Introduction

On Friday, Fed chair Jerome Powell spoke at Jackson Hole, WY. There, he confirmed what I had predicted in my June article, Unemployment Is Up, Job Growth Is Slowing, Rate Cuts Incoming, the Fed intends to cut rates at their September meeting.

At the time, I argued that the weakening labor market is weaker than headlines report and the Fed will need to start dropping rates during Q4 of this year.

Well, Q4 starts in a week. Powell, at Jackson Hole on Friday, confirmed that the Fed is intending to cut rates starting at the September 18th FOMC meeting. Specifically, he said, “The time has come for policy to adjust… The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

The largest concern, and the data I think is most relevant to this discussion, is labor. Powell also confirmed this in his speech when he said, “We do not seek or welcome further cooling in labor market conditions…[Labor could be strengthened with] an appropriate dialing back of policy restraint.”

Unemployment Is Up

The actual numbers can be a little confusing. Unemployment shot up in July, one of the prompts for the Fed to pivot, but the unemployment figure that is reported in headlines is somewhat misleading.

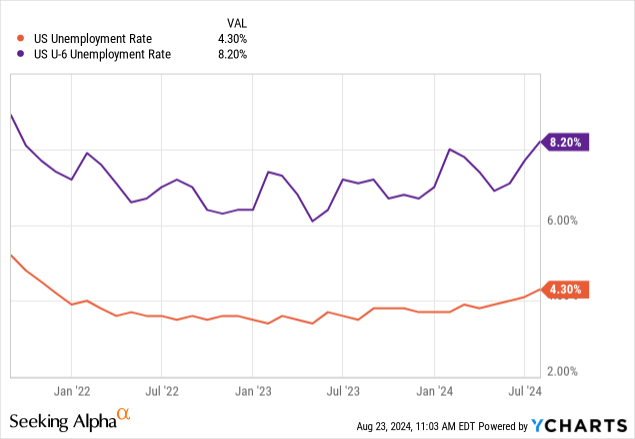

The headline unemployment number, shown as the tangerine line below, counts only those people actively looking for work who do not have a job. My preferred figure, U-6, shown as the grape line below, counts the headline figure as well as people who want work but have given up looking and people who are “underemployed,” or those who have taken part-time work when they are really seeking full-time work.

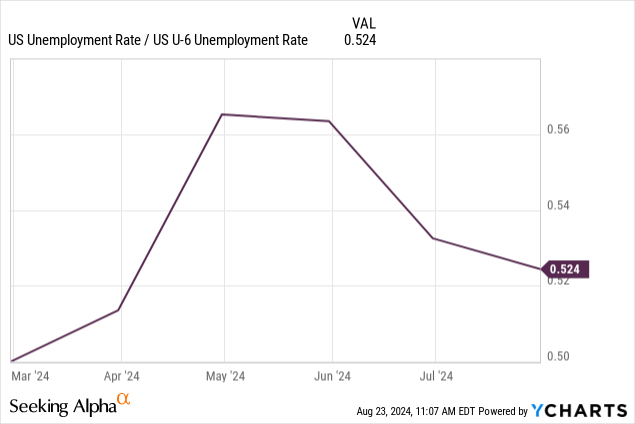

That uptick at the end of last month is indicative of a surge in both newly unemployed people and those dropping out of the search. We’ve seen a growing ratio between these two figures in April, which has cooled in recent months, but is still elevated.

Job Revisions

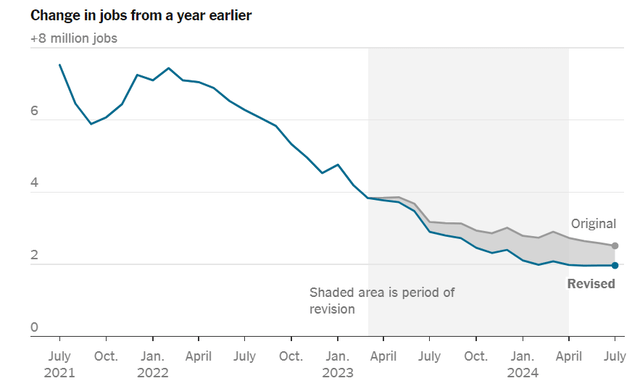

Earlier this week, the Labor Department via the Bureau of Labor Statistics (“BLS”), issued a revision of their 2023–2024 jobs count, ending in March of this year. Previously, the BLS said that there had been an average of 242,000 jobs created per month. The new revision is showing a 28% decline, down to an average of 174,000.

Figure 1 (Ben Cassleman via NYT)

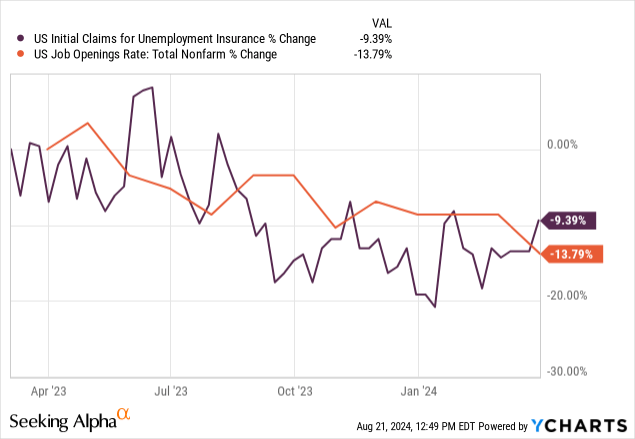

This comes after we’ve seen a decrease in both unemployment claims and nonfarm job openings as well. The chart below is only showing the shaded area in Figure 1.

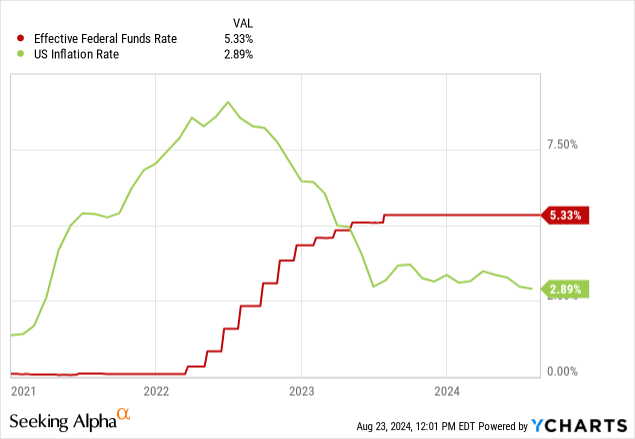

Inflation Is Being Tamed

The primary job of the rate hikes was to curb inflation and bring it back toward the Fed’s 2% target. This has worked remarkably. We can see where the lime line, the inflation rate, spikes from 2021 to 2022. Its peak comes when the cherry line, interest rates as dictated by the Fed, starts to rise in 2022. Immediately, we see a decline in the inflation rate and now a stabilizing of prices.

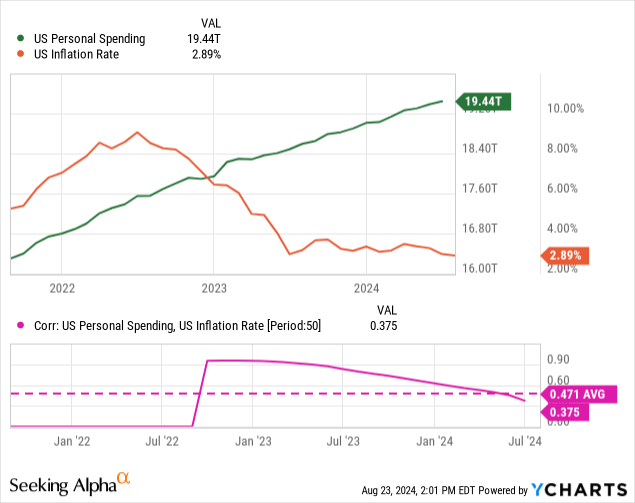

Consumption Hasn’t Been Hurt

We’ve seen no meaningful reduction in consumption, which was my largest worry initially, as I’ve been worried that reduced consumption driven by high inflation could cause a recession.

Since inflation peaked, we’ve seen a divergence in the correlation between inflation and personal spending, with the figure now trending back toward no correlation. This trend gives me hope that as inflation subsides, it hasn’t and won’t harm consumption long term.

Powell Wants to Cut Rates

In his speech, Fed chair Powell said, “While the task is not complete, we have made a good deal of progress toward [a soft landing].”

Here he is making it clear that he still believes in the soft landing narrative that has been circulating since rates hit their peak in the Summer of 2022. This is a great sign for the soft landing crowd, including myself, who are holding on to long duration bonds in hopes of benefitting from the rate cuts that should follow.

The Market is Starting to Listen

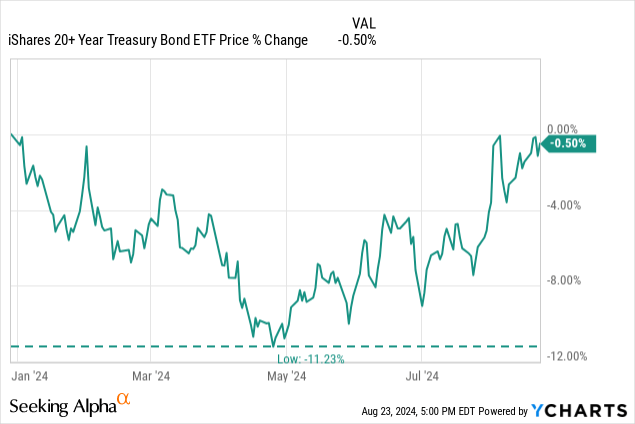

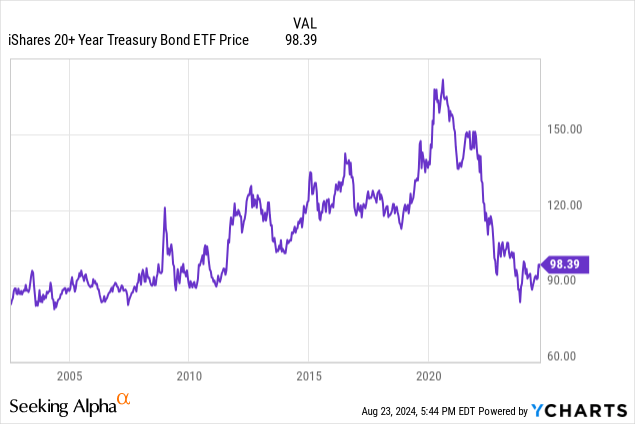

Even though rates haven’t started falling, we’ve seen the anticipation of cuts elevates the price of long-term bond funds like the iShares 20+ Year Treasury Bond ETF (TLT).

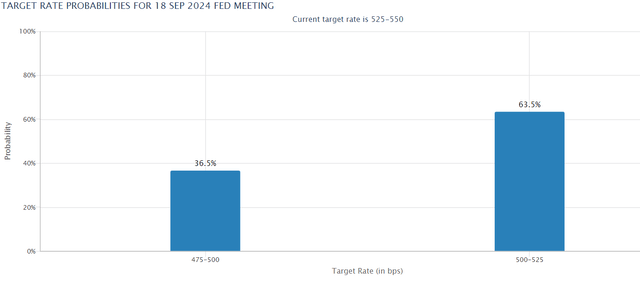

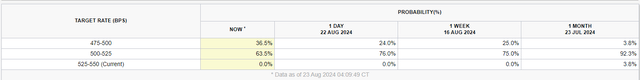

Market participants see rates being dropped by 25-50bp in September, with the new target most anticipated to be 5-5.25%.

Figure 1 (CME FedWatch)

We can see how steep the change was from the day before the speech to the day of, with the 4.75-5% range seeing a 52% increase in expectations. This confirmation has inspired significantly more confidence in market participants.

Figure 2 (CME FedWatch)

The Trade is Still On

In the past few articles I’ve written on US macro, I’ve advocated the long duration trade. Back in March, I published the first article advocating the trades I’ve taken, and I want to re-hash them and update them here. Here is a snippet from that article that explains where the trade started.

The Long Duration Play

– 20+yr bond funds like TLT are the way to go to take advantage of falling rates, as their prices rise the most when rates fall.

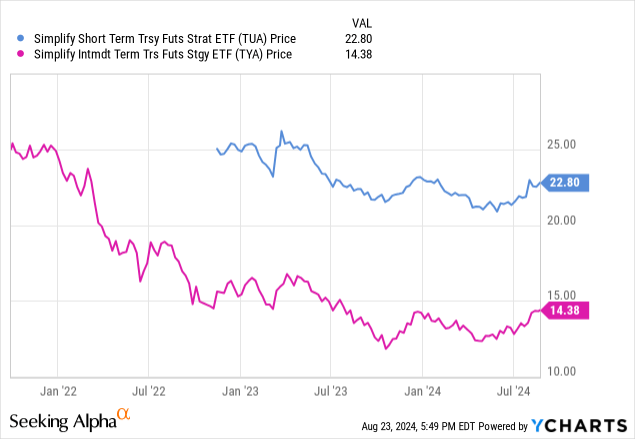

– Investors may also be interested in Simplify’s take on the duration trade, TUA & TYA, which I wrote about briefly here. This is a leveraged ETF, investors beware!

The Fixed Rate Play

– We know that rates will change in the next nine months, and likely lower. This means that now is the perfect time to lock in rates on CDs or other cash-like instruments that offer fixed rates for long periods of time.

– Newly-issued mortgages are offering incredible rates. Simplify’s MTBA invests only in these high yielding mortgages, which are typically fixed-rates. This gets rid of the lower yielding “fluff” in the index.

– It is time to slowly move out of T-Bills over the next nine months, shifting over to longer timelines.

Long Duration

The long duration play is still active. While I showed TLT recovering from its YTD slump earlier, it is still down badly in the long term.

I do not hold a position in TLT. Instead, I am holding leveraged positions of the 2yr and 10yr treasury bills via Simplify’s TUA and TYA. These are positions I intend to hold until the longer-term rate that the Fed predicts is reached, 2.5-3%.

These ETFs are also down badly and are poised to recover (and potentially more) if the Fed stays on its current course.

Major risks to their recovery include the Fed walking back on their word to lower rates, surprise economic data that shows increasing inflation or dramatically increasing unemployment, and not having a definitive timeline on when rates will drop. The Fed currently predicts we will be down at 3% or less by 2026, but it may be longer than that, potentially an unknown amount of time.

Fixed Rates

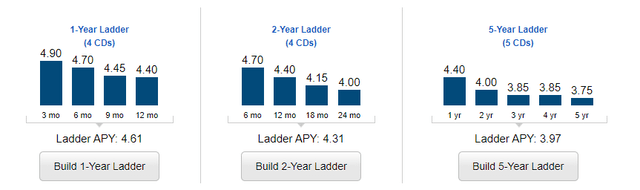

The fixed rate play is mostly done, now that CDs are factoring in future rate cuts. CDs are still paying out relatively good rates, with five-year ladders still being around 4% APY.

Figure 3 (Fidelity Investments)

Locking in rates now might be beneficial, and I believe that we will not see a return to rates above 4% for some time, barring an economic surprise.

I recommend that any excess cash needing to be locked up in timed deposits do so immediately, as rates are only likely to fall from here. As per the FedWatch tool from CME, less than 1% of market participants are expecting rates to stay the same in September, with essentially no-one predicting a rate hike.

Now may be the last moment to grab timed deposits before rates begin to fall.

Conclusion

The Fed has all but started the process of cutting rates, with the first one in September being confirmed by the Fed chair, Jerome Powell, on Friday. This comes on the heels of slowing growth and rising unemployment, back dropped by the stabilizing inflation rate that the Fed Funds Rate was raised to tackle.

Now that the job is done, rates can fall. There are opportunities to take advantage of this, but they are almost entirely in bonds and cash-equivalents. I recommend not fighting the Fed on this one.

Thanks for reading.

Read the full article here

Leave a Reply