It’s been challenging to invest outside the US and not be disappointed. The fact of the matter is that the last decade plus has been dominated by US market momentum and large-cap tech. Still, it’s always worth tracking global markets for opportunities. Thankfully, there are a number of ETFs out there that give investors the ability to access markets they normally can’t.

To that end, I think it’s worth looking at the iShares MSCI Indonesia ETF (NYSEARCA:EIDO). The fund benchmarks the MSCI Indonesia IMI 25/50 Index, a broad-based index reflecting a wide spectrum of Indonesian equities.

Why consider investing in Indonesia? Overall, it’s got fairly strong economic growth, a strategic location in the region for trade and investment, and a wealth of natural resources. The Indonesian government has vowed to become one of the five largest economies in the world by 2030, and the roadmap includes plans to improve infrastructure, streamline processes to make it easier for foreigners to invest in the country, and bring clarity to regulatory barriers. Foreign investment has been surging, as money pours in from countries such as Singapore, China, Hong Kong and Japan.

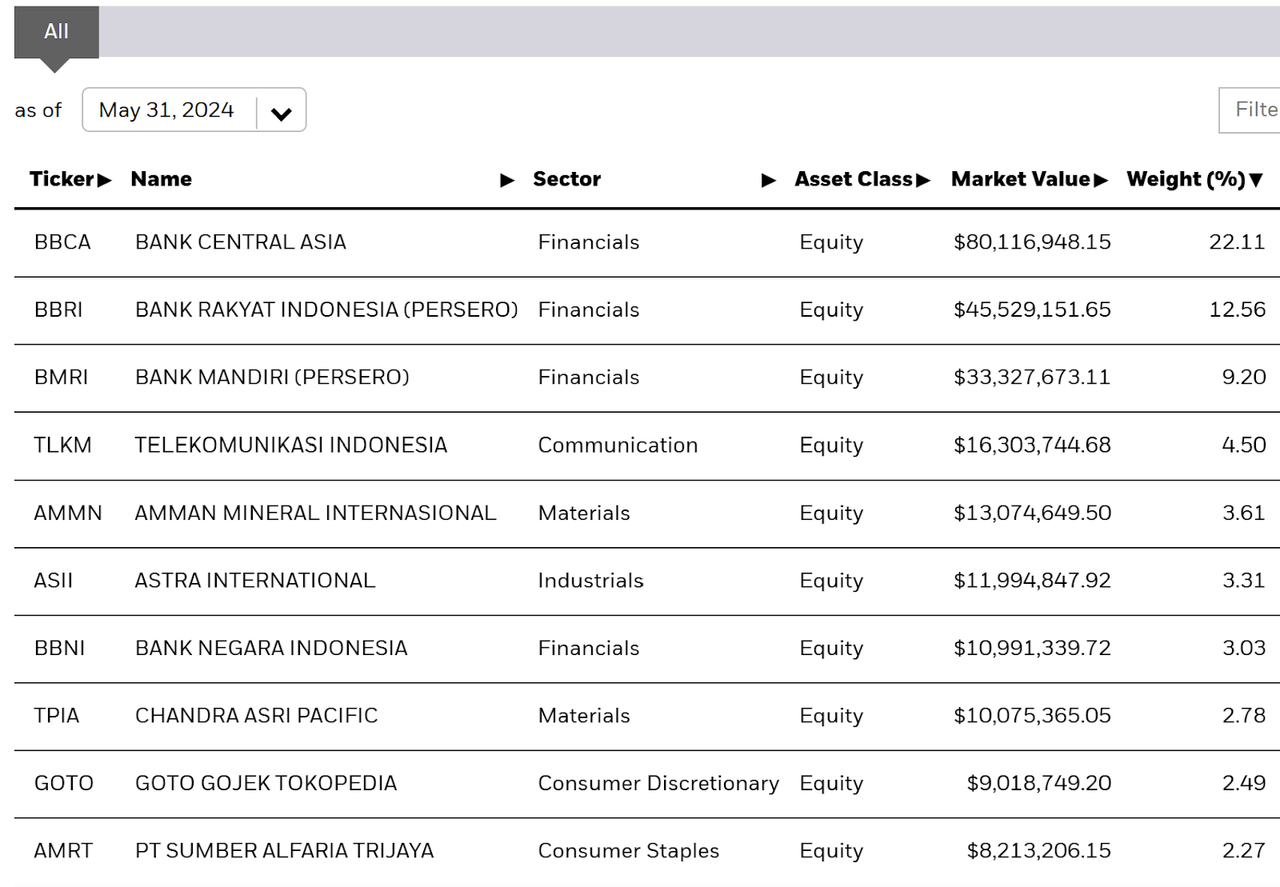

A Look At The Holdings

The EIDO fund has 83 positions, but it is highly, highly concentrated in the top 2 stocks, which make up nearly 35% of the fund overall.

ishares.com

With a weight of 20.49%, PT Bank Central Asia (OTCPK:PBCRF) is EIDO’s largest holding. It is the biggest bank in Indonesia and the third-biggest in ASEAN. The bank has a history going back to 1957, is present in all 33 provinces across Indonesia, and is a leading issuer of credit cards within that country. As to Bank Rakyat Indonesia (Persero) (OTCPK:BKRKY), this state-owned banking behemoth played a critical role in spreading capital inclusion within the country. It was established in 1895 and has a strong branch network.

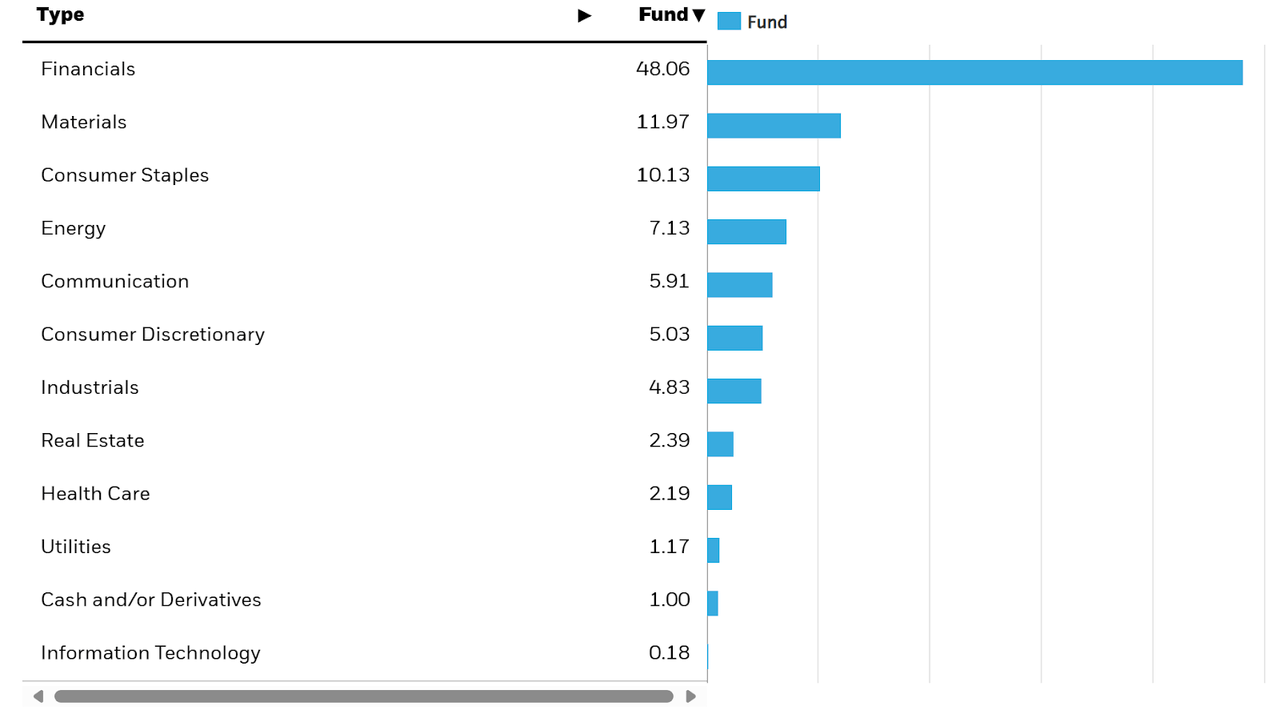

Sector Composition

It should come as no surprise given the top 2 positions here that Financials are the largest sector allocation of the fund, making up nearly 50% of EIDO. Materials come in 2nd, followed by Consumer Staples. Notice there is basically no Tech here at all. This clearly has hurt the fund’s performance against the US.

ishares.com

It makes sense to some extent that Financials make up such a large portion of the fund, as it’s more on the frontier/emerging side, and banking institutions are critical to the next stage of development economically in general.

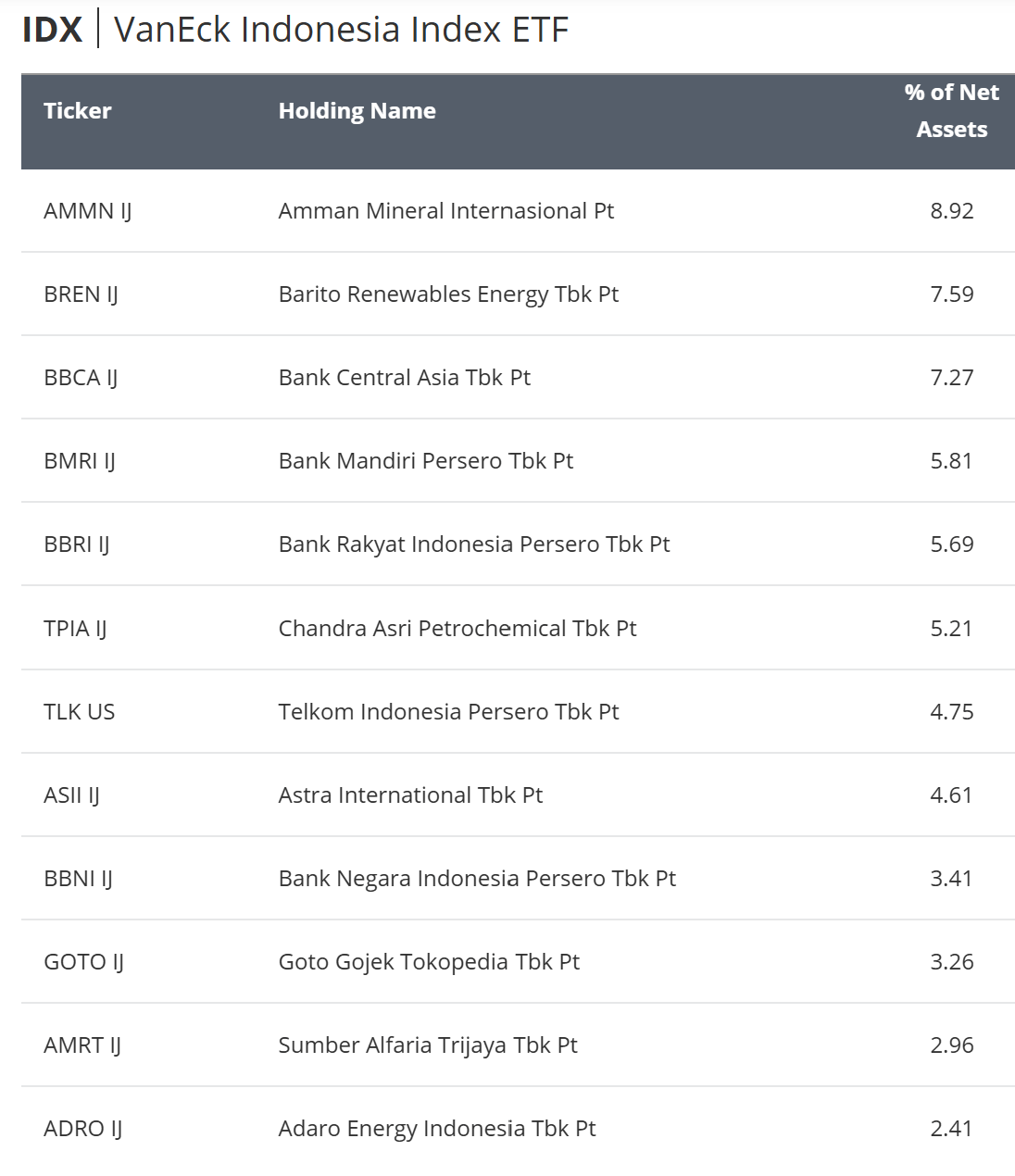

Peer Comparison: EIDO vs. IDX

EIDO is not the only ETF that gets investors access to the Indonesian equity market. One competitor is the VanEck Vectors Indonesia Index ETF (IDX). This is a smaller fund at $26 million in AUM. The positions and weightings look very different in IDX.

vaneck.com

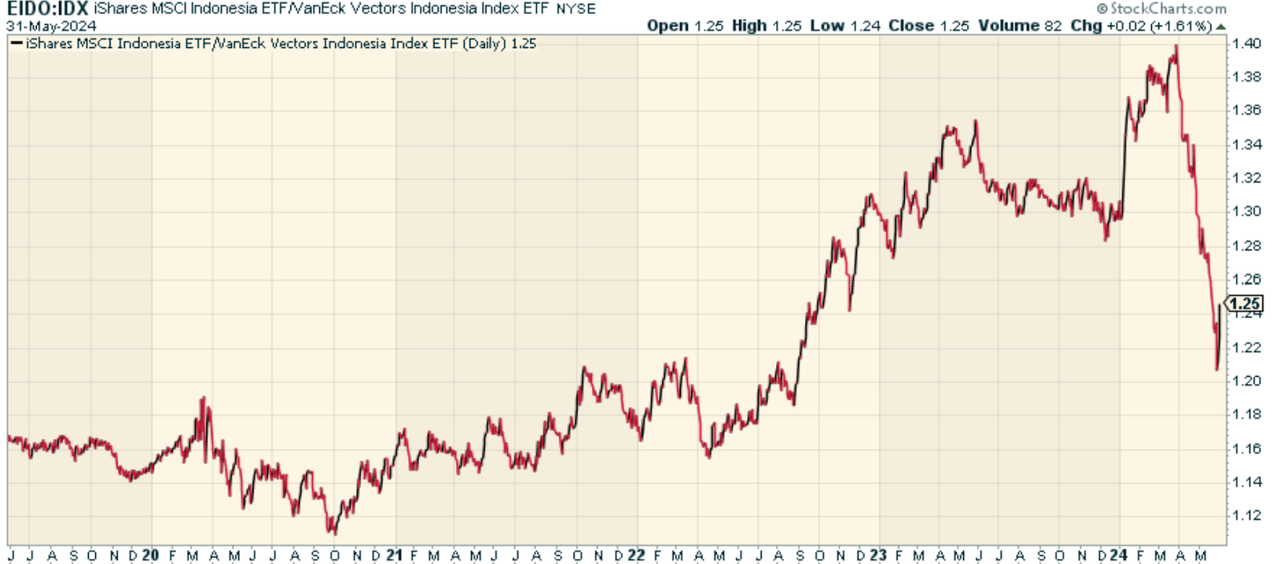

So how does the performance compare? When we look at price ratio of EIDO to IDX, we find that EIDO has outperformed, but it’s quite volatile on a relative basis. This makes sense given the clear concentration and idiosyncratic risk EIDO has given the top 2 holdings.

stockcharts.com

Weighing the Pros and Cons

If one wants to gain exposure to one of the world’s fastest-growing emerging markets, an easy way to do so is by investing in EIDO. The fund offers investors exposure to Indonesia’s booming economy. It’s volatile, but could be a long-term winner as the country continues to emerge and expand. The downside here is volatility. Indonesia’s equity markets might have higher levels of draw-downs and be more vulnerable to political and regulatory uncertainty, and there might be decreased liquidity in equities. Investors might also face the risk of currency volatility and capital controls. Furthermore, EIDO’s high concentration in the financial sector, while presenting potential upside in times of economic expansion, might also accentuate the tail-risk exposure in the event of a banking crisis or sector-related setbacks.

Conclusion

While I worry about the high concentration in the top 2 stocks, I think investing in Indonesia generally speaking is interesting. As Indonesia continues to grow its role as an economic power, funds like this make more sense. I’d say maybe consider blending this with IDX given the very different portfolio holdings, though.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here

Leave a Reply