As we come up on Atlassian Corporation’s (NASDAQ:TEAM) Q4 and Annual Report 2024 on August 1, 2024, I think an update to my February 10 thesis is in order. At the time, I recommended a Sell rating based on the fact that the company had no operating leverage and that efficiency metrics such as ROE, ROTC, and ROA were all struggling to get above breakeven. What added fuel to the bearish fire was that the company was continually guiding for weak cloud revenues. Q3 2024 results were reported since then, and now that we’re on the verge of looking at full-year and Q4 results, we should take a look at how these metrics have played out and are expected to play out when earnings are announced next month.

On the one hand, key profitability metrics have been improving quarter over quarter; on the other, we’d need to see some stability and sustainability in those improvements to prompt a rating upgrade to a Hold. I’m still not ruling out a Buy call even further down the road if I feel the valuation is justified.

Revenue and Profitability Trends Since Q2 2024

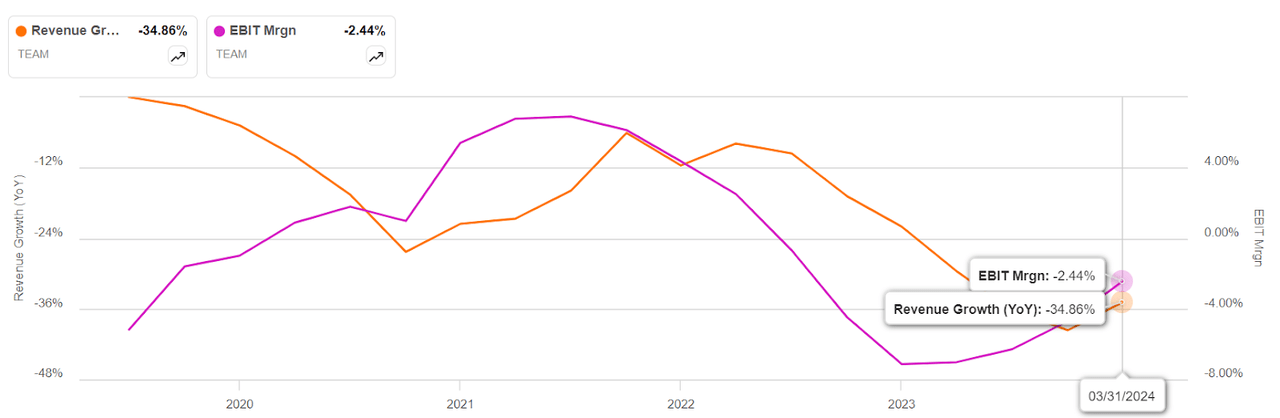

The one thing that was positive was total revenue growth, even when I wrote my bearish thesis. Revenues did weaken in Q3 on a YoY basis, but only marginally. TEAM is still growing its quarterly revenues near the 30% level year-over-year. The problem, as we saw in my earlier article, is one of operating leverage, and that trend repeated itself in Q3, as I suspect it will in Q4 as well. Although the numbers seem to be improving quarter over quarter, I’d like to see a lot more consistency. That’s the only way things can improve in the long term.

SA

That being said, there’s certainly a positive element that came out of that: Q3 showed a positive GAAP operating income, as opposed to a 1.9% operating loss in Q1 and a more worrisome 4.6% loss in Q2, which translated to a net income margin of just over 1%. Not quite what bullish investors might have expected, and I think it was more of a temporary suppression of both SG&A and R&D spending, both of which TEAM cannot afford to ease up on to any significant degree. It’s going to hit revenue growth badly if they do. Still, Q3 saw a little wiggle room there – just about enough to allow the company to post positive operating and net incomes, with a GAAP EPS of $0.05.

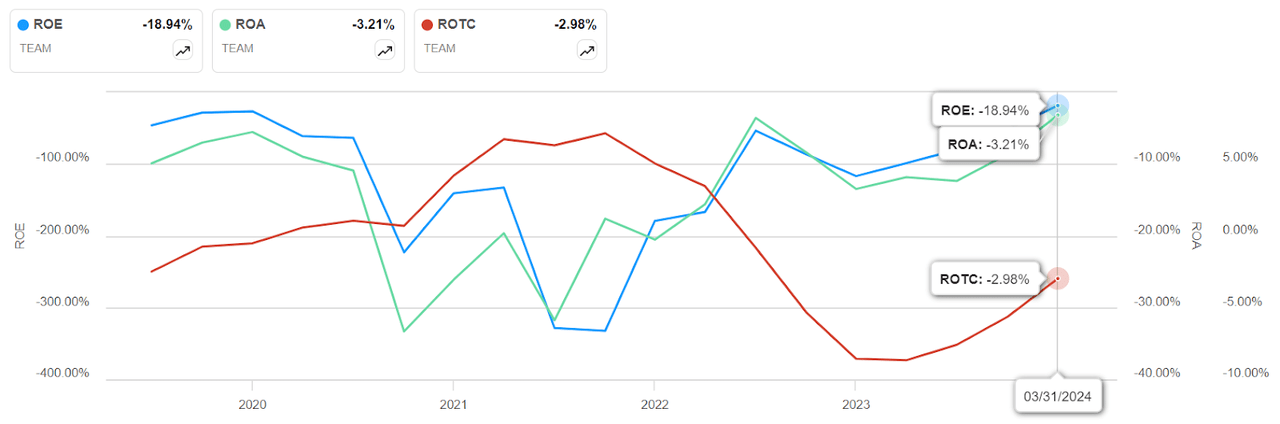

As a result of Q3’s somewhat positive results and the fact that its profitability metrics have incrementally improved over the past few quarters, TEAM’s efficiency metrics have also improved in the TTM. ROE, ROTC, and ROA, which were at -52%, -5.6%, and -8.6%, respectively at the end of 2023 are now significantly closer to zero, at -19%, -3%, and -3.2%, respectively, on a TTM basis as I write this. I suspect there will be a little more financial engineering in the works to get these numbers up to breakeven at the end of Q4.

SA

During that time, however, the stock has continued to slide, declining nearly 20% since the beginning of February, right after Q2 earnings were announced. Q3 saw a more precipitous drop, but it now looks like investor sentiment is rotating into positive territory, with the stock up 12% in the last month.

Reassessing (Or Reiterating?) My Bearish Thesis

Does that mean my bearish thesis is now invalid? I’m not sure that it is. When I look at valuation changes between now and then, I still see signs of weakness. This business is not currently worth 63x forward GAAP earnings, even if it’s down from the +80x level that it was nearly two quarters ago. In my February article, I said that if “you’re willing to continue holding on to a risky investment, you may just be stuck with it until the company turns profitable on a consistent basis and starts showing positive returns on the assets it possesses, the capital it deploys, and the equity that’s reinvested into the business. And that could be a very long time.”

Why do I still think so? My biggest reason is that the improvements in profitability can only be considered sustainable if they show positive trends over several quarters. While I’ll admit that the company might be on the verge of turning consistently GAAP-profitable at the operating and net levels, the current high interest rate environment might make it hard for subscriptions to keep growing at the current pace. Essentially, that’s what’s driving the borderline profitability at this point, and with the company guiding for a 7% operating loss margin in Q4, that keeps the timeline to consistent profitability fairly far away.

I’ll say it once again – revenue growth has not been a problem over the past few quarters. The challenge has always been about profitability, and the need to increasingly and disproportionately spend more to make more. As I said in my previous article, cost-cutting and operational efficiencies aren’t the answer to this larger problem.

This is not to say that I don’t understand the challenges, of course. Competition is tough in this space, and although many of Atlassian’s products dominate their segments, growth is expensive. However, although I’ll grant that Q4 guidance was a little stronger than what we saw through the first half of the year, a 32% cloud revenue growth rate and 40% to 42% data center revenue growth range might not solve that bigger problem. I think we’ll continue to see high SG&A as well as R&D spends in the range of 30s and high 40s as a percentage of revenues.

What are the Upside Risks to a Bearish TEAM Thesis?

The obvious risk is that Q4 will show improved profitability and FY25 will continue that upward trend. If that happens, valuation levels are naturally going to come down closer to realistic levels. At that point, I’d be more than happy to rate this a Hold or even a Buy. Even a couple of more quarters showing improved profitability and continued revenue growth in the 30% range would be positive enough to signal a Hold. I believe management guided quite conservatively for Q4, projecting a 27% growth rate at the midpoint of $1.120 billion and $1.135 billion, over $885.6 million in the year-ago period, and I suspect that stems from a further downsizing of SG&A and R&D spending. Nevertheless, if that target is achieved, I think we’ll see one more quarter of GAAP profitability. It might not be enough to break my thesis down completely, but I’ll concede that my bearish views are starting to show signs of deterioration.

One question that investors will have at the tops of their minds is probably about the CEO transition. After 23+ years co-helming Atlassian with co-founder and co-CEO Mike Cannon-Brookes, co-CEO Scott Farquhar will relinquish his current role at the end of next month. Will this impact the business in any negative or positive way? My opinion is that it won’t either way, because this is very likely a well-thought-out plan that will place the reins firmly in Cannon-Brookes’ hands but still see Farquhar play an active advisory role, if not an executive one.

Some Closing Thoughts

Finally, I’d like to clarify that my bearish stance on the stock does not mean I’m bearish on the company or its business model. Atlassian has a long growth runway ahead of it, and I believe that even though it will take several quarters to become sustainably profitable, the stock got ahead of itself far too early in the game.

And this is a problem I see with a lot of fast-growing tech companies, including, dare I say, Nvidia (NVDA), on which I’m still very much bullish. That bullishness is contingent on several things, including the way I see the timeline in the AI GPU landscape gradually evolving to allow more players to take up strong positions and significant market share, especially Advanced Micro Devices (AMD), a company I wrote about just last week.

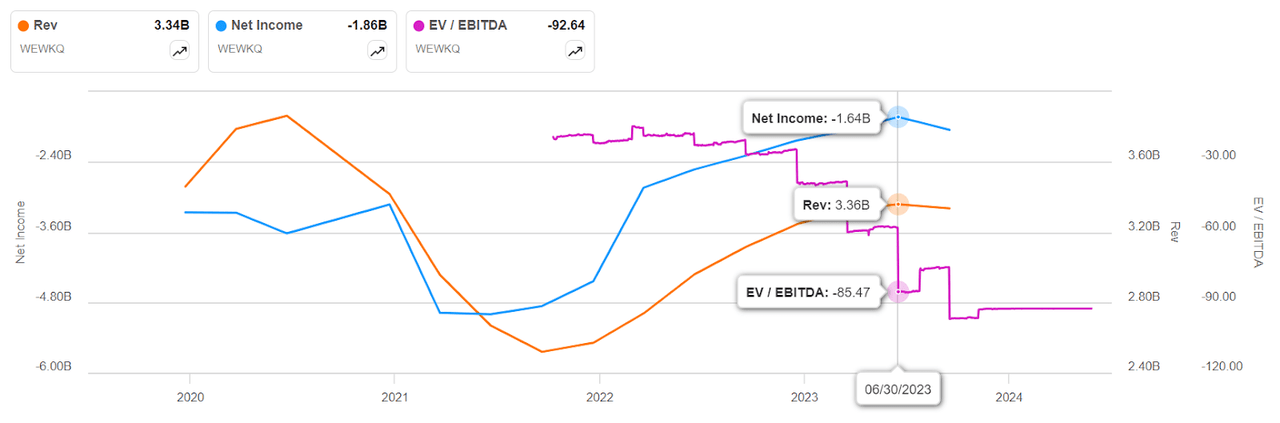

Many other fast-growers, unfortunately, have seen their valuations skyrocket on market optimism, only to come crashing down because they were valued too highly to begin with. Just look at what happened with WeWork (OTC:WEWKQ). Its revenues were in the billions of dollars a year, but because it couldn’t become sustainably profitable, it spiraled quickly into bankruptcy. Of course, its topline growth wasn’t as strong as what we have with TEAM, and that merely highlights the importance of continuing to grow revenues alongside a focused effort to become consistently profitable in the long term.

SA

I don’t see such a problem with TEAM by any stretch of the imagination, so I’m sure I’ll eventually become bullish on the stock. Not right now, though, and not at the current valuation without the promise of consistent profits being generated quarter after quarter. As far as I can see, TEAM is doing it right, growing its revenues by spending more, but well-aware of the need to achieve the right balance of growth, profitability, returns-based efficiency, and valuation to become a clear Buy for most investors. While it’s still a Sell at this point in time, I do see myself upgrading this to a Hold over the next couple of quarters. I’m just waiting for the right numbers to be reported and the right level of metrics that I expect to be confident with that call.

Read the full article here

Leave a Reply