Q2’23. The average production per well was 21mmcf/day for an aggregate 441mmcf/day. Much of their drilling throughout q2’23 was made up of less productive wells as the natural gas market went through a pricing trough. For reference, the average settlement price for q2’22 was $7.17/mcf as compared to $2.10/mcf in q2’23. Though the macro and geopolitical environments are day and night different, these higher prices have some room to increase as more capacity comes online for LNG exports.

Comstock Investor Presentation

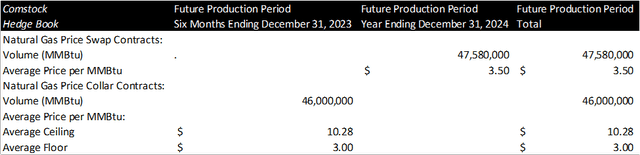

Despite the challenging gas market, Comstock is proactive and hedges roughly 40% of their book with an average floor of $2.99. This provided Comstock tremendous breathing room as gas prices dipped down to $2.06/mcf in April 2023, its lowest price since August 2020.

10-Q

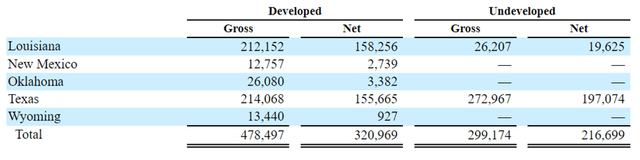

As far as operations and capital investment, Comstock has been investing significantly into exploratory drilling and completion. As they’re enhancing their properties in the Haynesville/Bossier region, they’ve invested $104mm into exploratory D&C for the first 6 months of 2023, nearly 2.5x the investment from 2022. Unproved property acquisition more than doubled for the same time frame, suggesting further development is on the horizon in the coming years. This absolutely coincides with the expansion of LNG terminals in the Gulf Coast from 12MTPA to the additional 9Bcfe/day of LNG export capacity to get to the 21Bcf/day capacity by 2027.

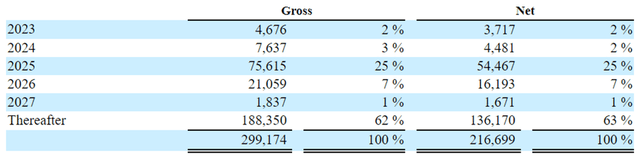

Until new capacity comes online, I’m expecting Comstock’s production volumes to remain relatively flat as natural gas prices gyrate in the $2-3.50/mcf range. I think this is a strong strategy to build up their lease book now as prices are relatively low and complete new higher tier gas wells as new export capacity comes online. This will allow Comstock to fully capitalize on their property development as opposed to producing just to produce.

2022 10-k

Of course, the one aspect Comstock will need to keep in consideration is lease expiration, which could hinder their plan if pricing doesn’t gravitate higher.

2022 10-k

Near-term, the next LNG terminal to come online is the QatarEnergy-Exxon (XOM) JV at Golden Pass in Texas which should be coming online in late 2024. According to Exxon’s press release, Exxon will have rights to 30% of the export capacity once online. This project will add an additional 32mtpa in which Exxon will have rights to 8mtpa. Free capacity should come out to something like 3.20bcf/day.

Financials & Valuation

Comstock is navigating through 2023 with challenging comps as their realized price for natural gas dropped 74% Y/Y for Q2’23. Though natural gas has the tendency to have highly volatile prices, I believe Comstock’s hedge book through 2024 should keep them relatively protected in the instance of a continued challenging market. Revenue for natural gas sales declined by -21% on a year-to-year basis using TTM figures. One asset that should bring more stability to Comstock’s operations is their 145-mile pipeline service that they acquired FY22. Though this pipeline was acquired to transport their own natural gas out of the Haynesville/Bossier basin, this pipeline gave Comstock the flexibility to market and transport other E&P’s natural gas. Overall, this feature accounts for 20% of the firm’s revenue generation. EBITDA generated from gas service came out to be $44mm for Q2’23 on a TTM basis with an 8% margin.

EBITDAX margin compressed a few points to 68% for Q2’23 on a TTM basis, down from 77% two quarters ago. Given the direction of natural gas from the start of q3’23 to where it presently sits, comps will remain challenging but look better on a sequential basis. I’m not expecting much excitement in the natural gas E&P space until the Golden Pass export terminal comes online in 2H24 or if a severe winter were to occur this year. Otherwise, it will be a waiting game.

One of the values management brought to the table was the initiation of a quarterly dividend at the end of FY22. At this present price, the dividend pays an annual rate of $0.50/share for a yield of 4.75%. Though we cannot presume an increase to the dividend rate this next year, we may be able to expect a higher rate as LNG export additional capacity comes online, potentially leading to a stronger domestic natural gas market. Only time will tell if it makes sense for management to increase the dividend. The dividend payout ratio is a mere 14% which will provide management the cushion to maintain the dividend and potentially pay down debt.

Speaking of debt, Comstock has a very low debt/EBITDAX ratio of 1.11x with no maturities prior to 2029. Liquidity is strong at $1.5b so there should be minimal expectation of any cuts to the dividend. Given that management’s leasing target is 90% full, this should also provide the flexibility for them to be opportunistic in acquiring additional leases in the Haynesville/bossier basin. Management also voiced that their pipeline will run its necessary capacity throughout 2024 before any expansions are necessary. Personally, I like their conservative approach to growth; this gives me comfort in making an investment in the firm during a challenging market.

SEC Filings

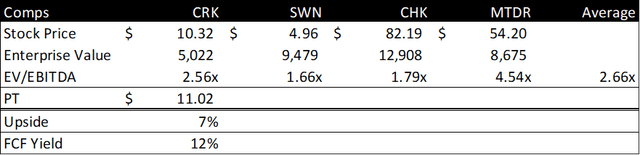

On a comparable basis, CRK is pretty well priced with a 7% upside to meet the market average valuation. Though this upside is relatively limited today, the stock at my price target will still yield 12%, giving it a strong value for a value-oriented portfolio. My recommendation is a BUY with an $11.02/share price target going into the end of 1H24. I believe there is a lot more value to be unlocked with the additional LNG export capacity coming online in years to come.

Read the full article here

Leave a Reply