Introduction

VICI Properties (NYSE:VICI) is a REIT that has disappointed many readers and investors here on Seeking Alpha. For the better part of two years the share price has spent a great deal of time in a range of $27 – $29.

However, there have been numerous buy articles praising the stock, and in my opinion, for good reason. The REIT owns iconic properties and is fundamentally sound while offering a great dividend yield currently.

And despite the recent share price appreciation as a result of anticipated lower interest rates in September, VICI remains one of the best REITs your money can currently buy.

In this article I discuss the company’s recent quarterly earnings, fundamentals, and why income investors are still getting this stock at a great price.

Previous Buy Rating

VICI Properties has long been one of my favorite REITs and I’ve published several articles covering them, with the most recent back in May.

I understand investors frustration with VICI, and that’s why I titled it: Upside May Require Patience, But Collect A 6% Yield While You Wait. Since, the stock is up over 8.73% and delivered a total return of double-digits in comparison to the S&P who is up nearly 4%.

Seeking Alpha

I discussed the REIT’s Q1 earnings that saw revenue, FFO, and AFFO all deliver solid growth from the prior year. Revenue and FFO both grew double-digits, up 10.3% and 13.41% respectively while AFFO also delivered solid growth, up 8.4%.

So, despite their lagging share price performance, VICI showed why they’re one of the best REITs your money can buy. Additionally, even with the recent share price appreciation, I think VICI is still a great bargain for long-term investors.

I discussed the recent loan the REIT provided to one of their tenants, The Venetian, to conduct extensive upgrades to their property. I also touched on their dividend that was well-covered with a payout ratio of 74%.

Latest Quarter

VICI recently reported their Q2 earnings and delivered another strong quarter with FFO of $0.71 and revenue of $957 million. They also managed to beat analysts’ estimates on both its top & bottom lines with estimates of $953.7 million and FFO of $0.66.

This was a much better report than anticipated as VICI was expected to disappoint on earnings due to capital commitments and pressures from the macro environment.

Instead, VICI did the opposite and delivered another strong quarter which they have been doing for the better part of six years since their IPO.

Some call the stock overhyped, an under performer, etc. But in my opinion, buying a stock at a cheap price that constantly delivers solid earnings, and pays you a dividend that’s well-covered is a no-brainer in my opinion.

If you have a short-term investment horizon, then VICI may not be the stock for you. However, if you have a long-term investment horizon, then you should be rejoicing for the chance to buy at current levels.

In the chart below, you can see the growth VICI saw year-over-year. That’s why I mentioned how they are one of the most fundamentally sound REITs today. Revenue grew 6.55% while FFO & AFFO grew 7.33% and 9.63% respectively. Adjusted EBITDA also grew impressively by 7.26% over the same period.

|

Q1’24 |

Q1’23 |

|

|

Revenue |

$957M |

$898.2M |

|

FFO |

$741.3M |

$690.7M |

|

AFFO |

$592.4M |

$540.4M |

|

Adjusted EBITDA |

$775.9M |

$723.4M |

VICI also committed capital to their partners. In the second quarter they provided $950 million to The Venetian and a few of their Great Wolf Lodge Resorts.

As previously mentioned, VICI provided a $750 million mezzanine loan to The Venetian during the first quarter. Some investors saw this as very Medical Properties Trust (MPW) like, providing capital to their struggling tenants.

And may view this as financial trouble from VICI’s tenants as a result of the high interest rate environment. However, VICI provided capital due to the popularity of The Sphere (SPHR), which continues to draw in visitors from all over the world.

And The Venetian is taking advantage of this by conducting extensive upgrades to its property. These investments are expected to be accretive and generate a blended yield of 7.9%.

In May, international visitation increased by double-digits year-over-year to 23%. And as a result of the popularity of the city, officials are anticipating adding a second airport as noted by VICI’s CFO during Q2 earnings. So, it’s safe to say Las Vegas will continue to grow and benefit from an increasing population and tourism for the foreseeable future.

Raised Guidance

As a result of VICI’s strong performance and growth, this allowed management to raise guidance for 2024. They now expect AFFO in a range of $2.24 – $2.26, up from $2.22 – $2.25 prior.

This represents a growth rate of 4.7% from the prior year. I also wouldn’t be shocked if the REIT raised guidance in the back half of the year as the macro environmental picture turns more favorable with interest rates expected to decline in September with a possible second cut in December.

Strong Liquidity Positions VICI For Growth

VICI has also been bolstering its liquidity this year. In Q1, the REIT sold shares and entered into swap agreements for its debt that was due this past May. This allowed them to defer until 2025, positioning them to capitalize on growth opportunities. VICI sold 4 million shares for net proceeds of $115 million.

They also had a total of $3.2 billion in liquidity and $347 million in cash & cash equivalents. They also have an accordion option allowing them to request an additional $1 billion in capital and had a net debt to EBITDA of 5.4x, within their target range of 5x – 5.5x.

This is in comparison to experiential REIT, EPR Properties’ (EPR) 5.2x and Gaming And Leisure Properties’ (GLPI) 4.5x. Management is also focused on lowering this in the coming quarters. VICI’s total debt stood at $17.1 billion with roughly $2 billion in debt due in 2025. 99% of this was also fixed-rate with a weighted-average interest rate of 4.36%.

Dividend

With AFFO of $0.57 this gives VICI a well-covered dividend with a payout ratio of 72.8%. Their FFO payout ratio is much lower at 58.4%. For comparison purposes, Gaming And Leisure Properties’ FFO payout ratio was 80.8% during their latest quarter.

Additionally, investors can expect a dividend increase this upcoming October if history repeats itself. I expect a dividend increase in the range of $0.43 – $0.435. Analysts’ expect a 3.6% increase to $0.43, giving VICI an annual dividend of $1.69.

Using their midpoint of guidance, this gives VICI a conservative payout ratio right at management’s target range of 75%. Their dividend yield is also still attractive despite their recent share price appreciation sitting at 5.2%.

Valuation

At the time of writing VICI has a forward P/AFFO multiple of 14x. Although their share price has appreciated over the past month, this is still slightly below the sector average of 14.91x.

This is also 6.25% below my price target of $34 that I had for the REIT back in May. Although I think the first rate cut is priced in already, if we get a December cut like some expect, I think VICI’s share price will see $33 – $35, or possibly higher by the end of the year.

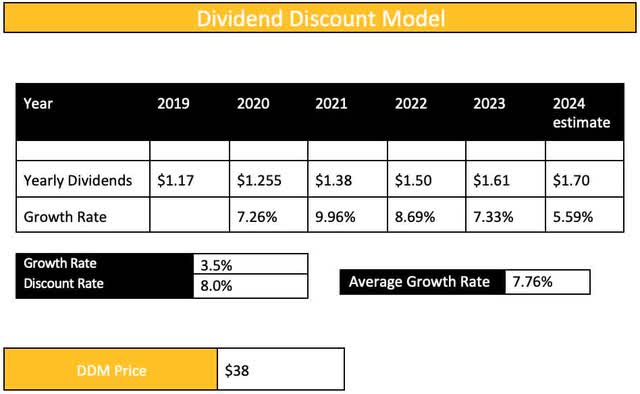

This is in-line with Wall Street’s price target of $35.12. Using the Dividend Discount Model I have a price target of $38, slightly below their average price target of $39. Despite the recent share price appreciation this still gives investors double-digit upside of nearly 19%.

Author DDM

Risks & Conclusion

Interest rates are anticipated to decline this year, especially after the recent FED meeting. However, unemployment has been rising, recently climbing to 4.3%. This was higher than the 4.1% expected, signaling that the economy is beginning to slow.

Moreover, if we fall into a recession, Las Vegas will likely see a slow down, thus decreasing foot traffic. This could also cause a slowdown at their other properties like Canyon Ranch.

This could also negatively impact VICI’s top two tenants Caesar’s Entertainment (CZR) & MGM Resorts (MGM), who make up 39% and 35% of VICI’s annualized base rent.

Although I suspect both tenants would be fine along with VICI if we did see a recession, this is still a risk to consider when investing. But with interest rates likely to decline soon, I think VICI Properties will continue to perform exceptionally, possibly raising guidance in the back half of the year.

Their strong growth year-over-year further solidifies why they are one of the best REITs your money can buy currently. At a forward P/AFFO multiple still below the sector average, VICI’s share price hasn’t seemed to have caught up to their fundamentals.

And, if you’re a long-term investor, VICI is still trading at a good price even after the recent rally in the sector, with the potential for double-digit upside. As a result of this and their well-covered and growing dividend, I continue to rate VICI Properties a buy.

Read the full article here

Leave a Reply