Introduction

Marqeta (NASDAQ:MQ) — a modern card issuing and payment solutions platform — is down nearly 20% YTD while the broader markets are up about 10% YTD.

Given the stock’s poor performance, some investors might have lost their confidence and patience in Marqeta stock. Perhaps, selling Marqeta right now and investing the proceeds in meme stocks like GameStop (GME) or AMC (AMC) might be a good idea…

Jokes aside, I’m here to share seven reasons why investors might want to hold on to their position or buy even more of MQ stock.

Reason #1: Disruptive Clientele

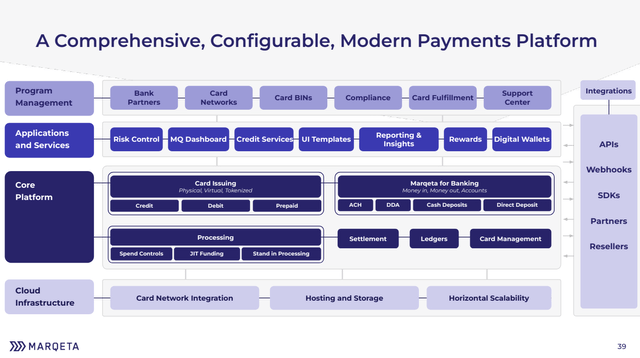

Marqeta pioneered modern card issuing more than a decade ago, enabling enterprises to launch customized card programs — such as debit, credit, and virtual cards — that are highly scalable, configurable, and reliable. Over the years, the company has also expanded to other financial services such as digital banking, risk management, and rewards programs.

Marqeta 2023 Investor Day Presentation

Marqeta is probably the best modern issuer processor on the issuing-facing side of the payment ecosystem, which is why some of the most innovative and disruptive technology companies partner with Marqeta. For instance,

- Block’s (SQ) Cash App Card, Square Debit Card, and Afterpay platform are all powered by Marqeta — Block has been working with Marqeta since 2018.

- Uber (UBER) Eats recently expanded its US partnership with Marqeta to eight additional markets worldwide — Uber has been working with Marqeta since 2020.

- Klarna, the Swedish BNPL giant, recently launched the new and improved Klarna Card in the US, which is supported by Marqeta — Klarna has been working with Marqeta since 2016.

Mind you, Marqeta’s clientele are some of the fastest-growing technology companies in their respective industries, so as these businesses grow, Marqeta grows as well.

At the end of the day, this sort of disruptive clientele shows how powerful the Marqeta platform is, which enables the company to capitalize on the great fintech opportunity.

Marqeta 2023 Investor Day Presentation

Reason #2: Massive Market Opportunity

The card industry is absolutely massive and growing at a rapid clip. In 2022, the US, Europe, and Canada generated over $15T in card volume. In 2023, Marqeta generated a Total Payment Volume (TPV) of $222B, which indicates a measly 1.5% market share for Marqeta. In other words, Marqeta has barely scratched the surface.

What’s more, Marqeta serves the fast-growing, nascent fintech industry, which includes early categories like neobanking, BNPL, and expense management. Low fintech adoption today means robust growth opportunities for Marqeta and its customers.

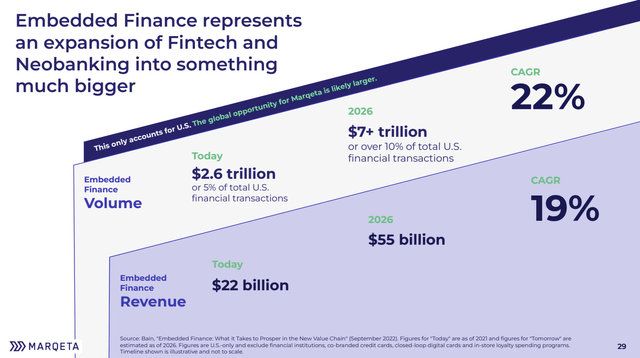

Another area Marqeta is capitalizing on is embedded finance, which is “a financial service natively integrated into the customer journey of a non-financial enterprise”. Some use cases include accelerated wage access and co-branded credit cards.

The embedded finance market was valued at $2.6T today, and it is expected to grow at a 22% CAGR to over $7T by 2026. As one of the strongest prospects in embedded finance, Marqeta will be at the forefront of this secular trend.

Marqeta 2023 Investor Day Presentation

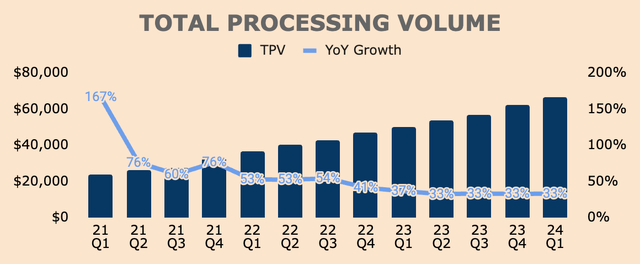

Reason #3: Robust Growth

Marqeta’s strong value proposition, disruptive clientele, and fintech opportunity have all led to robust growth for Marqeta’s platform. As you can see, TPV has been growing at high double-digits consistently over the last few years. In Q1, TPV was $67B, up 33% YoY for the fourth consecutive quarter.

Author’s Analysis

Breaking it down by vertical:

- Non-Block TPV grew 15 points faster than Block growth. If you’re unaware, Block is Marqeta’s largest customer.

- Financial services grew in line with the overall company.

- BNPL growth was faster than the overall company.

- On-demand delivery continued to grow by double digits and accelerated QoQ to the highest TPV growth in the last two years.

- Expense management growth accelerated for the second straight quarter.

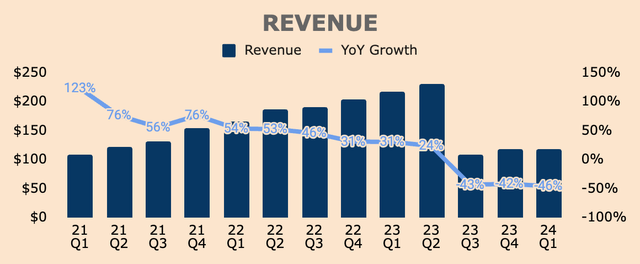

Strong TPV growth led to higher-than-expected Revenue numbers. In Q1, Revenue was $118M, down 46% YoY — not a typo. You might be thinking: “I thought you said Marqeta is a fast-growing fintech company?”

Well, to provide you with some context, the Revenue decline that you see below was due to the Block contract renewal that went into effect in July last year. As part of the new contract, there was reduced pricing as well as a change in Revenue recognition. In Q1’s case, there was a 10 percentage point headwind due to reduced pricing and a 58 percentage point headwind due to accounting changes.

Author’s Analysis

But excluding Block:

- Non-Block Revenue growth accelerated by 3 points QoQ.

- Top 10 customers grew Revenue by 30% YoY.

In other words, growth within the Marqeta platform remains robust — just look at TPV and non-Block growth. The point to take home is that Marqeta continues to process more dollars, which will eventually trickle down to its bottom line.

More importantly, while the Block renewal had a huge negative impact on Revenue, it had a much smaller impact on the company’s profit metrics. In fact, Marqeta’s profitability is heading in the right direction.

Reason #4: Improving Profitability

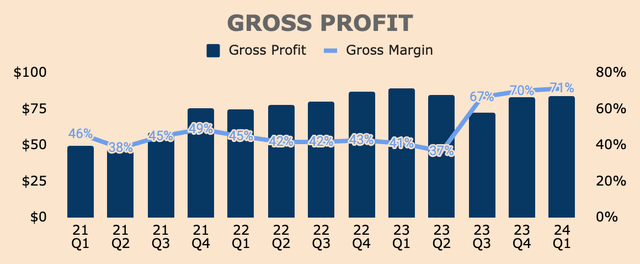

In Q1, Gross Profit was $84M, down 6% YoY due to reduced pricing as mentioned earlier. However, Gross Margin improved significantly, due to reduced Revenue, with the metric expanding 30 percentage points YoY to 71%.

But keep in mind that Marqeta’s Gross Margin is typically the highest in Q1 due to high network incentives. Gross Margin will then fall in Q2 due to its incentive tiers resetting in April. That being said, Gross Margin should stay within the 60% to 70% range.

On a side note, Non-Block Gross Profit growth accelerated by 7 points QoQ.

Author’s Analysis

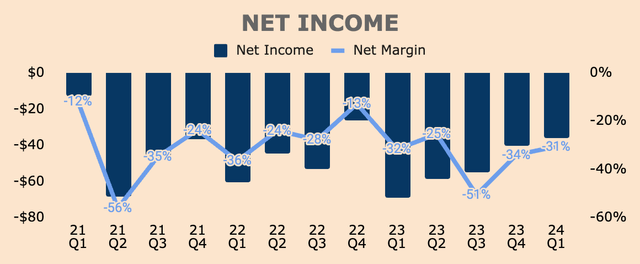

Jumping straight to the bottom line, Q1 Net Income was $(36)M, representing a Net Margin of (31)%. There’s no denying that Marqeta is still severely unprofitable.

However, things are heading in the right direction. Net Income actually improved by $33M YoY due to decreased Operating Expenses. In Q1, Non-GAAP Operating Expenses declined 20% YoY and 6% QoQ due to its restructuring in May last year as well as operational efficiencies.

As you can see, Net Income has improved for four straight quarters. We should expect this trend to continue as Marqeta scales further.

Author’s Analysis

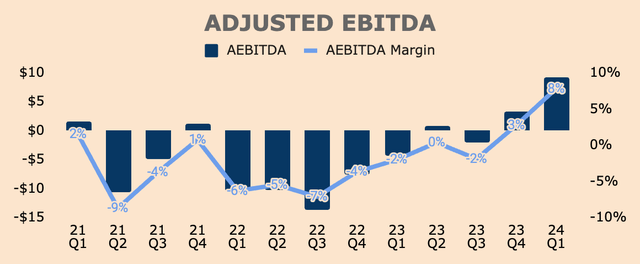

Adjusted EBITDA — which excludes non-cash charges and one-time expenses — was $9M in Q1 at an 8% Adjusted EBITDA Margin, which is a record-high for the company.

As you can see, Adjusted EBITDA is moving up.

Author’s Analysis

In short, Marqeta’s overall profitability is improving — it’s just that the Block renewal has distorted its path to profitability momentarily. That said, there’s a clear pathway toward GAAP profitability, and considering its growth and profitability momentum so far, I believe Marqeta will achieve positive GAAP Net Income much earlier than its scheduled target of Q4 2026.

Reason #5: Zero Debt

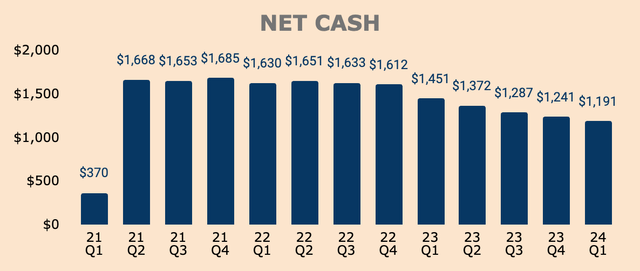

While Marqeta is still unprofitable, the company maintains a strong balance sheet with virtually zero debt. As of Q1, Marqeta has a Net Cash position of about $1.2B, which is over 40% of its current Market Cap of $2.9B!

Looking at the chart below, you may have noticed that Net Cash has been depleting over the last few quarters. This is due to the company aggressively buying back shares following its 80% crash in value.

