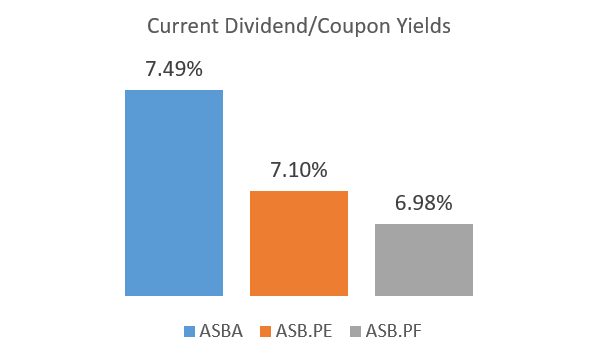

Associated Banc-Corp (NYSE:ASB) is a regional bank that is working through the challenges of maintaining deposits and increasing interest expenses faced by the industry. The bank is one of a few that offers a baby bond (NYSE:ASBA). A baby bond is a debt instrument, which trades on an exchange and can only be impaired by a default. I covered the Associated Banc-Corp baby bond back in December and decided to revisit my thesis. Currently, the bond is trading at a higher coupon yield than the bank’s preferred shares, and I believe income investors should consider adding it to their portfolio.

Microsoft Excel API

What Higher Interest Rates Have Meant for Associated Banc-Corp

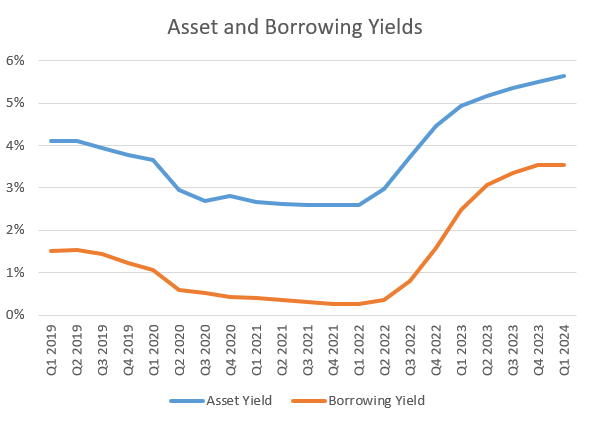

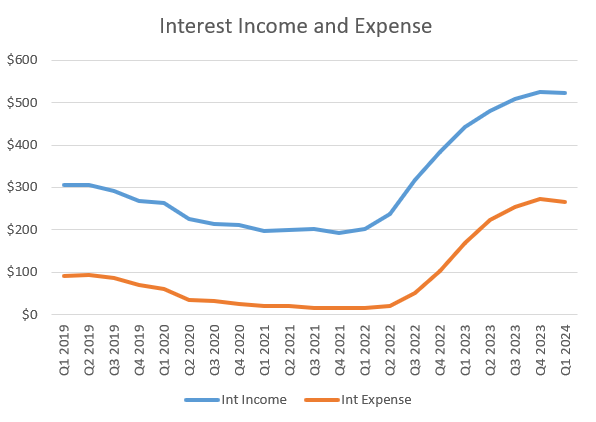

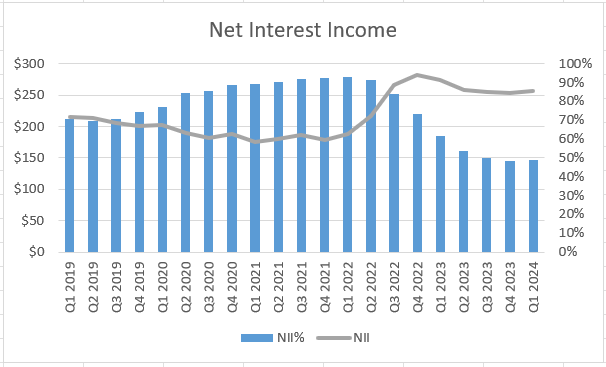

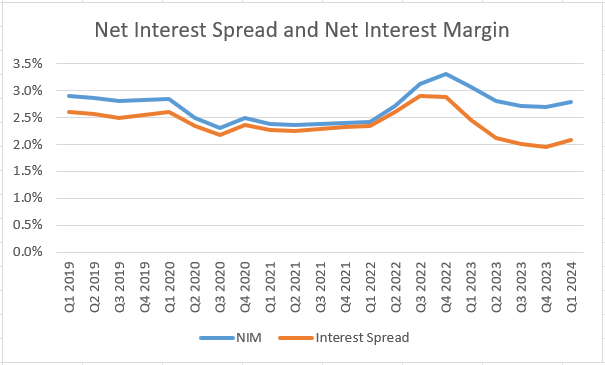

During the pandemic, interest rates bottomed out at levels not seen in recent memory. Associated Banc-Corp saw a drop in both interest income and interest expense. As rates rose, both of those factors in net interest income rose accordingly. Fortunately, net interest income (interest income less interest expense) is higher now than before the pandemic and appears to be stabilizing.

Company Financials Company Financials Company Financials

The bank also appears to be poised to grow in a higher for longer interest rate environment. The bank’s interest spread (asset yield less borrowing yield) rose in the first quarter, signaling that Associated was either having an easier time lending at higher rates, finding liabilities (like deposits) at lower rates, or a combination of the two. Net interest margin, which incorporates the weights of assets and leverage into the equation, also rose in the first quarter, which further bolstered this theory.

Company Financials

An Examination of ASB’s Deposit and Loan Changes

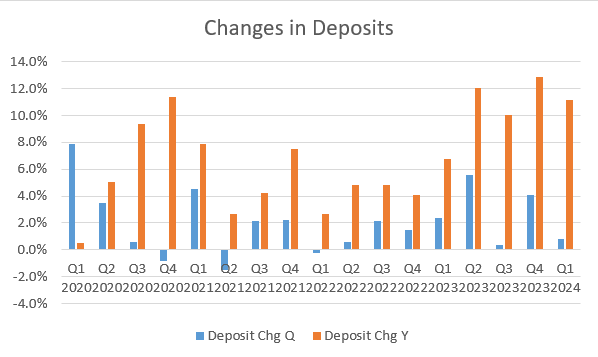

The regional banking sector has struggled to maintain deposits and consequently, it affects their ability to lend. Fortunately, Associated Banc-Corp is bucking this trend. For eight consecutive quarters, the bank has grown deposits and has seen some quarters with robust growth. Currently, deposits are 10% higher than they were a year ago. Deposit growth is the leading mechanism for banks to control their interest expenses and continue to have net interest income growth in times of high interest rates.

Company Financials

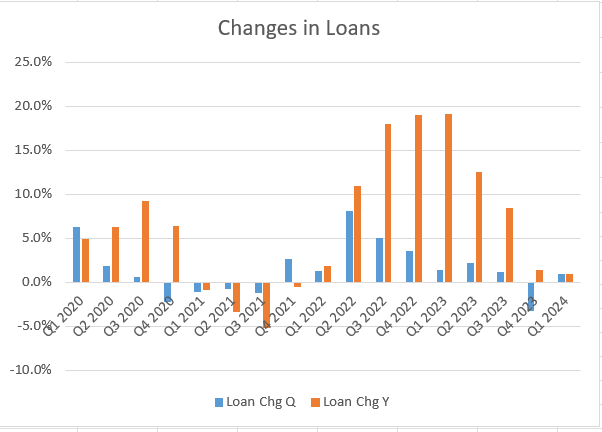

Consequently, Associated Banc-Corp can lend with more deposits. Despite a drop in lending in the fourth quarter, the bank has seen year over year loan growth going back to the first quarter of 2022. Lending growth has tapered off in recent quarters, but Associated Banc-Corp can still use its excess capital to buy agency and Treasury securities, which grew by $100 million in the first quarter.

Company Financials SEC 10-Q

Risks to Associated Banc-Corp

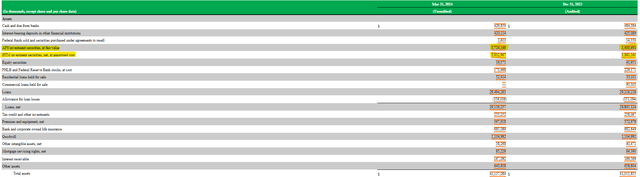

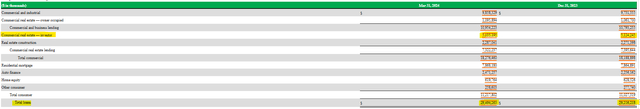

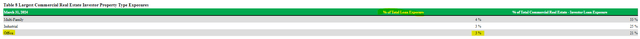

Like other banks, investors need to be mindful of the risks facing the industry and examine how those risks are quantified in the bank’s financial statements. The first risk faced by Associated Bank is its exposure to commercial real estate loans, especially those designated as investor or non-owner occupied. Currently, the bank is trimming those loan balances back, but investor CRE still comprises approximately 17% of total loans. A deeper dive into that category shows there is quite a bit of diversification within it. While office is a major part of that group, investors can take comfort in the fact that office only consists of 3% of total loans.

SEC 10-Q SEC 10-Q

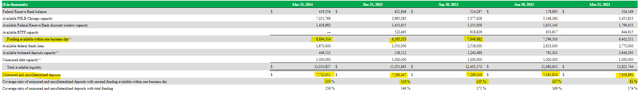

The second risk facing Associated Banc-Corp investors is uninsured deposits. Deposits that are uninsured, or not backed by the FDIC, can flee a regional bank at the first sign of trouble. Fortunately, Associated Bank has worked to improve its liquidity and has access to capital should deposit flight occur. Not only does Associated Bank have access to liquidity, but the bank has 115% coverage to liquidity available within one business day, a major improvement from 81% when the regional banking crisis occurred.

SEC 10-Q

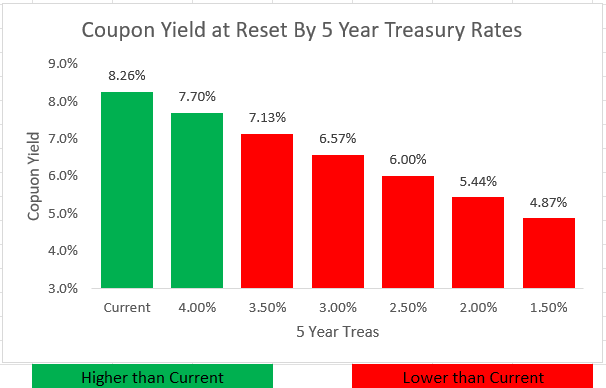

The final risk investors should be aware of is specific to their investment in the bank’s baby bond. The bond matures in 2033, but resets in March 2028 at a rate of the 5 year Treasury bond plus 2.812%. This creates interest rate risk for investors should rates be very low when the reset date hits. Because of the reset rate, no yield to maturity is available, but investors should realize that if interest rates are 100 basis points lower than they are today, the bond’s income will decline. Coupon yield is not a one-way street, however, as investors may enjoy price appreciation with a drop in interest rates. Either way, investors should be advised of the reset rate and its possibilities before investing.

Excel Model

Conclusion

Associated Banc-Corp has all the hallmarks of a bank that is navigating the challenges of the industry. While investors may see the common shares as an option based on this analysis, it’s important to mention that they are trading at a 52-week high. Additionally, the preferred shares are attractive as the risk to their dividends is minimal. However, the baby bond is safer than both and paying a higher income than both, therefore I encourage income investors to invest in the baby bonds.

Read the full article here

Leave a Reply