Over the past five years the total price return of Starbucks Corporation (SBUX) has been only about 8%, which is very disappointing and not in line with the market return. By the way, if we had considered the total price return until the beginning of August 2024, the situation would be even worse. The new CEO has generated enthusiasm and more investors are ready to bet on a recovery, but in my opinion it’s not so obvious.

Although SBUX remains the undisputed leader in its industry, there are other coffee chains that are gradually gaining more and more acceptance. In general, my impression is that SBUX in recent years has overestimated its competitive advantage and management mistakes have favored rival companies such as Dutch Bros Inc. (NYSE:BROS).

Founded in 1992, BROS’ popularity has grown exponentially in recent years, especially among young people. The simplicity of its business model is its strength. Thanks to low costs and economies of scale, I believe the operating margin has ample room for improvement. The company is very ambitious and aims to expand to all states through its ability to sell products suitable for any customer.

In my opinion, BROS is making cracks in the SBUX empire and has the potential to continue to increase its market share.

Main differences between SBUX and BROS

Both companies operate in the same market, but there are different considerations to be made for BROS and SBUX. The first lies in market capitalization: About $5.70 billion for BROS and more than $100 billion for SBUX.

This means that the two companies are at totally different stages of their lives: BROS is in the midst of growth and expansion, SBUX has been dominating for decades and wants to consolidate its position. Of the two investments BROS is definitely the riskier one, but at the same time also the one with a higher potential return. If the company sticks to its expansion plans, I believe there is room for a great investment.

Potentially higher operating margin

Although the customers are the same, I believe that BROS’s business model is more attractive in terms of profitability. Before I explain why, I would like to make it clear that this is simply my opinion: As of today, BROS is still too small to make accurate estimates of its future profit margins. Suffice it to say that until a few years ago the operating margin was even negative.

Dutch Bros store

The reason I’m optimistic stems from how the two companies sell their products. Compared to SBUX, I believe that potentially BROS’s store management can be more efficient for two reasons:

- The first is that BROS has much smaller stores so it can expand rapidly over the next few years. Opening one is certainly cheaper than an SBUX store given its small size. To date, BROS has nearly 900 stores, mainly on the West Coast and the South, but in the next 10 to 15 years it expects to reach 4,000 stores, expanding to the East Coast as well. This goal may seem overly optimistic, but this company tends to keep its promises. In 2018 when there were about 300 stores, it had set a goal of reaching 800 by 2023, which it has actually accomplished.

- The second advantage of BROS is that its business model is entirely drive-through. There are no seats, stores are only a few square feet, only a few employees are needed, and this means lower operating costs. Among other things, it avoids having customers occupying a seat for hours simply with a $5-10 order. While this aspect has made SBUX very popular, it’s one of its most important limitations.

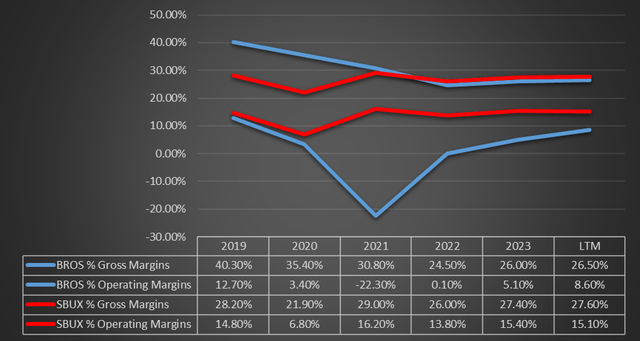

Chart based on SA data

Based on these considerations you might think that BROS has far higher margins than SBUX, but at least for now this is not the case.

First of all, as already anticipated, BROS is minuscule compared to SBUX and does not have the same economies of scale. This has a negative effect, especially on operating margin. The more the company expands, the more economies of scale will increase, especially if the goal of 4,000 stores is reached. SBUX already enjoys these economies of scale since it has 17,068 stores in the United States alone.