For context, the company has fully exhausted its $200M buyback program initiated back in May 2023, which helped to decrease share count by 4% YoY. In addition, in Q1, the company also announced a new $200M buyback program, so expect more buybacks ahead, especially with the recent selloff.

Author’s Analysis

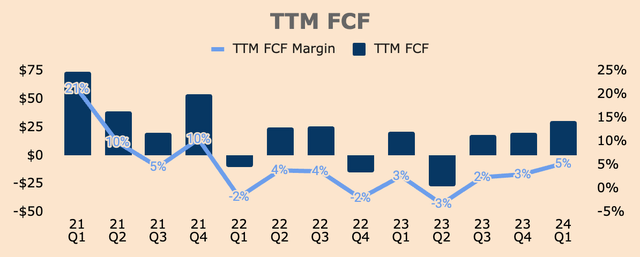

Now, Marqeta has the luxury to repurchase shares due to its large-Cash-no-Debt position. Additionally, the company is already cash flow positive. Quarterly cash flows are quite lumpy due to contract timing so I’ve included TTM numbers instead. In Q1, TTM Free Cash Flow was $31M, representing a TTM FCF Margin of 5%.

Author’s Analysis

Whatever it is, Marqeta has a strong balance with no debt over its shoulders. This gives the company a lot of flexibility in terms of capital allocation.

Reason #6: Easier Comps Ahead

Moving on, another reason to buy Marqeta stock is that following Q2 results, the Block renewal impact will be fully lapped, which means, beyond Q2, Marqeta will have easier comps, with all metrics expected to report positive growth.

So for Q2, management expects the following results:

- Q2 Revenue down 47% to 50% YoY.

- Q2 Gross Profit down 7% to 9% YoY.

- Q2 Gross Margin in the low-to-mid 60s.

- Q2 Adjusted EBITDA Margin between (5)% to (7)%. According to management, this will be the final quarter of negative Adjusted EBITDA.

While Q2 guidance looks ugly, the second half of the year will look much better due to easier comps. For one, H2 Gross Profit growth is expected to reaccelerate to 23% to 26%. In addition, H2 Adjusted EBITDA is expected to turn positive as well.

With this in mind, we should see more positive market reactions moving forward as Marqeta returns to positive growth.

Reason #7: Attractive Valuation

As it stands, Marqeta trades at an EV to Gross Profit of 5.3x, which is very cheap relative to its historical multiple. In my opinion, the stock has been under a lot of pressure lately due to slowing growth, accounting changes, and unprofitability.

But let me remind you, Marqeta is growing TPV at 30%+, has a 40% Net Cash position, is on track to turn profitable, has a strong client base, and has a long growth runway ahead, so I think a Gross Profit multiple of 5.3x is very attractive.

Koyfin

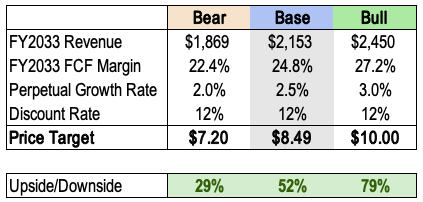

As for me, I’m keeping my price target relatively unchanged from my previous article, at $8.49 for the base-case scenario, which represents an upside potential of 52% based on the current price of $5.59.

As a reference, analysts have an average price target of $7.61.

Author’s Analysis

Thesis

2024 has not been a good year for Marqeta. The stock is down nearly 20% while the broader market marches to new high after new high — it’s quite frustrating to watch this happen.

Block concentration, accounting changes, and GAAP unprofitability might have put some pressure on the stock. Those are, perhaps, some of the major reasons to avoid Marqeta stock altogether.

However, for those who have a long-term horizon and high-risk tolerance, focusing on the positives might help:

- Disruptive, fast-growing client base

- Massive fintech market potential

- Strong topline growth

- A clear path towards profitability

- Pristine balance sheet

- Strong outlook ahead

- Decent upside potential

Hopefully, these seven reasons will help investors stay cool-headed and look forward to brighter days ahead.

Read the full article here

Leave a Reply