Barings BDC Inc. (NYSE:BBDC) is a Senior Lending-focused business development company with decent credit quality and a low enough dividend pay-out ratio to suggest that the dividend at its present run-rate of $0.26 per share per quarter can be sustained.

Barings BDC has appreciated quite a lot lately as the company worked through its credit issues and improved its non-accrual setup. Though the dividend is still covered by net investment income, I think incremental capital appreciation will be harder to achieve as the business development company pretty much restored its credit quality.

My Rating History

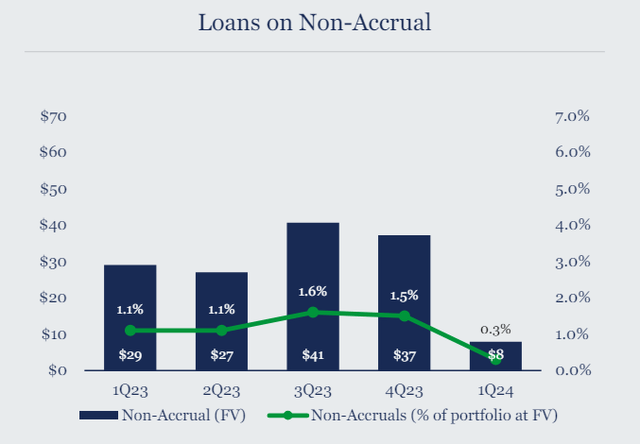

Barings BDC’s non-accrual trend drastically improved in the last quarter, with the company’s non-accrual ratio dropping from 1.5% in 4Q23 to 0.3% in 1Q24. The improvement in credit quality has been a catalyst for a higher stock price and a lower discount to net asset value, which, at my last count this February, was an excessive 22%.

Since the net asset value discount has fallen to 12% and Barings BDC has a bit of a higher dividend pay-out ratio compared to last quarter, I am recycling my investment profits into another BDC that recently moved out of favor with passive income investors: Oaktree Specialty Lending Corp. (OCSL). This BDC saw a deterioration of its credit quality lately, creating an opportunistic buying opportunity and a lever for profit growth moving forward.

Portfolio Review

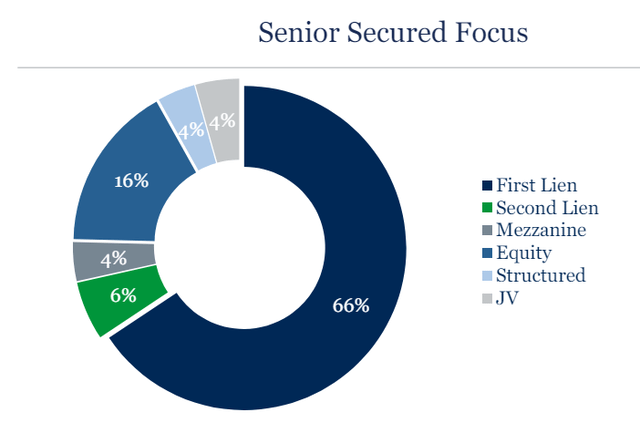

Barings BDC is a private credit-focused business development company with a main focus on originated Senior Secured Lending products. At the end 1Q24, Barings BDC maintained a dominating 72% Senior Secured Lending focus which is down 2 percentage points compared to when I last reviewed the business development company in February of this year.

The BDC does have a higher-than-usual Equity percentage that has the potential to drive Barings BDC’s total returns in case the company can make lucrative Equity exits.

Senior Secured Focus (Barings BDC)

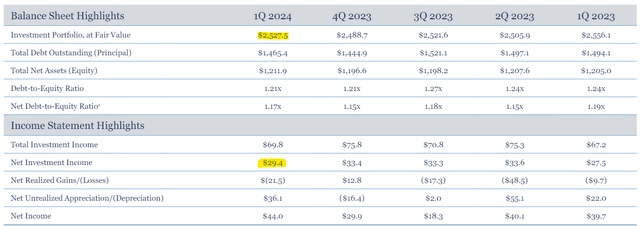

Barings BDC had a portfolio value of $2.5 billion in 1Q24, which was up 2% QoQ due to new originations. The business development company also produced healthy underlying growth in its net investment income, which passive income investors should use to determine the stability of the dividend pay-out.

Barings BDC earned $29.4 million in net investment income in 1Q24, up 7% YoY. Moving forward, higher-for-longer interest rates could be a catalyst for NII growth, which is dependent on the central bank holding its feet still.

If the central bank moves in on short-term interest rates and lowers them, the BDC’s floating-rate posture of 97% would probably not be as valuable to the company and its shareholders as it was last year.

Balance Sheet Highlights (Barings BDC)

The main consideration that is driven my change in the stock classification for Barings BDC relates to the business development company seeing an improvement in its underlying credit quality. In the first quarter of the present financial year Baring BDC’s non-accrual ratio dropped to 0.3%, down from 1.5% in the prior quarter. This reinstatement of better credit quality in the business development company’s debt portfolio is also the primary reason for the 15.4% upward re-rating of the BDC’s stock so far in 2024.

Loans On Non-Accrual (Barings BDC)

The Dividend Pay-Out Ratio Still Looks Good

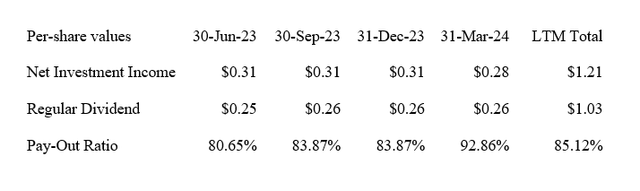

Barings BDC earned $0.28 per share in net investment income in the last quarter which was more than sufficient to cover the steady $0.26 per share per quarter dividend pay-out.

With a dividend pay-out ratio of 93% in the last quarter and 85% in the last twelve months, I think the dividend is sufficiently backed by net investment income and not at risk of a reduction.

With that being said, though, I think it is only fair to point out that the dividend pay-out ratio has risen lately, due to a drop in net investment income, which is lowering the margin of dividend safety for passive income investors.

I don’t think that Barings BDC is poised to cut its dividend, but the pay-out trend is leaning towards the negative in the last year.

Dividend (Author Created Table Using BDC Information)

Lower BV Discount Driven By Credit Quality Improvement

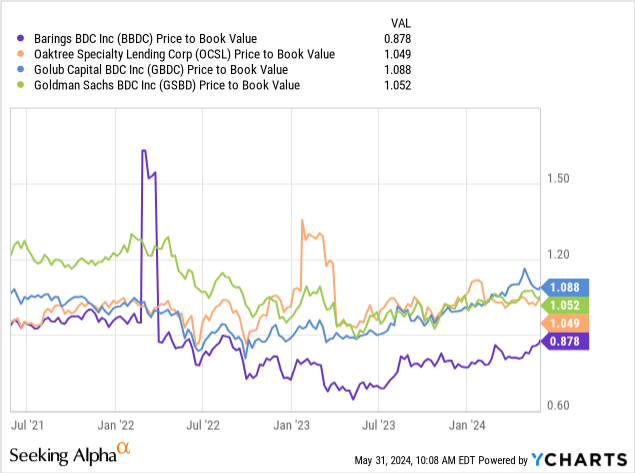

In February, I recommended Barings BDC to passive income investors when shares were selling, add a book value discount of 22%. Given the positive catalyst coming from an improved credit backdrop, the discount to book value for BBDC has fallen to 12% today.

With that said, I think that the BDC has much less upside given that its non-accrual ratio improved so much in 1Q24, which makes the stock a bit less compelling for those passive income investors that look for capital appreciation in addition to recurring, covered dividend income.

Barings BDC’s net asset value as of March 31, 2024 was $11.34 which reflects the BDC’s underlying, intrinsic value. Taking into account that Barings BDC’s pay-out ratio has risen in 1Q24 and that the BDC now has less potential to grow its profits as its credit profile has been restored, I think BBDC makes a less compelling value proposition than in February.

Why The Investment Thesis Might Work Or Not Work Out

I am modifying my stock classification to ‘Hold’ as the business development company has now seen a substantial improvement in its non-accrual ratio. As such, I think, that the upside potential might now be limited, though I also think that the dividend is not headed for the chopping block.

As I demonstrated above, Barings BDC had a dividend pay-out ratio, based on net investment income, of 93% which is sufficient to cover the dividend. However, the margin of dividend safety decreased in the last quarter and passive income investors should remain aware of this.

My Conclusion

I recommended Barings BDC to passive income investors in February because I thought the 21% discount to net asset was exaggerated at the time. A catalyst for a higher stock price was the successful restoration of the BDC’s credit quality profile in the last quarter.

The dividend is still solidly covered by net investment income, but the dividend pay-out ratio did increase QoQ, to more than 90% and the trend is slightly negative. I think that the dividend is sustainable here, but I see less upside potential for the stock when taking into account the big stock price jump this year.

As a consequence, I am modifying my stock classification to ‘Hold’ and I am recycling my investment profits into another BDC which also presently suffers from an elevated non-accrual ratio, Oaktree Specialty Lending.

Read the full article here

Leave a Reply