Investment Thesis

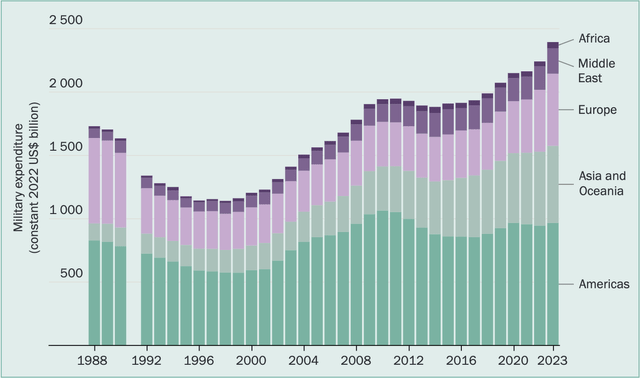

Global military expenditure continued to increase for the ninth consecutive year in 2023, growing 6.8% y/y, the sharpest increase on a y/y basis in over a decade, according to military trade data collected by research institutes.

The persistent escalation of geopolitical conflicts & tensions has raised military spending to newer highs, as seen in Exhibit A, and recent activity suggests spending is only going to grow from hereon.

Exhibit A: Global military expenditure rises for the ninth consecutive year marking a new record high in 2023 (SIPRI)

At the 75th NATO summit being hosted in Washington this week, leaders from NATO member countries pledged to further increase defense spending. That raises the prospects of several defense contractors and military equipment manufacturers, especially those of U.S. companies, as the U.S. increases its share in global arms exports.

This positions defense companies on a secular path to prosper from the long-term tailwinds that lie ahead, putting ETFs such as iShares U.S. Aerospace & Defense ETF (BATS:ITA) on watch.

While ITA looks increasingly interesting from here, there are also some near-term factors to consider, and based on the culmination of these factors and tailwinds, I continue to recommend staying Neutral on ITA.

Quick Recap of the ITA Fund

The ITA fund aims to offer investors exposure to various companies in the defense sector. They are engaged in the military sector either in some way of manufacturing, assembling, or producing equipment and products such as aircraft, radar equipment, missiles, weapons, and other parts & components.

The fund’s composition is based on tracking the performance of the Dow Jones U.S. Select Aerospace & Defense Index (DJSASD), which is rebalanced on a quarterly basis.

As noted in my previous coverage of the ITA fund, any company that is classified under the Aerospace and Defense subsectors according to the DJICS classification (Dow Jones Industry Classification Standard) will be a part of the DJSASD index, resulting in becoming a component of the ITA fund.

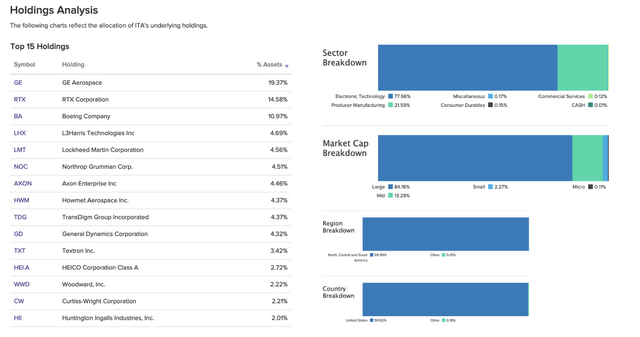

Here is an updated breakdown of the fund’s assets for the top 15 holdings in the ITA fund, which account for ~90% of the fund’s assets.

Exhibit B: Top 15 holdings for iShares US Aerospace & Defense ETF, ITA fund. (ETFdb)

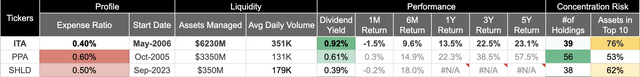

Fund Performance So Far Vs. Its Peers

One of the challenges I had detailed in my previous coverage on ITA was the fund’s meaningful exposure to The Boeing Company (BA), where I had mentioned:

The fund composition has been a standout factor over the years as ITA gets outperformed by its peers, XAR [SPDR S&P Aerospace & Defense ETF] and PPA [Invesco Aerospace & Defense ETF]. Specifically, for ITA, I do not think Boeing should hold such a large weight, especially because its revenue from Defense accounts for just over a third of its overall revenue.

At the time, I had recommended staying neutral on the ITA fund purely due to the fund’s composition structure, keeping its Boeing position in mind. Since my last coverage, the fund has returned just ~2%, augmenting my previous argument for staying neutral on ITA. This can also be seen in the performance of ITA versus some of its peers.

Exhibit C: ITA’s fund performance versus its peers (Author’s compilation)

As can be observed from Exhibit C, ITA has been consistently underperforming on all past investment horizons due to its fund composition, especially in the past 1-3 years when the outlook for Military & Defense companies became brighter with rising geopolitical tensions. Even newer funds like the Global X Defense Tech ETF (SHLD) have outperformed the ITA fund despite being marginally more expensive by 0.1%.

The ITA fund has reduced its allocation since my last coverage of Boeing from 15% in March this year to 11% as of July 10th. With Boeing’s planned acquisition of Spirit AeroSystems Holdings, Inc. (SPR), I expect a further redistribution in ITA’s fund composition, and I believe the fund will further lower its weight on Boeing after the deal is approved since Boeing’s revenue contribution from Defense will actually reduce post-merger.

This redistribution should start to make ITA interesting to watch, in my opinion.

Outlook and Valuation for ITA Fund

Aside from fund performance and composition factors, the overall macro outlook is looking even better than I last observed.

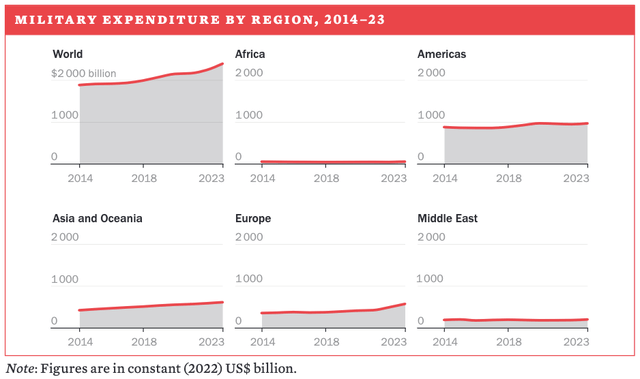

As I had mentioned earlier in this note, global military spending rose by one of the largest percent increases seen in over a decade, rising 6.8% y/y in 2023 to a record high of $2443 billion, as seen in Exhibit D below. In 2023, European regions’ military spending surged the highest among all other global regions, rising 16% y/y to $600 billion.

Exhibit D: Global military spending rising with Europe leading the charge in spending (SIPRI)

This is important to note because NATO countries have been increasing spending in line with the rise in conflicts and the intensity of those conflicts around the world, and leaders are looking to raise spending even more. What underlines the importance here is that NATO member states accounted for 55% of global military spending in 2023.

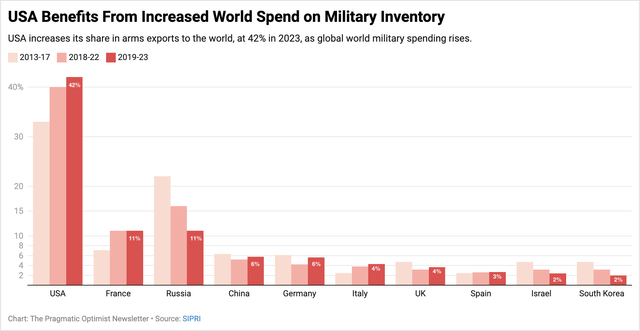

These trends in worldwide military spending have, in reality, been a considerable boon for military companies all around the world. The U.S.-based companies are the biggest beneficiaries among all other companies, as I have demonstrated in Exhibit E below.

Exhibit E: USA extends global leadership in military export in 2023. (SIPRI)

This outlook paints a strong picture for the ITA fund, which is now expected to post ~19% growth earnings over the coming years. The fund is also trading at a 29-30x forward earnings multiple if I look at the forward valuation multiple of the underlying DJSASD index.

In my opinion, this implies that the fund is reasonably valued currently, and given the few risks and factors to be considered, I will still recommend investors stay neutral on ITA despite the strong outlook.

Risks & Other Factors to Watch

One key overhang on the ITA fund will continue to be Boeing’s weight on the fund’s composition. I do expect this to marginally reduce over time, which will provide some boost to the fund’s composition.

U.S. elections are another key factor to watch, which will likely weigh on the ITA fund as well. Until there is a clear winner in the presidential elections, investors can expect a slowdown in customer & contract wins and orders placed for U.S. defense companies, which will pose some headwinds for the ITA fund. Once clarity emerges from the presidential elections, investors can expect more movement from the pledges that NATO member states made in the recent conference to turn into actual contract winds for defense companies.

Takeaway

As global military spending continues its robust upward trajectory, defense companies around the world, especially U.S. defense companies, stand to be beneficiaries of this tailwind, with iShares U.S. Aerospace & Defense ETF seeing its prospects improve as a result. Fund composition and election cycle headwinds will persist for ITA in the near term, but once those headwinds dissipate, I expect ITA to be a long-term winner.

For now, I continue to recommend a Hold rating on the ITA fund.

Read the full article here

Leave a Reply