Shares of Roche (OTCQX:RHHBY) rose last week to levels last seen in late 2022 after the company reported positive phase 1 results of CT-996, its oral GLP-1 agonist for the treatment of obesity. The usual caveats apply to this dataset – it is a small phase 1 trial with only four weeks of treatment and limited other data shared by Roche, and we are comparing the results across different trials that may have different baseline characteristics and design, but even so, I believe these results raise the efficacy bar for oral GLP-1 agonists as CT-996 has achieved the weight reduction in four weeks that leading oral weight loss drugs managed to do in 12 weeks.

These positive results come on top of the previous positive results of the injectable GLP-1/GIP agonist CT-388 that I covered in my May article, and make Roche an even more serious contender in the obesity market. Of course, many obstacles remain and I would expect the obesity market to continue to evolve rapidly, but these are the two critical steps for Roche as an injectable GLP-1/GIP agonist and an oral GLP-1 agonist could become foundational mechanisms for future weight loss regimens – for induction, maintenance, and combinations with other mechanisms that are emerging in the clinic.

Roche is raising the efficacy bar for oral GLP-1 agonists with CT-996

CT-996 is the second asset Roche gained through the $2.7 billion acquisition of Carmot in late 2023. The first asset is the subcutaneously administered GLP-1/GIP agonist CT-388, which generated positive phase 1b results in May, and which were Roche’s official clinical entry into the rapidly growing obesity market.

CT-996 is an orally available GLP-1 agonist, in development for the treatment of obesity and type 2 diabetes. The ongoing phase 1 trial consists of single- and multiple-ascending dose cohorts designed to evaluate the safety, tolerability, pharmacokinetics and pharmacodynamics of CT-996 in “otherwise-healthy adults who are overweight or obese, with or without type 2 diabetes.” Part 1 tested a single dose of CT-996 in 40 subjects and was successfully completed, and the part 2 tested CT-996 in 25 participants with obesity without type 2 diabetes, and this is the part from which the results were released last week. The primary endpoint of the study is safety and tolerability, as is usual for phase 1 trials, and secondary endpoints include efficacy measurements such as weight loss.

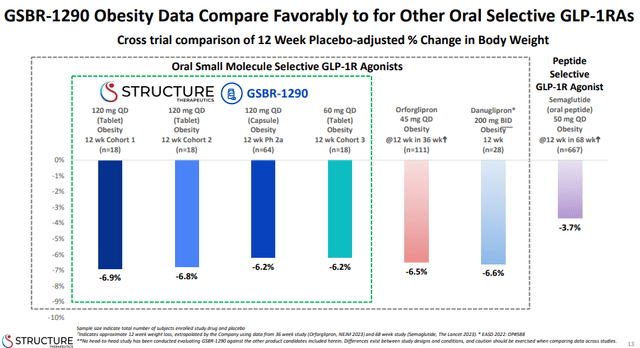

CT-996 demonstrated a 7.3% reduction in weight in the part 2 of the phase 1 trial at day 29 versus a 1.2% weight reduction in the placebo group for a placebo-adjusted reduction of 6.1%. These are impressive results in such a short period of time and compare well even against injectable incretins, and look favorable even when they are compared to 12-week data of oral GLP-1 candidates that are ahead of CT-996. The slide from Structure Therapeutics’ (GPCR) recent data presentation shows the 12-week efficacy bar set by GSBR-1290.

Structure Therapeutics investor presentation

CT-996’s placebo-adjusted weight loss of 6.1% after four weeks of treatment is nearly at the level of the 12-week efficacy of all of the competitors listed in the presentation slide above. And it is slightly better on an absolute basis than GSBR-1290, since placebo performed better in CT-996’s phase 1 trial.

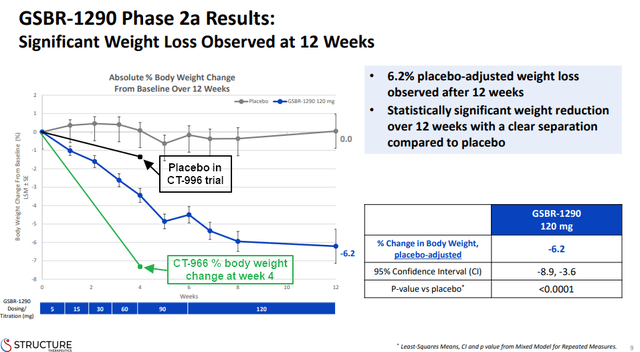

However, we cannot be sure that the impressive weight loss of CT-996 will continue beyond the first four weeks. In the next presentation slide, you can see weight loss progress of GSBR-1290 and how it hit a plateau after 8 weeks of treatment. I also drew the 4-week weight loss data of CT-996 and the data from its placebo group for better reference of the difference to GSBR-1290. Even so, I believe it is reasonable to assume that treatment beyond day 29 with CT-996 would result in further weight loss.

Structure Therapeutics investor presentation, author’s annotations

The real question now is what safety and tolerability really look like. Roche said that “CT-996 was well-tolerated, with mostly mild or moderate gastrointestinal-related adverse events, consistent with the safety profile of the incretin drug class,” and that there were no discontinuations related to the study drug. This does not tell us a lot and I believe safety and tolerability are critical for the long-term success of oral weight loss drugs given their potential role as maintenance therapy following the initial induction weight loss phase with more powerful injectable incretin drugs such as tirzepatide (Mounjaro/Zepbound), semaglutide (Ozempic/Wegovy), and injectable candidates such as Roche’s own CT-388.

Given the unknown safety and tolerability profile of both CT-388 and CT-996, I cannot have a bullish view with high conviction on Roche’s obesity pipeline, but do believe that the topline efficacy data are important and significant positive steps in the right direction. I also believe that there is still not a lot of value assigned to Roche’s obesity pipeline, which make future obesity-related readouts less risky for long-term investors.

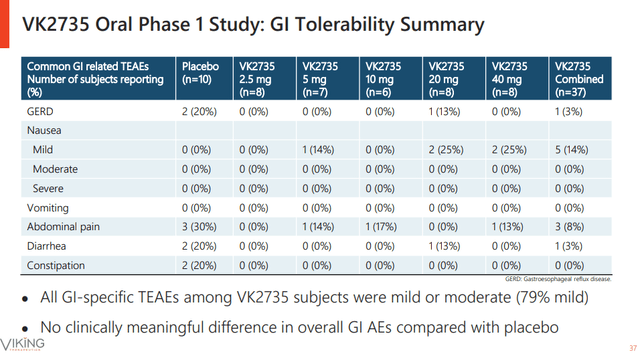

Regarding safety and tolerability, I am looking forward to the additional data from the phase 1 trial of Viking Therapeutics’ (VKTX) orally administered VK2735. The weight-loss data Viking reported look decent on an absolute basis at the highest dose level, but the placebo-adjusted weight loss of CT-388 is nearly twice as good (6.1% versus 3.3% for the highest dose of VK2735).

The reason I am mentioning VK2735 is the safety and tolerability data, which look very good. In the phase 1 trial of VK2735, there were only two side effects with double-digit incidence at the highest dose (mild nausea in 25% of subjects and abdominal pain in 13% of subjects, although these only represent two and one patient, respectively, given the small size of the study), and very low combined rates of adverse events that are not too different from placebo.

Viking Therapeutics investor presentation

Viking is also testing higher doses of VK2735 to see whether it can squeeze out additional efficacy without comprising safety and tolerability.

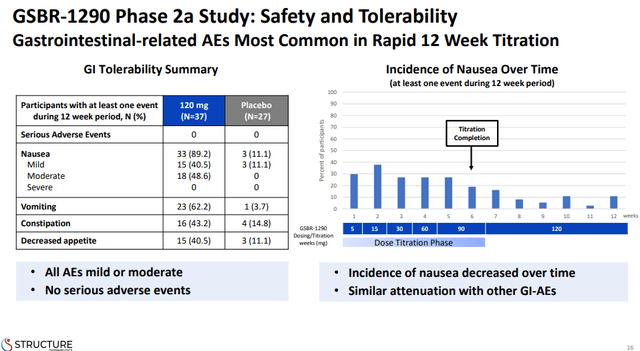

However, I should note that VK2735 is a GLP-1/GIP agonist and it is possible, if not likely, that the GIP agonism is attenuating the gastrointestinal side effects of GLP-1 agonism, and these safety and tolerability data compare very well to the GLP-1 agonist class where rates of gastrointestinal side effects are much higher. For example, the GSBR-1290 phase 1 data with an identical sample (37 treated subjects) shows significantly higher rates of nausea (89% for the 120mg dose), vomiting (62%), and constipation (43%), compared to placebo and across trials to VK-2735.

Structure Therapeutics investor presentation

Combination approaches are most likely the way to go, going forward.

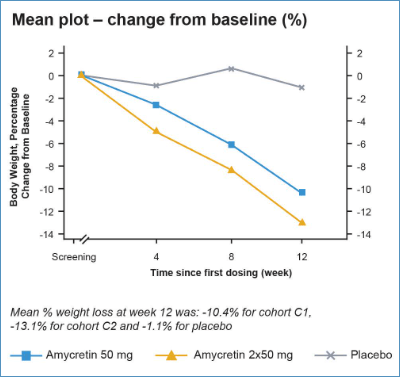

Another combination approach is being tested by Novo Nordisk (NVO) – oral amycretin, a combination of amylin and GLP-1 receptor co-agonist. The efficacy data look promising with the co-agonist approach generating 13.1% weight reduction in 12 weeks and 12% placebo-adjusted. This is also well above the efficacy of GLP-1 agonist as monotherapy which is in the 6-7% range at week 12, but interestingly, not better than Roche’s oral GLP-1 agonist CT-996 at week 4.

EASD abstract

We have yet to see the full safety and tolerability data from Amycretin’s trial, but the EASD abstract mentions tolerability problems that Novo believes can be solved by introducing a gentler titration regimen.

It is really fascinating to see this field develop so rapidly and, more recently, with lower level of predictability as other big pharma companies and some smaller biotech companies are finally coming up with what look like viable product candidates that can compete with the likes of Novo Nordisk and Eli Lilly (LLY).

More data from the subcutaneous CT-388 program expected in September

With the key topline efficacy readouts from CT-388 and CT-996 behind us, the investor focus, as far as Roche’s obesity pipeline is concerned, will turn to the safety and tolerability data from the two early-stage trials. Roche expects to present the phase 1b results of the subcutaneously administered CT-388 in early September at the EASD conference, and I assume the presentation of CT-996 data is probably 2-3 months behind.

Conclusion

CT-996 phase 1 data raise the bar for the oral GLP-1 agonist class and put another stake in the ground for Roche in the increasingly competitive obesity market. Efficacy is very important, but it is only one side of the equation for a successful drug, and we need to see good safety and tolerability in the following months. We do know from the company’s press releases that safety and tolerability are similar to the overall incretin class, but detailed data should put the concerns to rest and show the complete picture and potential profile of CT-388 and CT-996.

I continue to see Roche as well-positioned to create value in the long run and consider the obesity pipeline as a largely unaccounted for growth driver in analyst models.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply