In the continual search for alpha in international equity markets, more and more investors are turning to factor-based strategies. The iShares MSCI Intl Momentum Factor ETF (NYSEARCA:IMTM) aims to provide access to the momentum factor through investment in internationally developed large- and mid-cap stocks with relatively higher price momentum than the market as a whole. The underlying strategy relies on the seminal academic work of Narasimhan Jegadeesh and Sheridan Titman showing that stocks with persistently strong past performance tend to exhibit persistently strong future performance – at least in the short to intermediate term.

IMTM aims to take advantage of this momentum effect to beat market cap-weighted indices while benefiting from geographic diversification offered by its exposure to foreign equities. The fund tracks the MSCI World ex USA Momentum Index, which measures the performance of developed large- and mid-capitalization equities exhibiting relatively higher momentum characteristics within the MSCI World ex USA Index. At a 0.3 percent expense ratio, IMTM offers a means to obtain exposure to the momentum factor in international equity markets at a relatively low cost – and requires only one fund to expose your portfolio to the momentum factor internationally.

A Look At The Holdings

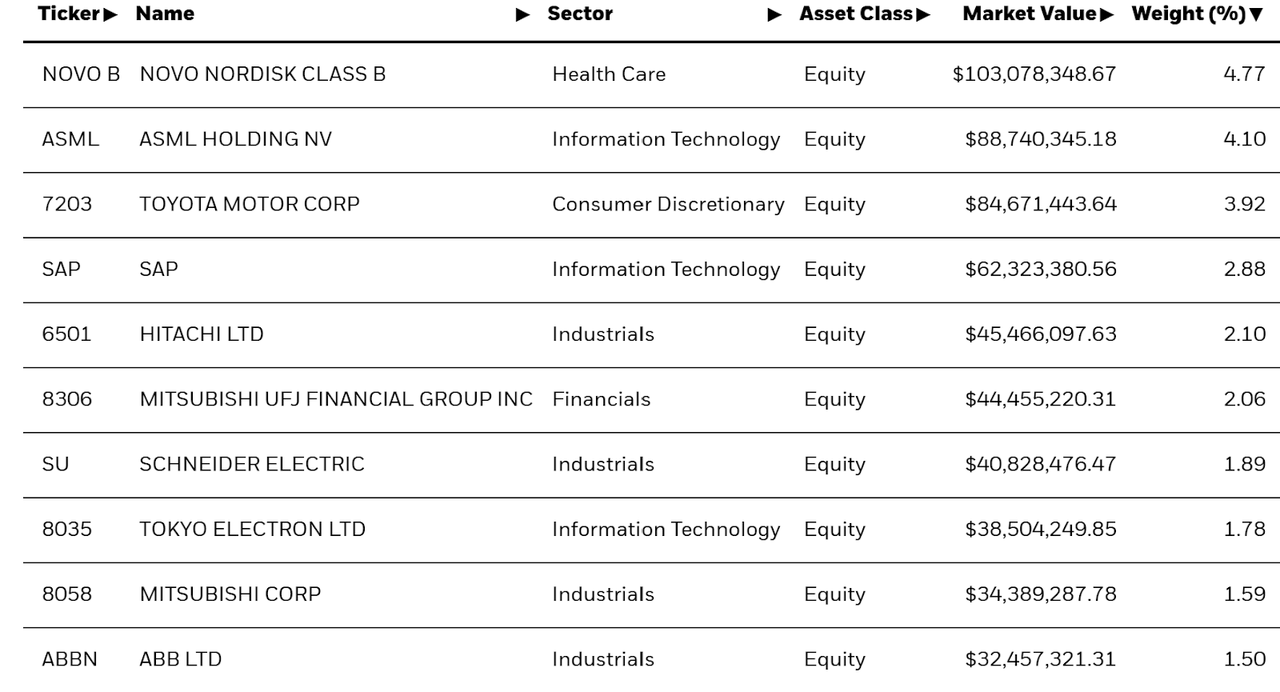

This is a fairly well-diversified fund with 301 holdings currently. No position makes up more than 4.77% of the portfolio.

iShares.com

What do some of these companies do outside of having high momentum? Novo Nordisk A/S (NVO) Class B is a Danish multinational pharmaceutical company that manufactures and sells diabetes care products. ASML Holding N.V. (ASML) is a Dutch company manufacturing some of the world’s most advanced lithography equipment for the semiconductor industry. Toyota Motor Corporation (TM) is a Japanese carmaker. SAP SE (SAP) is a German enterprise software giant. Hitachi, Ltd. (OTCPK:HTHIY) is the holding company for a Japanese conglomerate active in sectors that include information technology, energy, heavy industry, and infrastructure (such as construction machinery).

Sector Composition

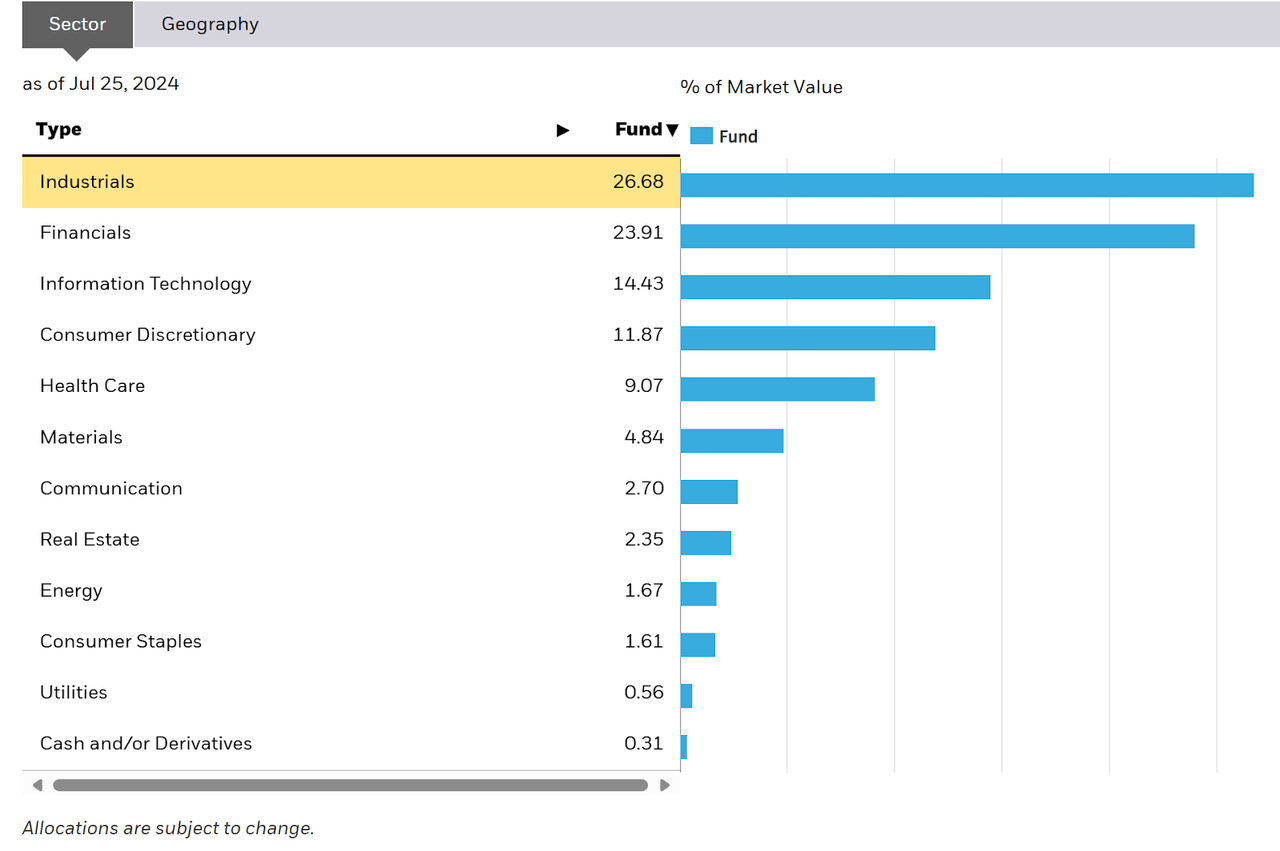

When looking at the sector exposure currently, it’s clear that the momentum factor has favored Industrials, which is the largest allocation. Financials come in 2nd, followed by Tech in 3rd. I like the lowered Tech exposure and weightings in Industrials and Financials.

iShares.com

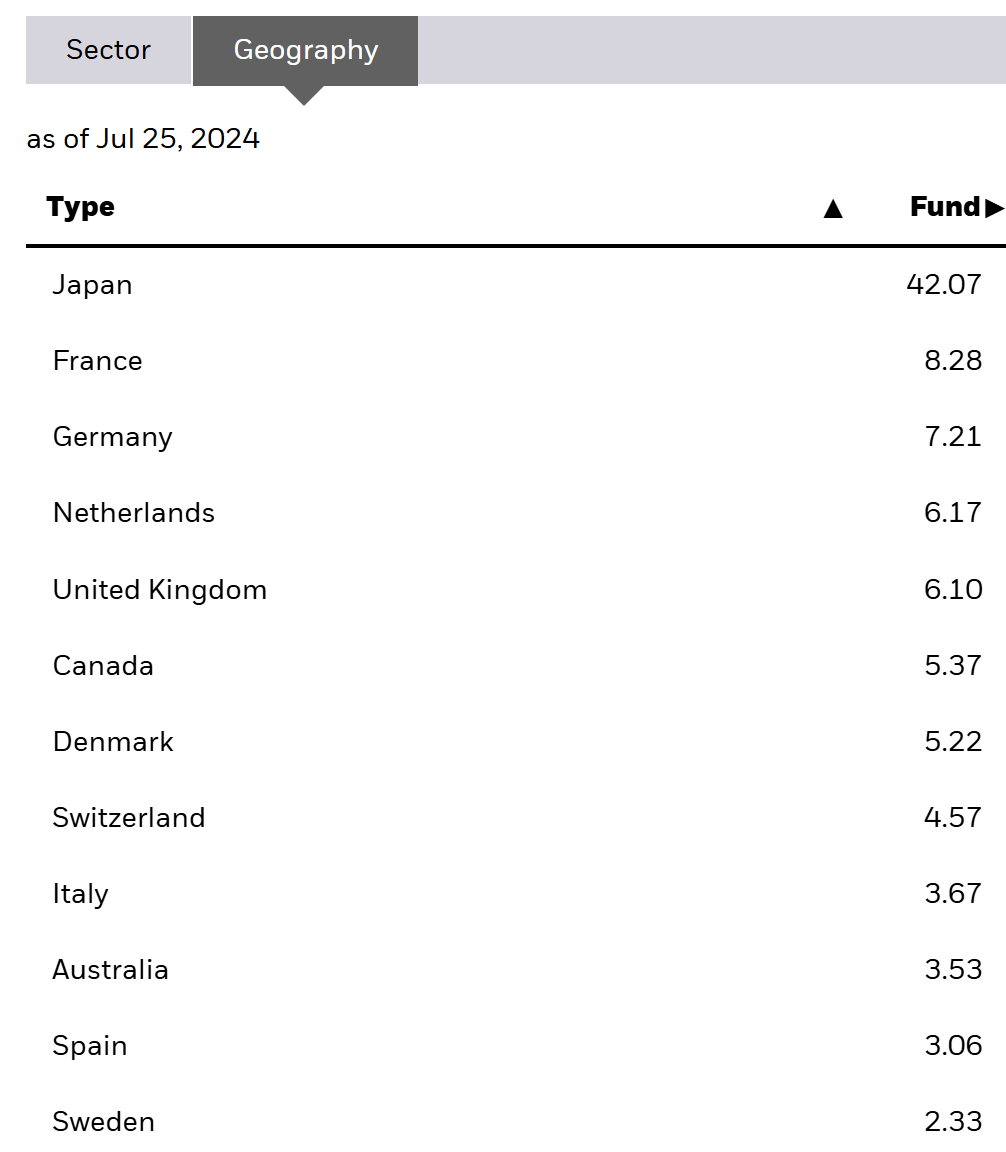

While I like the sector composition, I don’t like the geographic allocation (though I do understand why the weightings are as they are).

iShares.com

Japan makes up 42% of the fund. This is indeed where the momentum has been (largely because of the weaker Yen). France and Germany make up a distant 2nd and 3rd weighting. I worry about Japan’s equities and think that the large allocation here is a risk that negates the strong sector diversification.

Peer Comparison

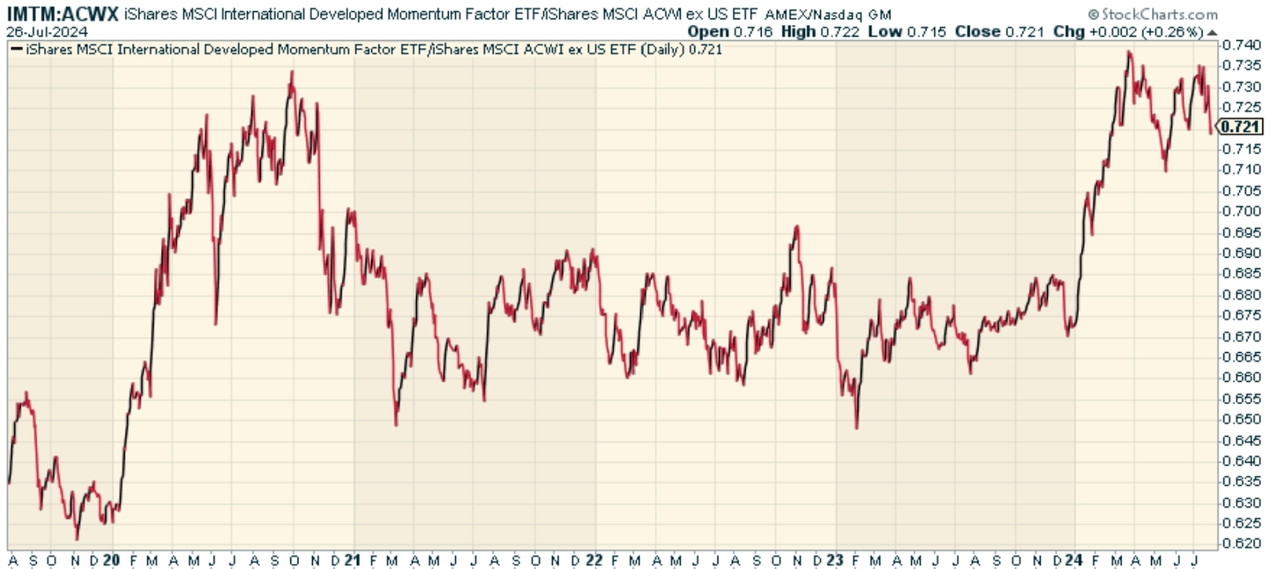

Since IMTM is about momentum, let’s compare it to the iShares MSCI ACWI ex U.S. ETF (ACWX). Same benchmark but without the momentum tilt. When we look at the price ratio of IMTM to ACWX, we find that momentum has indeed outperformed but in a very spotty way. It still appears that, for the most part, it’s still difficult to beat passive exposure.

StockCharts.com

Pros and Cons

On the positive side, momentum has actually tended to create alpha in the long run. By exploiting the tendency for stocks that have gone up in the past to continue going up in the future, momentum strategies can improve overall portfolio returns. Furthermore, IMTM’s international focus is also diversifying, sitting on a less risky portfolio than a standard developed-market portfolio that includes the US market.

But just as momentum can improve returns, it can also introduce risk and justify asset allocation limitations. Momentum factors do have the possibility of negative abnormal returns. During bad times, excess returns could vanish as momentum sell-offs accelerate on negative market shocks or when investor sentiment reverses abruptly. Moreover, momentum is known to exhibit high volatility. Because momentum stocks carry momentum, their reversals – when they occur – are likely to be fast, even precipitous.

Conclusion

The iShares MSCI Intl Momentum Factor ETF is an interesting fund in what it’s designed to focus on (which is all anyone ever talks about). Momentum in international markets, which have largely lagged the US, does appear to exist. And if you believe that international investing is about to make a comeback, this fund is worth considering. Just be careful of the large Japan exposure as of writing. That momentum looks particularly vulnerable now.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.

Read the full article here

Leave a Reply