Introduction

WD-40 Company (NASDAQ:WDFC) has been an exceptional compounder over time, delivering impressive long-term returns to shareholders. With a high quality business model of manufacturing and selling household maintenance and cleaning products, it’s hard to think of a more defensible business that’s unlikely to be disrupted any time soon.

In the company’s Q2’24 results, WD-40 re-iterated ambitious targets for sales growth of 6-12% with gross margin expected to increase between 51.5% and 53%. While WDFC exhibits strong growth in its higher value products and is growing well internationally, I find the valuation a hard pill to swallow for a company that’s expected to grow mid-single digits long-term. In this article, I’ll discuss the company’s latest quarterly results, analyze the growth opportunities and outlook, and explain why the valuation isn’t enticing enough to warrant a position in the stock.

Company Overview

WD-40 Company owns portfolio of brands specializing in household maintenance and cleaning. It also sells cleaning products used in workshops, factories, and other commercial environments. while the company is most famous for its WD-40 brand (the brand it got its start with in the 1950s), the company has come to own several other brands including 3-in-one, GT-85, 1001, Lava, Spot Shot, Sol Vol, No Vac, X-14, and Carpet Fresh, among many others.

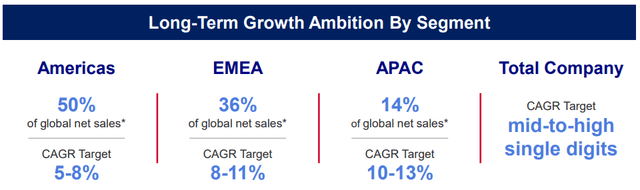

As a company, WD-40 can be though of into two separate segment. The first, maintenance products, makes up 94% of sales and is composed primarily of the company’s flagship WD-40 branded products. The remaining 6% is household and cleaning products, which are more niche products that focus on a particular focus area or geography. They provide healthy profit returns for the company, but aren’t core strategic priorities, given their smaller representation in the business mix and more limited growth. By geographic segment, Americas makes up 50% of net sales, EMEA represents 36%, and APAC comprises of 14% of global net sales.

Background

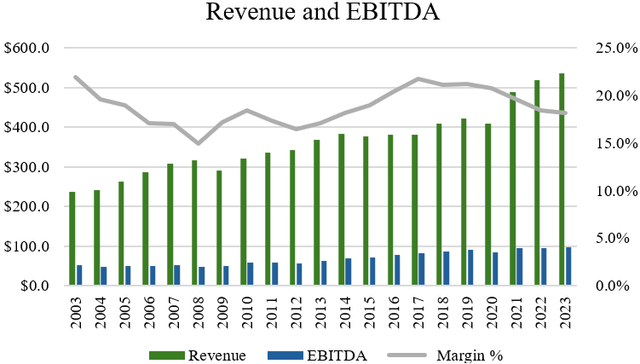

When looking at the historical financial performance of WD-40, the company has had a consistent track record of growing its top and bottom line. Over the last 20 years, the company has compounded revenues and EBITDA at CAGRs of 4.2% and 3.2%, respectively. In the last decade, the company has grown its revenues at a CAGR of 3.8%, with EBITDA growing 4.5% (source: S&P Capital IQ). Over time, while the growth rates have not been exceptionally high, the company’s financial performance has been fairly strong, even during weaker economic periods (eg. 2008-09), tending to be less cyclical as the demand for household cleaning products is more resilient. After all, there aren’t many macro events and factors that are going to stop people from spending money maintaining and cleaning their homes.

Author, based on data from S&P Capital IQ

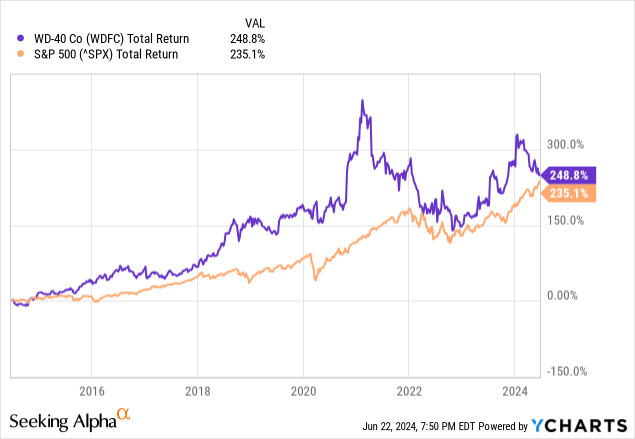

Over time, despite fairly low growth over time compared to the S&P500’s earnings growth, the company has outperformed on a total return basis delivering a return of 249%, compared to the S&P500’s return of 235%. In the last five years, however, the company’s share price has underperformed, delivering a total return of 47% while the S&P500 has gone on to more than double, delivering a strong return of 101%.

Recent Results and Outlook

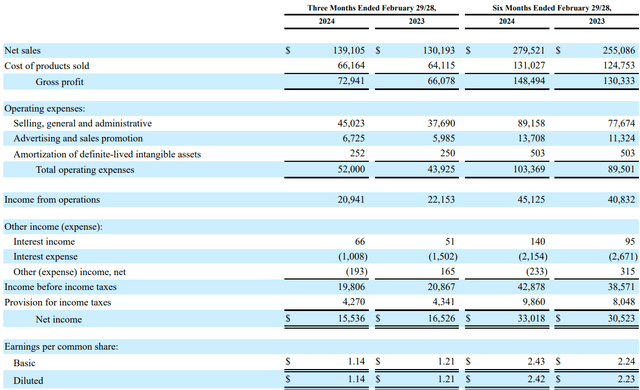

WD-40’s most recent results for Q2’24 were announced in April. During the quarter, the company reported quarterly sales of $139.1 million, representing year over year growth of 6.9% compared to last year, but missing analysts estimates by 1.15 million. With respect to margins, gross margins increased by 160 basis points. On earnings per share, the company reported EPS of $1.14 and beat consensus estimates by 2 cents.

Recent Results (10-Q)

Overall, this was a mediocre quarter for WD-40. In the Americas, consistent with historical performance, the growth in recent years has been slowing down, so sales were up just 1%. Compared to the latest year over year inflation rate of 3.3% in the U.S. it seems that the company’s sales can barely keep up with the rate of inflation. While some of this was attributable to ERP implementation, on the earnings call, management characterized this as “strong demand and sales growth”, which I think doesn’t accurately reflect the poor growth of the Americas segment. In maintenance products, growth was almost entirely driven by Latin America growth, as the U.S. was barely up 1%.

Internationally, WD-40 is seeing much better performance however. In EIMEA, sales were 16% to $54.3 million. Even though the company benefitted from currency fluctuations which boosted the results, removing the currency impact and looking at results on a constant currency basis, sales would have increased 11%. I’d still say that this is very good growth, marked by four consistent consecutive quarters of double-digit sales growth. Like EMIEA, APAC sales were also strong up 4%. The main detractor here was Australia, down 3% in maintenance products, but China sales as well the rest of APAC were up 3%. Gross margin for the segment were also impressive, up 320 basis points.

As for the outlook for the company, WD-40’s maintenance products category is targeting steady growth over the long-term. Clearly, as illustrated from the chart below, the company is targeting faster growth coming from international markets with a target for 8-11% in EMEA and 10-13% in APAC. With total company net sales CAGR targeted at mid-to-high single digits, this is roughly in line with the 5.8% net sales growth achieved in the maintenance products category over the last decade.

Investor Presentation

Another area for long-term growth is what the company refers to as their ‘premiumized’ products. This includes products like the Next Generation Smart Straw and EZ-Reach Flexible Straw products, which command higher margins and are faster growing that WD-40’s classic can. Historically, the company’s premiumized products have delivered a CAGR of 7.3% over the last five years. Longer-term, WD-40 is targeting a CAGR of over 10%.

With higher disposable incomes and products that focus on enhancing the user experience, these products should help the company expand margins and contribute to growth. Guidance for FY’24 is for between 6% and 12%, indicating that if WD-40 is to meet this goal, most of the growth will need to be achieved in the back half of the year. With barely 6% year over year growth this year for total net sales, I would assign a very low probability to WD-40 exceeding guidance. More likely, the risk is to the downside.

That said, we’re already starting to get a glimpse of the Multi-Use product sales and Specialist sales growth across different markets. In the Americas, for example, contrasted with 1% growth for the segment, WD-40 Multi-Use Product sales were up 1% and WD-40 Specialist sales were up 3%. In EIMEA, contrasted with segment sales growth of 16%, WD-40 Multi-Use Product sales grew 17% while WD-40 Specialist climbed 23%. So with growth from premiumized products outpacing the classic, lower value products, WD-40’s strategy is already starting to bear fruit.

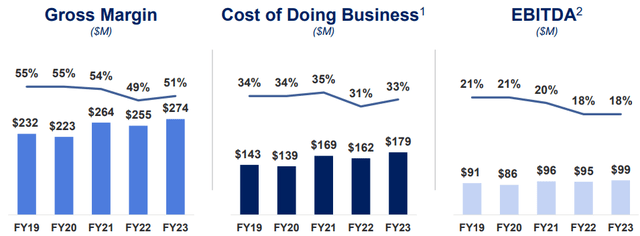

Finally, the last area I think went under appreciated by the market was on the company’s gross margins. When we look at the financial performance with respect to margins over the last five fiscal years, gross margins have deteriorated 4% while EBITDA margins have fallen 3%. Long-term, WD-40 has a target for 55% gross margins, so the company essentially wants to get back to their pre-COVID margin profile.

Investor Presentation

With gross margins increasing from 50.8% last year to 52.4% this quarter, the company has made progress in closing that gap. Some of that will be as a result of divesting lower-margin homecare and cleaning products businesses (a strategic initiative management is pursuing), so its really being driven by pricing power; more so on cutting costs and divesting lower margin business units. I would assign high confidence to the possibility of margin expansion. Post-Q2, management increased guidance for net income to be in the range of between $67.7 and $71.8 million with full year EPS coming in between $5.00 and $5.30, up from the prior range of between $4.78 and $5.15. So it seems to me that much of this margin expansion should trickle down the the bottom line too.

Valuation and Wrap Up

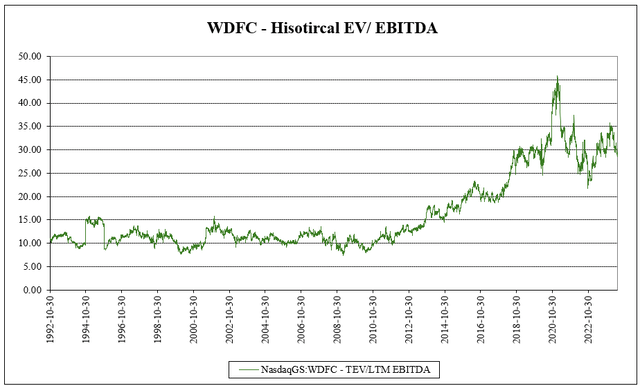

WD-40’s valuation isn’t cheap. With LTM EBITDA of $103 million, the company trades for 29.3x EV/EBITDA, or 28.4x forward. On P/E, the company trades at a lofty multiple of 44.5x earnings, and 42.4x forward earnings. Even using analyst’s EBITDA expectations for 2026, the company trades for 33.1x 2026 earnings (source: S&P Capital IQ). This indicates to me that the market has essentially priced this in for perfection, awarding it a high valuation given the defensive business model.

But when looking at the historical EV/EBITDA valuation for WDFC, the company traded in and around 10x EBITDA for much of the period between the 1990s to 2009. Since then, a significant portion of WDFC’s return has come from multiple expansion.

Author, based on data from S&P Capital IQ

While I am not saying the company’s valuation is going back to 10x EBITDA (we’re still in a period of relatively low interest rates), I believe it’s exceptionally difficult to conclude that the valuation is cheap or attractive at current multiples. For a company that’s expected to grow its net sales at mid-single digits long-term, I find paying close to 30x EBITDA way too expensive for a company that’s unlikely to make up for it with neither significant margin expansion or rapid growth. So even though I recognize the potential of a few hundred basis points of margin expansion, I believe that at today’s price, investors are paying for that and then some. As such, while I admire the company’s steady and consistent business model, I would assign a ‘hold’ rating on valuation concerns and would avoid the stock for now.

Read the full article here

Leave a Reply