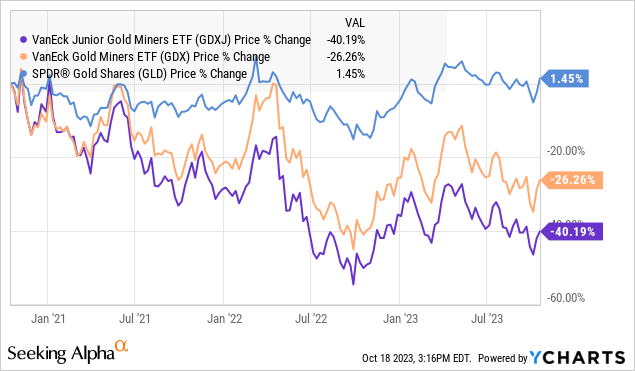

The VanEck Junior Gold Miners ETF (NYSEARCA:GDXJ) has likely disappointed a lot of investors in recent years, with the fund losing nearly half its value from a high in 2020. Even as the underlying price of gold currently trading just under $2,000/oz is essentially flat over the period, mining stocks have fared worse dealing with broader macro headwinds including inflationary cost pressures, rising interest rates, and overall poor sentiment.

That being said, we believe this segment of the market deserves a closer look, amid some renewed bullish momentum in the price of gold. There are several moving parts here, but we believe the junior mining stocks within the GDXJ fund are well-positioned to outperform the price of gold going forward.

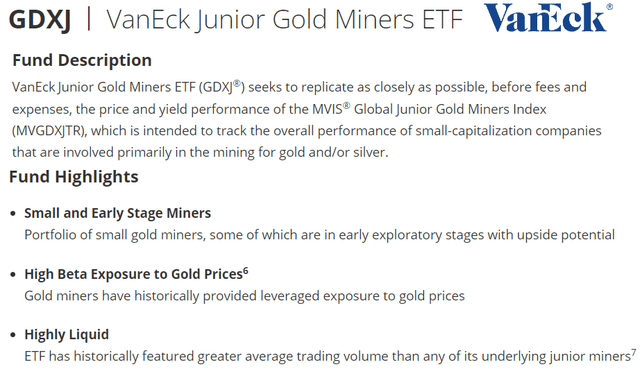

What is the GDXJ ETF?

GLDXJ technically tracks the “MVIS Gold Junior Miners Index”. According to the methodology, companies that generate at least 50% of their revenues from gold and/or silver mining are eligible. This includes companies with a business model centered around precious metals royalties or streaming, in addition to those that simply control mining projects with the potential to produce gold and silver.

Across the universe of eligible stocks, the bottom 40% of the sector in terms of market capitalization are covered as representing the junior miners or small-caps of the broader sector. There is also a minimum $150 million market value threshold and trading liquidity criteria.

source: VanEck

The idea with gold mining stocks is that their income potential and implied market value can climb beyond the corresponding impact of an increase in the price of gold to sales. This concept known as operating leverage is applied to all companies but is particularly relevant to commodity producers.

The attraction of GDXJ is that the portfolio of small-cap names has a higher beta than the gold market, meaning they are more sensitive to changes in the price of gold. Simply put, with a bullish view of gold and the expectation that the metal price can rally by 25% over the next year, we’d expect junior mining stocks to rally by multiples of that.

So while it’s difficult to predict exactly how high GDXJ could climb in a scenario where the price of gold reaches $2,500/oz, for example, our bet is that it would beat out its lower beta large-cap alternatives.

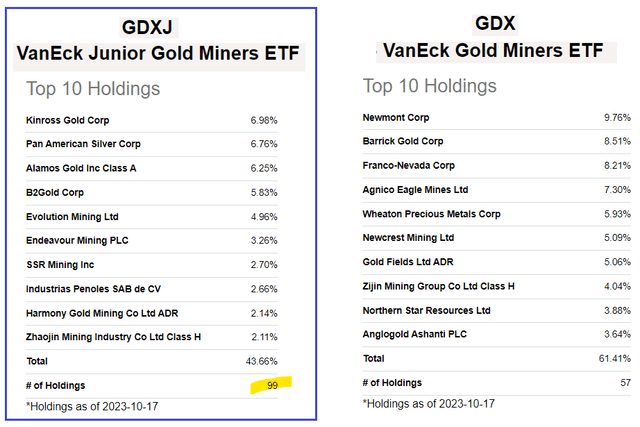

In terms of current holdings, Kinross Gold Corp (KGC) with a market value of $6.5 billion is the largest holding in GDXJ representing 7% of the fund. Here, while the company is technically a “mid-cap” but within the cutoff for index inclusion. Pan American Silver Corp (PAAS) with a 7% weighting, produces a significant amount of silver but falls within the “gold junior miners” theme.

