Note: All amounts discussed are in Canadian Dollars and the stock price refers to the TSX stock price and not the OTC one.

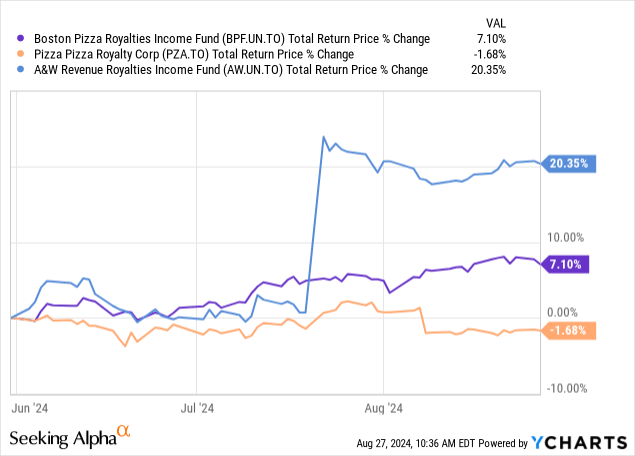

We covered the Boston Pizza Royalties Income Fund (TSX:BPF.UN:CA) first quarter results earlier this year. A 5% (ballpark) drop in foot traffic while standing at the doorstep of a recession ebbed our excitement for this royalty play. The unchecked immigration policy, despite wreaking havoc on many resources of the country, was actually a positive tailwind for food service providers like our protagonist. The stock was not too expensive and the dividend yield at around 8.3% was also tempting. However, our conservative investing style prevented us from being a buyer.

The slightly higher price point relative to the two other Canadian royalty plays we cover is a weakness that makes us cautious. Overall, we think this remains a buy only under $15.00. We maintain our hold rating for now.

Source: Boston Pizza: A Look At The 8.3% Yield After Q1 Results

While it has done well since then, the clear winner among the three is A&W Revenue Royalties Income Fund (AW.UN:CA), which we rated a buy around the same time.

We will cover BPF’s second quarter results today and update our rating.

Q2-2024

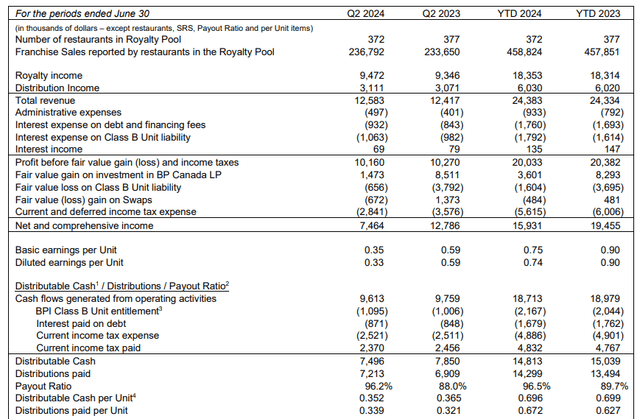

The struggles continued for the Pizza chain in Q2-2024 as it delivered a rather slow 1.3% growth in total franchise sales. Same restaurant sales came in slightly better at 1.7%. The difference between the two numbers is from a few restaurants actually closing in this timeframe. Q2-2023 had 377 on the restaurant count, and we are now down to 372. All the actual increase in sales has been generated through heavy menu price bumps, offset by declining traffic.

While Boston Pizza managed to push the top line ahead, the more important metric, distributable cash, fell. The drop was modest (from $7.85 million to $7.50 million), but definitely not something investors want to see.

Q2-2024 Results

The key culprits were three different expense categories which each removed about $100,000 from the distributable cash. Two of these were in the category of interest expenses and one was the administrative category. The company is generally run in a lean and mean way, but you will see expenses outpace revenues when interest expenses rise so quickly.

Outlook

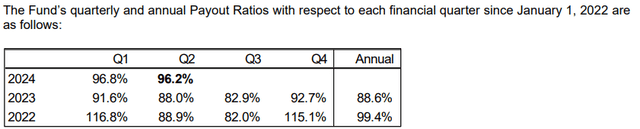

The payout ratio has now crept up to close to 100%. While this is to some extent normal, as the company does not like to retain excess cash, it is still high for the quarter. Last year Q2-2023 was at an 88% payout ratio, and we saw similar numbers in Q2-2022.

Q2-2024 Results

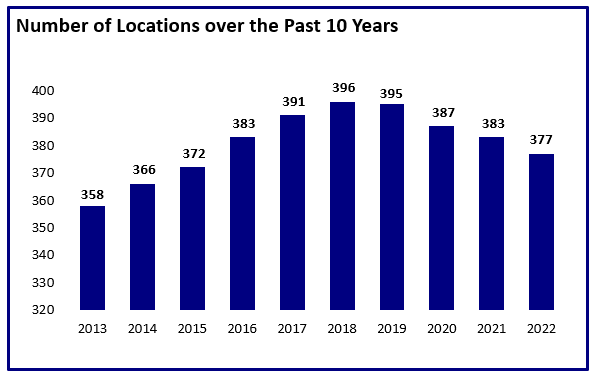

Part of the problem, of course, is that Boston Pizza increased the distributions. But this might make things extremely tight if sales start declining at a restaurant level. It is not like the company is going to get growth via total location increases. That metric looks dead in the water. We have put up an older pic here to make our point. The current 372 locations is at the same number seen in 2015.

2022 Report Boston Bizza

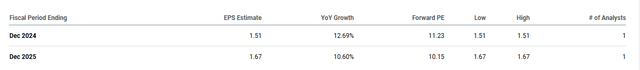

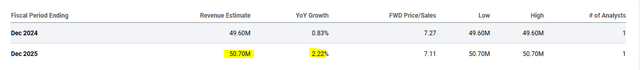

Bay Street does not have a lot of coverage on this name and only one brave soul is out there predicting what will happen.

Seeking Alpha

But from our perspective, both those numbers look fairly outlandish. The 2025 numbers are even more so as they are on the back of some fairly minimal revenue increases.

Seeking Alpha

One positive aspect here is that Boston Pizza will benefit as its interest rate exposure is directly on the front end, and it has primarily financed via floating rates.

Facilities now bear interest at variable interest rates as selected by Holdings LP and Royalties LP. In the case of Canadian prime rate loans, the interest rate is equal to the Bank’s prime rate plus between 0.00% and 0.65% (depending on the Fund’s total funded net debt to EBITDA ratio) and, in the case of CORRA loans, the interest rate is equal to: (i) CORRA; plus (ii) the applicable CSA; plus (iii) between 1.25% and 1.85% (depending on the Fund’s total funded net debt to EBITDA ratio).

Source: Q2-2024 Boston Pizza

Yes, there should be some flow through with the interest rate cuts that have happened. Even more is expected on this front though no one should expect the ZIRP (Zero Interest Rate Policy) era to be back. The biggest risk for the company is an outright decline in revenues in a recession. So far, we have seen foot traffic declines offset by price increases. But that works only to an extent. If we do hit a hard landing, we will likely see problems at both ends of this policy. First, the foot traffic will fall further and diners will gravitate towards lower-priced items. Second, Boston Pizza will stop pushing through price increases and may even cut them. We could envision distributable cash flow falling 20% in such a scenario.

Verdict

It is late in the game and we don’t like the setup. The P/E ratio always makes this look cheap, but these stocks generally trade in this multiple range. We have seen some alarming macroeconomic news of late and Pizza Pizza’s same-store sales numbers were quite scary as well. It is notable here that the Pizza Pizza Royalty Corp. (PZA:CA) chain competes at a far lower price point and is still seeing headwinds. We think this is a great time to exit Boston Pizza, and we are moving this to a Sell rating. We would consider moving to neutral on a price decline below $15.00 per share. On a related note, we also sold most of our A&W Royalties Income Fund holdings and will be tendering all the remaining for cash as well.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply