If one had to point out the main rival of Tesla one would almost certainly end up with BYD (OTCPK:BYDDF) (OTCPK:BYDDY), the Chinese battery and EV producer who for a brief period produced even more EVs than Tesla, and could very well overtake them again soon.

We discussed BYD more fundamentally here in early April and came away very impressed (and we’re not the only ones) as they have managed to gain ground rapidly on its main international rival Tesla (TSLA), which we analyzed more fundamentally in two separate articles.

We think BYD has the upper hand currently as it’s able to make much cheaper cars, which is where most of the demand actually is at the moment. As discussed in more detail, this is mainly due to producing their own batteries and having a well-integrated approach to assembly.

Here is a token of how competitive BYD is (our emphasis):

Take the BYD Atto 3, a compact electric crossover. In China, the midrange version sells for $19,283. In Germany, the little SUV is priced at $42,789 — a price that’s still competitive with comparable electric vehicles in that market… BYD’s big export markups also underscore the massive cost advantages that China’s EV industry has over foreign competitors.

BYD more than doubles the prices of its EVs in foreign markets, enabling it to produce huge margins it can’t get in the hyper-competitive home market and shedding the reputation for cheap products (and at least formally be less liable to accusations of dumping).

Tesla also has a production facility in China, but price differences are much less pronounced between markets:

By comparison, the Reuters analysis found that Tesla, which has a higher cost base than Chinese rivals, sells its Chinese-made Model 3 for only 37% more in Germany than in China, according to Tesla’s web site.

Tesla has advantages mainly in the amount of data it has gathered to drive their self-driving technology, where it is ahead of most of the competition if not all of them even if they’re not using lidars or radars.

It has additional advantages that are somewhat more peripheral, like its network of charging stations and using the massive amount of driver data to offer its own car insurance.

So let’s compare these two great rivals on some financial metrics

Growth

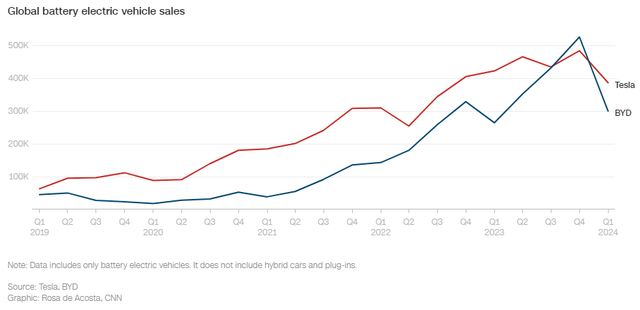

Although Q1 was disappointing for both BYD and Tesla, the latter could even reclaim its post as the no.1 producer of EVs:

CNN

EV sales were still up 13% y/y and sales recovered strongly in March (139.9 EVs, up 36.3% y/y and 302.4K cars, up 46% y/y) so the slow start to the year could just have been the festive season falling early this year. In terms of revenue:

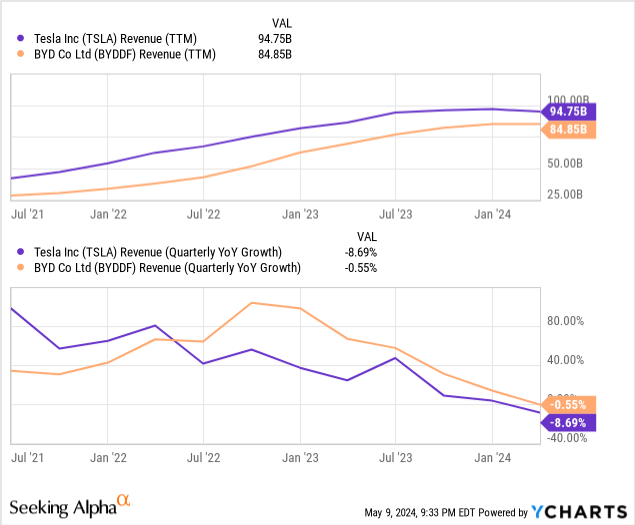

Since mid-2022, BYD is outgrowing Tesla, although they both have seen their growth come down a lot.

Margins

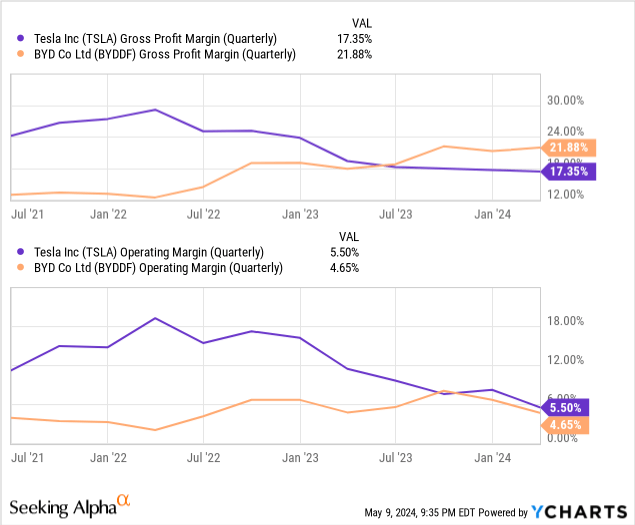

More remarkably, BYD has closed (operating margin) or even overtaken (gross margin) an erstwhile huge Tesla margin lead:

It’s remarkable how BYD has managed to close the margin gap (although part of that might have been caused by the much more stringent Covid restrictions in China until late 2022).

Cash flow

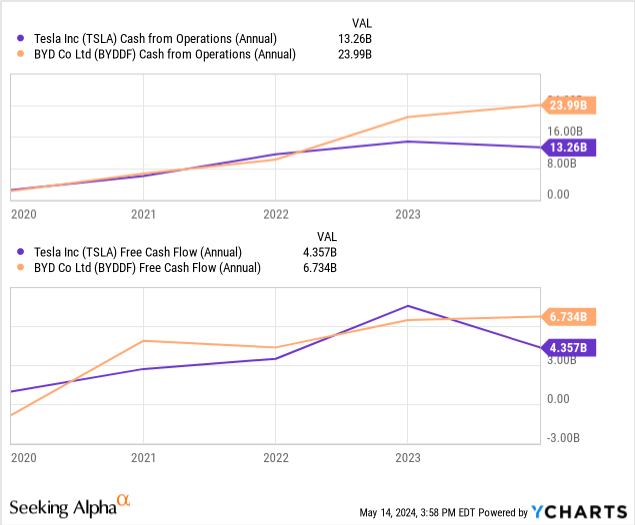

BYD produces nearly twice the amount of operating cash flow, despite being mostly dependent on a hyper-competitive Chinese market, so this is pretty remarkable:

BYD has overhauled Tesla in producing cash flow last year (for BYD, only yearly figures are produced).

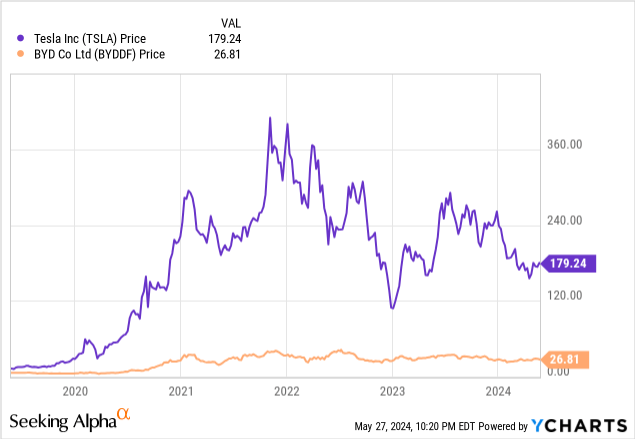

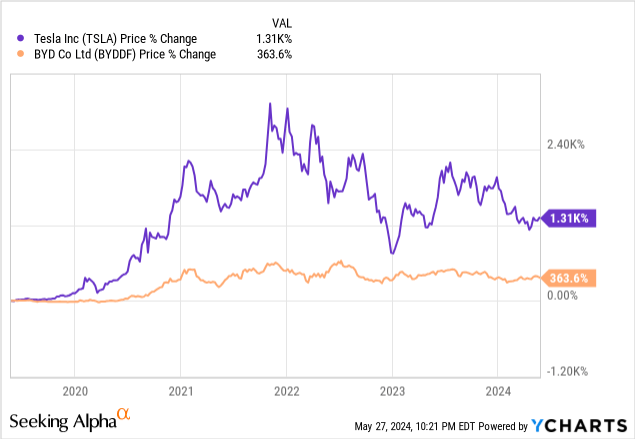

Share performance

So at first sight it seems a little odd that Tesla shares are doing so much better, even if Tesla hasn’t come close to its top reached in late 2021:

And on a relative basis:

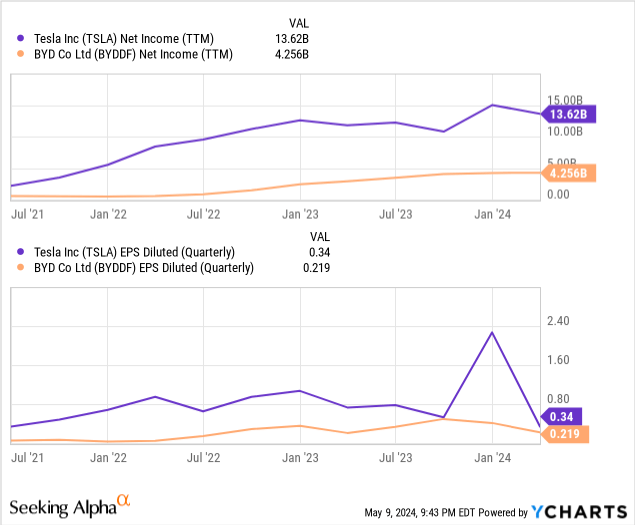

Earnings

But it is less surprising in the light of this:

Tesla has consistently produced much more earnings and earnings per share, although in the case of the latter, the gap is closing.

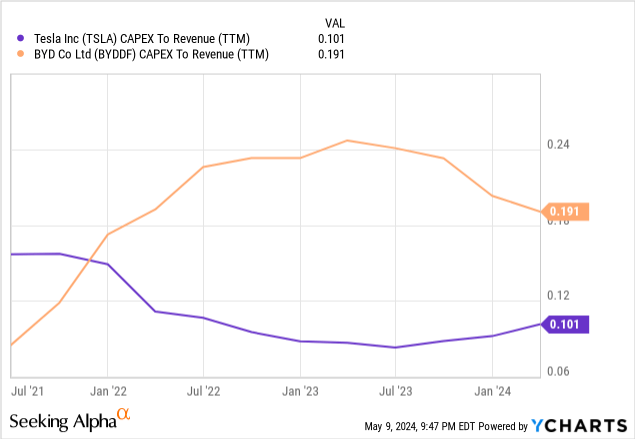

CapEx

We suspect that BYD invests much more, given BYD generates higher gross margins and produces almost twice the operational cash flow compared to Tesla:

Indeed, at 19%+, BYD spends more than twice on CapEx per revenue compared to Tesla, all these new plants and fleet of ships, adds up, which opens up the intriguing prospect of BYD to keep growing faster.

BYD is introducing new models much faster than Tesla:

- At least eight new models were revealed at the Shanghai autoshow in April 2023.

- Three new models under its off-road Fangchengbao brand.

- And some additional models in 2024.

It’s sort of dizzying and hard to keep up. Apart from the cybertruck, Tesla hasn’t introduced even a single new model in years, and BYD has announced its own pickup truck, the BYD Shark.

The Shark is a hybrid, not an EV, but if you want an outlandish looking EV SUV they also have that in the form of the low-cost ‘interstellar chariot’:

Electrek

The more one looks, the more BYD models one will uncover, like a new Denza, a new BYD and Mercedes-Benz co-branded luxury electric vehicle that will roll out before the end of the year. It’s much more BYD than Mercedes, though:

Denza was founded in 2010 as a 50:50 joint venture between Mercedes-Benz (Daimler) and BYD. Mercedes has since reduced its stake to just 10%, leaving BYD with the other 90%.

Now, introducing new models is expensive, but BYD uses the same platform for many models, which brings down cost. In fact, it is about to introduce a new platform that promises to bring down costs even further:

The new platform will update BYD’s DM-i and all-electric models, according to the sources. Most BYD vehicles are based on its e-Platform 3.0, featuring up to 1,000 km (620 mi) CLTC range… The big advantage of BYD’s current 3.0 is the eight-in-one integration, which cuts costs by nearly 20%. The upcoming 4.0 will take it to the next level with more integration and fewer wiring harnesses. This will support further cost reduction, according to the report. Its next-gen DM-i system will enable PHEVs to drive over 1,200 miles (2,000 km) with a fuel tank and full charge. This will make it hard for traditional gas cars to compete.

It has already introduced the first model based on this new platform, the Ocean-M. It also serves as a platform for hybrids, we should not forget that BYD sold 1.4M hybrids, apart from the 1.6M EVs, in 2023 and the platform it’s using is apparently so good that Toyota plans on using it.

It’s not stopping there, the second version of its Blade battery will appear this year:

The company’s latest Blade batteries have an energy density of up to 150Wh/kg. BYD’s next-gen EV battery is expected to reach upwards of 190Wh/kg. This could enable fully electric models to exceed 621 miles (1,000 km) CLTC range, which would be the highest among LFP batteries. The report claims BYD will release the new battery as soon as August 2024.

BYD also launched a sodium battery joint venture to produce lower-cost batteries. People with experience in US car production are clearly worried:

Terry Woychowski, former chief engineer for several General Motors pickup truck models, says that the extremely affordable yet allegedly high-quality BYD Seagull EV from China is a “clarion call” to American automakers to make electric vehicles for the everyman, noting that “things will have to change in some radical ways in order to be able to compete” against low-cost Chinese EVs.

Woychowski ascribes the BYD advantage to:

the entire suite of BYD Seagull components is “all in-house and vertically integrated,” describing this manufacturing setup as “an incredible advantage that they have.”

And he’s hardly alone, even Musk, who laughed at BYD in 2011 recently argued about the Chinese EV competition that:

they will pretty much demolish most other car companies in the world

And he argued for steep tariffs, to which the US government is now obliging, slapping prohibitive 100% tariffs on Chinese EVs. The reasoning behind that is distinctly dodgy (our emphasis):

Biden said the increased levies were a proportionate response to China’s overcapacity in the EV sector. Sources said China was producing 30m EVs a year but could sell only 22-23m domestically.

Overcapacity makes products more expensive, not less, so this is a really curious argument, especially as better arguments are available from my view. What should also be clear is the magnitude of the competitive threat (our emphasis):

China’s price advantage is big enough that even the 25 percent Trump-Biden import tax might not have been enough to deter companies like BYD from entering the US market. Hence the 100 percent tax.

Here you already see the contours of the next steps:

And that might not be the end of it. Commerce Secretary Gina Raimondo has described Chinese-made cars as a national security threat, and recently announced an investigation into the vehicles’ data collection abilities and the possibility they could send movement data to Beijing.

But when you have the likes of Musk and the Alliance for American Manufacturing arguing that the introduction of Chinese cars to the US market would be an “extinction-level event” for its carmakers, what are policymakers in the face of an election supposed to do?

How BYD can build such cheap EVs as the Seagull isn’t a mystery to the likes of Terry Woychowski, a former chief engineer on General Motors’ pickup trucks, who took one apart.

It’s no secret what are the main ingredients of that, lower labor cost, producing everything (including batteries) inhouse and cleaver engineering like design for manufacturability. The result is pretty good:

The Seagull still has a quality feel. Doors close solidly. The gray synthetic leather seats have stitching that matches the bright green body color, a feature usually found in more expensive cars. The Seagull tested by Caresoft has six air bags and electronic stability control. A brief drive through some connected parking lots by a reporter showed that it runs quietly and handles curves and bumps as well as more costly EVs

He’s far from the first one to come to this conclusion, and how the Chinese got to be so good at EVs is also corroborated by multiple accounts.

Instead of prohibitive tariffs (which are likely to be countered and also make Chinese batteries more expensive in the US), a better reaction is this:

Ford CEO Jim Farley, has seen Caresoft’s work on the Seagull and BYD’s rapid growth, especially in Europe. He’s moving to change his company. A small “skunkworks” team is designing a new, small EV to keep costs down and quality high, he said earlier this year

They will have to, as Ford’s charge into the EV market isn’t going too well, raking up over $100K losses per vehicle in Q1/24. This underlines the sense of panic in the US market and hence the strong policy reaction introducing prohibitive tariffs

However, the jury is still out what would happen if the likes of BYD start building plants in Mexico, which would produce EVs not liable to any US tariffs (at least for now).

BYD’s Q1/24

BYD experienced a disappointing Q1 with revenue only up 3.9%, missing estimates, the result of an intensification of a price war and an early holiday in China. Net income did rise 11%, so there is further operating leverage despite a price war in its core market, which is pretty impressive.

NEV sales (EVs and hybrids) rose 14% nevertheless to 620K cars and the company fared much better outside China as exports rose 153% to 98K cars.

March proved much better:

March sales were 302,459 vehicles, a 46% jump from a year earlier and its second-highest monthly sales tally. BYD reported an all-time monthly high of 341,043 units in December. Sales of its purely electric models hit 139,902 in March, a 36.3% increase year-on-year, while sales of plug-in hybrids rose 56.4% to 161,729 units.

So it looks like the start of the year was a temporary blip and management guides for 3.6M vehicles in FY24, a 20% increase. The cloud on the horizon is possible EU trade restrictions (the 100% Biden tariff isn’t really harming BYD as they don’t sell EVs into the US).

This will be difficult, as Chinese EVs sell at a huge premium in Europe compared to prices in China, as we explained above, which makes it difficult to accuse the Chinese producers of dumping, but we guess they’ll find a way, given the seriousness of the Chinese competitive threat.

We also went through the company’s Q1 filing, but there is little that stands out as a major change:

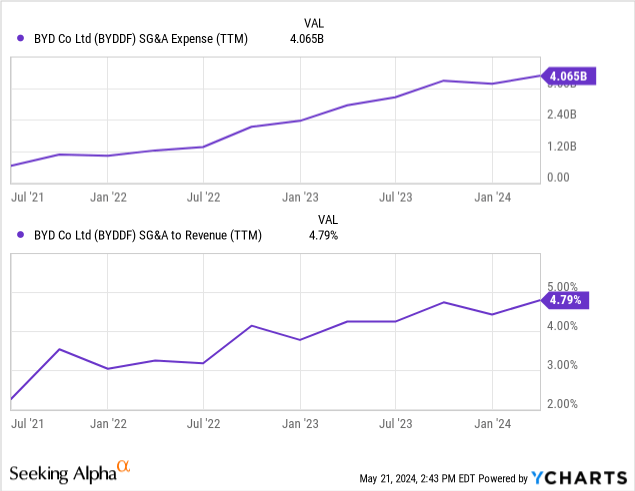

- S&M went up by 46.3% to RMB6.8B due to an increase in advertising and exhibition expenses

- R&D went up 70.1% to RMB10.6B “Mainly due to the increase in employee remuneration and material consumption

There is a degree of negative operating leverage:

In R&D as well:

This is definitely something to keep an eye on, basically R&D doubled as a percentage of revenue in just 18 months so it’s no surprise operating cash flow declined 29.3% to RMB10.2B, although we are by no means alarmed as RMB10B is still substantial and these quarterly figures are lumpy.

We also think that it’s likely that revenue growth will recover during the rest of the year.

The company receives quite a bit in government grants, ‘other income’ increased161.2% to RMB1.8B which is:

Mainly due to increase in government grants related to daily operating activities

Gains from investment rose 153.3% to RMB622M, these are mostly from investments in joint ventures.