The bigger point here is that GDXJ is well-represented by major corporations that in many cases include world-class assets in terms of ore grades and mining yields. The portfolio of 99 stocks also has a good diversification globally, including several international stocks that are not otherwise traded on a U.S. exchange.

GDXJ vs GDX

Here we can make a distinction between GDXJ and the VanEck Gold Miners ETF (GDX) which essentially holds all the bigger gold stocks that aren’t excluded from GDXJ.

Naturally, there are some advantages to that large-cap strategy considering top holdings in names like Newmont Corp (NEM) and Barrick Gold Corp (GOLD) are recognized as sector leaders with overall strong fundamentals.

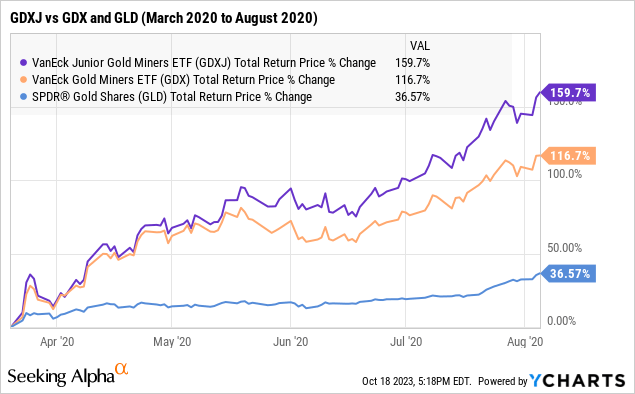

Seeking Alpha

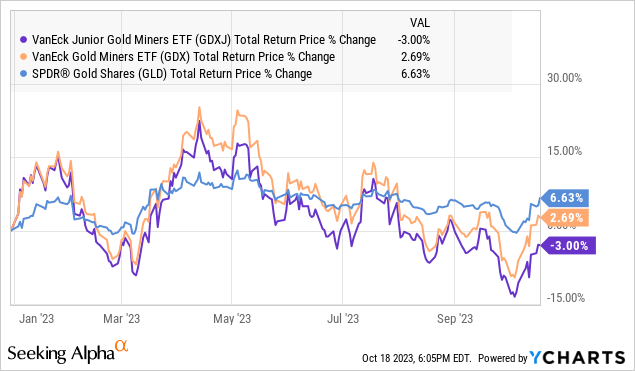

These types of gold mining bellwethers typically have globally diversified operations that add a layer of quality to cash flows which minimizes risk. That dynamic has translated into lower volatility for GDX historically, including generating a modest positive gain year-to-date, up 3% compared to a modest -3% decline from GDXJ.

On the other hand, one weakness of the GDX ETF is the portfolio concentration, with just the top 10 holdings representing 61% of the overall fund. GDXJ offers a more extensive portfolio with 99 stocks that are a bit more balanced in terms of exposure to each underlying name.

That unique profile includes some of the more speculative exploitation and development stage comings down the line stand to benefit the most from a major move higher in the price of gold leading to a structural repricing higher.

That’s what played out during the early pandemic for gold, where prices climbed from a low of $1451/oz in March of that year to $2028/oz by August. In this case, GDXJ returned 160% which was well above the 117% gain in GDX and the 37% rally in the SPDR Gold Shares ETF (GLD) over the same period.

The most bullish case for GDXJ would envision a repeat of a similar outperformance in the next bull market.

Gold Price Outlook

We can talk about how great GDXJ can be, but the reality here is that it will need some follow-through and a sustained rally in the price of gold to get the ball rolling. The good news is that we see several developments coming together that could market the start of a new bull market or the next phase of a longer-running bull market.

The first point here is that the geopolitical environment plays well into the allure of gold as a precious metal. The current Middle East crisis and uncertainties regarding the situation are already driving a bid for gold as a store of value and we believe that can continue.

