A man eating a chocolate bar.

As an analyst, there is nothing more exciting than covering businesses that I view to be of the utmost quality. As far as I’m concerned, that’s the name of the game as a dividend growth investor.

When considering prospective investments, there are a few characteristics that I seek:

- Reliable earnings growth. Depending on the industry, I tend to like to see earnings grow in at least 70% to 80% of years. This is because, all else equal, growing profits back up growing payouts to shareholders.

- Investment-grade balance sheet. When a balance sheet is investment-grade, that usually means the company has a low cost of capital. This can also help to fund future growth.

- A sustainable payout ratio. That’s because a lower payout ratio provides a business with a bigger cushion to hike the dividend further.

The confectioner and snacking company, Mondelez International (NASDAQ:MDLZ), is one business that I believe perfectly fits each of these requirements. When I initiated coverage with a buy rating in April, there was a lot to like.

MDLZ’s brands like Oreo, Ritz, and Cadbury were industry leaders within their respective categories. This meant the company came with appetizing growth prospects. The dividend was quickly growing and well-covered. MDLZ’s financial condition was robust. Finally, shares looked to be on sale.

Today, I’m reiterating my buy rating on MDLZ. The company’s exceptional brand portfolio aided it in pulling off a double beat during the first quarter of results shared on April 30. MDLZ’s interest coverage ratio was strong in the quarter. Finally, the stock still looks to be undervalued at almost a double-digit rate.

Brand Power Fueled Another Great Quarter

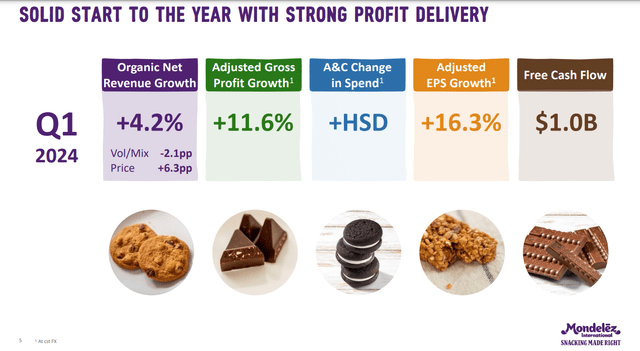

Mondelez Q1 2024 Earnings Presentation

When MDLZ shared its financial results for the first quarter, it did what great businesses do: Outperform analysts’ expectations, including mine.

The company’s net revenue edged 1.4% higher year-over-year to $9.3 billion during the quarter. This exceeded Seeking Alpha’s analyst consensus by $130 million in the quarter.

Backing the sale of its developed market gum business out of results, organic net revenue would have risen by 4.2% for the first quarter. What was behind MDLZ’s respectable topline growth during the quarter?

Just as I noted in my previous article, the company has been able to somewhat overcome the pricing fatigue that has afflicted consumer staples. That is because of the especially defensive nature of its portfolio.

MDLZ’s products have become a part of the daily routines of millions of consumers around the globe. As the cost of living has risen significantly in most parts of the world, some consumers have resigned themselves to never achieving milestones like buying a home.

Instead, these consumers soothe their financial anxiety by purchasing the simpler things in life (e.g., crackers, chocolate, etc.). This is commonly referred to as “doom spending.”

That is why, even in a difficult economic environment, MDLZ’s volume slipped by just 2.1% in the first quarter. According to opening remarks from Chairman and CEO Dirk Van De Put during the Q1 2024 Earnings Call, shoppers in many markets chose smaller pack sizes in the biscuits and chocolates categories. Consumers are still holding true to the brands that they know and love, though.

MDLZ’s 6.3% pricing hikes throughout the business also handily offset this slight volume decline for the first quarter.

If the company’s topline results were solid, its showing on the bottom line was even more impressive. MDLZ’s currency-neutral adjusted diluted EPS surged 16.3% higher over the year-ago period to $1 during the first quarter.

That easily beat the analyst consensus in my prior article, with which I agreed of $0.89. Thanks to a sizable decrease in the cost of sales via disciplined cost management, MDLZ’s non-GAAP net profit margin expanded by nearly 170 basis points to 14.5% in the first quarter. Combined with a 1.3% reduction in the diluted share count via share repurchases, that’s how the company’s currency-neutral adjusted diluted EPS growth rate outpaced net revenue growth for the quarter.

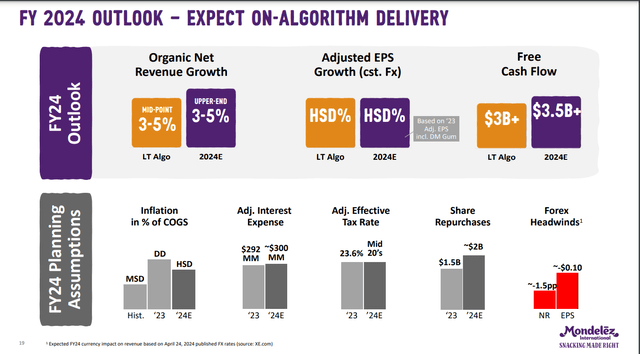

Mondelez Q1 2024 Earnings Presentation

MDLZ’s vibrant results to kick off 2024 gave it the confidence to reiterate its guidance for the year. The company anticipates that organic net revenue growth will be between 3% and 5%.

What about the volume decline in Q1, though?

As the year unfolds, CFO Luca Zaramella believes that the headwinds that weighed on volume will dissipate. This is why MDLZ is guiding for flattish volume in 2024.

One headwind is the boycotts of Western products in the Middle East and Southeast Asia. This is in response to the United States’ support of Israel in its ongoing conflict against Hamas in the Israel-Hamas war. Whether this eventually resolves this year or not, there should be tailwinds for MDLZ in the quarters ahead.

That is because the customer disruption in Europe due to the company’s annual price negotiation process has mostly played out. Zaramella noted that the vast majority of pricing had been landed in Europe on the Q1 2024 Earnings Call. This should provide a lift for the company’s volume in the quarters to come.

Much of the volume decline in Q1 was due to weakness within the Biscuits and Baked Snacks categories. As a result of higher penetration rates among brands favored by lower-income households (e.g., Chips Ahoy!) in the U.S., Biscuits and Baked Snacks volume and mix fell 3.2%.

Looking ahead, MDLZ is adjusting its price points for these types of brands. The idea that I agree with is that this will allow it to recuperate share and volume to return to growth. This factor alone should be enough to move the needle and return the company to marginal volume growth for the rest of this year.

Elsewhere, there is also room for MDLZ to grow. The company had double-digit growth with share gains in China during the quarter. As it keeps selling in more stores and ramps up distribution, this level of growth looks to be sustainable for the near future.

MDLZ also gained market share in Brazil and posted mid-single-digit net revenue growth. The company is working on upping its distribution in that emerging market to sustain this momentum.

MDLZ’s careful actions to contain its costs should be positive to the non-GAAP net profit margin. The company also anticipates that it will repurchase $2 billion in shares in 2024 (~2% of its outstanding shares). These elements will be the drivers that are anticipated to deliver high-single-digit currency-neutral adjusted diluted EPS growth in 2024.

Since I last covered MDLZ, the FAST Graphs analyst consensus remains unchanged at $3.50. This would imply a 5.4% growth rate over the 2023 base of $3.32. So, if anything, I think the current analyst consensus is selling MDLZ a bit short. Pulling the growth levers that I already noted (organic net revenue growth, margin expansion, and share buybacks), I wouldn’t be surprised to see $3.60 in 2025.

Finally, the company’s financial health is admirable. MDLZ’s interest coverage ratio was 40.4 in the first quarter. That means the company can effortlessly service the costs associated with its debts. So, it’s not a surprise that MDLZ possesses a BBB credit rating from S&P on a stable outlook per the Zen Research Terminal (unless otherwise sourced or hyperlinked, all details were according to MDLZ’s Q1 2024 Earnings Press Release and MDLZ’s Q1 2024 Earnings Presentation).

A Wonderful Business For A Discount

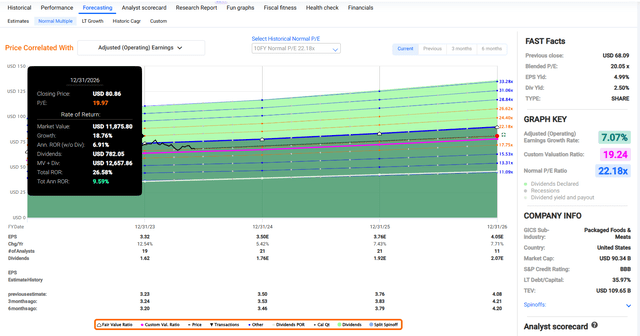

FAST Graphs, FactSet

As the S&P 500 index (SP500) has gained 6% since my last article, MDLZ has declined by 2%. This makes the consumer staple attractive from the current $67 share price (as of June 5, 2024).

MDLZ’s current-year P/E ratio of 19.3 is moderately below the 10-year normal P/E ratio of 22.2 per FAST Graphs. I’m adjusting my fair value multiple to a bit lower than in my last article.

This is because I believe that interest rates will likely remain above where they have been in the past 10 years. That should result in a reduced fair value multiple in the years ahead.

As far as growth is concerned, MDLZ’s growth prospects are intact. The company’s three-year forward annual growth consensus is 7.1%, which is in line with the 10-year normal of 7.6% according to FAST Graphs. That is why I believe fair value moving forward is a valuation multiple of 20 – – or one standard deviation less than the 10-year normal.

After this week is finished, 2024 will be 44% complete. That leaves 56% of 2024 and another 44% of 2025 ahead in the coming 12 months. Weighing the $3.50 FAST Graphs consensus for 2024 and $3.76 consensus for 2025, I get a 12-month forward currency-neutral adjusted diluted EPS figure of $3.62.

Using a valuation multiple of 20 with this earnings input, I get a fair value of $72 a share. Adjusting for what I think are slightly low analyst forecasts for 2024 and 2025, I could see fair value being $1 or $2 a share higher.

But for the sake of conservativism, my lower fair value estimate would still be a 7% discount to fair value. If MDLZ grew as anticipated and returned to fair value, it could generate 27% cumulative total returns through 2026.

Free Cash Flow Can Support Additional Dividend Growth

MDLZ’s 2.5% forward dividend yield is a bit on the light side for the consumer staples sector. The median forward dividend yield of the sector is 2.7%. Thus, MDLZ earns a C grade for forward dividend yield from Seeking Alpha’s Quant System.

Where the company stands out is dividend growth. MDLZ’s 10-year annual dividend growth rate of 11.7% annually is much better than the sector median of 5.2%. This is enough for a B+ grade from the Quant System for that metric. The 10.5% annual dividend growth rate in the last three years also suggests that dividend growth remains vigorous.

The Quant System anticipates that forward dividend per share growth will be 9.5% annually. Against the 4.7% sector median, this is enough to justify an A grade.

Why is the Quant System so bullish on MDLZ’s dividend growth potential?

The company’s 48% EPS payout ratio is well below the 70% EPS payout ratio that rating agencies view as safe for the industry, per the Zen Research Terminal.

After putting up $1.3 billion in free cash flow in the first quarter, MDLZ is also guiding for more than $3.5 billion in free cash flow for 2024. Assuming $2.4 billion in dividends paid and just $3.6 billion in free cash flow, that would be a payout ratio of around two-thirds (details sourced from MDLZ’s Q1 2024 Earnings Press Release and MDLZ’s Q1 2024 Earnings Presentation).

This leaves MDLZ with enough cash to finance at least 60% of its planned share repurchases with retained free cash flow. Since the company is steadily growing, an incremental increase in long-term debt isn’t concerning to me. In my view, that should keep the leverage ratio around 2.5x that was recorded in the first quarter per Zaramella.

Risks To Consider

By any objective measure, MDLZ is a flourishing business. Nevertheless, it isn’t a risk-free investment.

One risk to MDLZ is that it operates in a highly competitive space. To this point, the company has maintained or grown its market share in most categories.

If MDLZ mismanages its pricing strategies, though, that could diminish its brand power. This could cause it to lose market share to competitors.

Another risk to MDLZ is that 73.4% of 2023 net revenue was derived outside of the United States (info according to MDLZ’s 10-K Filing). This opens the company up to the risk of unfavorable foreign currency translation.

An additional risk includes operating in markets where regulations differ from the United States. If MDLZ doesn’t comply with varying local regulations, it could face sizable penalties from regulatory authorities.

Summary: A Blue Chip With A Viable Path To 10% Annual Total Returns

In every aspect that matters, MDLZ is a phenomenal business. The company remains positioned to deliver high-single-digit annual currency-neutral adjusted diluted EPS for the foreseeable future. MDLZ’s finances are enviable. The dividend also has the flexibility to keep growing at a high-single-digit rate each year.

The element that seals the deal to make MDLZ a buy is arguably the valuation. The stock isn’t a downright bargain. But for its quality, the valuation remains interesting here. That’s why I’m expecting 10% annual total returns over the next few years and maintaining my buy rating.

Read the full article here

Leave a Reply