Well over two years ago, in late January 2022, I wrote an article regarding Smith-Midland Corporation (NASDAQ:SMID). If you haven’t heard about the business, I wouldn’t be surprised. Today, the firm has a market capitalization of only $167.6 million. It’s not the smallest company that I have analyzed, but it’s not far off from it. Operationally speaking, the company focuses on developing and selling certain precast concrete products and systems to customers. These are used in construction, the development of highways, the utilities sector, farming, and more.

This is the kind of company that I generally like. However, small firms like this do tend to have some rather volatile results from year to year. That is exactly what we have seen as of late. That was one of my deciding factors, combined with how shares were priced, that led me to rate it a ‘hold’ back then. Since then, the stock has underperformed the broader market, appreciating by only 13.9% while the S&P 500 is up 23.1%. As much as I would like to say that now is the time for an upgrade, I do not feel that way. Given the current pricing of the stock, both on an absolute basis and relative to similar firms, I actually think downgrading it to a ‘sell’ to reflect my view that shares are likely to continue underperforming the broader market, is the way to go.

Wildly mixed results

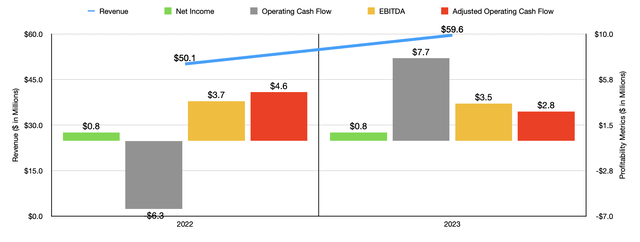

Author – SEC EDGAR Data

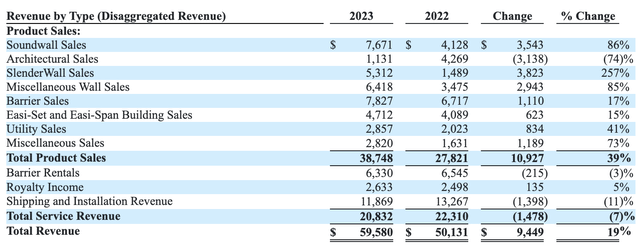

Before we get to the most recent data provided by management, I think it would be useful to touch on how the past couple of years have been. Back in 2022, the company generated $50.1 million worth of revenue. This number increased nicely to $59.6 million in 2023. This rise came in spite of the fact that overall service revenue for the company dropped from $22.3 million to $20.8 million, driven mostly by a fall in shipping and installation revenue because of a decline in the shipping and installation of its SlenderWall product and architectural panels. The increase, then, came from a jump in product sales from $27.8 million to $38.7 million. There were multiple contributors here. But the two largest would be a surge in SlenderWall sales from $1.5 million to $5.3 million and a jump in Soundwall sales from $4.1 million to $7.7 million. The former of these jumped so much because the company had two different projects that it was working on in 2023, compared to only a single project the year prior. And for the latter, the increase was because of higher production volumes in both its North Carolina and South Carolina plants because of larger soundwall projects on a year-over-year basis.

Smith-Midland Corporation

On the bottom line, you would expect some meaningful improvement. But that’s not exactly what transpired. Driven almost entirely by higher income tax expense, net profits for the company actually remained virtually unchanged at $0.8 million. Other profitability metrics were all over the place. Operating cash flow, for instance, went from negative $6.3 million to positive $7.7 million. If we adjust for changes in working capital, we actually get a drop from $4.6 million to $2.8 million. And finally, EBITDA for the business fell from $3.7 million to $3.5 million.