Second, BROS decided to rely more on opening new stores rather than franchising, and this has led the gross margin to shrink in recent years. In fact, in 2019, BROS’s gross margin was higher than that of SBUX.

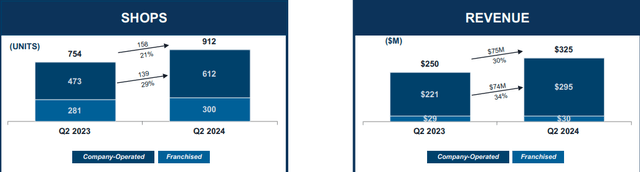

BROS Q2 2024

The company’s reason behind focusing primarily on its own stores stems from the need to have more control over its business. Franchises allow higher operating margins (McDonald’s Corporation (MCD) is an example), but in the early stages of a company it’s essential to offer the best possible service, which is not always guaranteed if the store is managed by an outside party.

Company-operated stores are growing a lot as quarters go by (revenue up 34% from Q2 2023), and I think this strategy will be pursued at least until BROS has an established brand across the country. Many people have not yet tried any of BROS’ products, many others don’t even know what it is since the stores are mainly focused on the West Coast.

This company is still in an early stage, so it’s reasonable to assume that it would prefer to expand as much as possible rather than think about having higher profit margins. Nevertheless, its gross margin is similar to that of SBUX.

Once the economies of scale are significant and the brand is popular throughout the country, there can be more focus on the franchise. At that point, BROS’s operating margin can potentially be better than SBUX’s. Of course, this process takes time and carries risks since BROS is still at a stage where it is burning money.

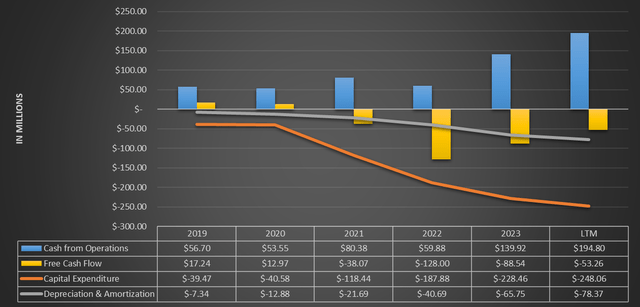

Chart based on SA data

Cash from operations is growing strongly, which is very positive, but the free cash flow remains negative. The point is that BROS has a huge capex compared to cash from operations, and that’s the only way to sustain the ambitious expansion plan. In fact, depreciation, and amortization expenses are relatively low compared to capex.

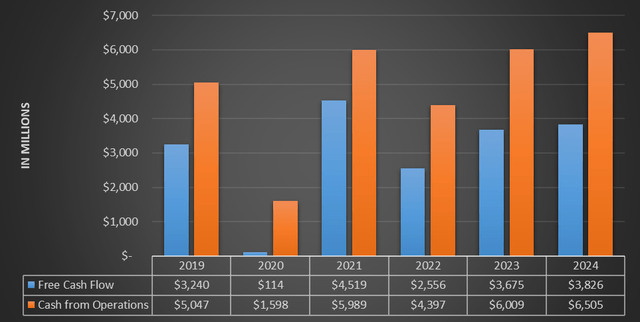

In contrast, SBUX has no problem generating a good amount of free cash flow, but has cash from operations with significantly lower growth.

Chart based on SA data

This important difference supports my initial statement about the high riskiness of preferring BROS to SBUX. Although a market cap of $5.70 billion is not very little, BROS remains highly speculative since it has not yet found a balance in terms of profitability. There’s a basis for it to have a higher operating margin than SBUX in the future, but one should not underestimate all the difficulties it will face.

Same-store sales and customer satisfaction

Although the two companies operate in the same market, their results in the last period were completely different: More and more customers preferred BROS to SBUX.

SBUX same-store sales declined for the second quarter in a row, -3% in the last quarter. Traffic to its stores in the United States also continues to deteriorate, -6% in the last quarter. It seems that people are less and less interested in SBUX and stores are struggling to increase their sales. Opposite argument for BROS.

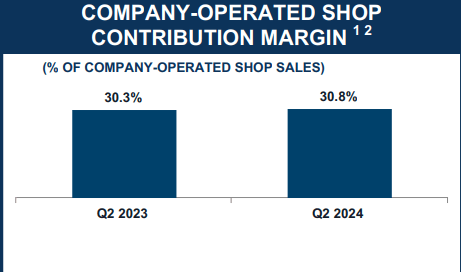

Same shop sales increased 10% in Q1 and 4.10% in Q2 2024, without selling off its products as the company-operated shop contribution margin improved.

BROS Q2 2024

In addition, 36 new stores were opened in Q2 alone. The company has been opening at least 30 new stores for 12 quarters in a row.

Objectively, BROS is going through a better time than SBUX, but the aspects that have driven this trend depend on subjective consumer preferences. After all, we’re not talking about aerospace engineering, and there are no metrics that can determine whether BROS’s coffee is actually better than SBUX’s: It’s simply a matter of personal preference.

Since an objective comparison between the products the two companies sell is not possible, to understand why people prefer BROS I read for hours what the opinions of people who have tried both are. Here are the main themes I found:

- BROS has a greater variety of sugar-free products than SBUX, which is why it’s preferred by people with diabetes or those who are careful about how many calories they take in. In addition, BROS has more flavors available.

- BROS is less well-stocked than SBUX in terms of food, but it has a wide selection of beverages. In particular, its strengths are cold drinks and energy drinks. The latter are attracting younger customers.

- The third factor is probably the most important and concerns BROS employees, who are much more friendly than those at SBUX: customers feel more comfortable.

- BROS beverages are generally considered to be of higher quality than those of SBUX because the coffee does not taste burnt. This issue has been highlighted many times, but it obviously does not affect all SBUX stores.

- The prices of BROS drinks are comparable to those of SBUX, but their size may be bigger.

In general, people who try BROS tend to return there, not only because of the taste of their products but also because of the friendliness of the employees. The target audience is mainly young people, who feel part of a community by stopping for a few minutes at BROS. Since it mainly provides cold drinks, BROS is preferred to SBUX after lunch. I, personally, have not had a chance to try BROS, but it would also be interesting to understand your point of view in the comments, especially those who have tried both.

Risks and valuation

As I have mentioned several times, BROS’s main risk is its size, which is not yet large enough to take advantage of important economies of scale. SBUX is facing a complicated period, but with the new CEO, the games could change. The company could expand its cold drink offerings as well as attract younger customers by selling energy drinks.

To date, BROS does not have a big enough competitive advantage, and industry giants can wipe it out by operating at a loss. For example, McDonald’s in late December 2023 launched CosMc’s. The business model is virtually the same as BROS, the only difference being that McDonald’s can count on an annual free cash flow of $7 billion. Having that amount of money and a brand that is already recognized worldwide is a strength that BROS cannot count on.

If it wanted to, CosMc’s could sell its products at an extremely low price (operating at a loss) with the aim of wiping out all the competition in the industry, including BROS. This is a tangible risk that can be avoided only if BROS succeeds in making its brand stand out from the crowd, which is not easy since it sells products that are easily replicable. So far, the results achieved have been objectively positive, but the future remains uncertain.

As for the valuation of BROS, it’s complicated to make fair value estimates since its negative free cash flow does not allow the use of the discounted cash flow model: A valuation based on multiples is more reasonable, in my opinion. In particular, I would rely more on sales than earnings since it is still in the early stage of its expansion.

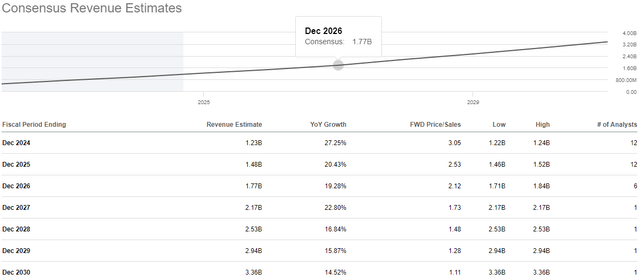

BROS’s NTM Price / Revenues is currently 2.77x, not too different from SBUX’s 2.91x despite the fact that the two companies are growing at completely different rates. Street estimates of BROS’ 2030 revenues are $3.36 billion, implying a potential market cap of $9.30 billion (six-year CAGR 8.50%) if the multiple remains the same. However, this is a rough estimate since the multiple may vary as well as the growth rate.

Seeking Alpha

In my opinion, the Street Estimates may be too conservative given the company’s potential. A growth rate of 14.52% in 2030 is too little compared to the strong expansion plan discussed above. By the way, in addition to creating at least 30 new stores each quarter, BROS is also gradually increasing revenues per store. Keeping the multiple at 2.77x, assuming revenues grow 25% from 2024E to 2030, the CAGR rises to almost 15%.

Overall, I rate BROS as a buy: The company is not expensive given its potential, but it is also not the bargain of a lifetime at these prices. If the price hits $20-$25 per share, at that point I might consider a strong buy.

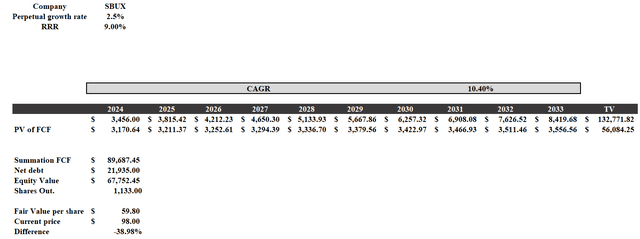

As for SBUX, it’s possible to make more specific assumptions about being a more established company. I constructed a discounted cash flow model with the following inputs:

- RRR of 9% being a solid company in the market in which it operates. Entering too high an RRR would not make sense since it is not a high-risk investment.

- Starting with the 2024 free cash flow estimate (Street Estimates), I have factored in a 2024-2033 growth rate of 10.40% per annum, double what was achieved from 2015 to 2023. In other words, I’m assuming that the new CEO will do a great job.

DCF model

Based on these assumptions, the fair value is almost $60, much lower than the current price. Since this model is only quantitative, it does not take into account brand recognition and market dominance, but the result obtained is rather disappointing. My estimates were optimistic, yet the company remains overvalued even if we included a premium of $10-20 above fair value.

Overall, from a quantitative point of view, at the current price in my opinion, SBUX is a bad investment while BROS represents an interesting option. If I currently wanted to buy an industry giant, I would prefer MCD to SBUX by far, but that may be the subject of another article.

Conclusion

SBUX has been facing a complicated period for several years even though it still maintains leadership in its industry. Competition has become increasingly fierce and BROS is taking advantage of this weak moment. In particular, it has been gaining market share in cold drinks due to its wide selection that can satisfy any customer: From protein drinks to sugar-free drinks in any flavor.

Beyond customer focus, my preference for BROS depends mainly on the potential of its operating margin: As each shop is very small but efficient, operating costs are very low. Moreover, should it achieve its plan to expand to 4,000 stores, it will benefit from significant economies of scale.

SBUX thought it was too big to suffer from competition and relaxed too much, but now it’s facing a reality check. Dissatisfied customers have increased over time and are less willing to spend as shown by data on same-store sales. In any case, SBUX still has all the cards to succeed in turning itself around and putting BROS in trouble. McDonald’s is the other giant to keep an eye on.

As for BROS valuation, it’s complicated to know how much its fair value might amount to since the company is currently burning cash and diluting its shareholders. Much will depend on its growth rate. If it were to be 25% per year until 2030 (which I think is possible), I think there’s a good chance that BROS will turn out to be a good investment. Different discussion for SBUX: At the current price no premium can justify a buy, which is why I consider it a sell.

Read the full article here

Leave a Reply