Introduction

I published a ‘Strong Buy’ thesis for SoFi Technologies (NASDAQ:SOFI) in June. I am moderately happy because the stock price increased by 4.4% since my recommendation was published.

The number of physical bank branches in the U.S. is poised to continue deteriorating because customers’ preferences are changing as modern technologies allow them to complete routine tasks with smartphone apps. SoFi’s strong revenue growth during the unfavorable monetary environment of the last couple of years supports the opinion that customers are seeking a financial one-stop-shop in their smartphones. The expected monetary easing from the Fed will likely spur the demand for loans, which is a strong bullish catalyst for SoFi as a company that has gained a solid footprint in lending. The company’s $7.5 billion valuation looks ridiculous compared to some other fintech companies. Based on the above information, I think that maintaining a ‘Strong buy’ for SOFI is reasonable.

Fundamental analysis

Really good news was released yesterday, informing us that the U.S. inflation eased to 2.5% in August. Decreasing inflation in the U.S. is highly likely a robust reason for the Fed to start its monetary policy softening soon. This is a very bullish sign for SoFi investors.

According to the Fed’s July 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices, lending standards remain tight relative to historical ranges. This factor is a headwind that weighs on the demand for loans. Therefore, the expected three interest rates cuts by the end of 2024 will soften lending standards and positively affect the demand for loans.

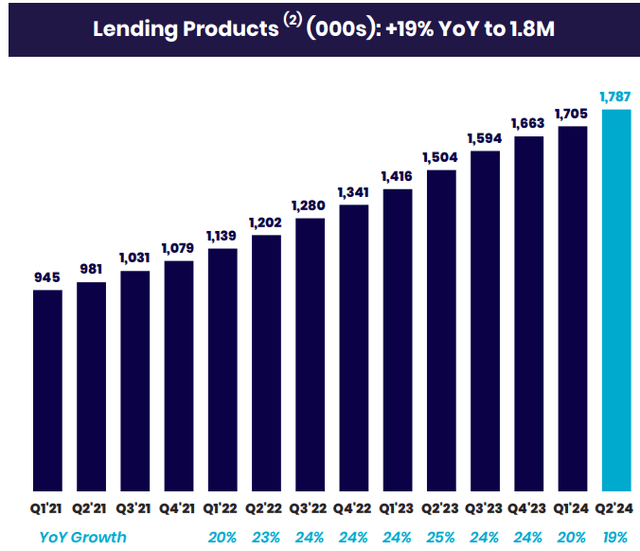

SoFi’s lending products demonstrated growth even during a challenging environment, and positive trends in monetary policy will likely help in accelerating growth.

SoFi’s Q2 2024 presentation

The stock reacted to the information about easing inflation with big optimism, as the stock gained 3.7% in one day. Overall, the market’s sentiment around SOFI has improved significantly over the last month, while the stock gained around 12%.

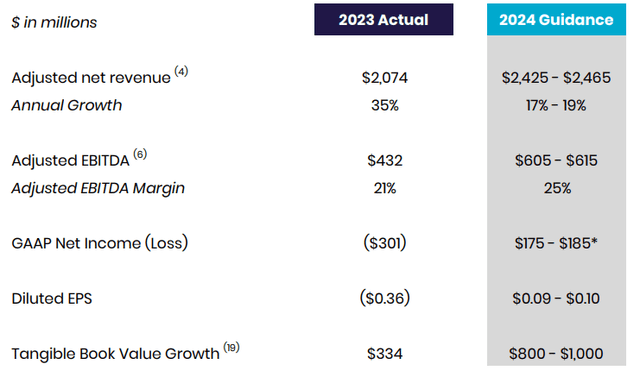

For growth stocks with rapidly growing revenue, there is always a risk that the management will not be able to keep costs under control. As a financial services company, SoFi needs to consistently expand its customer base. This requires substantial marketing costs, and I believe that the market’s cautious stance about SoFi was mostly explained by the uncertainty regarding the ability to deliver profitable growth. I think that SoFi addressed these fears with robust FY 2024 guidance, expecting a massive bottom-line improvement compared to FY 2023. With that being said, I think that SoFi’s marketing strategies are quite efficient.

SoFi’s Q2 2024 presentation

Efficient marketing is crucial for SoFi because the business approach itself is compelling for users. Visiting physical bank branches is very time and energy consuming. In the modern world, where many people do not need to leave home to earn money, it is highly likely that they will be eager to spend time on completing routine tasks. The rapid rise of services like groceries and food delivery from restaurants allowed people to spend almost no time on completing their chores. Therefore, the practice of people visiting physical bank branches is also already outdated.

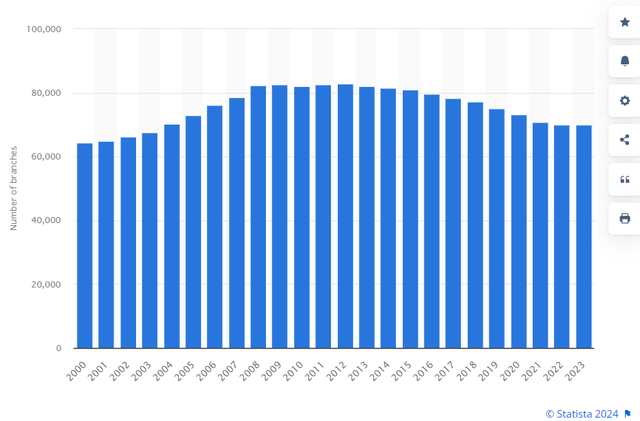

Statista

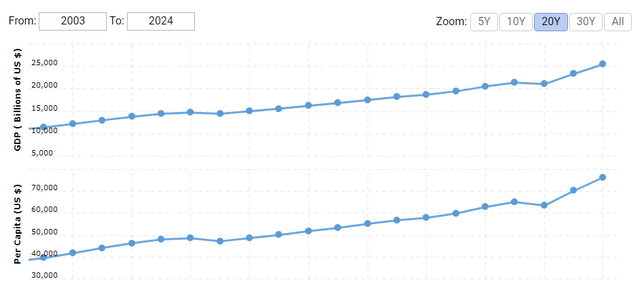

My assertion is backed by statistics. The number of bank branches in the U.S. peaked during the 2007-2008 banking frenzy. However, the number has been shrinking since then. It is currently at the same level as it was twenty years ago. Over the same period, the U.S. GDP has more than doubled. I do not have exact information about how far the total number of banking operations increased over the last 20 years. But I think it is safe to assume that the U.S. economy’s doubling over the last two decades has inevitably led to much higher demand for banking services.

macrotrends.net

The deteriorating number of branches is unsurprising, and I expect it to continue shrinking. Like any business, banks are looking for better cost efficiency to boost profitability. Maintaining physical branches is costly because they require the bank to own or lease the location itself and incur a myriad of costs, starting from paying salaries to branch employees, ending with paying for cleaning. Maintaining an IT infrastructure that enables it to deliver financial services via an app is also not free of charge, but this business model appears to be much more flexible and easier to manage. For example, Bank of America (BAC) has almost 4,000 branches. Just imagine how many employees are required just to ensure that internal controls are in place in each branch?

As a disruptor that has no physical branches, SoFi is apparently poised to benefit from these big changes in the way the financial services industry works. Trying to be a disruptor alone does not give any advantages, but SoFi’s rapidly improving profitability suggests that the company is quite an efficient disruptor.

Valuation analysis

Before I share my valuation calculations, I want to share a peer comparison. In my previous article, I have demonstrated the example of a British fintech Revolut. In mid-August, Revolut has been valued at $45 billion. SOFI’s market cap is currently below $7.5 billion, six times lower than the U.K.-based “neobank”. Revolut’s financial performance is impressive, and this company is already profitable, but key metrics are not multiple times higher than SoFi’s.

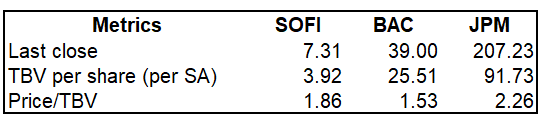

Looking at the price-to-book (P/B) ratio compared to other banks is also useful to understand SOFI’s valuation. Benchmark banks are JPMorgan Chase (JPM) and Bank of America, the two U.S. banking industry leaders. To be conservative, I am using tangible book value (‘TBV’) per share. SoFi’s Price/TBV ratio is in line with benchmark banks.

Calculated by the author

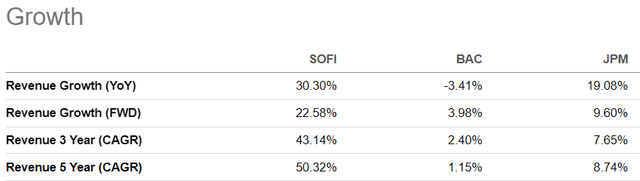

Having in line Price/TBV figures with BAC and JPM suggests that SOFI is undervalued. I signal undervaluation here because SoFi is a disruptive fintech company at early stages of its development with vast potential, while the earnings of the largest banks have stagnated because the industry is extremely old.

SA

Mitigating factors

The company competes with giant legacy banks like JPM and BAC, which possess vast resources and boast significantly larger customer bases. Additionally, there are more than 4,000 commercial banks in the U.S., meaning that SoFi is up against thousands of well-established financial services institutions. Intense competition presents significant risks for SoFi because capturing market share in a saturated industry is challenging.

SOFI’s last 52-week range is notably wide, spanning from $6 to $10.5. This substantial range indicates that the stock is vulnerable to sharp short-term price fluctuations and is significantly influenced by market sentiment. Such volatility means investors must be prepared for rapid changes in the stock’s price.

Conclusion

SoFi is in a robust position to benefit from sharp changes in the behavior of banking customers due to the evolving technological landscape. Revenue growth is impressive, and rapid profitability improvement suggests high efficiency of SoFi’s marketing efforts. The valuation is very attractive as well.

Read the full article here

Leave a Reply