U.S. stock indexes opened modestly lower on Wednesday morning as Treasury bond yields remained near fresh 16-year highs and geopolitical angst hit global sentiment.

How are stock indexes trading

-

The S&P 500

SPX

dipped 22 points, or 0.5%, to 4,350 -

The Dow Jones Industrial Average

DJIA

fell 110 points, or 0.3%, to 33,893 -

The Nasdaq Composite

COMP

eased 106 points, or 0.8%, to 13,435

On Tuesday, the Dow industrials and the S&P 500 ended nearly flat, while the Nasdaq Composite dropped 0.3%, according to FactSet data.

What’s driving markets

The third quarter U.S. corporate earnings reporting season continues to absorb investors, with P&G

PG,

Morgan Stanley

MS,

and U.S. Bancorp

USB,

among those presenting their numbers before the opening bell on Wall Street, while Netflix

NFLX,

Tesla

TSLA,

and Lam Research

LRCX,

will feature after the close.

However, investor sentiment has been soured after reports saying hundreds had died following an explosion at a Gazan hospital raised fears that the Israel-Hamas war would draw in other forces in the region.

See: Why Biden’s planned Israel visit is calming markets — for now

Recent hopes that a trip by U.S. President Joe Biden to the Middle East might boost diplomacy have been damped after Jordan cancelled a summit at which Biden was to meet the Jordanian and Egyptian leaders, as well as Mahmoud Abbas, President of the Palestinian Authority.

“Overnight we’ve seen a fresh risk-off tone because of the geopolitical situation, and …that has led to a clear reaction in markets, said Henry Allen, strategist at Deutsche Bank. Concerns about compromised oil supplies from the regions helped push Brent crude

BRN00,

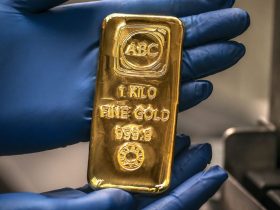

at around $91 per barrel, while gold prices

GC00,

hovered around $1,965 an ounce.

Previous upsurges in geopolitical anxiety have seen a rush to perceived haven assets such as U.S. Treasurys, pushing down yields.

See: Long-term U.S. Treasury yields may resume their march higher despite recent bond-market swings, BlackRock says

But the 10-year Treasury yield

BX:TMUBMUSD10Y

remained higher, at 4.866%, after Wednesday touching its highest level since July 2007 as traders continued to express concern about sticky inflation following news released the day before showing U.S. retail sales growing more than expected in September.

In U.S. economic data Wednesday, construction of new U.S. homes rebounded 7% in September to an annual pace of 1.36 million units after a sharp 1.5% drop in the prior month, though building permits, a sign of future construction, fell 4.4% to a 1.47 million rate.

U.S. economic update set for release on Wednesday also includes the Fed Beige Book at 2 p.m. Eastern.

Fed officials due to make comments include Governor Chris Waller at noon; New York Fed President John Williams at 12:30 p.m.; Richmond Fed President Tom Barkin at 1 p.m.; and Philadelphia Fed President Patrick Harker at 3:15 p.m..

Companies in focus

-

Morgan Stanley

MS,

-6.01%

fell 5.4% on Wednesday after the bank said its third-quarter profit fell 10% amid weakness in its investment banking business, but its trading and asset management revenue rose. -

Procter & Gamble

PG,

+2.93%

rose 2.9% after the consumer goods giant posted better-than-expected fiscal first-quarter earnings early Wednesday, boosted by another increase in prices. -

United Airlines

UAL,

-7.83%

shares fell 7.4% on Wednesday morning after the carrier warned that the Israel-Hamas war and higher jet fuel costs could have an impact on fourth-quarter results.

Read the full article here

Leave a Reply