Investment Outlook

Yalla Group Limited (NYSE:YALA) provides a social media networking platform for Middle Eastern users to connect online.

I previously wrote about Yalla in August 2023 with a Buy outlook due to new game launches and growing revenue and profits.

Revenue growth has since slowed and is expected to slow even further through the end of 2024 amid macroeconomic headwinds.

My outlook on YALA’s near-term prospects is now Neutral (Hold).

Yalla’s Market And Approach

Yalla’s market is the greater Middle East and Northern Africa [MENA] social media market, and is an estimated $41 billion in size in 2024, according to a market research report by Mordor Intelligence.

The market is expected to reach $59 billion in annual turnover by 2029.

If achieved, this growth would represent a CAGR of 9.4% from 2023 to 2029.

This robust growth rate is being fuelled by a transformation in attitudes among the MENA region’s younger demographic cohorts.

However, piracy and lax copyright violation enforcement will be a drag on the industry’s growth potential, as these features drain resources from new investments in the industry.

Dubai, UAE-based Yalla’s primary offerings include Voice Chat, Social Network, Entertainment, Online Games, and Gift Exchanges.

Major competitive or other industry participants include the following:

-

Meta Platforms.

-

TikTok.

-

X.

-

Snapchat.

-

LinkedIn.

-

Other social media-enabled services.

Recent Financial Trends

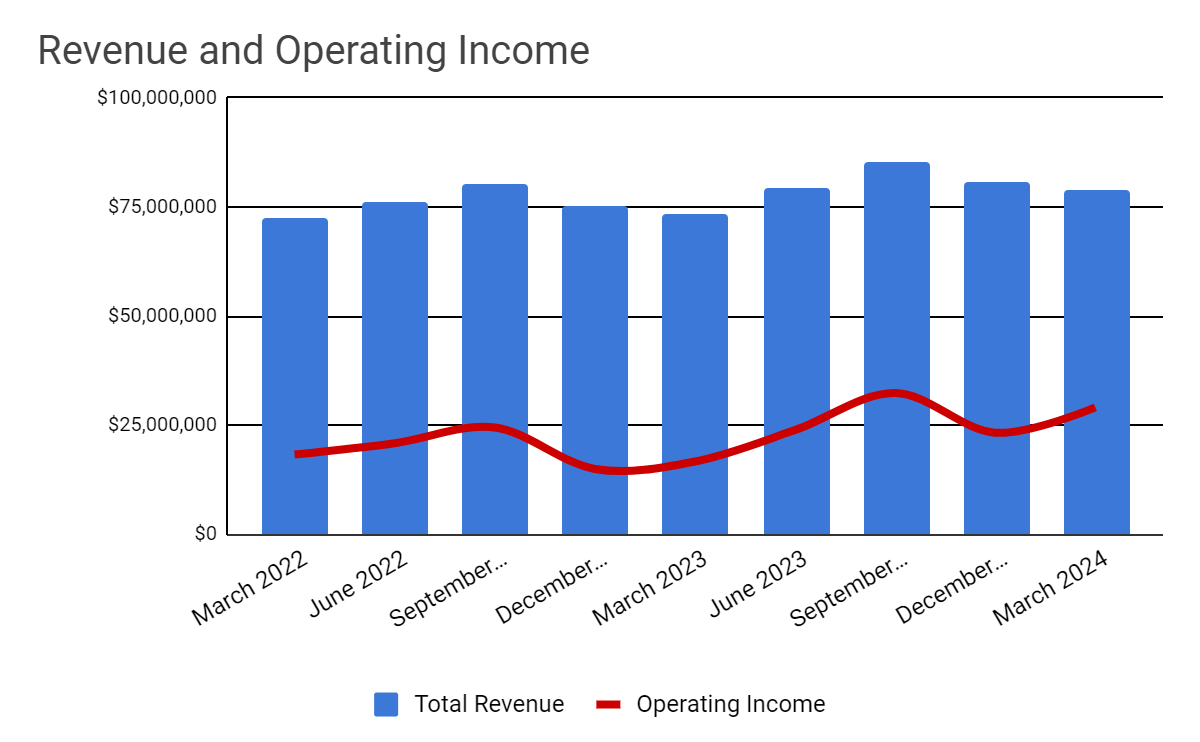

Total revenue by quarter (columns) has risen more slowly in recent quarters due to a greater focus on “high-quality growth”; Operating income by quarter (red line) has remained higher because of management’s continuing focus on improving operating efficiencies.

Seeking Alpha

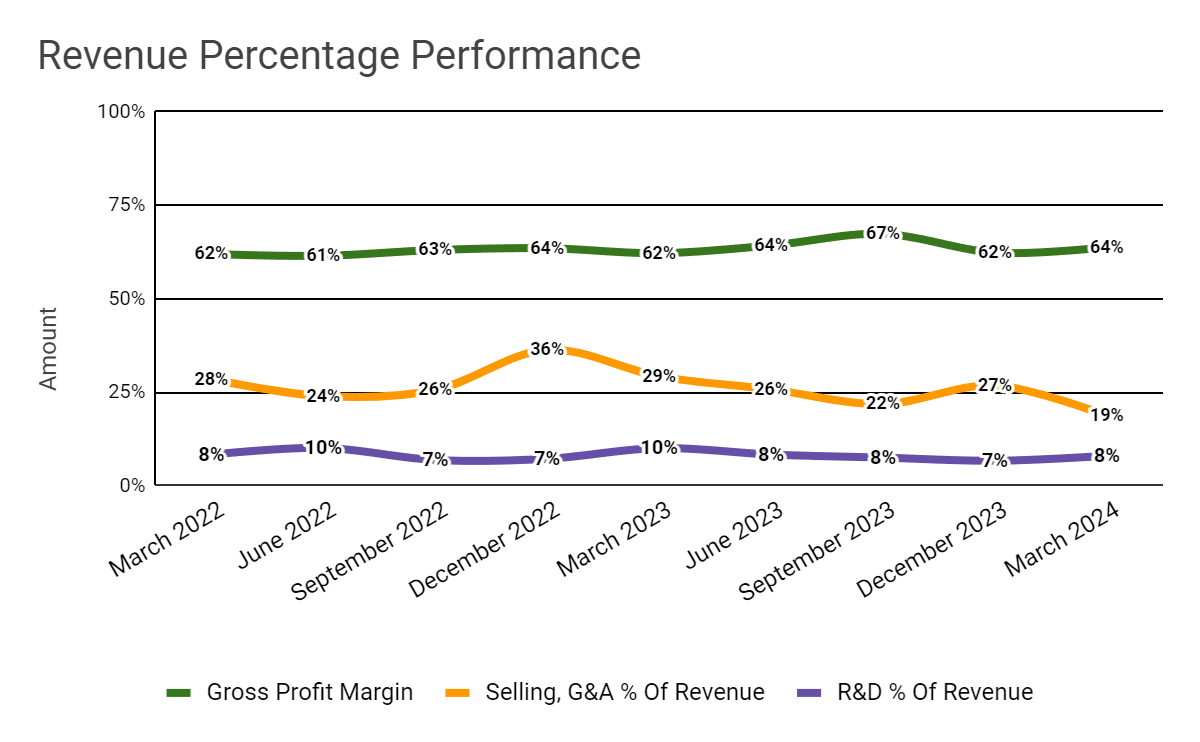

Gross profit margin by quarter (green line) moved lower despite higher commissions paid to third-party payment platforms; Selling and G&A expenses as a percentage of total revenue by quarter (orange line) have dropped due to greater discipline in its advertising approach and to reduced share-based compensation to employees; R&D expenses as a function of revenue (purple line) have dropped from lower performance-based incentive payments.

Seeking Alpha

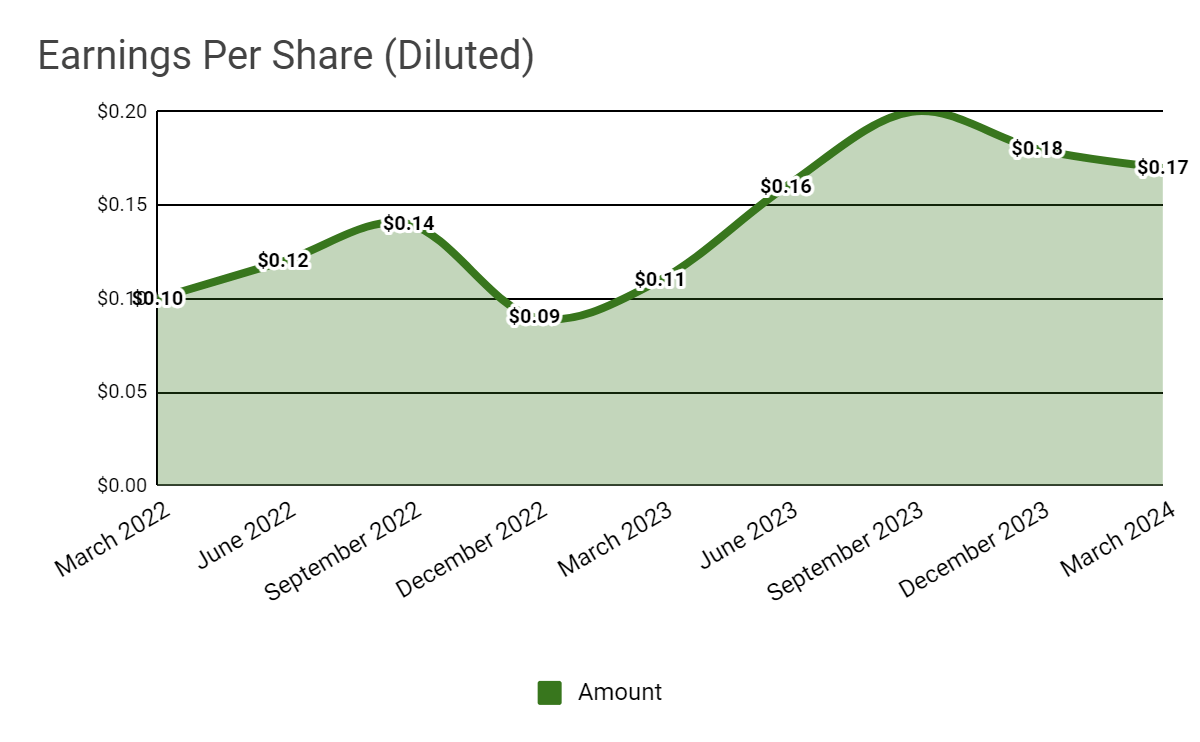

Earnings per share (Diluted) have trended higher on improving cost controls and moderate growth in top-line revenue.

Seeking Alpha

(All data in the above charts is GAAP).

For balance sheet results, YALA ended the quarter with $482.3 million in cash, equivalents, and short-term investments with no debt, so the company has a strong balance sheet.

I’ve included a major financial and operating metrics table below for reference:

|

Metric |

Amount |

|

EV/Sales (“FWD”) |

0.8 |

|

EV/EBITDA (“FWD”) |

2.0 |

|

Price/Sales (“TTM”) |

2.3 |

|

Revenue Growth (“YoY”) |

6.3% |

|

Net Income Margin |

39.6% |

|

EBITDA Margin |

34.3% |

|

Market Capitalization |

$733,970,000 |

|

Enterprise Value |

$247,760,000 |

|

Operating Cash Flow |

$139,320,000 |

|

Earnings Per Share (Fully Diluted) |

$0.71 |

|

2024 FWD EPS Estimate |

$0.71 |

|

Rev. Growth Estimate (“FWD”) |

1.6% |

|

Seeking Alpha Quant Score |

Hold – 3.01 |

(Source: Seeking Alpha).

While Yalla isn’t an enterprise SaaS company, tracking its Rule of 40 performance is helpful as it shows improving operating margin offsetting a reduction in revenue growth:

|

Rule of 40 Performance (Unadjusted) |

Q2 2023 |

Q1 2024 |

|

Revenue Growth % |

9.7% |

6.3% |

|

Operating Margin |

25.7% |

37.0% |

|

Total |

35.4% |

43.3% |

(Source: Seeking Alpha).

Why I’m Neutral On Yalla Group

Yalla is producing slowing top-line revenue growth even as it has been doing a better job in generating earnings.

This indicates the company is being managed more for profitability rather than “growth at all costs.”

An issue is that forward revenue growth is now an estimated 1.6% based on consensus estimates.

With most discretionary operating expenses likely already removed from the company’s cost structure, my question is where the catalyst comes from for the stock to move higher, other than on multiple expansion.

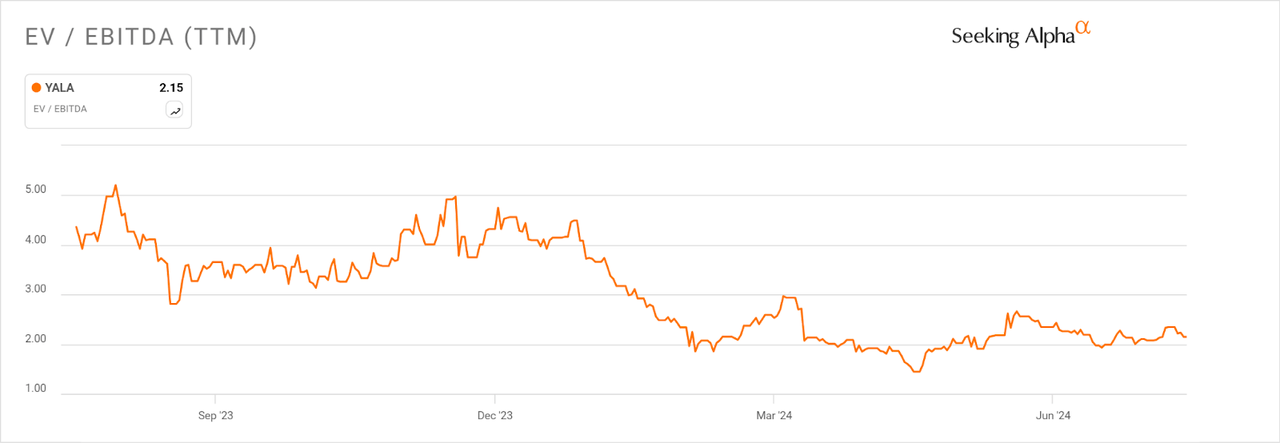

The Seeking Alpha chart below shows the EV/EBITDA multiple history for the past year for YALA:

Seeking Alpha

The chart indicates significant multiple compression in the past twelve months as revenue growth has slowed and earnings have improved, so perhaps a market re-rating can occur in the future if revenue begins to grow again.

Over the past four quarters, Yalla has faced challenges, including the introduction of a tax in the UAE and stronger competition from global competitors in the streaming sector, such as TikTok.

However, a potential for future growth has been the group’s foray into mid-core and hardcore gaming services through its Merge Kingdom and Age of Legends titles.

Management says it remains committed to investing in new game development and in seeking partnerships with global gaming studios to expand its portfolio.

My sense is that Yalla is focused on adding games via partnerships, as this requires far less capital expenditure and risk-taking associated with direct game development.

The ability of the company to integrate its voice chat engine into game offerings has also provided a unique approach that seems to resonate with certain localities of users.

But, while it is laudable that Yalla is producing increased profits, my primary concern is around its growth prospects going forward.

As global GDP growth continues to slow following a post-pandemic growth spurt and consensus estimates of only 1.6% forward revenue growth for Yalla, the near-term outlook is not exactly robust.

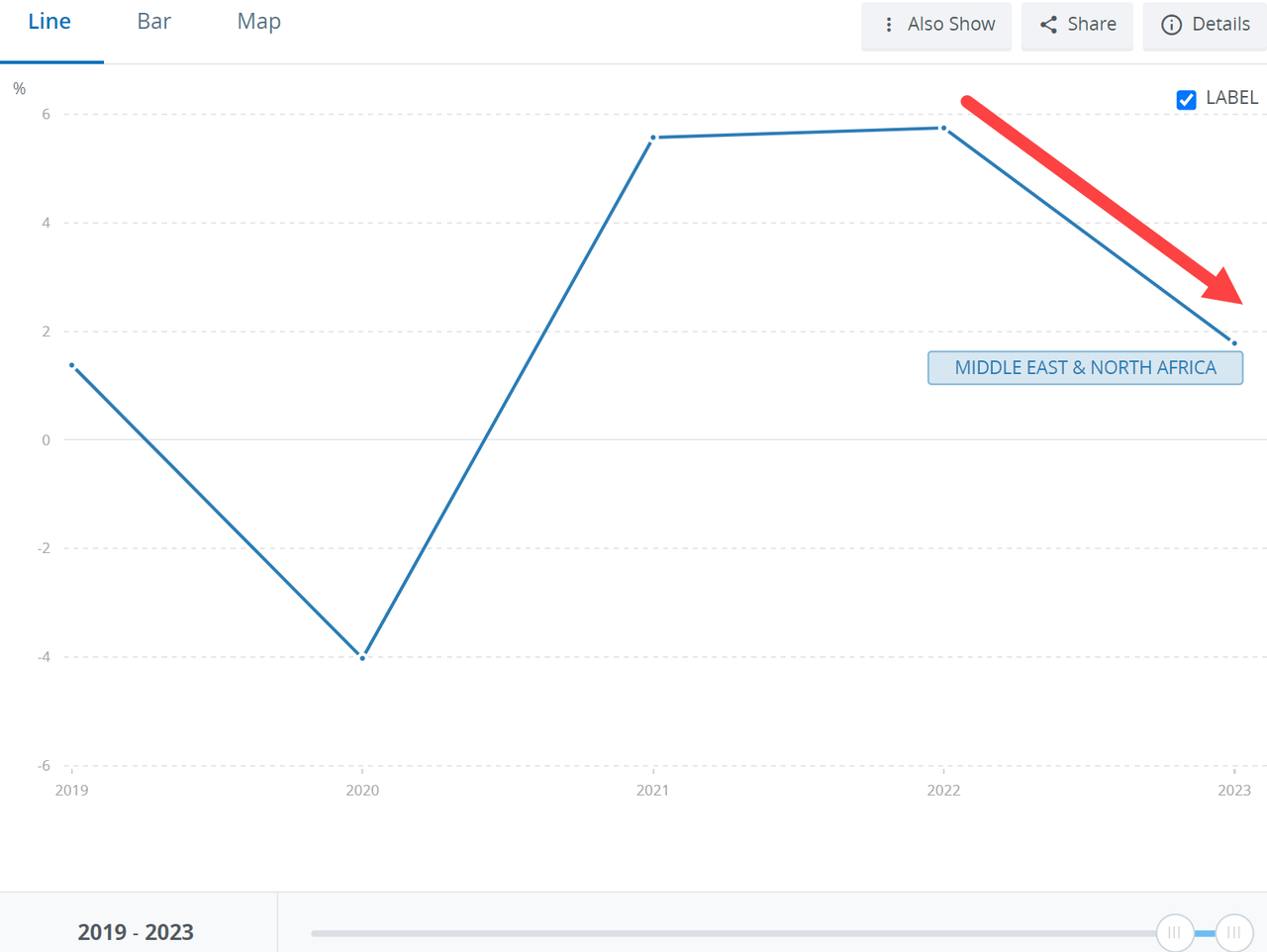

The chart below shows the MENA region’s GDP growth dropping sharply to only 1.7% during the calendar year 2023:

World Bank Group

Given slow revenue growth prospects for Yalla Group Limited in the remainder of 2024 and macroeconomic headwinds, my outlook on YALA is Neutral (Hold).

Read the full article here

Leave a Reply