U.S. stocks closed lower Tuesday after the long Labor Day weekend, as bond yields and oil prices climbed. The Dow Jones Industrial Average

DJIA,

shed about 195 points, or 0.6%, ending near 34,642, according to preliminary FactSet data. The S&P 500 index

SPX,

dropped about 0.4% and the Nasdaq Composite Index

COMP,

fell 0.1%. Investors returned from the long weekend in a less bullish mood on weaker economic data from China and Europe, but also with more clouds on the horizon in oil markets. Oil prices

CL00,

closed at the highest level since November on Tuesday, after Saudi Arabia and Russia opted to extend oil supply production cuts through the end of 2023. West Texas Intermediate crude for October delivery

CL.1,

CLV23,

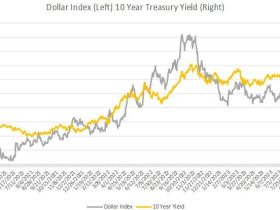

settled at $86.69 a barrel. U.S. Treasury yields also rose, with the 10-year Treasury rate

TMUBMUSD10Y,

climbing to 4.267% in late afternoon trade, its fourth-highest of the year, according to Dow Jones Market Data. The benchmark rate is used to price everything from consumer loans to corporate debt.

Read the full article here

Leave a Reply