At a Glance

- Central banks around the world are buying gold at record levels

- Silver is seeing strong demand for its use in emerging technology

The metals market has certainly been volatile this year with gold, silver and copper leading the charge. We even got to see them on television a lot recently. The outlook for precious and industrial metals appears to be positive as demand for gold and silver has skyrocketed, although Dr. Copper may have separated itself from the group.

One of the biggest drivers of potential upside rests with upcoming Fed decisions and the possibility of interest rate cuts. As of early August, the CME FedWatch Tool was pricing in near a 100% probability for a cut in September and around 80% probabilities for further cuts in both November and December. Historically, commodities are typically seen as hedges against inflation. However, the U.S. dollar has gained during the same period as these metals, though it’s been retreating somewhat in August.

As the dollar has weakened, commodities like metals and oil typically do well because higher quantities of a commodity can be bought with dollars, and those with non-dollar currencies can buy more dollars with their own currencies. This then comes down to the basic economic principle of supply and demand. All three of these metals are either undersupplied now or will likely be in the near future.

Copper and AI

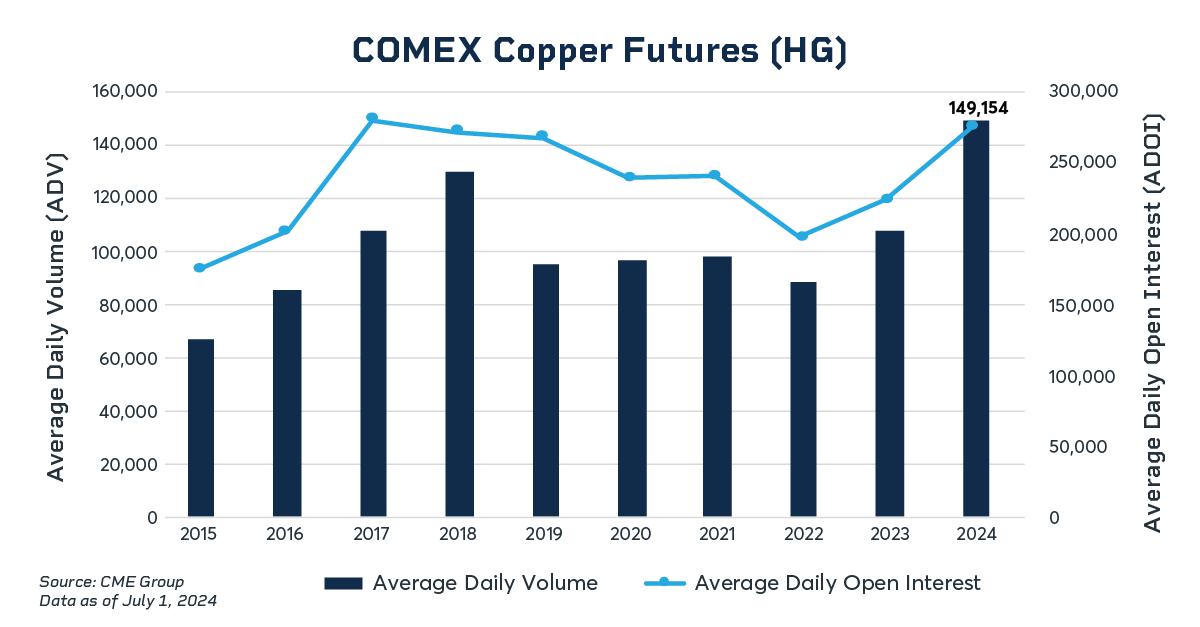

Copper reached its all-time high in May and has since fallen about 20%. Demand increased due to its use in building AI chips and in electric vehicle production, with COMEX Copper futures seeing a record level of participation this year as market participants considered potential supply lags.

However, the recent selloff in global technology stocks and doubts about the growth of the AI industry has hit the price of copper hard. Much of copper’s demand has come from China, and China’s recent economic data has shown that it is not recovering. If weak Chinese orders and demand persist, it may suggest that the decline is more than temporary.

Global Considerations for Gold

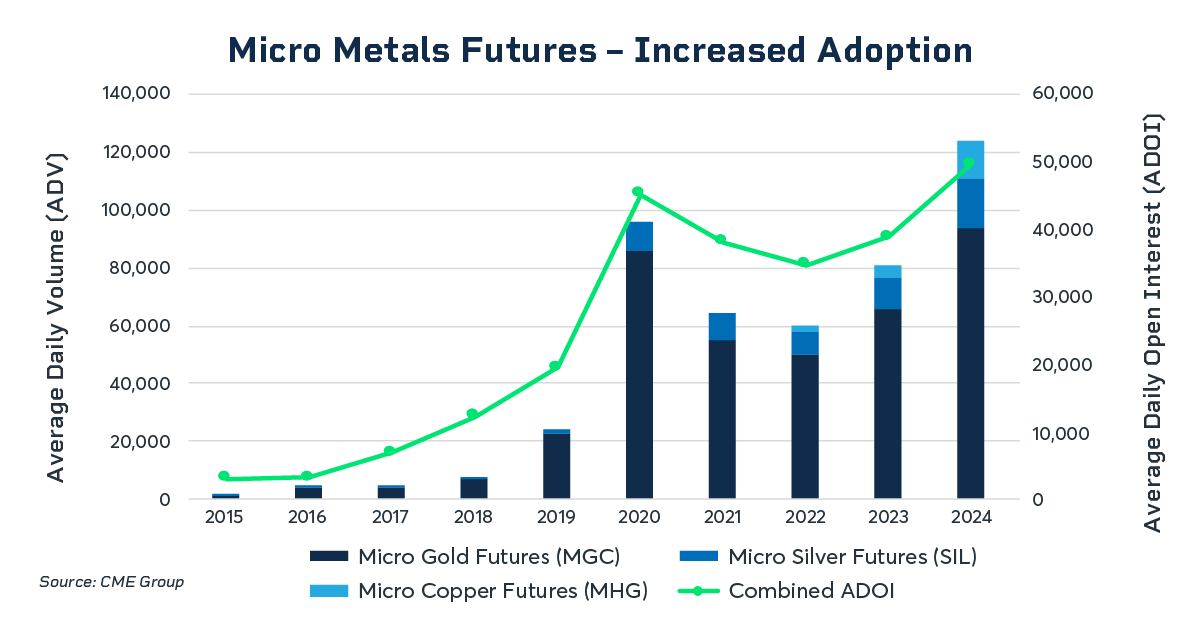

Lower rates and a continuation of geopolitical risks provide major tailwinds for gold. Amid this ongoing uncertainty, Micro Gold futures July ADV increased 68% to 106,000 contracts as more market participants turned to the safe haven asset.

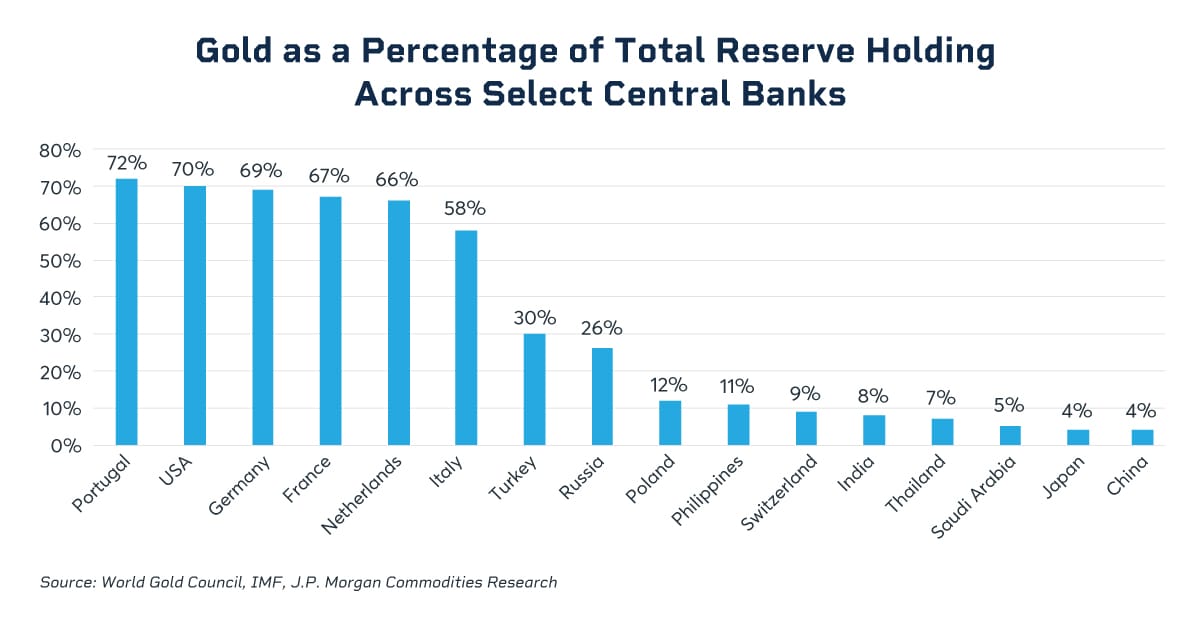

Additionally, central banks worldwide have been buying gold at record levels. Led by China, central banks purchased 1,037 tonnes of gold in 2023, according to the World Gold Council (WGC). WGC annual survey data showed that 29% of central banks expected their own gold reserves to increase in the next 12 months.

Gold/Silver Ratio Remains High

Micro Silver futures have gained this year due to strong demand for its utility in emerging technology, especially given that it can conduct electricity faster than any other metal. The Silver Institute reported a 184.3 million-ounce deficit in 2023 on the back of robust industrial demand. Demand continues to outpace supply and deficits will likely persist beyond 2024 due to the expanding industrial demand for silver.

The correlation between silver and gold is also widely watched. The gold/silver ratio is calculated by taking the current price of an ounce of gold divided by the current price of an ounce of silver. Historically, when the ratio has topped 80, it has signaled that silver is inexpensive relative to gold. The last three times this happened, silver rallied 40%, 300% and 400%. When the ratio has fallen below 20, it has signaled that gold is inexpensive relative to silver.

Currently, the ratio remains historically high. The most recent example of silver being inexpensive compared to gold was back in 2020 at the beginning of the COVID-19 pandemic when the record gold/silver ratio reached 123:1 but then quickly moved back closer to 60:1.

The possibility of interest rate cuts and ongoing geopolitical events all provide potential momentum for gold and silver to rally through the end of the year. Copper, with its closer ties to economic data coming out of China, could find itself trailing comparatively for the near future.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply