Investment Thesis

DraftKings Inc. (NASDAQ:DKNG) is a stock that has hit a rough patch. The stock appears to be a pointless investment, as it swings down more than 20% from its recent highs.

And I know that you’d expect me to come out supporting my own stocks. But at the same time, I have been through these periods enough times to know that investments often look dire and distressing for a while before they find their traction once again.

All in all, I continue to believe that DKNG will reach $65 per share by summer 2025.

Rapid Recap

Back in April, I said,

[…] this business is still delivering hyper-growth (this means stable growth above 30% CAGR). Furthermore, its mid-30s% CAGR growth rate doesn’t even factor in its recent acquisition of Jackpocket. So, there’s still more upside optionality to come later in 2024, once Jackpocket has been integrated for a while.

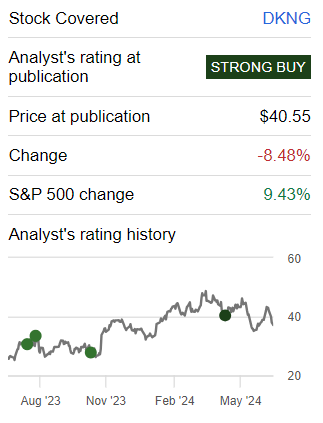

Author’s work on DKNG

As you can see above, this stock has been incredibly volatile. What’s more, despite being incredibly bullish on this stock, since I penned those words, the stock has significantly underperformed the S&P500.

However, I maintain that this underperformance is not just unjustified, but leaves this stock primed, like a coil, to bounce back stronger.

Common-Sense Investing

Everyone wants strong performance across the portfolio. But strong performance comes at a cost. You have to embrace significant volatility to get strong results. Because there’s no free dinner anywhere.

But provided that the thesis is intact, you will get rewarded. I know this may sound difficult to believe right now. However, I know this to be true. I’ve seen this happen on numerous occasions. Investors are in a risk-off period and a negative story gets attached to the stock. And that negative story, or fear, increasingly surfaces for a while. It inundates the stock.

Yet, after some time, this fear will become priced in and investors will move on to different stories and events in different companies. Or put differently, investors will throw in the towel on DKNG and the stock will with time become once again get re-priced on its underlying prospects and free cash flows.

Simply put, stick with this thesis. You will get rewarded.

DraftKings’ Near-Term Prospects

DraftKings provides online sports betting and gaming services, allowing users to place bets on sports events and play various games, including casino and lottery-style games, through their website or app. Their strategy centers on attracting new customers and retaining existing ones by keeping them engaged. They continually innovate, seeking new and improved ways for users to enjoy their platform and win prizes.

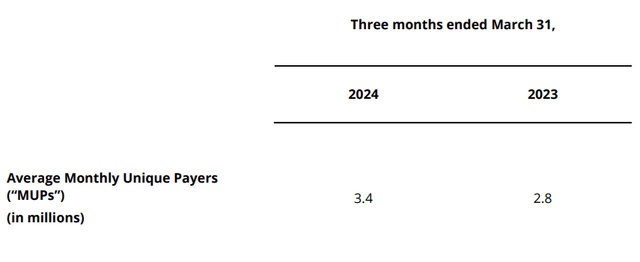

DKNG Q1 2024

This is my contention, provided there’s demand for a service or offering, it makes very little difference what the share price does in the short term. The share price will reflect the prospects of the business.

And if there’s strong demand for a service, provided the company successfully monetizes that demand, the stock will move higher, as investors chase the increasing free cash flow.

It’s just that at times investors discount the free cash flows more aggressively than at other times. Meaning that, sometimes, investors only care about the next quarterly result, whereas at other times, investors are more inclined to look further ahead. So, it’s simply a case of waiting. But we will get rewarded.

Given this background, let’s now discuss DKNG’s financials.

