Fed Chair Jerome Powell gave his much anticipated opening remarks at the Jackson Hole Symposium, an annual gathering of central bankers, monetary analysts, and academics, this morning at 8 am (MDT)/10 am (EST). Many analysts believed that he would address the recent macro data and the surge in expectations that the Fed would cut in September. He would not disappoint.

Setting the Stage

But first, let’s set the stage. This speech comes on the back of a weakening macro backdrop that has caused Treasury yields to slide and the Wednesday release of the July FOMC Minutes that provided a glimpse of policymakers’ perspectives in last month’s meeting.

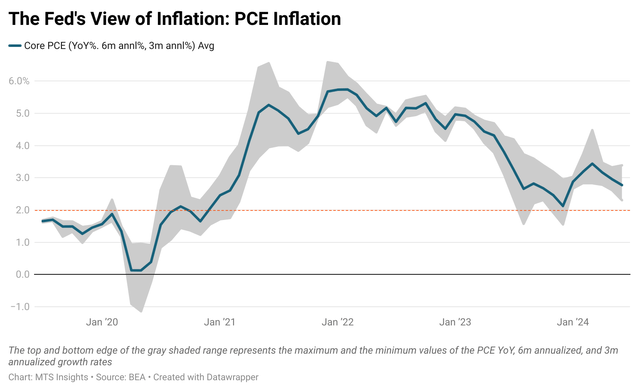

The Fed and Powell face a dynamic economic landscape marked by progress on inflation but emerging concerns about the labor market. The Fed has gained confidence in its battle against inflation, with core PCE inflation moderating to 2.6% YoY and the short-term 3-month annualized rate standing at 2.3%, inching closer to the Fed’s 2% target. Similarly, CPI readings have shown evidence of disinflation, with goods prices deflating and services price growth gradually moderating. Although there is a broader consensus that the lagging measure of housing CPI inflation is causing services inflation to be stickier on paper than it is in reality. Indeed, Supercore inflation (core inflation ex-housing and used autos) sits at 2.4% YoY, with the short-term 3-month annualized rate at -0.4%.

BEA, FRED

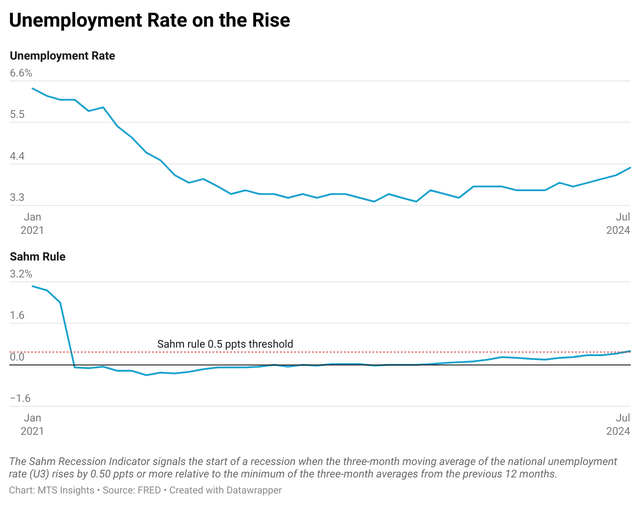

However, the labor market has shown signs of cooling, with the unemployment rate ticking up to 4.3% in July-a 0.8 ppt increase over the past year and nearly a three-year-high. This rise has marginally triggered the Sahm rule, a simple recession indicator that uses the change in the unemployment rate as a signal that a downturn is coming, at 0.53 ppts. On top of these newer developments, a recent BLS benchmark revision to employment data from March 2023 to March 2024 revealed that job creation was overestimated by approximately 800,000 jobs. These developments have shifted the FOMC’s focus, with many members noting decreased risks to the inflation goal but increased risks to the employment mandate (this was also noted in the FOMC minutes).

BLS, FRED

Despite the slight rise in joblessness, economic growth remains resilient, with solid retail sales and consumer spending, and a healthy Atlanta Fed’s GDPNow forecast for Q3 2024 of 2.0% (though that has been revised down from 2.9% in the last 10 days). The actual GDP growth of the US economy is likely a minor issue for the Fed as far as it does not impact the employment mandate.

FRED

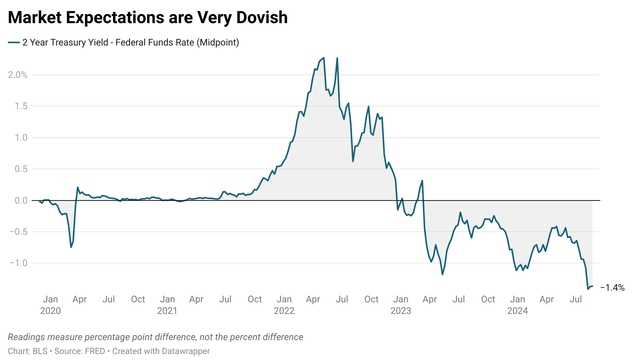

As these data points have been updated, market expectations have adjusted to become the most dovish they have been since the end of the pandemic, even more dovish than when there was volatility caused by financial stability concerns in March 2023. The 2-year yield – FFR spread is around -130 to -140 bps, meaning that a lot of easing is priced into 2025 and possibly even 2026.

The July FOMC minutes were broadly dovish, after it was noted that most members saw a plausible case for easing in July. Data since that meeting suggests that those members would probably be in favor of cutting in July. Powell made a more direct reference to a rate cut in the July press conference, and the Minutes reinforced that this move is clearly on the FOMC members’ minds. Michael Gregory at BMO agreed that a September move was being “teed up,” and TD Bank’s Vikram Rai affirmed that TD economists:

“expect that given the further softening in labour market conditions since this meeting, the FOMC will have the confidence to lower its policy rate by 25 basis points in September and again in November and December.”

Chair Powell Speaks

Chair Powell’s speech began promptly at 10 am and was broken into two segments.

The first segment of Powell’s speech addressed what everyone had on their minds, rate cuts, and he delivered with a dovish pivot. First, Powell noted that his “confidence has grown that inflation is on a sustainable path towards 2%” and that “the cooling in labor market conditions is unmistakable” which suggests that the FOMC sees the current macro backdrop in Q3 as significantly different from the start of the year. Powell then clearly noted that a pivot was coming in September:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the outlook, and the balance of risks.”

While there was no specific guidance on the broader rate cut path, he seemed to emphasize that the plan is to announce a cut in September. In another strong dovish statement, he noted that FOMC members “do not seek or welcome further cooling in labor market conditions” which is strong evidence that the employment mandate is now the focus and guiding policy decisions. Two years ago, Fed Chair Powell admitted that a recession might be needed to get inflation under control. In 2024, he is pivoting from hiking to cutting with confidence that inflation is under control and no recession is needed. For all intents and purposes, this is what a “soft landing” looks like.

In the second segment of his speech, Powell reviewed his thoughts on the post-pandemic inflation surge and subsequent cooling. He attributed the initial surge in inflation to a combination of factors: an increase in goods consumer spending that resulted from pent-up demand, stimulative policies, pandemic-induced changes in work and leisure practices, and excess savings, coupled with tight aggregate supply that resulted from severe supply chain disruptions and labor force draw-downs. Powell acknowledged that the initial assumption of transitory inflation proved incorrect around October 2021, leading to a period of rapid monetary tightening in 2022 and 2023.

The Fed was willing to admit that it would have to cause “pain” in the economy. However, the 2023-2024 trend of disinflation occurred without a sharp rise in unemployment. Powell explained that he thought this was a result of several factors: the slow but eventual unwinding of supply constraints, restrictive monetary policy moderating demand, labor market easing through vacancy declines (instead of layoffs), and well-anchored inflation expectations. Powell closed out the speech emphasizing the unique nature of the pandemic economy, the limits of economic knowledge, and the importance of remaining open to new ideas and criticism.

Market Reaction

Markets have responded positively to Powell’s dovish remarks, even though pre-speech trading suggested that his dovishness was largely expected. About thirty minutes before the market opened, treasury yields were rifting lower, with the 10-year yield (US10Y) down about -2 bps and the 2-year yield down around -1.5 bps. US equity futures were higher, with S&P 500 futures (SPX) up about 0.6% and NASDAQ futures also rising. Following the announcement of the pivot, yields extended their moves down and major US equity indexes jumped about 0.8%, making intraday highs.

Moomoo

Around midday, sectors that would benefit from rate cuts led the way with a strong gain. The regional banking (KRE) and more general banking (KBE) ETFs were up 4.2% and 3.6% respectively. Homebuilders (XHB) jumped 3.2%, and the more general S&P real estate sector (XLRE) was up 1.8%. Semiconductors (XSD) were up a strong 2.6% as well. Defensive sectors were left behind in the rally, with consumer staples (XLP) down -0.1% and healthcare (XLV) up 0.2%. In terms of size, small caps (IWM) were booming, up 2.8%, and coming close to completing a rebound from the sharp move down at the beginning of the month. Commodities also joined the rally. Oil prices which started the day up over 1% made higher highs and metal prices like aluminum and copper jumped around 1 to 2% as well.

As mentioned before, rate cut expectations are the most dovish they have been since inflation peaked, as there seems to be almost certainty that the Fed will cut in September. The discussion now becomes whether the Fed will cut by 25 bps or 50 bps and what that means for the broader economy. If the Fed thinks it needs to cut quickly, that would communicate that a recession is more likely or financial stability is a concern. On the other hand, a gradual cutting cycle would be received better by markets, as it would reinforce the soft landing narrative. For now, all eyes are on the September meeting and potential data points, including two CPI prints, a PCE inflation update, and the August jobs report, that will inform the FOMC’s decision-making next month.

Read the full article here

Leave a Reply