Last Friday, Lakeland Industries, Inc. (NASDAQ:LAKE) filed a $100 million mixed-shelf offering with the SEC. A shelf offering is a precondition for companies to offer either their stock or convertible stock securities, like convertible debt.

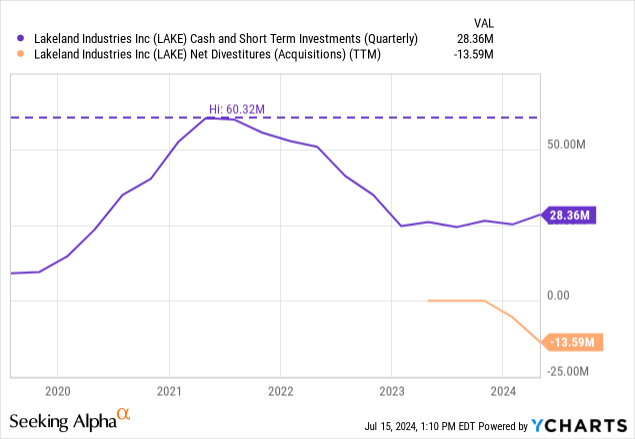

Because of its aggressive acquisition strategy, Lakeland has exhausted the cash reserves it had built during the pandemic. Today, the company has little cash when accounting for acquisitions made after reporting for 1Q24.

Under this context, filing a shelf that would allow the company to issue up to 60% of its current market cap in new shares is worrying. Lakeland investors now face the risk of dilution.

The context

I have been covering Lakeland since September 2022, with a Hold rating. My latest article is from May 2024. I have consistently rated the stock as a Hold because I am concerned with the company’s valuation and its aggressive acquisition strategy. The market has proven me wrong so far, with the stock up 100% since September 2022 and 30% since May 2024.

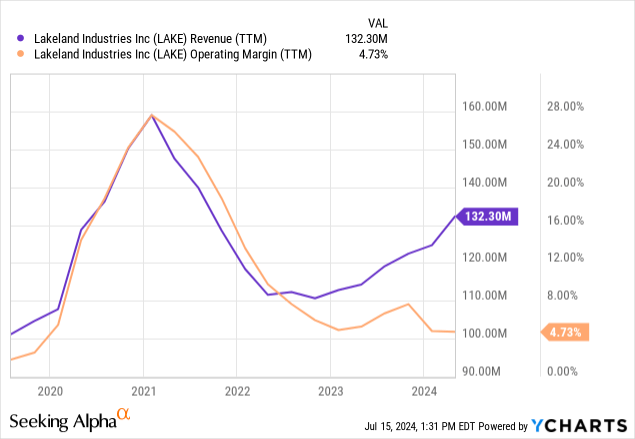

The latest article explains the thesis well, but here is a small summary. Lakeland is a mature company operating in a mature industry, selling protective equipment for industrial, fire, and medical settings.

The company did very well during the pandemic, thanks to the demand for personal protective equipment. Lakeland accumulated a lot of cash, thanks to that windfall. However, instead of returning that cash to shareholders by buying back stock or issuing dividends, the company decided to reposition its business to focus more on the fire protection vertical and engaged in a series of acquisitions.

Lakeland used all of its cash to acquire Eagle Technical, Pacific Helmets, Jolly Scarpe, and LHD Fire. These companies manufacture protective suits, helmets, boots, and other equipment for firefighters. In total, the company spent more than $40 million in acquisitions (the figures below correspond to 1Q24 when the acquisitions of Jolly and LHD Fire for a combined $26 million had not been recorded yet).

I believe the strategy has been too aggressive and done too fast. If the new businesses have the same operating margins as Lakeland (below 5%), then the multiples paid for them are high (over 15x EBIT). Further, three of the four acquisitions have been made without a permanent CEO, given that the previous CEO resigned in October 2023, and a replacement has not yet been found.

The offering and dilution risk

Last Friday, Lakeland filed a shelf offering for $100 million. The offering is a prerequisite for Lakeland issuing stock, preferred shares, warrants, or convertible debt. It gives Lakeland the right, but not the obligation, to issue these securities for a period of up to three years.

The above means that Lakeland’s management or Board might consider offering equity-related securities to raise cash. As mentioned, these can be common stock, preferred stock, warrants, or convertible debt. The company can issue any amount up to a cumulative $100 million (for example, $10 million in common stock and $10 million in convertible debt). It can also leave the shelf unused.

After filing the shelf, the company does not need to disclose an equity offering with anticipation. It can, for example, approach a private investor, close a deal below the current market price, and only then disclose the information to the market.

Further, $100 million is currently equivalent to 60% of the company’s market cap. Considering that large deals require a significant discount to the current share price, a deal of that size could reduce the company’s current shareholders to less than 50% of the post-deal capital stack.

There are a few reasons why the company might have filed the shelf. One is that the Board considers it a last-resort resource if the company needs quick liquidity (given that it has exhausted its cash reserves). That is, the shelf is established just in case. Another possibility is that the company is excited to make more acquisitions and plans to finance that with equity or convertible debt instead of free cash flow or normal debt.

In any case, the risk of dilution for investors has increased substantially.

The valuation is still high

In my previous article, I assumed the company’s target revenues from its acquisitions would materialize in FY25. The multiple was high compared to the then prevalent market cap, considering the low cash risk and the maturity of the company’s markets. The valuation makes even less sense now that the stock price is higher and the dilution risk has also increased.

If the acquisitions work as expected, the company will add $50 million in revenues from Pacific, Jolly, and LHD Fire, bringing the total revenue figure to $175 million. Assuming the company can obtain operating margins of 5%, it could generate about $9 million in operating income in FY25 or FY26. Without debt and assuming a 25% effective tax rate, that income will become about $6.75 million in net income.

Against these profits, Lakeland Industries, Inc. stock trades at a market cap of nearly $170 million or a P/E ratio (of expected FY25 earnings) of 25x. This is a high multiple that requires significant post-acquisition growth to be justified. For example, assuming that in the next 5 years the multiple moves to 12x, the company needs to grow earnings by 16% compounded (from $6.75 million to close to $15 million) only to generate a return of 10%. In any other scenario, the stock generates a poor return.

For that reason, I continue to believe LAKE is not an opportunity and a Hold at these prices.

Read the full article here

Leave a Reply