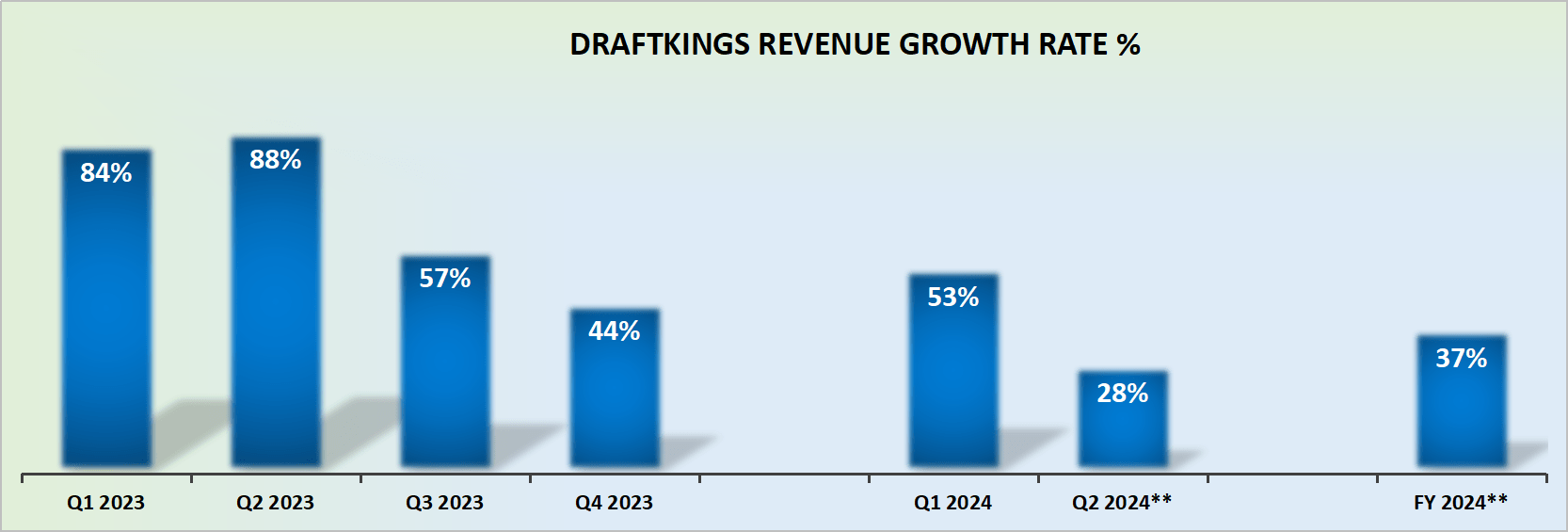

DraftKings to Grow by 37% CAGR in 2024

DKNG revenue growth rates

DKNG guides for more than 35% revenue growth this year. This is a company that has made several bolt-on acquisitions, and investors are often wary of companies that rely on regular acquisitions to grow their topline.

Along these lines, the fact that the Jackpocket acquisition is still being integrated, and a new acquisition was rumored to take place, is something that investors haven’t been overly keen to embrace.

But I know that getting up to $5 billion in revenues isn’t an easy feat. Oftentimes, to grow at scale and at a fast clip requires different technologies to be added to a platform.

My recommendation is not to get unduly caught up in the news flow coming out of a company. What investors back is the expectation of more free cash flow. And the share price will follow this expectation.

DKNG Stock Valuation — 36x Forward Free Cash Flow

I believe that in early 2025, as a forward run-rate, DKNG could be on a path to $500 million of free cash flow. This means that DKNG is priced at 36x forward free cash flow.

On the surface, I recognize that this may seem like a punchy valuation. But the business is clearly growing at a very rapid pace, at more than 35% y/y revenue growth rates.

Once the business slows down its growth aspirations to less than 20% CAGR, at that point, DKNG can work on maximizing its free cash flow. But that junction isn’t on the cards. Not yet.

DKNG’s balance sheet carries approximately $400 million of net debt and possibly even slightly more net debt, if it decides to go through its newly rumored acquisition. This is obviously something that I’m acutely aware of.

However, at the same time, given that DKNG makes close to $500 million of free cash flow in twelve months, I’m hoping that DKNG will use the next year to improve its balance sheet and slow down the pace of its acquisition.

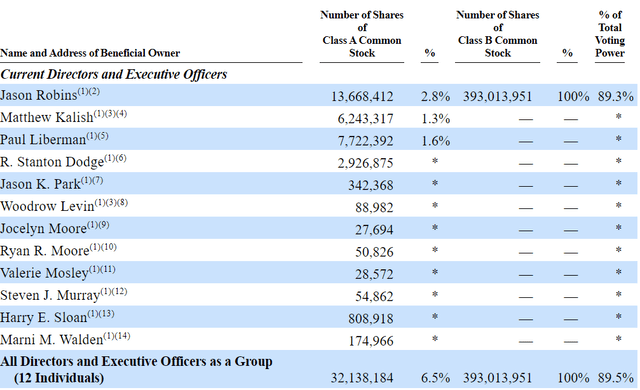

Moreover, given that management is by far the biggest shareholders in the company, holding around $1 billion worth of stock of DKNG, I believe that founder and CEO Jason Robins is acutely aware of the fact that his company’s stock is out of favor right now and not being given enough credit.

DKNG proxy

So far, DKNG has a long history of increasing its growth prospects. We are in a good company here. Stick with this stock.

The Bottom Line

Buying DraftKings stock makes sense due to its impressive financial outlook.

Despite recent volatility, DraftKings is projected to grow at a 37% CAGR in 2024, with revenue anticipated to exceed $5 billion. This growth is bolstered by strategic acquisitions and continuous innovation.

Moreover, DraftKings is expected to generate $500 million in free cash flow as a forward run-rate by early 2025, even with a net debt of approximately $400 million.

With management heavily invested in the company, their commitment to improving the balance sheet and driving long-term value underscores the potential for substantial returns.

Price target: $65 per share by summer 2025.

Read the full article here

Leave a Reply