Roblox Corporation’s (NYSE:RBLX) business continued to rebound in the second quarter, with revenue growth and cash flow areas of particular strength. While this is positive, Roblox’s cost structure is problematic, and it is not clear if or when this will be resolved. AI-enabled moderation and scaling of the advertising business are probably the most viable near-term paths to improved profitability. Initiatives in these areas will take time to yield meaningful results, though.

I previously suggested that Roblox’s stock would probably perform ok in the short run, provided that its growth remained solid, as this would drive cash flows significantly higher. Roblox’s cash flows are largely a function of the timing of payments though and do not reflect the profitability of the platform.

I continue to think that absent a change in app store policies, or a large amount of success in advertising, Roblox will find it difficult to generate decent profit margins. As a result, it is difficult to see the stock providing investors with strong returns from current price levels. There are also emerging regulatory risks, although Roblox’s focus on user safety may help it to navigate this.

Market Conditions

The gaming market is worth upwards of 160 billion USD, with around half of this coming from advertising. Roblox’s business only currently amounts to around 2.5% of this, potentially providing a large growth opportunity.

Gaming has been under pressure in recent years though, due in part to headwinds in China, a COVID hangover and adtech changes. Given the nature of Roblox’s platform, it is relatively immune to macro conditions, as its users generally spend modest amounts on the platform and advertising isn’t a material part of the business yet.

Regulators could provide headwinds to most social media in coming years, with the negative impact on younger users becoming more widely recognized. China put restrictions on the amount of time under 18s could spend gaming in 2021. A suspension of new video game approvals was recently lifted, but China has also placed restrictions on spending and incentives. While this hasn’t impacted Roblox, it has had important implications for the broader gaming ecosystem due to the size of the Chinese gaming market.

The US Senate recently passed a bill that aims to protect children from harmful content and behavior online, like bullying, sexual exploitation and alcohol advertising. A UK regulator has also proposed social media rules which aim to protect children from harmful content. The South Australian government is pushing for an outright ban on social media for children, although it is not clear yet whether this is even feasible. Under the proposal, children aged 14 and 15 would require parental consent to access a social media account.

Regulation could also provide Roblox with a boost in coming years, although it will take time to see how this plays out. The Digital Markets Act in the EU has the potential to make app sideloading a viable alternative, lowering the burden of platform fees. So far, it appears that there will be little meaningful change though, and Roblox’s guidance assumes that the status quo is maintained.

Roblox Business Updates

Roblox provides a real-time 3D platform that enables shared experiences. Its platform is powered by user-generated content and operates at the intersection of gaming, entertainment and social media.

Roblox is targeting 1 billion daily active users, which it expects to achieve through an expansion into social communication, shopping, entertainment, and learning.

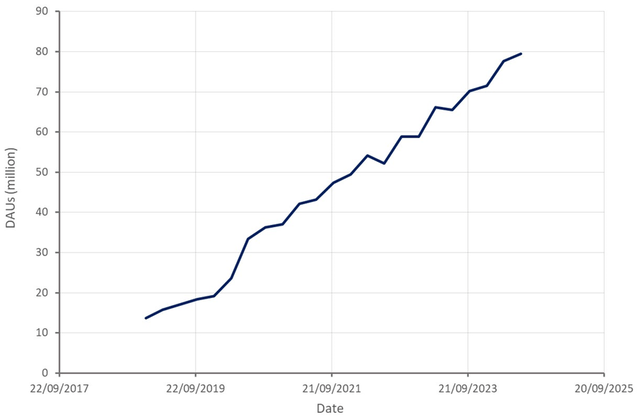

Figure 1: Roblox DAUs (source: Created by author using data from Roblox)

Roblox has launched a video ads product and enhanced its self-serve ad manager. The company has also introduced third-party integrations with IAS and PubMatic, Inc. (PUBM). Advertising should be a high-margin source of incremental revenue, but it will take time to scale this part of the business. The macro environment also isn’t conducive to more experimental advertising, like Roblox offers. Ads aren’t expected to be a meaningful growth contributor until around 2026 / 2027.

Roblox is also now testing shopping in Roblox with Walmart Inc. (WMT) and e.l.f. Beauty. IKEA also has a virtual store where real-life employees have been hired to work. This is a first step towards building an e-commerce solution, which would be an incremental, high-margin source of revenue.

On the entertainment front, Netflix launched its persistent IP hub, Next World. Roblox has also seen activations from Shrek, Despicable Me, and Six Flags. New artists on the platform include the Rolling Stones, Ice Spice, and Post Malone. While these initiatives could help attract users to the platform, it is not clear that it will be a meaningful source of revenue in the near term. In addition, content costs could mean that Roblox’s margins on any entertainment revenue are low.

Roblox also continues to make significant investments in AI, which has the potential to expand the capabilities of the platform and help to reduce costs. The company is running over 150 ML and AI pipelines, addressing areas like safety and translation. As Roblox is primarily targeted at younger users, ensuring user safety is a key concern for the company and a relatively large expense item. Roblox has over 1,700 trust & safety agents across the globe who appear to generally be contractors. AI has the potential to significantly reduce this burden over time, though.

Financial Analysis

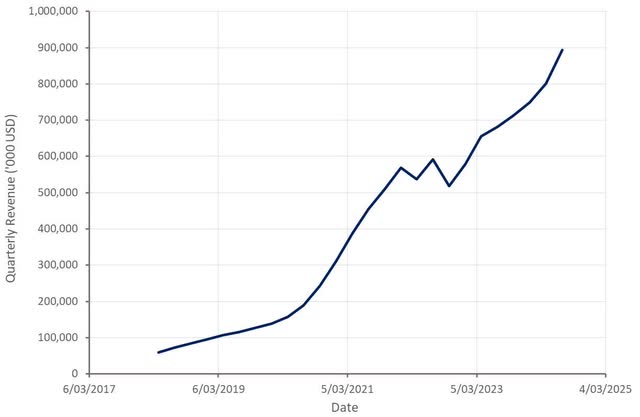

Roblox generated 893 million USD in revenue in the second quarter, an increase of 31% YoY, while bookings totaled 955 million USD, up 22%. The company had 79.5 million DAUs in Q2, up 21% YoY, with the over 13 cohort an area of particular strength. From a geographic perspective, DAUs increased 56% YoY in Japan and 57% in India. Hours engaged was 17.4 billion, up 24% YoY. Average bookings per payer have been fairly flat in recent quarters, with international expansion likely hiding underlying progression.

Roblox is guiding to 860-885 million USD revenue in Q3, representing 21-24% growth. Bookings are expected to be between 1 and 1.025 billion USD, an increase of 19-22% YoY. For the full year, Roblox expects 3.49-3.54 billion USD revenue, up 25-26%, and 4.18-4.23 billion USD bookings, an increase of 19-20%.

Figure 2: Roblox Revenue (source: Created by author using data from Roblox)

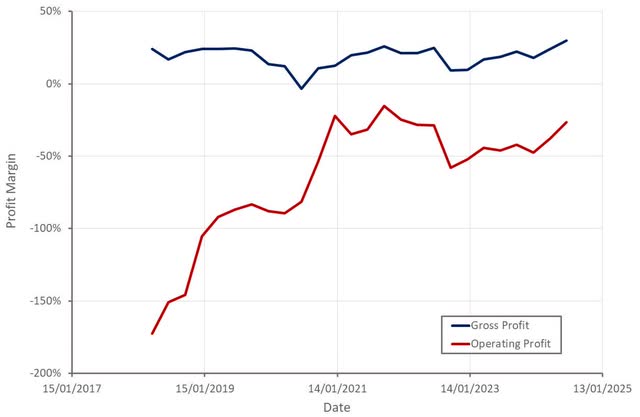

Payment processing and other fees are generally around 25% of bookings. This cost is expected to rise as Roblox’s sales are shifting towards mobile distribution channels, like the Apple Inc. (AAPL) App Store and the Alphabet Inc.’s (GOOG), (GOOGL) Play Store. These distribution channels are subject to extremely high processing fees compared to channels like credit card payment processors.

Roblox’s cost to serve declined 25% YoY in Q2. Infrastructure, trust, and safety costs as a percentage of bookings also declined from 17% to 13% over the past 12 months. This improvement is being driven by investments in AI that enable Roblox to moderate its platform using fewer resources.

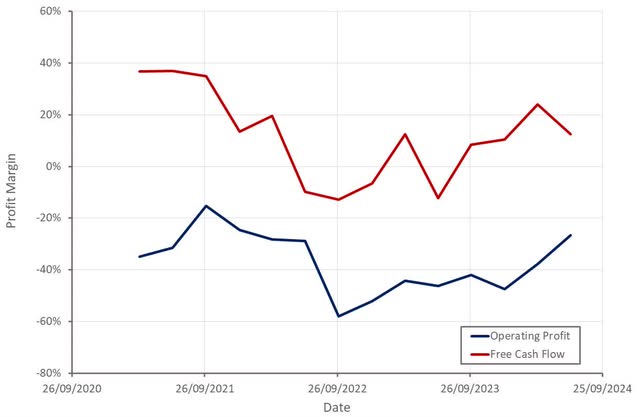

Roblox’s consolidated net loss was 207 million USD in Q2, with the improvement driven by a combination of operating leverage and cost discipline. Cash flow from operating activities was 151 million USD in the second quarter, compared to 112 million USD during the same quarter last year (Q2 2023). This is largely a function of Roblox collecting payments from users far in advance of paying developers. While this is a genuine source of cash, it is only meaningful while the company is growing.

Roblox is still unprofitable and only slowly improving its underlying profitability. The company probably needs to generate upwards of 5 billion USD revenue to be profitable on a GAAP basis. This is dependent on how important alternative revenue streams, like advertising and e-commerce, become over the next few years, though.

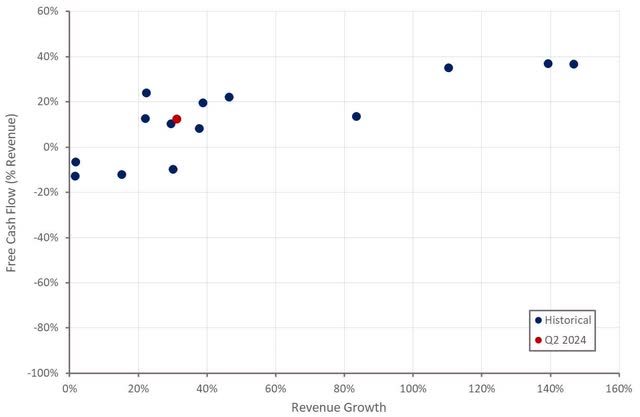

Figure 3: Roblox Profit Margin (source: Created by author using data from Roblox) Figure 4: Roblox Free Cash Flow (source: Created by author using data from Roblox) Figure 5: Roblox Free Cash Flow (source: Created by author using data from Roblox)

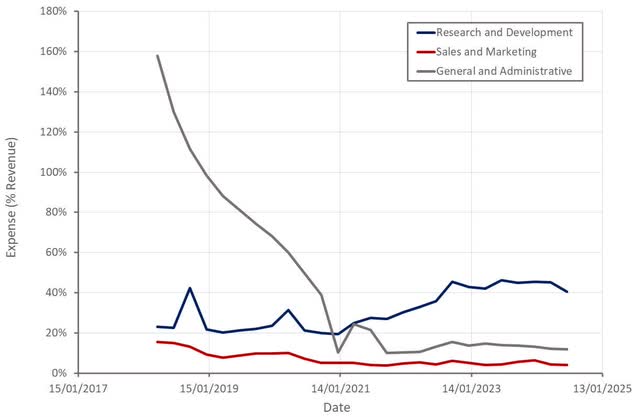

Roblox continues to invest a large amount in R&D but outside of this, its operating expenses are fairly modest. I typically think R&D is a good thing, but it is not really clear what outcomes Roblox is creating given how much it is spending.

R&D is targeted at reducing costs, acquiring older users, accelerating growth and increasing social communication. These efforts are critical to the future of the company, as costs are currently structurally high, and revenue growth is largely dependent on expanding the user base. While R&D is high, it makes sense if these investments lead to 1 billion DAUs.

Figure 6: Roblox Operating Expenses (source: Created by author using data from Roblox)

Conclusion

Roblox’s valuation is significantly lower than the peaks of late 2021 but is actually still fairly high, unless there is a fairly dramatic shift in the company’s cost structure. Based on its current business, Roblox’s operating margin at maturity may only be something like 10-15%. This will depend on both app store fees and Roblox’s success in areas like advertising.

While Roblox is continuing to invest in areas like AI and advertising, and has seen a modest reduction in the burden of trust and safety expenses, these efforts are not really meaningful yet. This isn’t necessarily important from a long-term perspective but if Roblox’s growth slows again in the near term, the share price could come under significant pressure again. Investors appear enamored with Roblox’s cash flows, and these will shrink if growth slows.

Figure 7: Roblox EV/S Ratio (source: Seeking Alpha)

Read the full article here

Leave a Reply