Investment Outlook

The Hackett Group, Inc. (NASDAQ:HCKT) continues to invest in its Generative AI capabilities.

I previously wrote about HCKT in September 2023 with a Hold outlook due to slower revenue growth and full valuation.

That situation continues to exist, with clients delaying decisions within its primary revenue segment, Global S&BT combined with an apparently full stock price valuation on slowing revenue growth.

I reiterate my Neutral (Hold) outlook on The Hackett Group, Inc. for the near term on slowing prospects for a return to future growth but a medium-term potential for AI-related engagement growth.

The Hackett Group’s Market And Approach

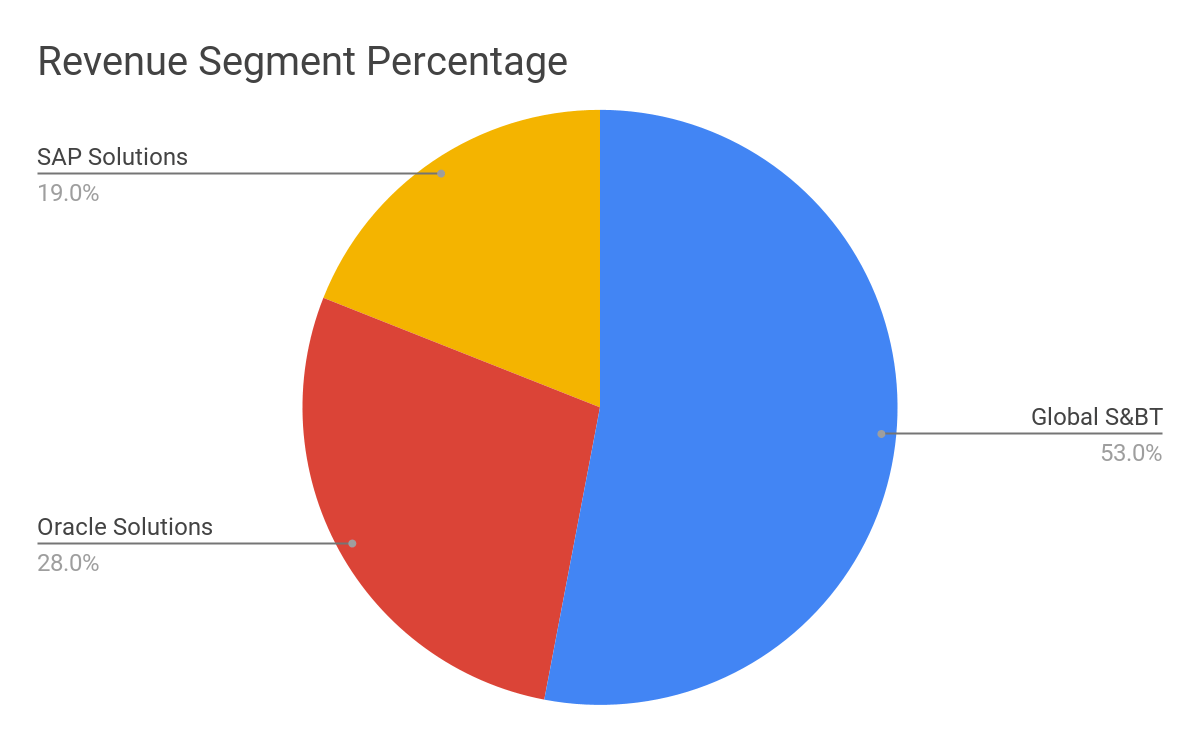

The firm reports in three revenue segments, Global S&BT (Solutions & Business Transformation), Oracle Solutions and SAP Solutions, with the most recent quarterly breakdown percentages shown in the pie chart here:

Seeking Alpha Data

Hackett’s specific services within these major segments include:

– Strategic Consulting

– Benchmarking Research

– Oracle & SAP Solutions

– OneStream Platform and Marketplace Solutions

– Business Transformation

– Market Intelligence Service

– Ancillary Services.

According to a 2022 market research report by Business Research Insights, the global digital transformation consulting market was an estimated $53.3 billion in 2021 and is forecasted to reach $235 billion by 2031.

This equates to an expected CAGR of 13.2% from 2022 to 2031.

The main reasons for this forecasted growth rate include a continued transition from on-premise systems to cloud-based environments that feature more complicated architectures.

Also, the pandemic likely pulled forward the impulse for updating enterprise systems to both improve efficiencies and increase resilience, producing future growth opportunities for digital transformation consulting companies.

Major industry players in the digital transformation consulting space include:

-

Globant

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemini

-

Company in-house development efforts.

Recent Financial Trends

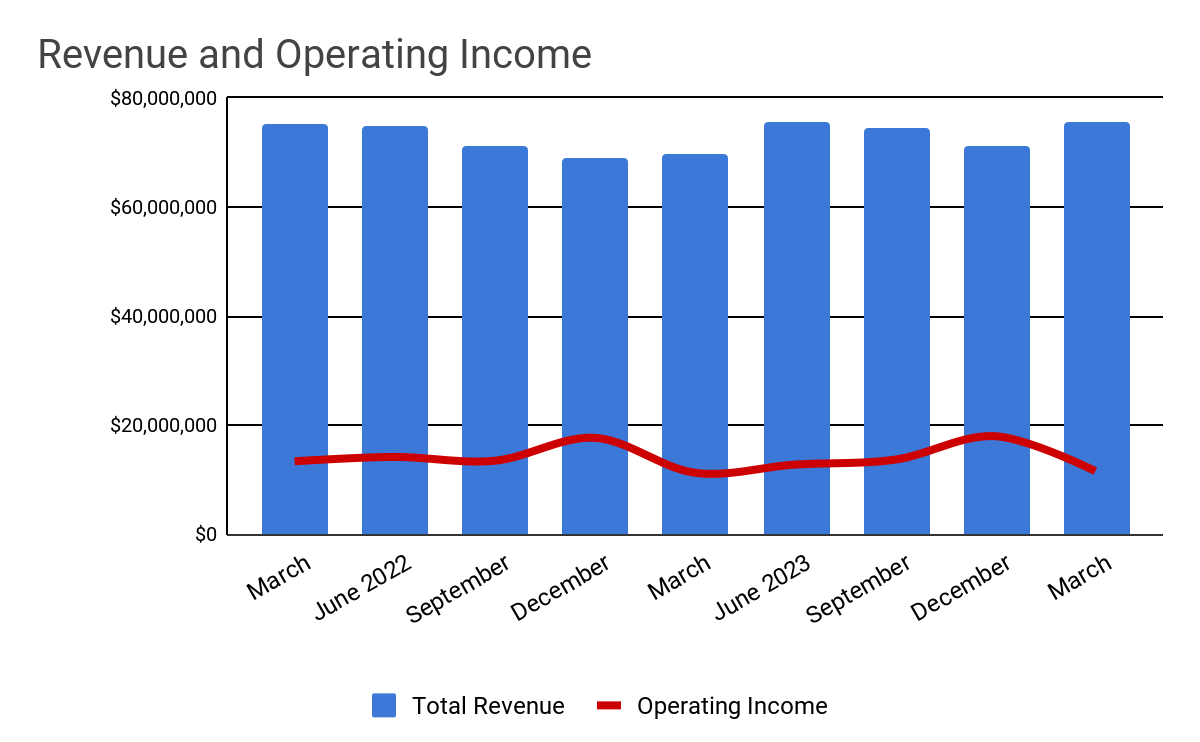

Total revenue by quarter (columns) has plateaued in recent quarters due to tepid client spending in the company’s Global S&BT segment; Operating income by quarter (LINE) has turned lower because of higher SG&A expenses.

Seeking Alpha

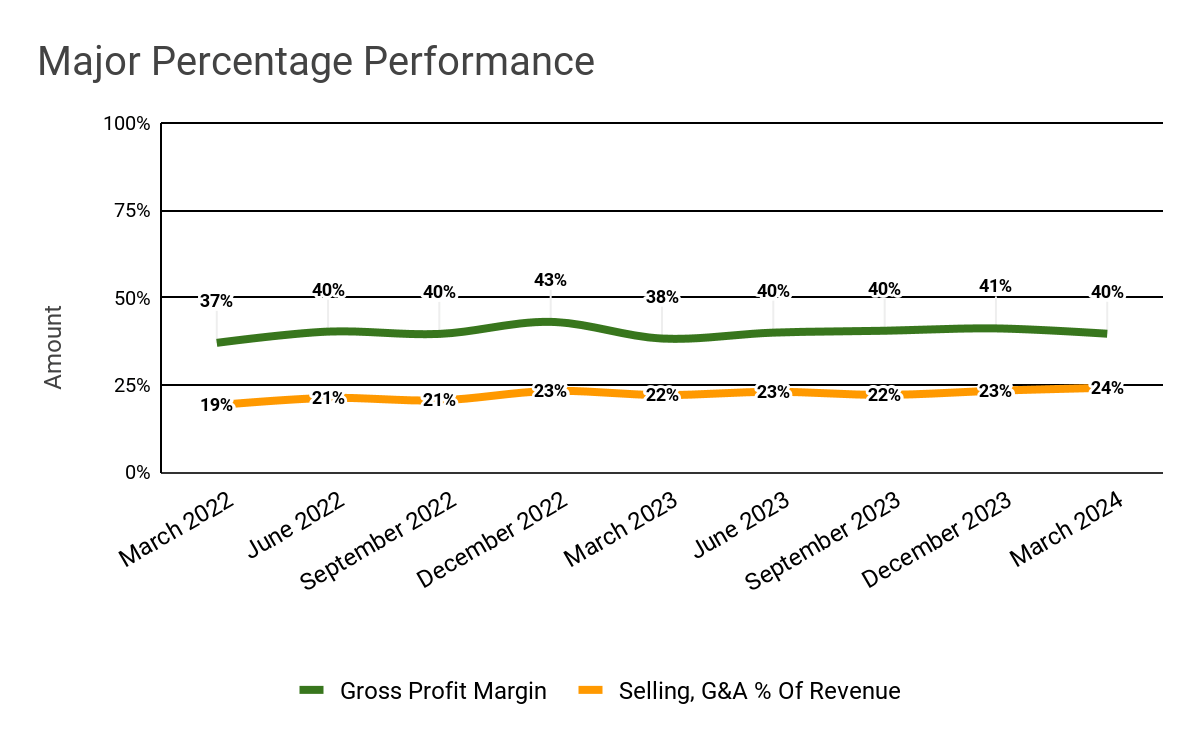

Gross profit margin by quarter (green line) has remained relatively stable, while Selling and G&A expenses as a percentage of total revenue by quarter (orange line) have increased due to higher headcount and severance costs.

Seeking Alpha

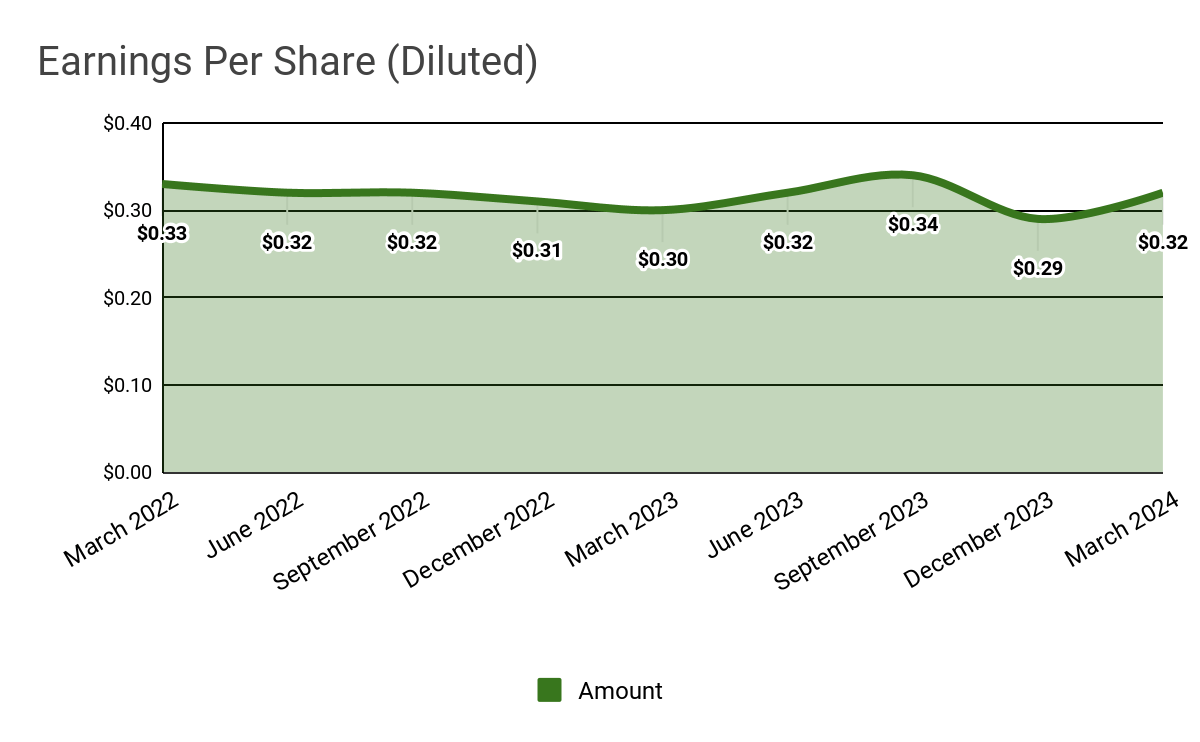

Earnings per share (Diluted) have improved sequentially on slightly higher revenue and reduced interest expense.

Seeking Alpha

(All data in the above charts is GAAP.)

For balance sheet results, HCKT ended the quarter with $13 million in cash and equivalents and $30.7 million in total debt, all of which was long-term.

Over the trailing twelve-month period, free cash flow was an impressive $39.3 million, and capital expenditures were only $4.0 million. The company paid $10.9 million in stock-based compensation (“SBC”) in the last four quarters, slightly higher than in previous periods but not unduly so.

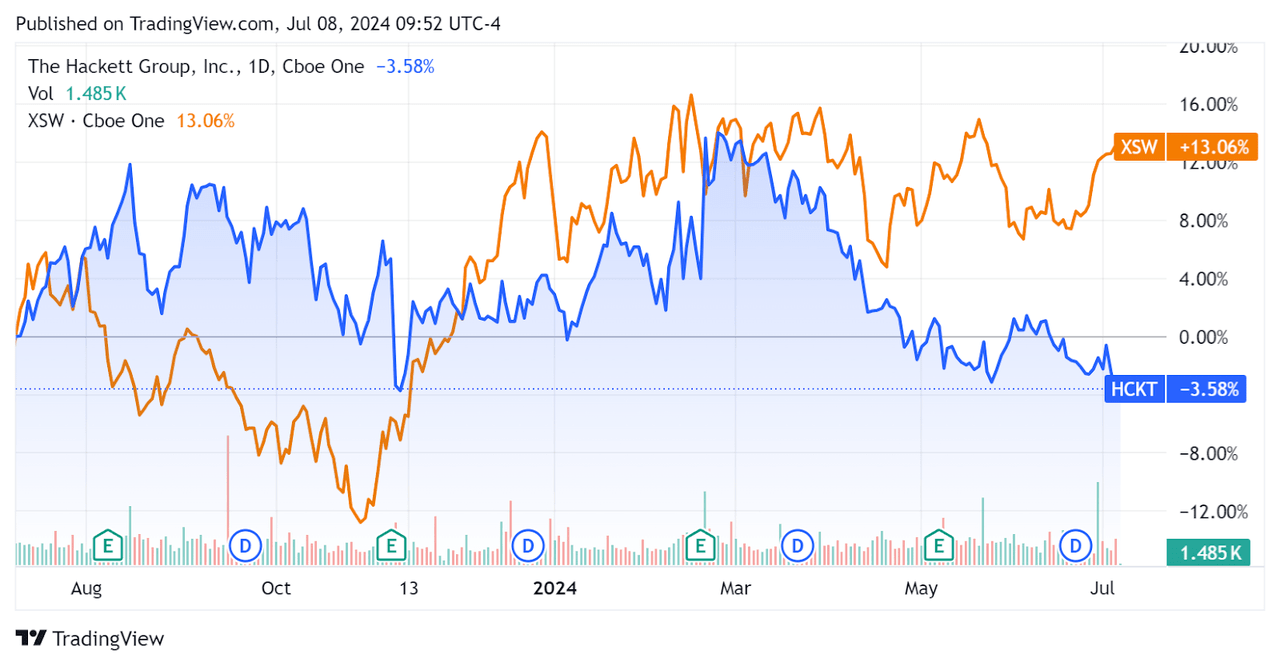

In the past 12 months, HCKT’s stock price has fallen by 3.6% vs. that of the SPDR S&P Software & Services ETF’s (XSW) gain of 13.1%, as the chart shows here.

TradingView

Below is a major financial and operating metrics table for HCKT’s recent results and forward guidance:

|

Metric |

Amount |

|

EV/Sales (“FWD”) |

2.0 |

|

EV/EBITDA (“FWD”) |

9.7 |

|

Price/Sales (“TTM”) |

1.9 |

|

Revenue Growth (“YoY”) |

4.5% |

|

Net Income Margin |

11.7% |

|

EBITDA Margin |

20.1% |

|

Market Capitalization |

$584,860,000 |

|

Enterprise Value |

$604,120,000 |

|

Operating Cash Flow |

$43,260,000 |

|

Earnings Per Share (Fully Diluted) |

$1.27 |

|

2024 FWD EPS Estimate |

$1.55 |

|

Rev. Growth Estimate (“FWD”) |

3.0% |

|

Free Cash Flow/Share (“TTM”) |

$1.44 |

|

Seeking Alpha Quant Score |

Hold – 2.61 |

(Source: Seeking Alpha.)

Why I’m Neutral On The Hackett Group

HCKT is growing only slowly as it seeks to navigate uncertain client decision-making behaviors, like many consulting companies in the current environment.

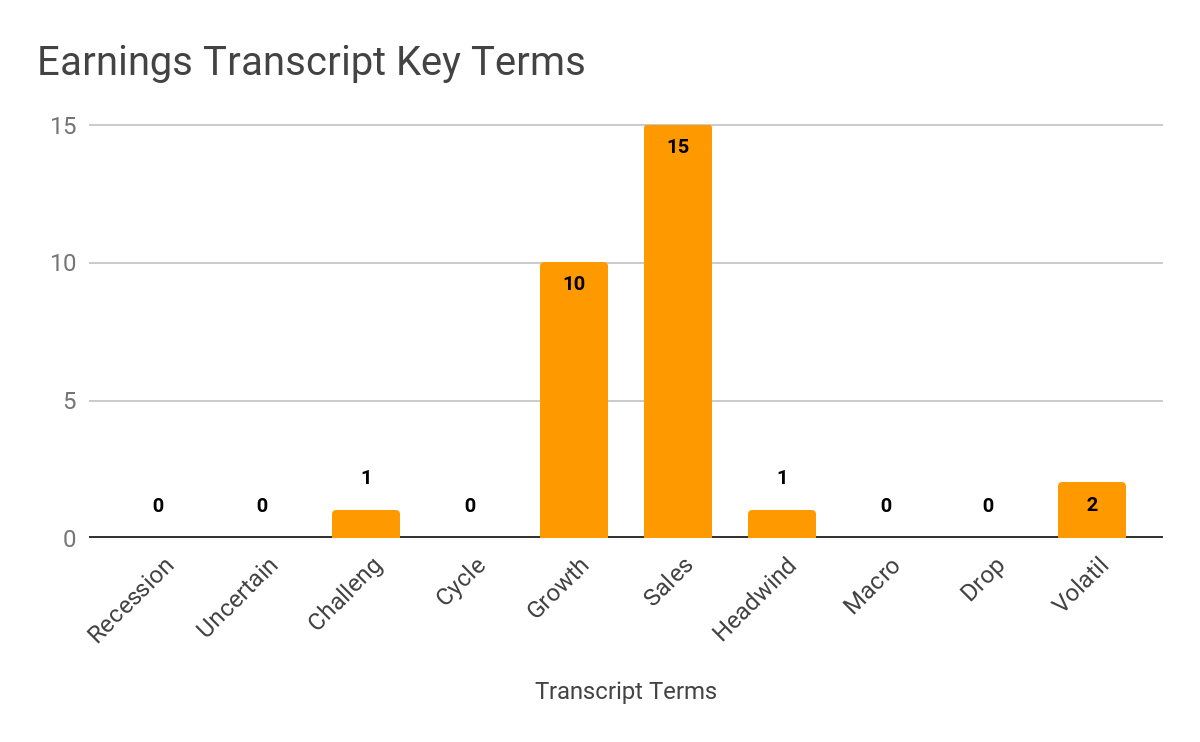

The graphic below shows the frequency of various keywords in management’s most recent conference call.

Seeking Alpha Data

I’m interested in primarily negative mentions, and the reference to volatility is relevant to the firm’s largest revenue segment, Global S&BT.

This segment has seen slowing client demand (volatility) due to macroeconomic headwinds, according to leadership, so when its major segment has a revenue growth problem, the company as a whole has a problem.

HCKT is reallocating management toward its generative AI initiatives, but the difficulty here is that many organizations are not moving at full speed toward AI engagements.

Rather, I’m seeing numerous accounts of companies dipping their toes in and starting small pilot projects for cost-takeout functions but not proceeding to more discretionary, ‘transformation ’-level projects.

As a result, consulting companies are forced to spend on their AI initiatives, employee training and retention to be in a position for when AI project growth materializes, possibly not for several quarters from now.

So, there may be a mismatch between spending and revenue generation, depressing earnings growth in the process.

Consulting firm management teams have to choose between keeping their hard-won, trained employee base and allowing for greater attrition or even layoffs.

I haven’t seen layoffs on a large scale yet, but there are instances of increased attrition, small layoffs and rescinding or delaying of new hire commitments in some cases.

Additionally, HCKT’s forward revenue growth is now expected to be around 3.0% compared to year-over-year growth of 4.5%, indicating a further slowing of revenue growth.

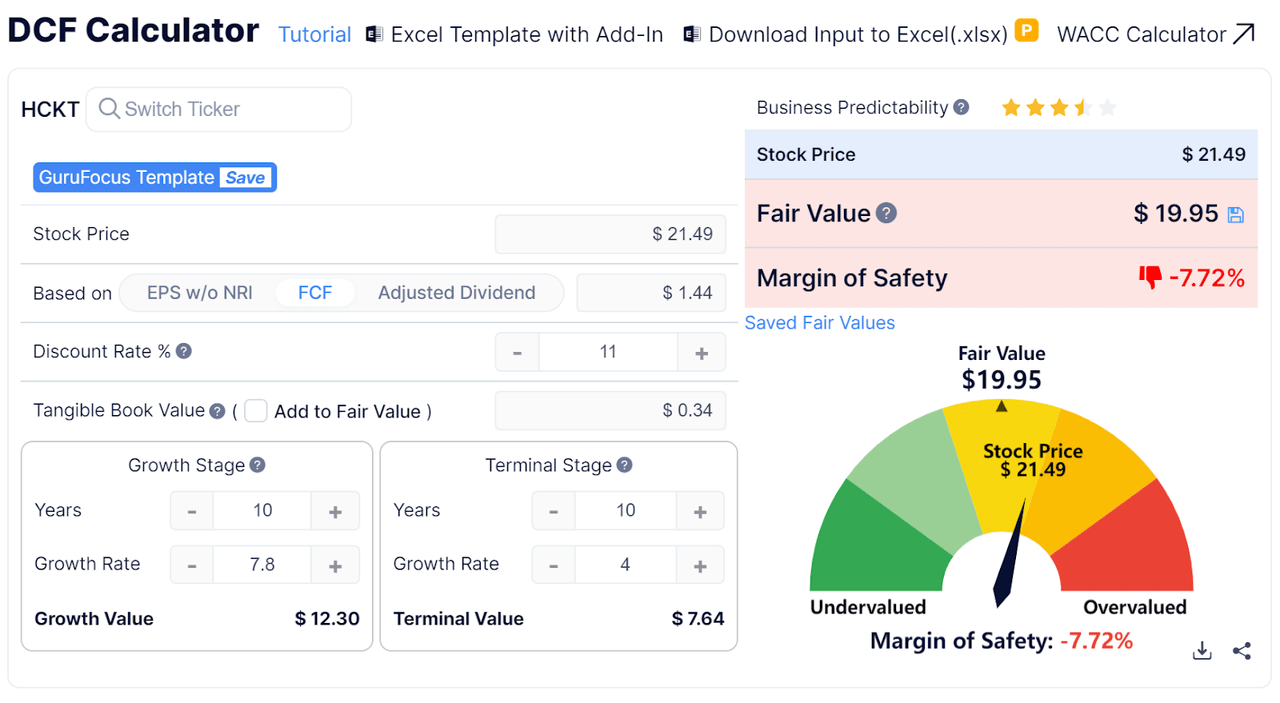

As to valuation, my discounted cash flow calculation, based on the company’s current free cash flow per share and an 11% discount rate (4.3% 10-year + 6.7% ERP), indicates the stock is currently fully valued:

GuruFocus

With an apparent full stock valuation, problems with its major revenue segment’s growth rate and a wider economic slowdown in the overall economy underway, I remain Neutral (Hold) on The Hackett Group, Inc. shares for the near term.

Read the full article here

Leave a Reply