- Long-term deferred expenditures (basically stuff they prepaid) went up by RMB1.3B and its current prepayments by another RMB800M

- Deferred tax assets went up by, RMB500M

The company’s cash position worsened RMB13.3B to RMB86.8B, but there was a considerable rise in inventories of RMB11.1B to RMB98.8B so if demand picks up we should see a decline in inventories and an improvement in cash.

The alternative view is that the rise in inventories is worrying but without a comment from management it’s difficult to assess. Were they building for a recovery in demand, or are inventories rising because they can’t sell what they built?

We guess it’s the first, we find it difficult to believe that a company like BYD would not have its finger on the market pulse and adjust production accordingly and the latest (May/24) sales signals are getting better:

China’s leading electric car maker, BYD, just hit a new YTD EV sales record last week in its home country. BYD expects the momentum to continue with new EVs rolling out in key segments globally. New data from Morgan Stanley (via Investing.com) shows electric vehicles outpaced their gas-powered rivals last week after recovering from the recent holiday in China… BYD had the biggest WOW improvement, with registrations up 30% to 69,500 last week.

Besides, the company is in the early innings of an assault on foreign markets and has the cheap but very well-regarded Seagull as one of its spear points. But we’ll have to keep an eye on how this develops in subsequent quarters.

Valuation

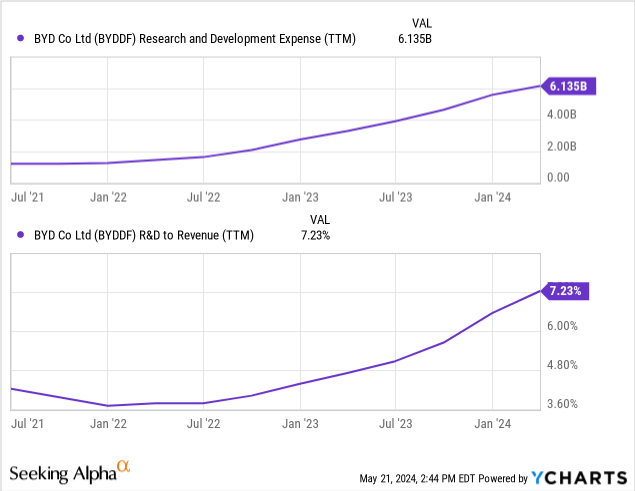

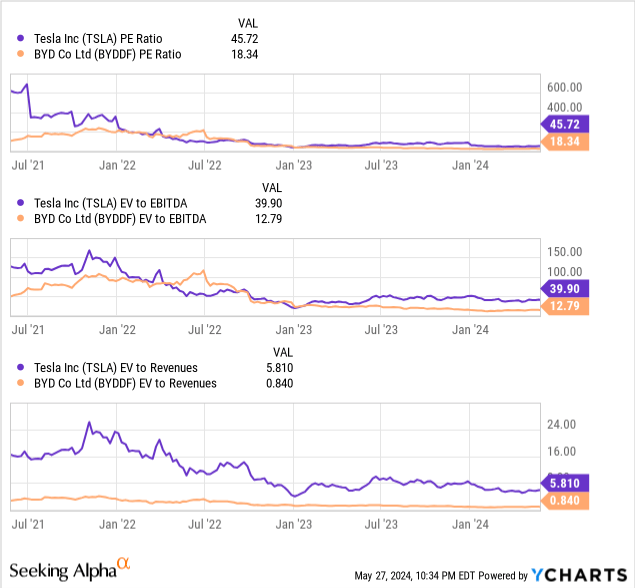

There is still a vast valuation gap between Tesla and BYD:

We think this vast valuation gap is more a reflection of overvaluation of Tesla than any undervaluation of BYD.

We do think BYD shares are attractive here, given BYD’s trend of winning market share. The shares are particularly cheap on a sales basis. The company is prioritizing market expansion over profitability, witnessing the huge R&D and CapEx effort (both much higher than Tesla’s).