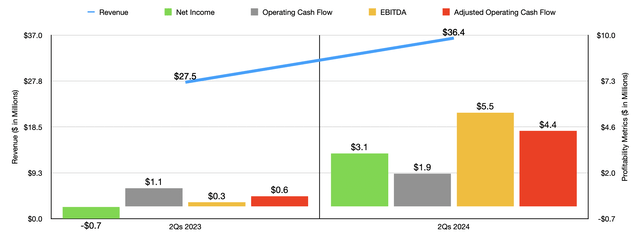

Author – SEC EDGAR Data

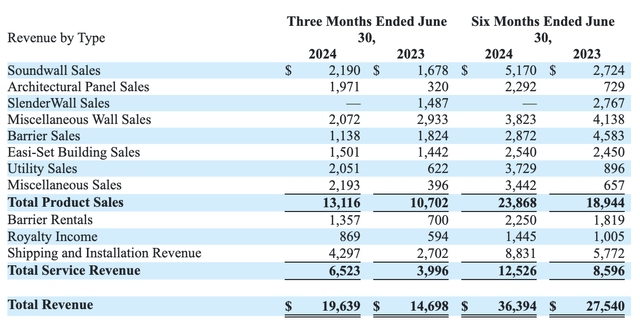

At the end of 2023, Smith-Midland ended up with a backlog of $60.8 million. That was comfortably higher than the $52.4 million the company ended the 2022 fiscal year with. This suggested that further revenue growth was on the horizon. And that is precisely what we ended up seeing. For the first half of 2024, the company generated $36.4 million worth of revenue. That is quite a bit higher than the $27.5 million in sales generated one year earlier. This came about even though the company saw no SlenderWall sales this year compared to the $2.8 million worth of revenue achieved one year earlier. Compensating for that were a couple of things, including higher soundwall sales of $5.7 million compared to $2.7 million a year earlier, a nice increase in architectural panels sales from $0.7 million to $2.3 million, and a surge in shipping and installation revenue from $5.8 million to $8.8 million. Higher production volumes aimed at addressing increased backlog, the fact that the company had architectural projects that started production at the end of the first quarter of 2024, and other factors, ended up being responsible for this improvement.

Smith-Midland Corporation

Unlike what we saw in 2023 compared to 2022, the bottom line for the company was significantly better in the first half of 2024 compared to what was seen in the first half of last year. The company went from generating a net loss of $0.7 million to generating a net gain of $3.1 million. Operating cash flow went from $1.1 million to $1.9 million. On an adjusted basis, the increase was from $0.6 million to $4.4 million. And finally, EBITDA for the company skyrocketed from less than $0.3 million to almost $5.5 million.

Unfortunately, because of how volatile results have been, it really is not possible to put any reliable weight on future results. One might argue that the revenue, profits, and cash flows, achieved so far this year might represent a new normal for the company. But I’m not so sure. I say this because the backlog in the most recent quarter was $59.2 million. That’s down from $60.9 million one year earlier. But more importantly, it’s a drop from the $64.6 million that the company had at the end of the first quarter of this year. This suggests to me that we might be in the early stages of a return to more normal levels of revenue and profitability. However, it’s very likely that we won’t get there until sometime next year.

Author – SEC EDGAR Data

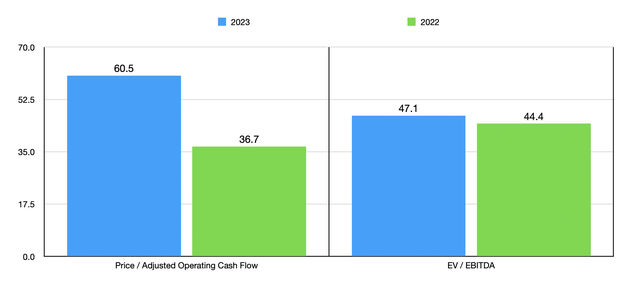

The prudent approach to valuing the company would be to use historical results from 2022 and 2023. In the chart above, you can see what this means for the company’s valuation. Especially when using the 2023 figures, shares look very expensive right now. In the table below, I then decided to compare the enterprise to five similar firms. And using both of the valuation metrics, I found that Smith-Midland ended up being the most expensive of the group. Even if we assume that the 2024 figures represent a new normal for the company, the stock does not look undervalued. As an example, let’s assume that financial results are so good that the trading multiples of the company, on a forward basis, are half of what we get when using 2022 results. Even in this case, the company would be more expensive than any of the five firms on an EV to EBITDA basis. It would also be more expensive than four of the five companies on a price-to-operating cash flow basis.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| Smith-Midland Corporation | 60.5 | 47.1 |

| Knife River Corporation (KNF) | 13.5 | 10.9 |

| Summit Materials, Inc. (SUM) | 11.7 | 10.0 |

| Eagle Materials Inc. (EXP) | 14.9 | 11.1 |

| Martin Marietta Materials, Inc. (MLM) | 26.5 | 10.6 |

| James Hardie Industries plc (JHX) | 19.0 | 17.0 |

Takeaway

Right now, Smith-Midland does not appear to me to represent a good opportunity for investors. Results have been volatile and shares are expensive. The company does enjoy a net cash position as opposed to net debt, but the size of that net cash position is only $1.9 million. And even if we assume the best, shares still look a bit pricey. Given these factors, I have no choice but to downgrade it to a ‘sell’.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply