Above: Passion for big racing events is global. Flutter Entertainment plc (FLUT) has the revival of racing as a valuable business for sports betting central in its focus.

- Flutter Entertainment has focused on the 80% of FanDuel (“FD”) players who never bet on racing.

- Its partnership deal with Churchill Downs (CHDN) gives it first mover advantage in developing this legacy betting sport.

- On a sales growth basis alone, its three-year projection is powerful.

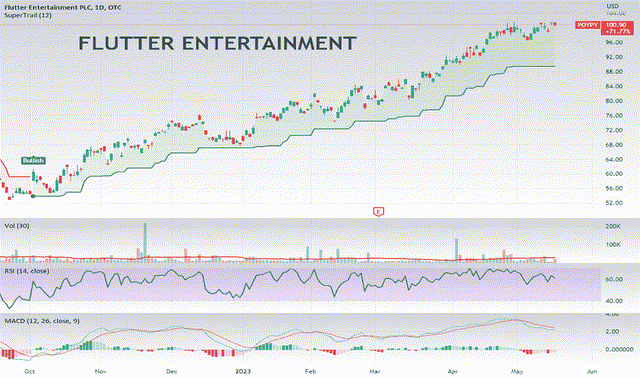

FLUT price at writing $196

The price at our last post this March 31st was $197

Appraisal: Forward momentum continues.

Google

This year’s Kentucky Derby not only produced a wow finish for its 150,000 attendees, but continued to grow its betting handle, rising from $188m last year to $210m this year. Those numbers are predominantly live and Kentucky-based (The state legalized sports betting this past March 31). This was just after the NYSE trading began for FLUT stock as it transitioned from its UK listing.

The TV ratings for the event hit 16.7m, up from 14.8m last year and the single biggest ratings jump since 1989. By any comparison, this event lies in the chump change range against major U.S. sports betting handle. But its possibilities have not been lost on FLUT management. Over the past two years, FLUT has made moves to exploit what is clearly a real potential.

It created the TVG network in 2022 heavy with horse racing content to begin exposing U.S. bettors to the entertainment values of the sport.

In 2022, it also did a partnership deal with Churchill Downs on a shared wallet betting site, plus various marketing events aimed at teasing out cross play between CDHN’s Twin Spires site and FanDuel. FLUT’s global business, particularly in the horse racing crazed UK and Australia, will bring a lot of know how to any broad-based thrust into educating U.S. bettors in the sport.

Here’s management’s theory

google

The history of horse race gambling is, of course, the grandfather of all legal sports betting going back in the modern era to the 18th century. The golden age of horse racing in the U.S. was between 1930 and the early 1960s. Inside those decades, racing attendance was by far the biggest among all sports. The causes of the decline are many. It was the rise of TV sports team play, a younger generation that saw it as an old folk slow game, and other socio-economic factors contributed to the erosion of interest in the sport. But the Triple Crown events maintained massive one shot interest, first among them the Kentucky Derby, as noted.

Google

What FLUT management sees past the realities of a dormant sport of decades ago, lifted temporarily into huge interest in a handful of events, is opportunity. It recognizes that it must begin with an educational process that moves younger generations of bettors into the entertainment value of the sport.

It then must adapt to the trove of tech applications available now, which were not around in past decades. In other words, make it more compelling to move bettors now indifferent to the Derby into action.

In that regard, an analogy between the Derby or Triple Crown races and the Super Bowl is, of course, light years away from perfect, but is a logical pathway for a savvy management.

google

Above: FD drives the bus, but it’s got many rich passengers.

It’s a one-time (or three) event that is already a generator of massive interest beyond the core body of sports fans. Its TV ratings prove it goes beyond the sport. For example, the NBA championship game generated 11.7m viewers last year, less than the Derby. Interest in betting odds, specific horses, favorites and long shots do mimic elements in other sports. TV and internet coverage is a given. Legal sports betting now in 38 states and DC. All have in state racetracks or ones near borders. The Super Bowl single event generated $23b in national handle this year. If the Triple Crown, available in all legal states, could be built up to $4b in handle bearing a normalized 7% hold, that’s $280m in win. FD’s share of the market is ~40% or $90m in gross win. But equally important is the probability that new bettors far more educated in horse race betting would have a retention percentage that could bring the total win far beyond the event itself.

This is the core thinking of FLUT advancing on a sustained marketing thrust into the creation of a presence of horse betting that could become elemental in its revenue.

Briefly, in our view, this move into horse racing is an example of a management who sees real possibilities hiding in plain sight. Competitors aren’t asleep. But what counts here to investors is our previously noted belief that in this sector, scale is an overwhelming advantage.

Moving on horse racing from such a dormant stage with investment and partnerships creates a first mover place.

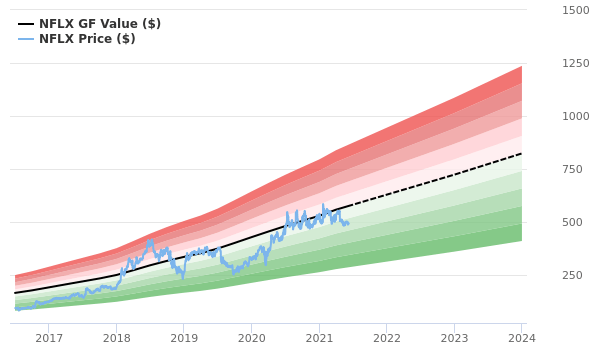

FLUT Revenue growth projected

One of the core rationales of investors in sports betting stocks is the recognition that over the top marketing and promotional costs are a key factor that keeps strong positive EBITDA at a distance. Some sites expect to near or actually turn profitable this year. But Mr. Market is looking to the top line YOY sales growth as the reason to be in the stock.

Here’s what FD sales growth estimates look like now

FLUT Revenue consensus among six industry analysts:

2023: $11.7b

2024:E: 13.7

2025E: 15.27

FY earnings estimates (my calculations)

2024: $6.34

2025E: 8.73

2026: 11,25

3 years CAGR: 28%

Average earnings growth YOY: 12.22%

Margin 36.5% in the past two years, despite high costs of promotion and marketing.

Cash on hand $3b

Total debt: $7.52b

Market cap at writing: $34b

Enterprise value at writing: $40b, or $6b under current market cap. We believe the undervaluation here is largely attributable to the company putting growth ahead of accelerating EBITDA for the moment. We do expect FLUT will imminently achieve sustained profitability

Conclusion:

We continue our bullish stance on FLUT totally understanding that Mr. Market in general is still worried about the over-the-top cost elements in the sector. But I also believe that the company’s scale, market share and continuing aggressiveness in exploring cost-efficient, high possible reward marketing policies make it a strong buy.

Sales growth for FLUT as well as its nearest competitor DraftKings (DKNG) remains the confidence builder for investors. For FLUT, part of the growth story comes from beyond U.S. shores. A consensus of our industry associates believe that the present global addressable market for sports betting is $200b. FLUT is well positioned to benefit from this huge market than most.

For that reason, I am putting a short-term price target of $239 on the shares by the end of Q3 this year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply