Commerzbank (OTCPK:CRZBF) has reported an improved operating performance over the past couple of years, but this trend seems to be over as the European Central Bank has recently started to cut rates in Europe.

As I’ve analyzed in previous articles, Commerzbank trades at one of the lowest valuation multiples within the European banking sector, measured by its discounted price-to-book value (P/BV) multiple, but this seems to be justified by the bank’s lower structural profitability compared to peers.

Despite that, its business is somewhat geared to rates, thus its operating performance has improved over the past couple of years, leading to a strong share price rally in recent months. As I’ve not covered Commerzbank for some months, I think it’s now a good time to analyze its most recent financial performance and update its investment case.

Commerzbank’s Q1 2024 Earnings

Commerzbank is a retail and commercial bank focused in its domestic market and Poland, being somewhat geared to interest rates. Due to the rising interest rate environment in Europe since mid-2022, its operating performance has improved markedly, a trend that has been maintained in the first quarter of 2024.

Indeed, the bank reported a record quarter, supported both by higher net interest income (NII) and fee income, leading to record results and a higher capital ratio.

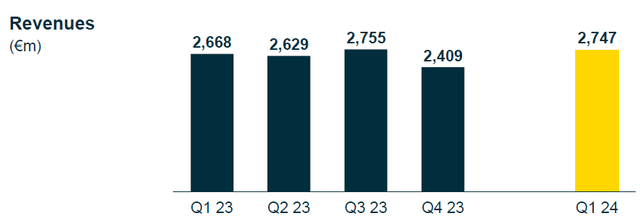

Its total revenues in the quarter amounted to €2.7 billion, up by 3% YoY, with NII increasing by 9% YoY to €2.1 billion and being the major growth engine. Indeed, NII accounts for some 78% of total revenue, thus Commerzbank is among the European banks with higher revenue reliance on NII, but its gearing to rates is not higher because most loans are fixed-rate, while in other geographies (namely in Southern European countries) loans are mainly floating-rate and have higher gearing to short-term rates.

Revenues (Commerzbank)

Its fees and commissions amounted to €920 million, up by 0.5% YoY, supported by the securities business. Regarding loan growth, it was not much of a tailwind in Q1 2024 because German small and medium-sized enterprises (SMEs) are not investing much due to the uncertain economic outlook, thus loan demand remains somewhat weak.

While economic conditions have improved in recent months in Germany and the bank no longer expects a recession in 2024, loan demand is not expected to pick up much in the coming months, thus further revenue growth may be hard to achieve considering that the cost of deposits has been increasing and the European Central Bank (ECB) has recently started to cut rates. While it’s still unclear how many cuts the ECB will do for the rest of 2024, this is a negative trend for Commerzbank’s top-line in the coming quarters.

Nevertheless, according to analysts’ estimates, its total revenues are expected to be around €10.9 billion in 2024 (vs. €10.5 billion in 2023), which means modest revenue growth is still expected for the full year.

One potential positive factor for higher revenue growth than currently expected is related to its provisions for forex loans related to mortgages in Swiss francs at its Polish subsidiary, an issue that I’ve discussed in a previous article, and that continues to hurt its top-line. In the last quarter, Commerzbank booked another €318 million provision related to this issue, raising total provisions to €1.9 billion. While it’s still difficult to estimate the total cost of this issue, the bank seems to be well provisioned and therefore this may represent a lower burden to its revenues in the coming quarters.

Regarding costs, Commerzbank reported a decline of about 8% YoY to less than €1.6 billion, a very good outcome considering the inflationary environment. This is mainly justified by much lower contributions for the single resolution fund, after it reached its target volume. Indeed, Commerzbank’s contributions were €15 million in the last quarter (vs. €184 million in Q1 2023), being a major reason for the drop in costs during the last quarter. Due to the combination of higher revenues and lower costs, the bank’s efficiency improved, measured by a lower cost-to-income (C/I) ratio, which stood at 58% in the last quarter (vs. 65% in Q1 2023).

This is a much better efficiency level than reported some years ago, but it’s still above the most efficient banks in Europe that report C/I ratio of around 40-45%, thus there is still some room for Commerzbank to manage costs and improve efficiency in the future.

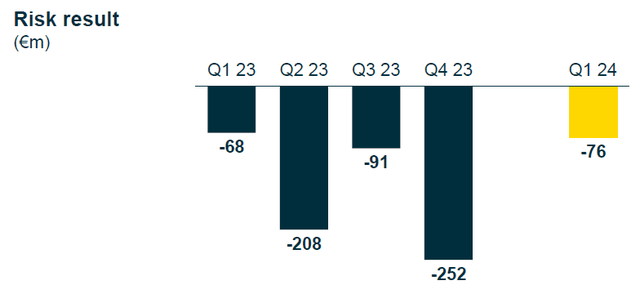

Regarding asset quality, its risk provisions were only €76 million in Q1 2024, relatively stable from the same quarter of 2023, but much lower compared to the previous quarter. There were a few single loans that defaulted in the quarter, but overall its asset quality remains quite good and its cost of risk ratio was only 11 basis points in Q1, a level that is below the average of the European banking sector.

Risk provisions (Commerzbank)

Its net income in the quarter was €778 million, representing a record result, up by 28% YoY. Its return on tangible equity (RoTE) ratio, a key measure of profitability in the banking sector, was 10.5% in the quarter, well above its target of at least 8% in 2024 and the best profitability level reported over the past few years.

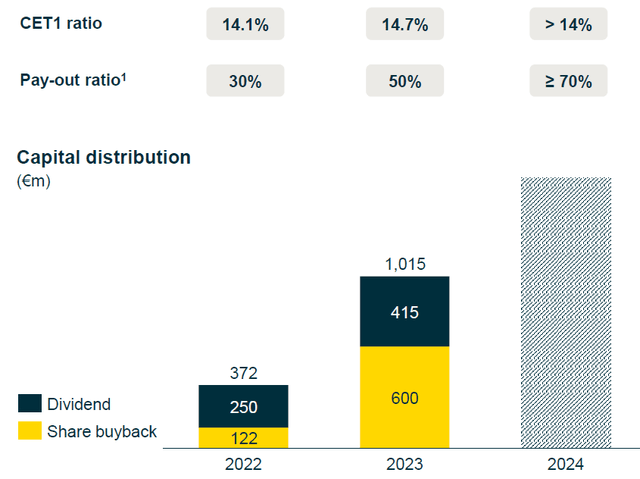

Regarding its capital position, Commerzbank had a CET1 ratio of 14.9% at the end of last March, being well above its capital requirements and its own target of at least 13.5%. This means the bank has an excess capital position of 140 basis points, or more than €2 billion of capital not considering future earnings. For the full year, the bank expects some impact from recent small acquisitions, impacting negatively its capital ratio by 10 basis points, and also a negative impact by higher risk-weighted assets, but its CET1 ratio is expected to be well above 14% by the end of 2024.

This strong capital position is a key support for an attractive shareholder remuneration policy, both from dividends and share buybacks. While related to 2023 earnings, the bank distributed some 50% of earnings to shareholders, its guidance is to increase its payout to about 70% related to 2024 earnings.

Capital returns (Commerzbank)

If Commerzbank’s operating performance remains positive in the second quarter, the bank wants to apply for a new share buyback program, which has to be approved by the European Central Bank, and is likely to raise its dividend ahead. Indeed, its annual dividend related to 2023 was €0.35 per share, but the street is currently expecting an annual dividend of €0.58 per share in 2024, representing an annual increase of about 64%.

At its current share price, Commerzbank offers a forward dividend yield of about 3.9%. While this yield is interesting, it’s lower than the average of the European banking sector and there are better income alternatives in the sector, such as KBC Group (OTCPK:KBCSF), which I’ve recently covered and offers a dividend yield above 7%.

Regarding its valuation, Commerzbank is currently trading at around 0.6x book value, which is much lower than the sector’s average of about 0.96x book value. While at first glance this may seem quite cheap, investors should be aware that Commerzbank has a long history of trading at a steep discount to its peers, plus its own historical average over the past five years is only 0.34x book value.

Historically, Commerzbank has been one of the cheapest banks based on the P/BV multiple, and comparing it to some of its closest peers, such Societe Generale (OTCPK:SCGLF) which is trading at 0.32x book value or ABN AMRO (OTCPK:AAVMY) at 0.56x book value, I think Commerzbank is currently fairly valued and its upside potential doesn’t seem great right now.

Moreover, investors should take into account that the rate cycle in Europe seems to be for more rate cuts ahead, thus the tailwind of rising rates over the past couple of years will turn into a headwind in the coming months and Commerzbank’s revenues and earnings probably have reached their peak in the last quarter. Therefore, while its valuation multiple has re-rated significantly from 0.3x book value in mid-2022, to about 0.6x today, it’s likely that Commerzbank’s P/BV multiple has reached its peak and further gains aren’t likely ahead.

Conclusion

Commerzbank’s recent financial performance has clearly improved from its subdued historical metrics, being clearly supported by the rising interest rate environment in Europe. However, the rate cycle is now turning to the downside, thus Commerzbank’s upside potential seems limited and its income appeal is not great compared to its peers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply