Introduction

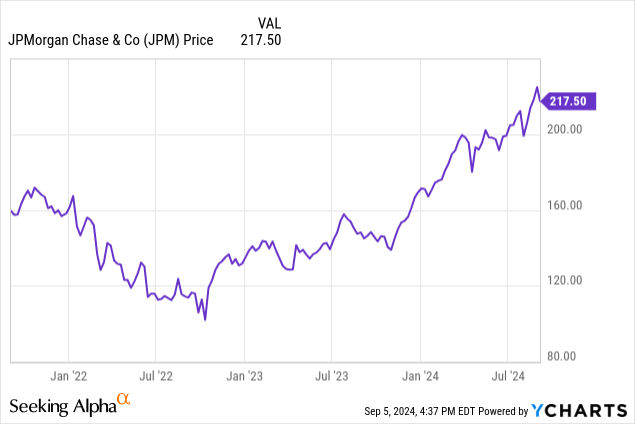

I don’t think JPMorgan (NYSE:JPM) needs to be introduced to any investor. As a US-based financial conglomerate, the financial institution is a household name. While I also like the company from an earnings perspective, its dividend yield is currently pretty low at 2.1%. That’s why I focused on the bank’s preferred securities in previous articles as I still believe the combination of owning common stock for capital gains and preferred stock for the income is the best way to be invested in JPMorgan.

No need to be worried about JPMorgan’s ability to generate a profit – loan loss provisions are completely under control

While this article is meant to be focusing on the preferred equity issued by JPMorgan, a review of some of the preferred shares goes hand in hand with how the bank is doing as the preferred dividends obviously need to be covered by the bank’s earnings.

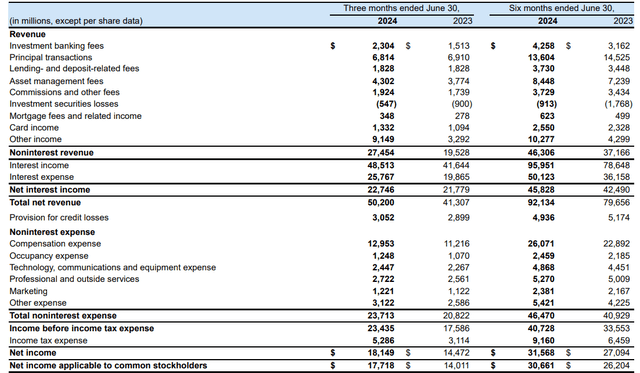

Looking at the Q2 results, JPMorgan once again saw a year-over-year increase in its net interest income as the bank reported $22.75B net interest income, representing an increase of in excess of 4% on a YoY basis. Additionally, the total amount of net non-interest income also came in pretty strong with a total net non-interest income of almost $4B.

JPM Investor Relations

As the income statement above shows, the provision for credit losses also increased, from $2.9B to $3.05B on a YoY basis, and despite alarmist articles here on Seeking Alpha, that’s the normal course of doing business. Some loans simply don’t work out, and as long as the underlying earnings can cover the anticipated losses, the bank is doing fine. And per the income statement, even after including the in excess of $3B in loan loss provisions, JPMorgan still reported a pre-tax income of $23.4B. This means that even if the bank would see its provisions eightfold, it would still be profitable.

But as shown above, the net profit generated by JPMorgan was approximately $18.15B, of which around $400M was needed to cover the preferred dividends. Needless to say I’m quite happy with the low percentage of its net profit needed by JPMorgan to cover the preferred dividends.

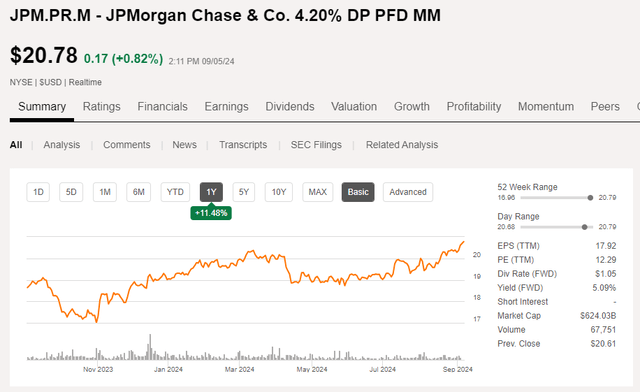

A look back at the evolution of the Series EE preferred stock

I have covered several preferred securities that have been issued by JPMorgan and I usually tried to find the middle ground between generating a decent income as well as keeping the potential for capital gains on the table. The preferred shares with a low preferred dividend coupon were obviously hit the hardest during the era of rising interest rates and the Series MM ( NYSE:JPM.PR.M) with a 4.2% preferred dividend yield have done well, recently. Since my article was published in October 2023, the Series MM saw the price increase by 19% which, in combination with the preferred dividends, resulted in a total return of in excess of 20%.

Seeking Alpha

I consider the “easy gains” to have materialized by now, and considering the current yield of that security is just over 5%, I think it may make sense to start looking into swapping the security out for a higher yielding security.

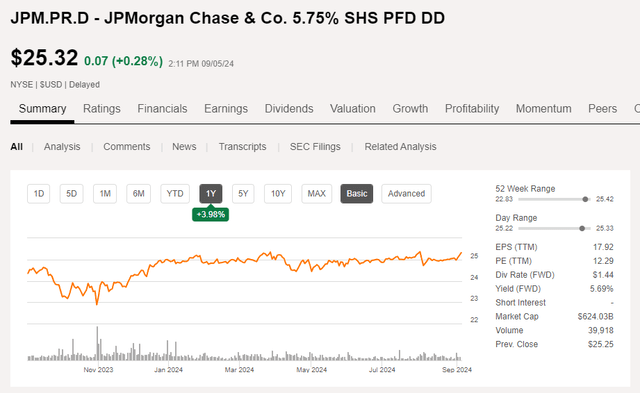

The Series DD preferred stock, trading at (NYSE:JPM.PR.D) offers a 5.75% preferred dividend yield but as the stock is trading at a premium to the principal value of $25 per share, the current yield is just under 5.7%. These preferred shares can be called at any given time, so you could realistically expect the prefs to continue to trade around the $25 mark.

Seeking Alpha

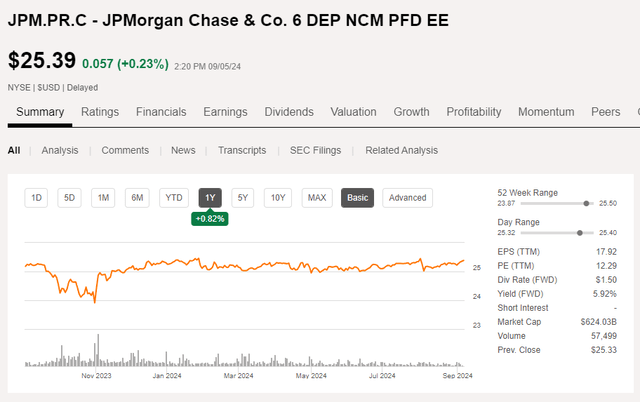

While an interesting pick, it would make even more sense to have a closer look at the Series EE preferred shares (JPM.PR.C), which I covered in this older article. Those preferred shares have a 6% preferred dividend coupon and are currently trading at a marginally higher share price than the Series DD. This means the current yield is approximately 5.9%.

Seeking Alpha

The Series EE can also be called at any moment and as that series is a less cost efficient way of funding (read: the higher coupon means it’s more expensive capital than its other series of preferred shares), the likelihood of this series to be called is higher than the lower-yielding preferred equity.

Investment thesis

This doesn’t mean one “has” to make the switch from a lower yielding security as the upside potential of the 5.75% and 6% preferred shares is pretty limited: If interest rates on the financial markets continue to drop, JPMorgan could easily call the more expensive capital in which case there would be a 1-1.5% capital loss. Meanwhile, if/when the interest rates on the financial markets continue to decrease, the lower yielding securities may see further share price increases.

I currently have no position in any of JPMorgan’s preferred securities and I’m mulling over if I should re-initiate a long position in its preferred shares. I have a small long position in the common shares.

Read the full article here

Leave a Reply