Overview

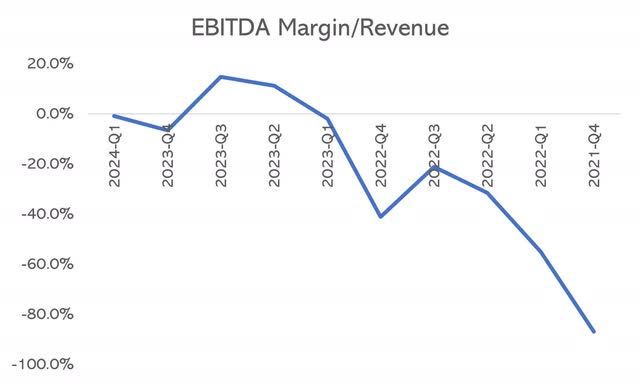

Genius Sports (NYSE:GENI) showed strong revenue growth in Q1 2024, as has been the case in the last few years. Q4 revenue exceeded expectations with $120 million, a 23% year-on-year increase. Growth was produced in all segments. The company also surpassed expectations in Adjusted EBITDA, achieving $7 million from a $13 million loss for the entire 2023 year. In Figure 1, you can see how the evolution has been trending upwards.

Figure 1: Author

Net working capital decreased to $108 million compared to $121 million at the end of 2023. This decrease is due to accounts receivables. Capital expenditures were $11.7, which was in line with previous quarters, and 10% of revenue, which was slightly smaller than in prior quarters but a high level of investment in general.

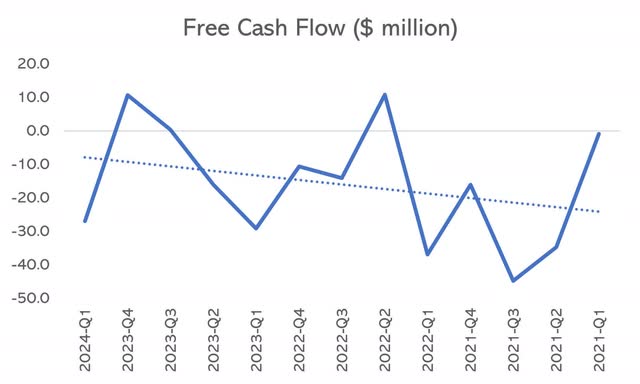

Figure 2: Author

The quarter’s free cash flow was -$27 million, displaying somewhat erratic behavior but showing a slightly positive trend (Figure 2). The business is growing quickly and gradually improving its margins with a substantial investment in technology.

These results can make you optimistic about the company’s prospects. However, I am more critical and will outline my reasons in the article.

Technology is key but not enough for differentiation

Sports data is critical because it is essential to a company’s business, especially for betting and media companies. Without data, they don’t collect revenue. One expects the technology to replace scouts, decrease costs, or create an edge over competitors.

Based on my assessment, the technology required to provide the service seems unlikely to meet its expectations. Initially, it’s unclear whether the technology will lead to cost savings. The initial investment is substantial. Genius’ CAPEX represents about 10% of its revenue, a significant amount. The company needs to invest in expensive cameras and RFID equipment. Moreover, the ongoing operational expenses are not insignificant. Genius has to cover costs for cloud services, hire costly data engineers, and develop and maintain expensive algorithms.

We don’t have information to deduce if the technology creates a competitive advantage. In my analysis methodology, if I don’t have at least a slight evidence, I don’t consider that there is an advantage. Genius uses data collection and tracking technology, data analytics and visualization, and finally, data distribution. Optical tracking and computer vision analytics can be the most proprietary technology, but they are replicable, even if they are complex. You can see, as an example, the generative algorithms and the fight between Google and OpenAI: it is hard to differentiate.

Concerns about exclusive multi-year deals

Exclusive rights from sports leagues carry high risk due to the league’s significant power. When the contract expires, it can significantly impact revenues and shock the stock price.

The NFL deal has some concerns and creates doubts about other deals and, more importantly, the exclusive deals model used so far. In the contract, Genius has to pay the NFL minimum revenue guarantees exceeding $120 million a year. In the first years of the deal, Genius may not generate enough revenue and would be unprofitable in the short term. Some revenue-sharing mechanisms exist, but the NFL’s share grows when Genius’s revenue increases. That means that the upside is limited and can lower potential earnings from the partnership.

The NFL received warrants to purchase Genius’ stock price at a discount in the deal. This can be good because the NFL is more attached to the company when deals expire, but your position in the company can be diluted if you are an investor. There is considerable conflict of interest as the NFL would be a client and an investor undermining rational business decisions.

One consequence is that these non-profitable characteristics will keep the company from positive margins and profitability. However, the real problem is whether this deal structure is extensive for the rest of the deals or future deals. This would be a structural problem, and it would be a significant concern.

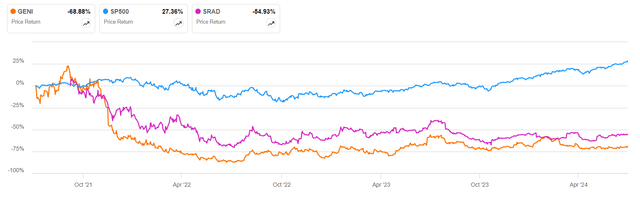

Since the deal announcement in April 2021, the stock’s volatility has been higher (5.28 vs 4.02), reflecting investor insecurity about its prospects. Since then, Genius’s stock price has been in decline. However, it is not all about the company; its main competitor, Sportradar (SRAD), has evolved similarly but with a slightly higher premium.

Figure 3: Seeking Alpha

The industry doesn’t have very attractive features

So, it is critical to analyze the industry and understand why the two leading players are underperforming in the total market, as we have seen in Figure 3. My first point is that significant barriers to entry make it harder for new players to enter the market. It is an industry that has been technically more complex. So it has been more capital-intensive over the years., Besides, the leading players have been securing data rights with leagues. This locks official information, making alternative data sources less valuable. Genius has multi-year exclusive partnerships with the NFL, NBA, NCAA, and PGA…. The company’s acquisition of Second Spectrum has given technological capabilities.

There is a diverse customer base, from sportsbooks to media companies and sports leagues. The industry is not dependent on a few clients, giving it more power. Switching costs for buyers can be significant because they have to integrate the technology of the data source. More than 300 sportsbooks, over 100 content providers, and media outlets exist. Prominent sportsbooks like DraftKings and FanDuel can exercise a stronger position.

However, the main problem I identified is that suppliers, sports leagues, have considerable bargaining power. Each sport usually has just one major league, like MLB or NFL. The NBA is the main league in the US market. Even when the company doesn’t state a client with a share of revenue greater than 10%, it does recognize that client concentration is a problem: “We depend on a limited number of customers for a significant portion of our revenue. The loss of any of these customers or a reduction in the amount of business we do with them could have a material adverse effect on our business, financial condition, and results of operations.”

Lastly, there is a high-intensity rivalry, especially with Sportradar. This rivalry is more aggressive when negotiations for exclusive league partnerships are involved, making the exclusive multi-year agreements less profitable than they appear.

My conclusion is that the industry is not highly attractive. The sports league is almost exclusively focused on its sport and exerts a powerful position in the relationship. I think the technology won’t give a significant advantage over the competition. I estimate the industry will have two big players and a few smaller ones, but the sports league will limit its profitability.

Valuation

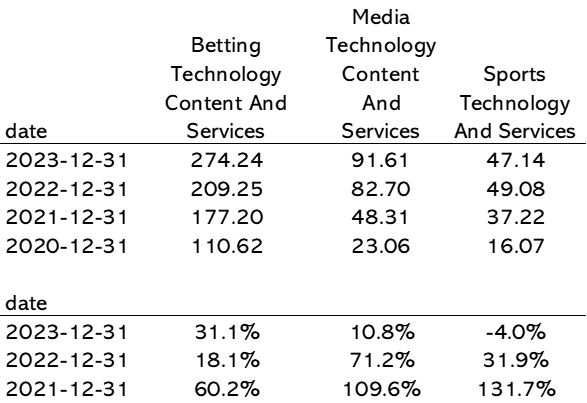

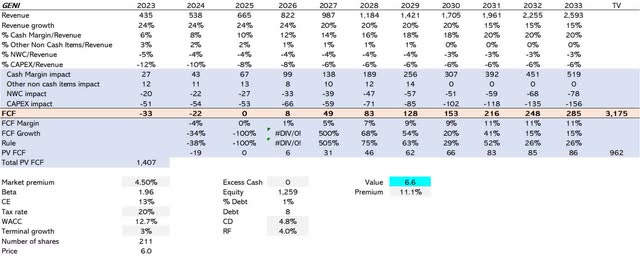

In Figure 4, it is shown the value drivers of Genius considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

Figure 4: Author

The company has been growing at a good pace, 37% in the last three years. I am confident that the company can grow at least 24% during the next three years, as sports betting is expanding into new states and new media outlets need more sophisticated data. Later on, this growth will be reduced to 15% in 2033. Figure 5 shows how the betting segment is the one with the highest rate.

Figure 5: Author

The cash margin has been good in the last year but on an erratic trajectory. Management states that they are improving. In Figure 6, I show the value drivers of Sportradar. You can see that they are getting a cash margin of 30%. I estimate Genius will improve its margins to 20% in 2033. I don’t foresee greater margins due to the competitive dynamics of the industry I have talked about before. I even estimate that Sportradar will decrease its margin for the same reasons.

Figure 6: Author

The company must reduce its level quickly for non-cash, net working capital, and capex items. Otherwise, it won’t be able to grow its free cash flow. I am confident that management can handle it. Networking capital change must be 4% of revenue this year and be reduced to 3% at least in 2030. The same happens with CAPEX. It must be reduced to 10% this year, 8% next year and 6% in 2027. That means continuous technological competition will erode the profitability of Genius and its competitors.

Cash flows will be discounted at a 12.7% WACC because the beta is 1.96 and risk-free at 4.0%. Given the company’s low leverage, WACC is mainly the cost of equity. The terminal growth rate is set at 3%.

Figure 7: Author

As shown in Figure 7, my value estimate is $6.6 per share, an 11% premium over its current stock price. It is not a big difference in the current price. I would like to see a bigger premium and a bigger margin of safety to consider it a buy.

Risks

I foresee two risks. The first one is not getting the margin expansion I modeled. The second one is not being able to manage cash: managing net working capital and CAPEX.

If margins increase to 16% instead of 20%, the value estimate will decrease to $4 per share. If margins only get 10%, there practically won’t be any value in the company. As I have outlined in previous sections, industry dynamics can limit the growth of this margin.

If the company doesn’t manage cash well, it will destroy much of its value, especially for CAPEX and the technological capabilities needed to compete. If the company needs to invest 12% of its revenue in CAPEX, as it did last year, its value will decrease to $2.6 per share.

Conclusion

I have outlined the huge investment in technology, but I don’t expect it to be a differentiation factor. I have concerns about the deal structure with significant leagues and the industry’s not being very attractive.

Considering those factors, my valuation doesn’t build a premium with the current price. If any risk materializes, the stock will be punished. So, I recommend holding the position and seeing how the industry dynamics evolve.

Read the full article here

Leave a Reply