This article series aims at evaluating ETFs (exchange-traded funds) regarding past performance and portfolio metrics. Reviews with updated data are posted when necessary.

HDEF strategy and portfolio

MSCI EAFE High Dividend Yield Equity ETF (NYSEARCA:HDEF) started investing operations on 8/12/2015 and tracks the MSCI EAFE High Dividend Yield Index. It has a portfolio of 115 stocks, a 12-month yield of 4.69% and a total expense ratio of 0.20%. It pays quarterly distributions.

As described in the prospectus, eligible companies must be in the MSCI EAFE Index and have above-average, sustainable and persistent dividend income and quality characteristics. During the most recent fiscal year, the fund’s portfolio turn-over rate was 5%, which is very low.

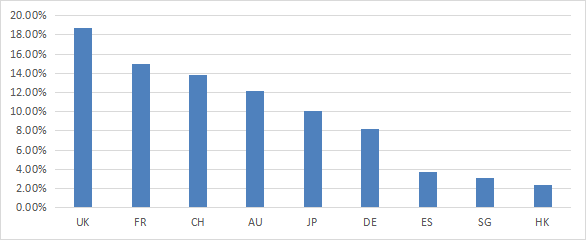

HDEF is mostly invested in large and mega-cap companies (about 90% of asset value). Over 70% of assets are invested in Europe. The heaviest country in the portfolio is the U.K. (18.7%), followed by France, Switzerland, Australia, Japan and Germany, each between 8% and 15%. Other countries are below 4%. The next chart plots the top countries, representing an aggregate weight of 87%. Hong Kong is at 2.35%, so exposure to geopolitical and regulatory risks related to China is low.

Country allocation (chart: author; data: DWS)

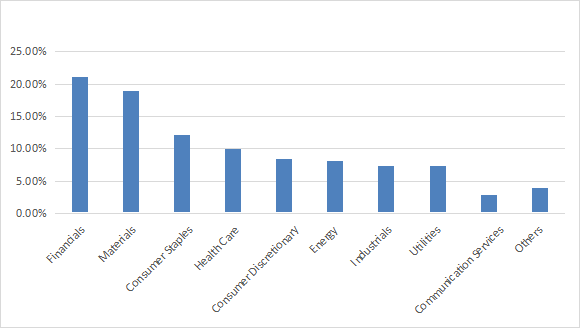

The top two sectors are financials and materials, with 21.1% and 18.9% of asset value, respectively. Consumer staples is at 12.2% and other sectors are below 10%.

Sector breakdown (chart: author; data: DWS)

The top 10 holdings, listed below, represent 39.8% of asset value. The heaviest ones weigh about 5%, so risks related to individual stocks are moderate.

|

Name |

ISIN |

Weight % |

Country |

Sector |

|

Novartis AG |

CH0012005267 |

5.02 |

CH |

Health Care |

|

TOTAL SA |

FR0000120271 |

4.98 |

FR |

Energy |

|

BHP Billiton Ltd |

AU000000BHP4 |

4.9 |

AU |

Materials |

|

Sanofi-Aventis |

FR0000120578 |

4.85 |

FR |

Health Care |

|

Unilever PLC |

GB00B10RZP78 |

4.75 |

GB |

Consumer Staples |

|

Allianz SE |

DE0008404005 |

4.08 |

DE |

Financials |

|

Iberdrola SA |

ES0144580Y14 |

2.98 |

ES |

Utilities |

|

Zurich Insurance Group AG |

CH0011075394 |

2.95 |

CH |

Financials |

|

Rio Tinto PLC |

GB0007188757 |

2.95 |

GB |

Materials |

|

Glencore PLC |

JE00B4T3BW64 |

2.37 |

GB |

Materials |

HDEF vs. competitors

I will compare the fund’s valuation and performance metrics with four other global dividend ETFs:

- SPDR S&P Global Dividend ETF (WDIV), reviewed here

- First Trust Dow Jones Global Select Dividend ETF (FGD), reviewed here

- SPDR S&P International Dividend ETF (DWX), reviewed here

- iShares International Select Dividend ETF (IDV),

These funds have some common characteristics making them close competitors: a global equity portfolio, a yield above 4.5%, no currency hedge.

I have explained here why currency-hedged funds should not be compared with non-hedged funds.

The next table reports valuations ratios. HDEF is in the middle of the pack regarding these metrics. A note of caution though: these ratios may be biased by sector breakdowns and country allocations. For example, FGD and IDV are heavier in financial companies than their peers, which may partly explain why they look cheaper. Valuation ratios are usually lower and less reliable in financials than in other sectors. Moreover, countries have a discount or premium due to perceived risks related to their economic and political contexts.

|

HDEF |

WDIV |

FGD |

DWX |

IDV |

|

|

Price / Earnings TTM |

9.92 |

11.86 |

5.95 |

14.1 |

5.85 |

|

Price / Book |

1.58 |

1.08 |

0.8 |

1.26 |

0.85 |

|

Price / Sales |

0.92 |

0.77 |

0.66 |

0.85 |

0.72 |

|

Price / Cash Flow |

6.25 |

8.04 |

3.95 |

7.47 |

4.17 |

Source: Fidelity

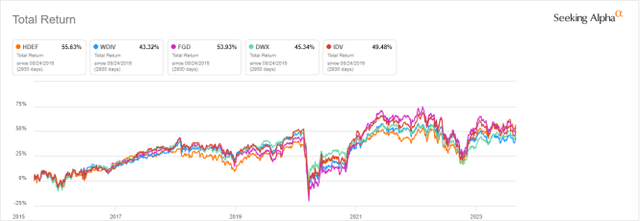

The next chart plots total returns since HDEF inception. It is the best performer, shortly ahead of FGD. The difference in annualized return is immaterial, though.

HDEF since inception vs. Competitors (Seeking Alpha)

HDEF has outperformed its peers by about 12% in the last 12 months:

HDEF vs. Competitors, total return on the last 12 months (Seeking Alpha)

The next table reports the annual sum of distributions per share in 2017 and 2022. 2016 has been excluded because of an exceptional distribution by HDEF.

|

HDEF |

WDIV |

FGD |

DWX |

IDV |

|

|

2017 |

0.83 |

2.56 |

1.06 |

1.59 |

1.53 |

|

2022 |

1.18 |

3 |

1.26 |

1.51 |

1.99 |

|

total growth |

42.17% |

17.19% |

18.87% |

-5.03% |

30.07% |

HDEF has the best total dividend growth rate with 42% (or 7.3% annualized). In the same time, the cumulative inflation has been about 20% (based on CPI). Among the five funds, only HDEF and IDV have outpaced it.

Takeaway

MSCI EAFE High Dividend Yield Equity ETF is invested in 115 global stocks with above-average dividend yield and quality characteristics. The portfolio is well-diversified across countries, sectors and holdings. Compared to four ETFs with similar characteristics, HDEF has average valuation ratios but beats its peers in total return and dividend growth rate.

Read the full article here

Leave a Reply