ageas (OTCPK:AGESF) has reported a strong operating performance related to 2023 and increased its dividend above expectations, showing that its high-dividend yield is sustainable over the long term.

As I’ve analyzed in previous articles, ageas is one of the most attractive income picks within the European insurance sector, due to the combination of a high-dividend yield and better long-term growth prospects over the long term than its peers.

Since my last article on ageas, the company has reported its annual results related to 2023, thus I think it’s now a good time to analyze its most recent financial performance and update its investment case, to see if it remains an interesting income pick for long-term investors.

ageas’ 2023 Earnings

While the European insurance market does not have particularly impressive growth prospects, ageas is one of the few exceptions due to its exposure to Asia. This profile has been a strong support for above-average growth compared to its peers, a trend that was also visible in 2023.

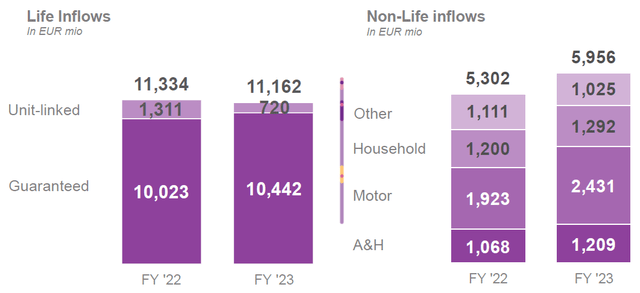

Indeed, its inflows during the year increased by 8% YoY, which were supported by the non-life segment across all business lines and also by positive momentum in China in the life segment. However, the life segment was impacted by forex movements, leading to slightly lower inflows compared to the previous year. Adjusted for this effect, its inflows in the life segment increased by 4% YoY, driven by strong growth in China (+11% YoY).

In the non-life segment, inflows increased by 17% YoY at constant exchange rates, with significant business growth across most of its insurance lines, of which motor reported the highest growth due to increasing premiums across all of its markets.

Inflows (ageas)

Regarding its adjusted operating result, it increased by 9% YoY at constant exchange rates to €1.17 billion, which was close to the top of its guidance range of between €1.1-1.2 billion. Investors should note, however, that its reported operating profit declined compared to 2022, due to two one-off effects in the previous year that boosted its operating result by €191 million, namely the gain on the sale of its commercial lines in the United Kingdom and the liability management action on the FRESH instrument.

Therefore, on an organic basis, ageas reported strong growth in operating result during 2023, which is a very good outcome considering the inflationary environment which led to higher claims costs, especially in the motor segment. However, as the company maintained a strong underwriting criteria and increased premiums during the year, it was able to pass higher costs to customers and protect its business margins.

Also, higher than usual weather costs in the U.K. in 2022 were also a drag on its operating result, an issue that was not present during the last year, being also a factor leading to a lower combined ratio in 2023. Indeed, its combined ratio was 93.3% (vs. 97.7% in 2022), showing that its underwriting result in the non-life segment was higher over the last year, boosted by higher inflows and good cost control.

Additionally, the company also started an external reinsurance business line, which helps it to grow its premiums and operating results, while diversifying a little bit more its operating profile. Its reinsurance segment is still somewhat small within the group, but has shown some positive trends in recent months, namely at January renewals, boding well for earnings growth and cash upstream in 2024.

Regarding capital generation, ageas reported an operational generation of more than €1.8 billion in 2023, up by 0.6% YoY. Its Solvency II ratio at the end of 2023 was 217%, which is a very strong capital ratio, being both above the average of the European insurance sector and its own internal target of being above 175%. This means ageas has an excess capital position and doesn’t need to retain much of its earnings in the future, allowing it to return most of its organic cash generation to shareholders.

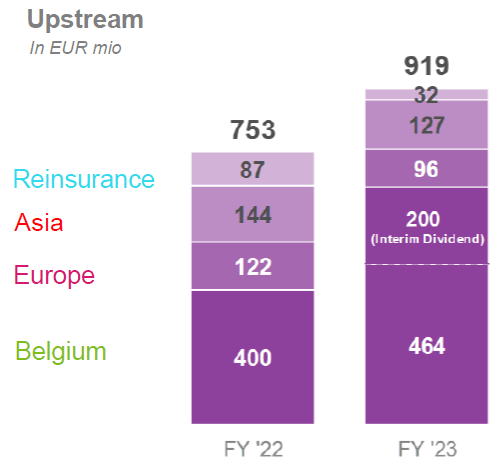

Regarding cash upstream from its operating entities, ageas received some €919 million during 2023, an increase of 22% YoY. This was justified by higher dividends received from Belgium, Europe, and its reinsurance segment, while in 2024 the company expects to receive between €750-800 million.

Cash upstream (ageas)

Due to higher dividends from its operating entities and proceeds from the sale of France, Ageas’ cash at the holding level increased to nearly €1 billion at the end of 2023, which is a very comfortable position.

This ample cash position and recurring dividends up streamed to the holding company are strong supports for its shareholder remuneration policy, based on a progressive growing dividend and potential share buybacks if cash generation is above its target.

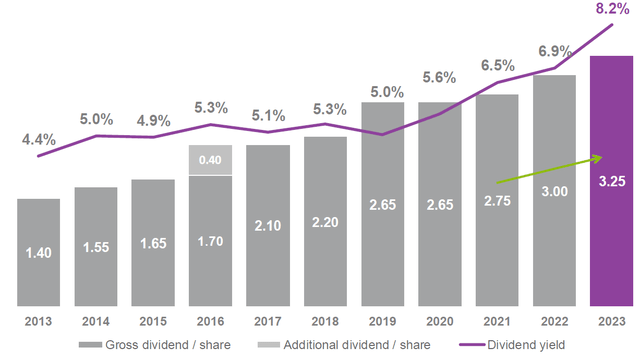

Its dividend growth history has been quite good over the past decade, and its most recent annual dividend was slightly ahead of expectations, as the company increased the dividend to €3.25 per share, while the market was expecting a dividend of €3.20 per share.

Dividend history (ageas)

This represented an annual increase of 8.3% YoY, above its own target of growing the annual dividend by 6-8%. This clearly shows that ageas’ organic capital and cash generation was positive and above expectations, allowing it to be more aggressive on capital returns. At its current share price, ageas offers a dividend yield of about 7.4%, which is still quite attractive to income investors, but lower than at the time of my last coverage on ageas when it was yielding more than 8%. This is due to a strong share price rally over the past few months, as the market reacted quite well to the company’s earnings and dividend beat.

Going forward, ageas is not likely to change its growth strategy much, being mainly focused on organic growth and returning significant capital back to shareholders, even though potential acquisitions are not ruled out if the opportunity arises. Indeed, a few months ago, ageas made a takeover bid for Direct Line (OTCPK:DIISF), a U.K. motor insurance company which I’ve covered in the past, but failed to get approval from Direct Line’s management and eventually decided to walk away as it could not justify a higher bid that would still make sense from a financial perspective to its shareholders.

This shows that ageas has ambitions to grow, but not at all costs, preferring to return capital to shareholders if there aren’t better alternatives to allocate its excess capital and cash position.

Regarding its valuation, ageas is currently trading at about 1.08x book value, which is at a discount to the European insurance sector, which trades at close to 2x book value on average, and also at a lower valuation compared to its closest peers, such as ASR Nederland (OTCPK:ARNNY) or AXA (OTCQX:AXAHY), which trade at 1.13x and 1.65x book value, respectively. This means that ageas seems to be somewhat undervalued right now, offering therefore a good combination of income and value for long-term investors.

Conclusion

ageas has reported a positive operating performance in 2023 and has a comfortable capital and cash position, being a strong support for a sustainable dividend in the future. While in some cases a high-dividend yield is a warning sign of poor dividend sustainability, this is not ageas’ case, and it remains a great income pick in the European insurance sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply