We are initiating coverage of the Matthews Pacific Tiger Active ETF (NYSEARCA:ASIA) with a Sell rating.

ASIA is an actively managed ETF focused on companies domiciled in Asia ex-Japan, including both emerging and frontier markets. The fund aims to invest in businesses with strong growth, healthy balance sheets, sustainable cash flow, and capable management teams. The fund can invest across all market caps but focuses primarily on Mid- and Large-Cap companies.

Our Sell recommendation is driven by several key concerns, including high turnover among the fund’s management team, significant exposure to China in light of elevated geopolitical risk, and poor long-term absolute and relative performance.

A Team in Turmoil

In December 2023, three portfolio managers, including former Co-Lead manager Sharat Shroff, who had been with the company since 2008, left Matthews International Capital Management, the firm that launched and also manages the exchange-traded fund Matthews Pacific Tiger Active ETF (ASIA). Even in the absence of our other concerns about the strategy, this level of turnover at the senior investment team level is significant enough to seriously consider, if not justify, a Sell rating on the fund.

While we believe current Co-Lead manager Inbok Song and the four supporting Co-Managers have solid credentials, turnover among the senior investment team at Matthews calls into question whether the current team can successfully execute the firm’s investment process and generate better results for investors. Sean Taylor, Matthews’ CIO and now the Co-Lead manager of ASIA alongside Song, has emphasized efforts to improve position sizing, portfolio construction and risk management across the firm’s investment strategies. However, it remains to be seen whether these initiatives can turn the tide on the fund’s disappointing results. In our view, ASIA’s exodus of investment talent is concerning and disruptive. In addition to Shroff’s recent departure, emerging markets manager John Paul Lech and Japan specialist Taizo Ishida also left the company last December. Since the end of 2019, investors have pulled about $19 billion from Matthews’ funds, as firm AUM has declined from $27 billion to $8.0 billion as of May 31, 2024. Given the -70% decline in firm AUM over a relatively short period, we have serious concerns regarding the long-term viability of the firm. Baring a material and sustained improvement in performance, we think it’s likely this trend will continue.

ASIA: A Closer Look at the Portfolio

While ASIA was just launched in September of last year, its mutual fund counterpart (MAPTX) has a much longer history with an inception date dating back to 1994. For longer-term insights into the portfolio and performance of the strategy within which ASIA is managed, we review and discuss the historical portfolio and performance of MAPTX which executes the same strategy and is managed by the same team.

Given the strategy’s Growth orientation, the fund has historically been overweight high growth Consumer Discretionary and Tech stocks. From a geographical perspective, the fund’s exposure is very similar to its benchmark – with the vast majority of the fund concentrated in China/Hong Kong, India, Taiwan, and South Korea.

As of March 31, 2024, more than 30% of the fund was invested in China/Hong Kong. Given the increasing tension between the U.S. and China, a global effort to reduce supply chain reliance on China, periodic government crackdowns on various sectors, and an ongoing property market crisis, we have a hard time gaining comfort with maintaining significant exposure to China today. Importantly, ASIA doesn’t have to maintain this level of exposure to China/Hong Kong – their mandate is broader and includes all developed, emerging, and frontier markets in Asia (excluding Japan). As such, we would’ve preferred the team to de-emphasize China in light of these risks.

From a sector perspective, we generally think the fund’s main fishing ponds, Consumer and Tech, are typically fertile grounds from a business quality perspective. However, while some of the fund’s top holdings, outlined in the table below, are trading at material discounts to their developed market counterparts, many of these stocks don’t look overly cheap relative to history.

Holdings & Valuation

ASIA: Top 10 Holdings (Matthews Asia)

For example, although Taiwan Semiconductor Manufacturing Company (TSM) at ~11x NTM EBITDA trades at a significant discount to Advanced Micro Devices (AMD) at almost 50x NTM EBITDA, the fund has experienced meaningful multiple expansion – with its NTM EBITDA multiple almost doubling since October 2022. So despite what might appear like an attractive discount relative to developed markets, we would not be surprised to see multiple compression across ASIA’s Large Cap Growth-oriented portfolio, particularly in stocks with the greatest exposure to China and its related geopolitical risks.

On an overall portfolio basis, as of March 31, 2024, ASIA’s portfolio traded at 15.3x forward 12-month earnings and 13.2x forward 24-month earnings, a premium to its benchmark (the MSCI All Country Asia ex Japan Index) at 13.2x and 11.7x respectively. The fund’s price-to-cash flow of 10.9x also exceeds the benchmark’s 8.4x multiple. To be fair, the fund’s aggregate forward 3-year EPS growth is more than double that of the index (26.1% vs. 12.6%) so we would expect ASIA to trade at a premium to its benchmark.

However, as we discuss in greater detail in our assessment of the fund’s historical performance, ASIA hasn’t been rewarded for its orientation toward more expensive, higher growth businesses. And we think investing in these types of businesses only gets more challenging in a higher-for-longer interest rate environment.

Performance

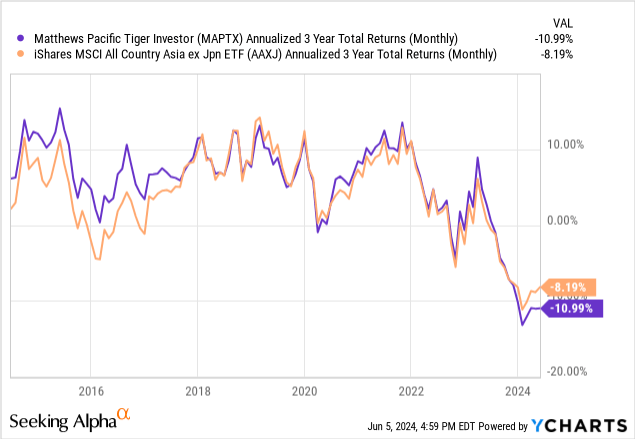

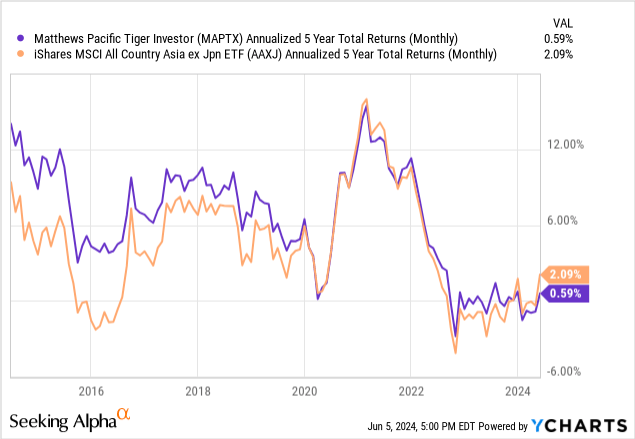

Using MAPTX as a proxy for the longer-term performance of ASIA and the strategy, the strategy has underperformed its benchmark over nearly all meaningful trailing periods, including over the trailing 1-, 3-, 5-, 10-, and 15-years.

As outlined in the charts below, the strategy’s rolling 3- and 5-year rolling returns highlight the strategy’s challenging performance, particularly over the last 3 to 5 years.

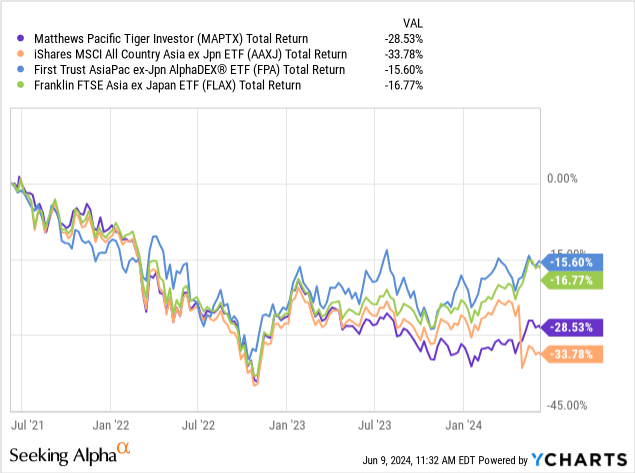

To further contextualize ASIA’s performance, the chart below shows the fund’s total return over the last three years relative to funds with similar exposure, like iShares MSCI All Country Asia ex Japan ETF (AAXJ), First Trust Asia Pacific Ex-Japan AlphaDEX Fund ETF (FPA), and Franklin FTSE Asia ex Japan ETF (FLAX). To be fair, this has been a challenging space to invest in, as seen in the disappointing returns across all of these funds. However, ASIA (represented by MAPTX) is among the worst performers of this group, only slightly outperforming AAXJ over the period.

In light of what we see as a multitude of significant headwinds working against the strategy – team turnover, geopolitical risks, and valuations – we struggle to find catalysts in favor of ASIA’s go-forward performance at this point.

No Shortage of Risks

As alluded to earlier, beyond the recent turnover in senior investment team personnel, as well as what appears, to us, to be an insufficient margin of safety, ASIA is vulnerable to macroeconomic and geopolitical risk, particularly in China and emerging markets businesses with significant revenue exposure to China.

U.S.-China tensions, a global effort to reduce supply chain reliance on China, periodic government crackdowns on various sectors, and an ongoing property market crisis, all present potentially significant risks to ASIA. Moreover, the portfolio’s orientation to higher growth stocks and sectors may also underperform if there’s a sustained rotation to value in a higher for longer interest rate environment.

Summary – The Sell Case

In short, our Sell recommendation on ASIA is driven by several key concerns, including high turnover among the fund’s management team, significant exposure to China in light of elevated geopolitical risk, and poor long-term absolute and relative performance. The fund’s exodus of investment talent is concerning and disruptive, and we have doubts whether the current team can successfully execute the firm’s investment process in light of elevated personnel turnover and a material decline in assets.

While some of the fund’s holdings trade at discounts to their developed market peers, we don’t think valuations look overly cheap relative to history. We also think that investing in higher growth companies only gets more challenging in a higher for longer interest rate environment.

As such, we initiate coverage on ASIA with a Sell rating and will continue to monitor the firm and its strategy for improvements related to our key concerns.

Read the full article here

Leave a Reply