The chip recovery timeline is being pushed back again.

ASML Holding,

a crucial supplier to the industry, now expects chip makers to hold off on investments next year, with the latest U.S.-China tensions acting as a headwind for the semiconductor sector.

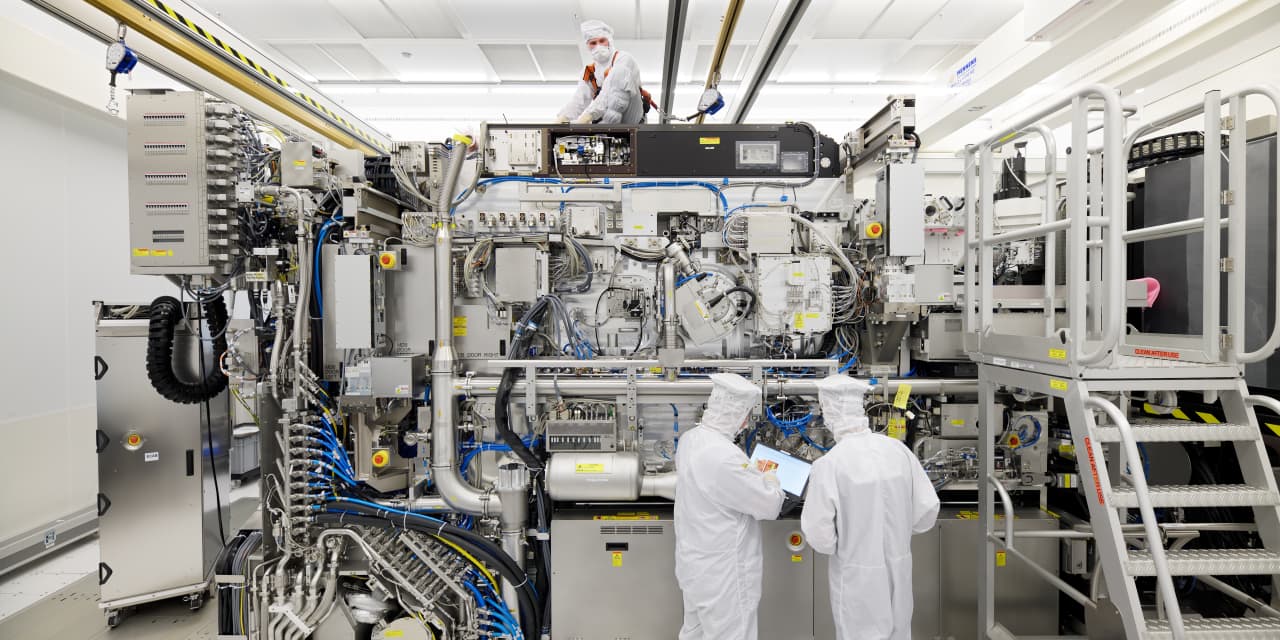

ASML (ticker: ASML) supplies the lithography machines that are essential for manufacturing semiconductors. Customers include Taiwan Semiconductor Manufacturing (TSM), Samsung Electronics (005930.Korea), and Intel (INTC). It is Europe’s most valuable technology company.

The Dutch company’s role means it is a bellwether for the semiconductor industry and the latest signs aren’t good.

“Customers continue to be uncertain about the shape of the demand recovery in the industry. We therefore expect 2024 to be a transition year,” ASML CEO Peter Wennink said in a statement issued as the company disclosed its earnings on Wednesday.

ASML now expects its revenue to be broadly flat next year. The uncertainty seen by customers looks to have been heightened by the U.S.’s tighter restrictions on exports of artificial-intelligence chips, announced Tuesday.

“The new China restrictions announced by the U.S. government may also be partly responsible for the flat outlook, which ASML interprets as being applicable to a limited number of fabs in China,” wrote Jefferies analyst Janardan Menon in a research note.

ASML said the curbs on exports to China wouldn’t affect its overall targets for 2025 and 2030, but would alter the regional balance of its sales.

ASML reported a third-quarter net profit of €1.89 billion ($2.0 billion) compared with €1.94 billion for the second quarter. Net sales came to €6.67 billion, down from €6.90 billion the preceding quarter.

More worryingly, net bookings for the quarter fell to €2.60 billion from €4.50 billion. Jefferies’ Menon had forecast bookings of €4.50 billion for the quarter. Bookings for extreme ultraviolet lithography machines, ASML’s most advanced systems, came to €500 million. ASML’s EUV systems take 18 months to build and it is barred from selling them to China.

For the fourth quarter, ASML said it expects to report net sales of between €6.7 billion and €7.1 billion with a gross margin between 50% and 51%. It reiterated its full-year guidance for net sales growth toward 30%.

The question now becomes when the chip recovery will begin. ASML said it expects significant growth in 2025.

“We believe investors may need more clarity on the nature of possible EUV pushouts, and confidence on order recovery. However, we view the 2024 guidance as conservative, more likely than not to ultimately be revised up over time ,” wrote

UBS

analyst Francois-Xavier Bouvignies.

UBS has a Buy rating and target price of €780 on ASML stock. ASML shares fell 2.6% to €558.20 in Amsterdam on Wednesday.

U.S.-listed shares of ASML were down 3% in premarket trading. American depositary receipts of

Taiwan Semiconductor Manufacturing

were down 2.0% while

Intel

was down 1.3%. Tech stocks were generally lower in response to an increase in yields on government bonds.

Write to Adam Clark at [email protected]

Read the full article here

Leave a Reply