Still, the reason we are exceptionally bullish on gold right now is a sense that there are multiple paths for the next leg higher. One of the big themes in gold over the past year is how resilient the market has been despite rising interest rates now at a nearly 2-decade high, along with the U.S. Dollar strength.

In many ways, this is surprising because gold has historically pressured the alternative of higher real rates considering investors can simply hold risk-free treasury notes and earn +5%. As we see it, the potential that rates ultimately move lower going forward would sort of turbocharger the attraction of gold as its catalyst of declining real rate and a weaker U.S. Dollar emerging. That move hasn’t quite started yet but would be a power backdrop for the relative attraction of both precious metals and the related miners within the GDXJ ETF.

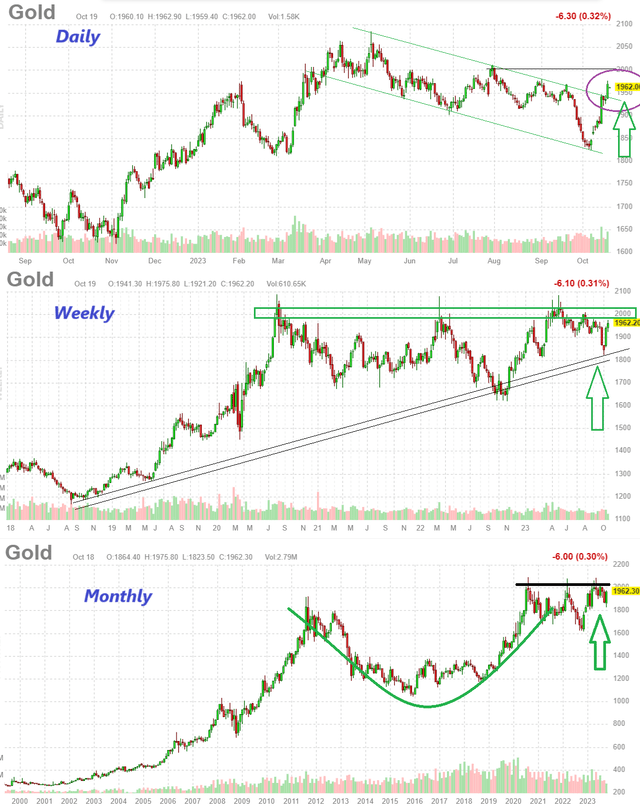

Finally, we have to mention what we see as a fantastic technical setup. We consider ourselves fundamentals-first investors with a macro perspective, but it’s clear to anyone with even a rudimentary understanding of chart analysis that the setup right now in gold is outstanding.

On the daily chart, we’re eyeing a breakout above a long-running downtrend that had been in place since early Q2. From the weekly chart, Gold is also coming up against the $2,000/oz price level that has worked as resistance since 2020. Zooming further out, a massive cup and handle have developed on the monthly chart that can often signal a continuation of the rally.

The call we have is that the potential that gold breaks above $2,000/oz can open the door for momentum to accelerate and get to target a larger move towards $2,500 as our initial 2024 price target.

source: finviz

GDXJ Price Target

Putting it all together, the backdrop here is very bullish for the GDXJ ETF in our opinion. With shares currently trading under $35.00, a rally back to the high of this year from Q2 around $44.00 represents 26% upside potential. A move in gold towards $2,500 could place the highs of 2022 above $52.00 as our next price target.

From a fundamental perspective, the underlying companies of the portfolio would benefit from both higher cash flow and earnings. There is also a sense that inflationary pressures that defined 2022 and supply chain shortages are easing. We’d expect a measure of valuation multiples expansion into improved mining sentiment.

source: finviz

Final Thoughts

GDXJ is a high-quality exchange-traded fund that offers targeted exposure to this unique market segment. The fund has a volatile trading history but can represent a compelling contrarian trade eyeing stronger momentum in the gold market in the year ahead. Without picking winners and losers among mining stocks, GDXJ has good upside potential.

In terms of risk, beyond the underlying price of gold, junior miners remain exposed to broader macro trends. A deeper deterioration in the global economy impacting financial market liquidity could undermine the outlook for gold mining stocks.

Read the full article here

Leave a Reply