We think that it could be a much more profitable company if it scaled down some of its most ambitious expansion plans (like the fleet of megaships to transport cars for export markets).

Yet despite much bigger R&D and CapEx efforts, BYD produces substantially more cash flow compared to Tesla, which is why we think BYD deserves higher earnings multiples.

Should the EU emulate US protectionism versus Chinese EVs, that would dent our enthusiasm a little, but we think there are some ways around that (building that plant in Hungary, for starters).

Discussion and conclusion

It seems that only Tesla can stand up to the Chinese EV competition, but the fact that even Musk has pleaded for steep US tariffs is a sign even he sees a clear threat. And rightly so, BYD in particular can produce much cheaper EVs than Tesla, which can also withstand any objective comparison.

Adding to the problems, as a result of the cost advantage BYD (and multiple other Chinese EV producers) is operating in the mass market segment where most Western companies struggle, and it’s here where most of the demand seems to be at the moment.

While Tesla is more profitable and US tariffs (and possibly additional protection should the Chinese embark on Mexico as a production site) will save them from the Chinese competition on its home turf, the going will get a lot tougher almost anywhere else.

BYD not only produces much cheaper cars, it is also introducing new models much faster than Tesla, forcing Tesla into a series of price cuts globally, particularly in China.

There are several possible explanations (by no means mutually exclusive) for the still vast valuation gap between Tesla and BYD:

- BYD suffering from the China discount, Chinese shares are much cheaper in general and are struggling while US equity markets are booming.

- BYD depends more heavily on the Chinese market where there is cutthroat competition and margins are wafer thin, while Tesla gets most of its sales from the US where it is shielded from Chinese competition.

- BYD spends much more on CapEx, forgoing profits today for profits tomorrow and prioritizing growth over profits as it invests heavily in new capacity, an export drive, new models, and new technologies.

- Tesla has been more profitable, at least up to now, but BYD has already overtaken Tesla in cash generation despite higher CapEx and low margins in China.

We think that based on pure financial information, there is no reason for the huge Tesla valuation premium. In fact, if anything, BYD’s immediate prospects in EVs seem brighter than those of Tesla.

Tesla’s share price is mostly held up by the aura of the company and its FSD prospects and some other more peripheral income streams (like insurance, charger network, and services) as we argued in our Tesla article.

BYD is behind in FSD but given the rapidly increasing number of its cars (and busses) on the road it should be able to gather lots of data to make significant progress with its own FSD program.

They were the first to be licensed for Level 3 autonomy in China in 2023 (although that was conditional and limited to “high-speed roads in Shenzhen”) and it is working with Nvidia’s DRIVE Orin SoC as the centralized compute and AI engine for automated driving and intelligent cockpit features.

But we have seen no claims like Tesla’s that they will put self-driving cars on the road anytime soon. BYD management is on record arguing that full autonomy is “basically impossible.”

Nevertheless, they are investing billions in ADAS and other smart systems for cars:

BYD, the world’s largest electric vehicle ((EV)) maker, will invest 100 billion yuan (US$14 billion) in smart cars, as the company expects intelligent new energy vehicles to be the next battlefield for the industry, founder and CEO Wang Chuanfu said.

So while they are behind Tesla on FSD, we don’t see compelling reasons why they couldn’t catch up, given the data collection potential, investments they are making, and competitive pressure in China where the young seem particularly interested in smart systems in cars and some competitors (most notably Baidu, which already has a fleet of robotaxi’s operating in major Chinese cities).

Another headwind that might be blowing for BYD is import restrictions. The US government is just slapping 100% tariffs on Chinese EVs, which isn’t hurting BYD as they are not selling any EVs in the US.

They are considering building a plant in Mexico, which offers a way around those tariffs (although the US will likely find another way to prevent that, as we argued above).

More problematic would be increased trade restrictions selling to the EU, although BYD already has a plant producing buses in Hungary, and it has plans for an EV plant as well there, so that’s one way of getting around that eventuality.

So all-in-all, apart from the China discount, we see little rationale for the huge valuation premium that Tesla enjoys vis-à-vis its main rival, BYD.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply