Note: TechnoPro’s primary listing with the most liquidity is on the Prime Market of the Tokyo Stock Exchange with security ID Code 6028. There are risks related to the liquidity of its U.S. listing. Potential investors should consider investing using the primary ticker or at least research liquidity levels before making investment decisions.

In April of 2013, Japan’s largest engineering staffing company was renamed TechnoPro Holdings (OTCPK:TCCPY) after spending an extended period of time in the hands of private equity company CVC Capital Partners. Like many private equity companies, CVC promoted a culture of Key Performance Indicator (“KPI”) driven management focused on profit growth, value creation and cost discipline. By the end of 2014, TechnoPro was listed on the Tokyo Stock Exchange and embarked on a journey of rapid growth and impressive shareholder returns, culminating in a stock price that had more than quintupled by early 2023.

TechnoPro describes itself as a global human resource services company with technology at its core. The company essentially identifies cutting-edge areas within engineering and information technology and employees a pool of top-level experts with advanced skill sets in each area. Clients then come to TechnoPro to access talent for various needs such as research and development or advancing business operations, including in digital transformation. As TechnoPro’s staff of engineers and technical professionals has grown, so has the company. With its financially disciplined private equity culture combined with an ever-increasing demand for its services, TechnoPro has grown sales at a compound annual growth rate of 11.6% over the last decade while regularly producing returns on invested capital at an impressive 18%. TechnoPro remains Japan’s top engineering staffing company, but with a market capitalization still below $2 billion, this private equity-powered growth machine remains an undiscovered opportunity for many investors.

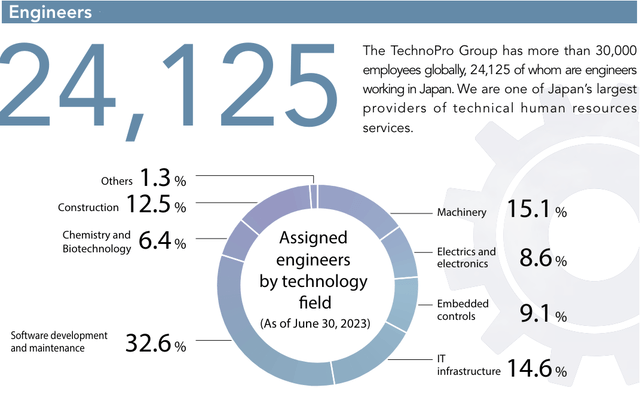

TechnoPro employees over 24,000 engineers. (TechnoPro Integrated Report 2023)

Source: TechnoPro Integrated Report 2023

TechnoPro details and industry positioning

TechnoPro is undoubtedly one of the leading companies in the technical human resources industry in Japan, but its share of the industry is far from dominant. The company’s own profile description lists the company as holding the number one position in the engineering staffing market, but with a market share of only 7.2%. The company goes on to quote a Yano Research Institute study claiming there are about 300 to 400 companies providing technical human resources services in Japan. The top three companies (including TechnoPro) hold a market share of 18.9% and the top eight companies account for 33.5% of the market. The company claims that this level of concentration creates an oligopoly nature to the market, but we are skeptical that companies like TechnoPro truly have high barriers to entry with such a high degree of market fragmentation and competition.

TechnoPro is No. 1 in its industry. (TechnoPro Company Profile)

Source: TechnoPro Company Profile

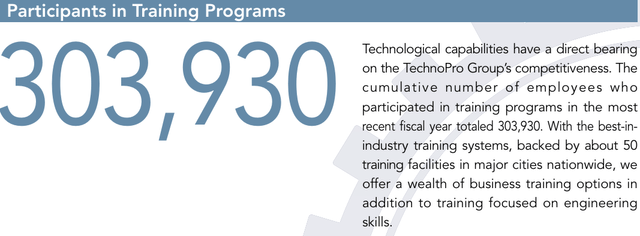

TechnoPro does create some level of differentiation and stability based on its scale, and can certainly lean on its base of nearly 2,500 clients across a variety of industries for continued success. But we see its true strength in its large base of employed engineers and its leading training programs. TechnoPro creates an attractive environment for engineers by paying competitive wages, but perhaps more importantly by offering them continued training in cutting-edge fields and the ability to work on a variety of project types. TechnoPro’s high employee retention is a testament to the attractiveness of the working environment and development opportunities. Training is also critical, as it allows TechnoPro to increase the value of its pool of engineers. The company grows through adding engineers and keeping their capacity utilization high, but it also benefits from being able to charge higher rates as the level of expertise and added value of its engineers increases through training and experience. In fact, the company is formalizing its development programs in preparation to materially grow training as a service to external clients in order to grow revenue and profit.

TechnoPro’s training participants. (TechnoPro Company Profile)

Source: TechnoPro Company Profile

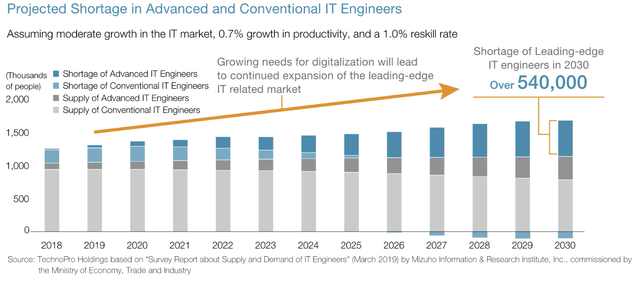

Our Base case for continued growth relies on the continued ability of TechnoPro to hold and attract talent through its attractive positioning and leading training programs. But there is substantial risk to this assumption. TechnoPro operates in a highly competitive market and demand for effective engineers is set to increase, if not even hit critical levels, over the remainder of the decade. Demographics in Japan with an aging and shrinking population are pressuring the supply of qualified engineers. At the same time, Japan is attempting to catch up with other parts of the developed world in terms of digital transformation. The result will likely be a shortage of exactly the kind of expertise that TechnoPro is nurturing and growing from year to year. The upside is that the company’s core product should continue to be in high demand, but the downside is that it will likely become more difficult and more expensive to hold on to talent and recruit new engineers. The backdrop therefore creates both an opportunity and a substantial risk for the company.

Japan faces a shortage of Engineers. (TechnoPro Integrated Report 2023)

Source: TechnoPro Integrated Report 2023

Overall, we are confident that the company can hold its leading position in a structural growth market without undue pressure on profitability, but the lack of truly dependable barriers to entry in this people-based industry is reason enough to temper expectations, and in our case, control position sizing for any allocation to the investment case.

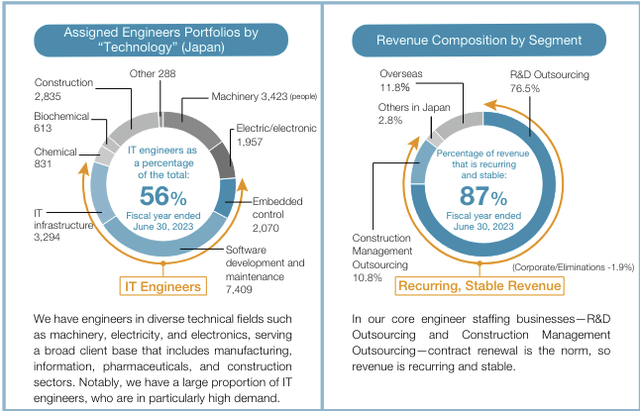

Investors should also be aware that TechnoPro is expanding outside of Japan. Its core business, roughly defined as R&D outsourcing in Japan, should remain clearly the bulk of the business, but overseas revenue sits at over 10% of the group following acquisitions such as the recent purchase of Robosoft which is based in India but has business in geographies such as the United States. TechnoPro plans to grow the overseas business, but perhaps more importantly, it intends to take expertise from companies like Robosoft to expand its Japanese business as well, offering Japanese clients leading technology solutions from across the globe. We can get a better view into TechnoPro and its industry by looking into the company’s midterm plans and its promising growth prospects.

TechnoPro plans to continue along its impressive growth path

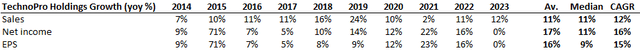

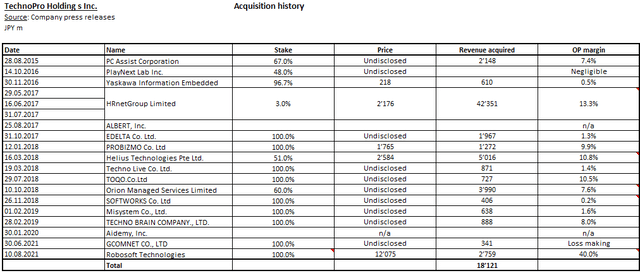

TechnoPro has grown sales at a double-digit rate over the last decade. The relative consistency of growth is also comforting. Growth has come from organic sources such as underlying expansion in the engineer staffing market and market share gains, but also through a series of acquisitions.

TechnoPro historic growth. (LSEG, company reporting)

Source: LSEG

We are encouraged to see that the lion’s share of growth has been organic while acquisitions have served more to add talent and skill sets or new markets without stretching the balance sheet or upsetting the successful culture of tight financial control and targeted growth. A list of acquisitions over the last decade compiled from company press releases shows that the amount of revenue acquired approximates only 14-15% of the revenue increase over the period, which clearly did not have a negative impact on operating margins.

TechnoPro acquisition history. (Company sales releases, Oyat)

Source: Company press releases, Oyat

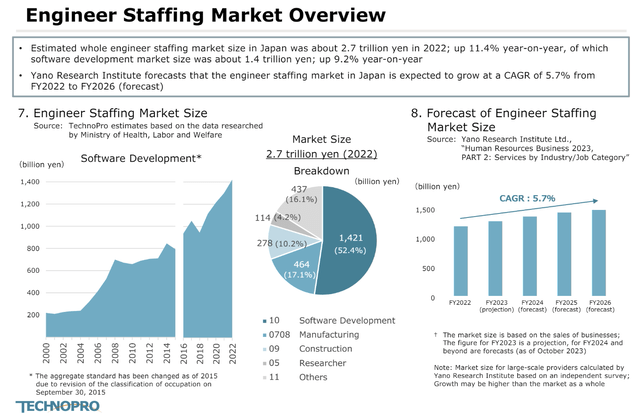

Historical performance is impressive, but more importantly we see reason to believe that the company can continue to grow at a mid to high single-digit rate going forward, even if acquisitions do not continue at their historic pace. We demonstrated the likely continued demand for the company’s services through a projected shortage of engineers and engineering expertise in coming years, and those dynamics materialize in industry growth projections. Looking at the engineer staffing market, we see that TechnoPro, even as the largest participant, still has ample room to consolidate the industry and take market share. We also see that the expected underlying growth rate is in the mid to high single-digit range, as demonstrated by the graphics below.

Engineer Staffing Market. (TechnoPro Q3FY 2024 Investor Relations Presentation)

Source: TechnoPro Q3FY 2024 Investor Relations Presentation

If TechnoPro can maintain or grow its market position, its core business should be able to achieve a growth rate between 5% and 10% in coming years. Additional growth might come from market share gains, new business areas such as engineer training services, overseas expansion or acquisitions. The company also plans to evolve part of its core business into a more solutions focused business that seeks to leverage its expertise and active customer relationships to expand work into more forward-thinking solutions implementation where projects can be attained to help customers design and implement cutting-edge solutions, especially related to digital transformation initiatives. One key motivation for acquisitions such as the overseas Robosoft transaction is to bring in leading solutions from companies and geographies that are more advanced than some areas of the Japanese market and apply them to TechnoPro’s offering in its home market.

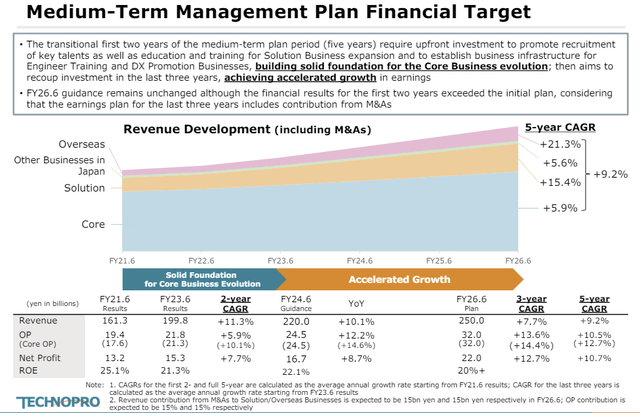

If we look at midterm financial targets, we see that the company plans to grow revenue close to 10% in the coming years while maintaining attractive profitability.

TechnoPro Medium-Term Management Plan (TechnoPro Q3FY 2024 Investor Relations Presentation)

Source: TechnoPro Q3FY 2024 Investor Relations Presentation

While we don’t see any obvious reason why the company can’t continue to grow at a double-digit rate, we do apply a greater degree of caution to our own Base case assumptions. It will be difficult for the company to continue to attract and retain talent in the coming years, and it has a limited track record of effectively running a large overseas business. We also note that historic figures from the last decade occurred during a relatively benign economic backdrop in Japan. There is clearly structural growth support in TechnoPro’s industry that might outweigh some degree of cyclical pressure, but it is still unclear to us how the company’s financial results might react to a meaningful downturn in the Japanese economy. It is possible that economic pressure could result in a sales decline which would test the flexibility of TechnoPro’s cost base or even result in rather depressed profitability levels. As shown below, the company defines nearly 90% of revenue as recurring and stable as most client contracts are renewed consistently, but we are more skeptical and wonder if that renewal rate would drop in a downturn. Most staffing contracts are three or six months in duration, so there is a major contract renewal cycle essentially every quarter. Recent contract renewal rates have exceeded 90% despite concerns of a global recession, but we assign a material level of risk to the idea that contract renewal rates could decline substantially if clients come under real economic pressure, creating additional uncertainty surrounding profitability levels. While the current fiscal year is nearly finished (June year-end) and likely to finish near the company’s guidance for double-digit growth, we find it more prudent to model mid-single digit growth rates for the midterm, building in some level of conservatism relative to company targets.

TechnoPro Revenue Breakdown. (TechnoPro Integrated Report 2023)

Source: TechnoPro Integrated Report 2023

A deeper look at TechnoPro’s financial profile beyond growth

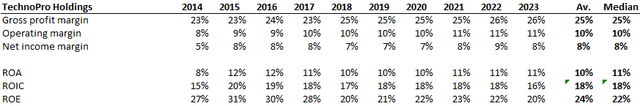

TechnoPro’s history of being managed by a financially rigorous private equity company with KPI-tracked performance is evident in the company’s continuing financial results. Profitability and return on invested capital (“ROIC”) present a consistent and impressive record of success with a focus on value creation. The figures below show steady operating margins that have gradually tricked up over the years while the company regularly posts an impressive ROIC near 18%.

TechnoPro’s margins and returns. (LSEG, company reportings)

Source: LSEG

We also find plenty of anecdotal evidence that the company’s culture continues to be focused on rigorous financial measurement and on continued attractive investment returns. The phrase “value creation” appears no less than 154 times in the company’s recent integrated report for 2023. A recent quarterly results update from TechnoPro’s investor relations team contains no less than three slides with a list of 74 KPIs for financial and non-financial targets, including areas such as human resources, technology, social responsibility and governance. The company’s comprehensive control capabilities with clearly defined targets gives us confidence that TechnoPro can continue to operate a well-oiled machine, at least as long as the company can avoid a material downturn.

Moving onto cashflows and capital allocation, we note that TechnoPro operates a capital-light business, requiring little in terms of capital expenditures or working capital. Profit is consequently turned into free cash flow at an impressive rate, with well over 100% of net income finding its way into free cash flow.

TechnoPro’s cash flow conversion. (LSEG, company reportings)

Source: LSEG

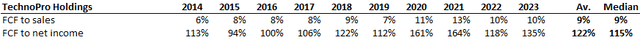

Management has a clear policy for how to allocate the cash generated by its business, with a priority to achieve a dividend payout ratio of 50% or higher. After the dividend, the company strives to invest in the business with acquisitions as a focus. In periods where appropriate acquisitions cannot be achieved, as in recent quarters, share repurchases are considered.

TechnoPro shareholder return. (TechnoPro Q3FY 2024 Investor Relations Presentation)

Source: TechnoPro Q3FY 2024 Investor Relations Presentation

Of course, it is important that capital allocation is done in coordination with the company’s financial position. Historically, TechnoPro has used only a modest amount of debt financing and currently has a net cash balance. Management mentions a debt-to-equity ratio of 1.0 times as an ultimate limit to help ensure financial health. All in all, TechnoPro has a strong balance sheet with a history of financial discipline which should continue to support its growth and capital allocation targets.

Risks and challenges related to TechnoPro’s business

TechnoPro’s growth relies on the ability to recruit and retain engineers. The tightening market for experts in the company’s end markets will make it increasingly difficult for TechnoPro to grow its talent pool, especially without increasing costs to do so. TechnoPro’s leading development programs should be part of the solution as a direct method for tackling the shortage of trained experts, but there is no guarantee that training new engineers or enriching the skills of experienced professionals will be enough to dampen the pressure from scarcity of TechnoPro’s most precious asset. We also accept that TechnoPro ultimately has limited barriers to entry in a competitive and still fragmented industry in Japan. The company’s strong market position and execution are driving impressive results for now, but it is certainly possible that the competitive backdrop intensifies. Importantly, much of TechnoPro’s business is technology related. There is a risk that artificial intelligence-driven innovation and digitalization may reduce the need for human engineers over the long term. There are also inherent risks to growth through acquisitions and overseas expansion. In addition, we have concerns or at least uncertainty regarding the cyclicality of the company’s business. TechnoPro’s listed history covers a relatively stable economic period, with revenue growth in every fiscal year. Should a material downturn affect the Japanese economy, it is possible that TechnoPro experiences periods of declining revenue despite the structural growth drivers in its industry, and we are not certain that TechnoPro’s cost base is flexible enough to preserve attractive profitability in such challenging market environments.

All that’s left now is TechnoPro’s valuation

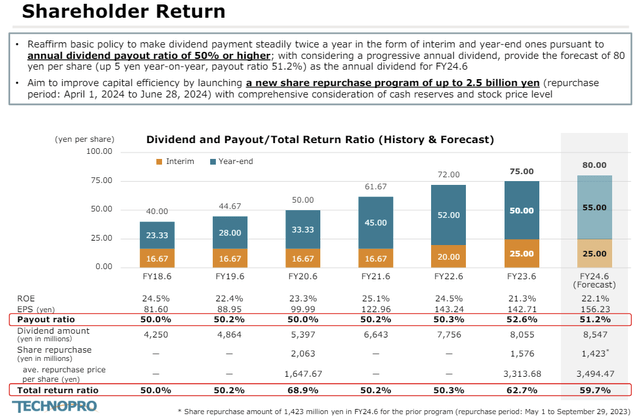

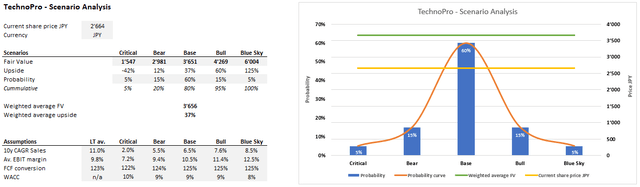

No investment case is complete without a grounded view on valuation. We use a number of discounted cash flow scenarios to estimate a probability-weighted fair value of close to JPY 3,656 per share. We constructed several possible valuation cases from Critical to Blue Sky, but ultimately, our final valuation is centered around our Base case valuation model. We do not see any particular skew to the up or downsides in terms of possible financial outcomes. Our various models are based on the following:

- Base case: A 6.5% revenue CAGR over the next decade with a 125% free cash flow to net income conversion rate and a weighted average cost of capital of 9%. Operating margins average 10.5% over the coming decade.

- Bull case: Growth holds up at higher levels, taking the 6.5% CAGR from the Base case up to a 7.6% CAGR. Operating margins go from 10.5% in the Base case to 11.5% over a few years (averaging 11.4%). The weighted average cost of capital is 9%, and cash flow conversion basically stays the same as the Base case.

- Bear case: The company misses guidance and grows slower over the decade, ending with a CAGR of 5.5%. Operating margins decline and average 9.4%. Weighted average cost of capital is 9% and cash conversion drops slightly compared to the Base case due to the lower margins.

- Critical case: We view this case as highly unlikely, but if there is a surge in competition or an unexpectedly rapid negative impact from artificial intelligence or simply a material economic downturn in Japan, it is altogether possible that this Critical case plays out. The current year can’t miss guidance by too much as it’s mostly in the books, but then growth drops to close to 0% quickly and ends the decade with a 2% CAGR (the outcome would be similar with a rather serious decline and then recovery). Operating margins decline to 6.2% and average 7.2% for the decade (below even the company’s worst ever year). Cash flow conversion drops to 121% and the weighted average cost of capital goes up to 10%.

- Blue Sky case: Growth stays elevated and results in an 8.5% CAGR for the decade. Operating margins increase with the scale, especially due to SG&A leverage to hit 13% and average 12.5% over the decade. There is no real meaningful change in cash flow conversion from the Base case, but the weighted average cost of capital drops to 8%, which is close to the company’s own estimate.

The details and the output of these valuation scenarios is perhaps easier to digest in graphical format and is detailed below. Overall, we see an attractive level of upside with a satisfactory level of predictability regarding the trajectory of the business.

TechnoPro Scenario Analysis. (LSEG, Oyat)

Source: LSEG, Oyat

TechnoPro should continue to grow and produce attractive levels of shareholder return

TechnoPro is a leader in the Japanese engineer staffing market and has an impressive track record of double-digit growth and high teens return on invested capital. The company employs the largest pool of talent in its industry niche with perhaps the most respected training and development program in its segment, busy enriching the careers of over 300,000 individuals a year. The company’s history of private equity ownership instilled a culture of disciplined financial control, which continues through the company’s KPI-driven measurement protocols and a keen eye for value creation. The company’s financial profile is supportive, with a net cash position and capital allocation split between the dividend and growth initiatives. Historical financial results speak for themselves, and we see little reason why the company can’t continue to grow in the mid-single digit range with stable, if not improving, profitability levels. If the company can achieve our Base case valuation assumptions or even its more aggressive internal growth targets, we’d expect an attractive level of shareholder return for investors aware of this promising Japanese small-cap company.

The investment case is not without risk, however, as a tightening labor market in Japan makes it increasingly difficult for the company to grow its team of engineers while artificial intelligence threatens to impact demand for the company’s core services. We also have concerns surrounding the degree of cyclicality TechnoPro’s business might experience should a material economic downturn impact Japan. But ultimately, we are confident that the company can continue to grow and sustain its current level of profitability and return on invested capital based primarily on its strong industry position, tight financial discipline and attractive plans to continue building expertise in high-demand areas of the engineering and information technology industries so important for Japan as it goes through the digital transformation of its economy. The current valuation, according to our modelling, offers attractive upside for investors looking for a profitable combination of return on invested capital and growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply