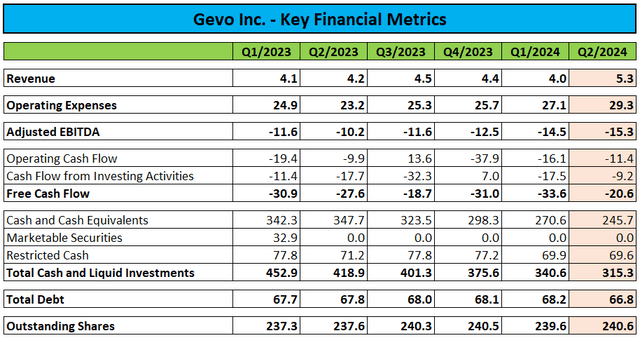

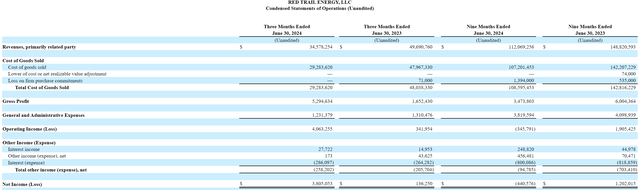

Aspiring sustainable aviation fuel provider Gevo, Inc. or “Gevo” (NASDAQ:GEVO) has a long history of overpromising and underdelivering. Over the past decade, the company has burned almost $600 million in cash without showing much if any tangible progress, as very much evidenced by the company’s most recent quarterly results:

Company Press Releases and Regulatory Filings

With revenues in the mid-single digit million dollar range and sizeable operating expenses, cash burn has been close to $30 million on average over the past couple of quarters.

The company finished H1/2024 with $245.7 million in unrestricted cash and cash equivalents and $66.8 million in debt, with the latter being fully covered by restricted cash.

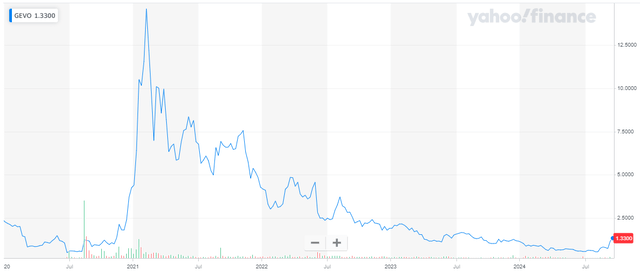

Gevo’s shares have been a momentum crowd favorite in the past, but the stock price has languished following a short-lived alternative energy hype in 2020/2021:

Yahoo Finance

However, last week’s announcement attracted investors back to the stock, with shares up by almost 100% over the past three sessions:

Yahoo Finance

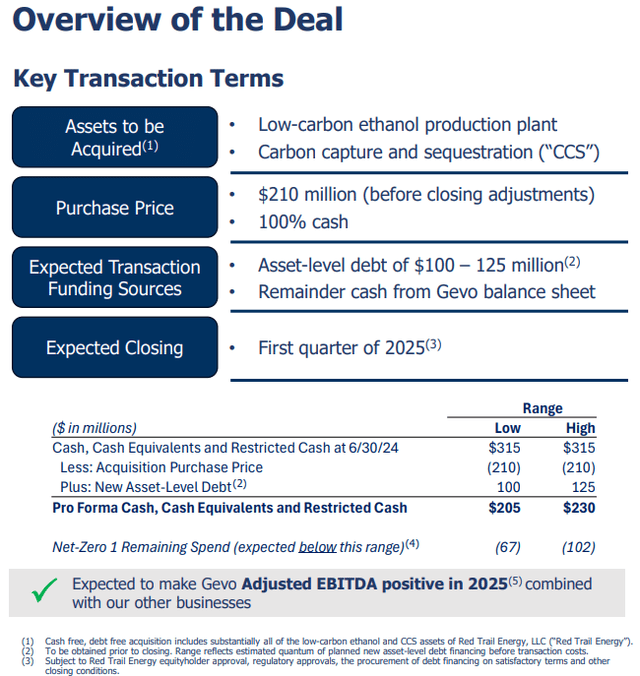

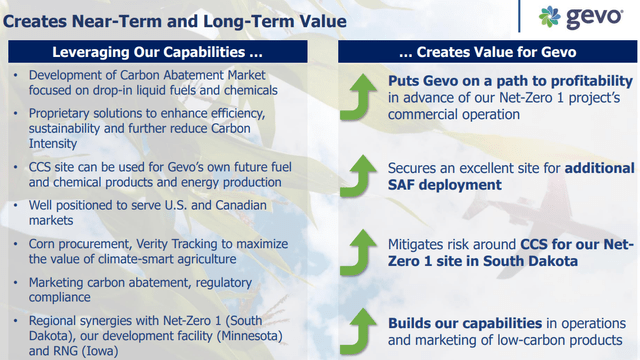

In short, Gevo has signed a definitive agreement to acquire the ethanol production plant and carbon capture and sequestration (“CCS”) assets of Red Trail Energy LLC for $210 million in cash which the company expects to finance with “a combination of asset level debt and cash from the balance sheet.”

Company Presentation

In the press release, management celebrated the acquisition as a game changer:

We accomplish several things with this investment. It immediately puts us on a path to becoming self-sustaining and profitable as a company in advance of our Net-Zero 1 project’s commercial operation. Not only are we securing an excellent site for additional SAF asset deployment, but we also mitigate risk around carbon sequestration regarding our Net-Zero 1 plant site in South Dakota. This acquisition gives us the opportunity to build capability as a company and is a terrific training ground for our Net-Zero 1 project, as we inherit a trained cadre of employees who understand plant operations.

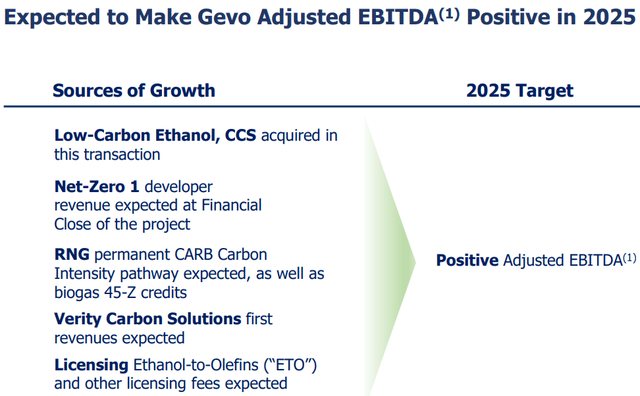

In fact, Gevo expects the transaction to result in the company generating positive Adjusted EBITDA next year:

Company Presentation

However, taking a look at Red Trail Energy’s recent results, it’s difficult to believe in management’s claims:

Regulatory Filings

While Q2/2024 was a profitable quarter due to lower input prices, ethanol margins tend to be volatile and have been rather challenging recently.

Even with anticipated contributions from the ramp-up of other business segments, it is difficult to envision a $60+ million improvement in Adjusted EBITDA next year without highly favorable ethanol crush margins.

In addition, acquired cash flows will be impacted by the requirement to service up to $125 million in required debt financing.

Moreover, I would expect the company to seize the opportunity and start selling shares under its $500 million At The Market (“ATM”) Offering Agreement with H.C. Wainwright & Co. to raise funds for the equity portion of the deal.

Investors looking to capitalize on last week’s news should rather consider an investment in Alto Ingredients (ALTO), a company that operates ethanol plants in Illinois, Idaho, and Oregon, with the latter facilities likely being available for sale at the right price.

Even when applying a 50% discount to the terms of the Red Trail Energy acquisition, Alto Ingredients’ Magic Valley, Idaho facility could be worth close to $100 million alone, which is material for a company with an enterprise value of just $200 million.

However, the company’s operating performance has been mixed at best in recent quarters, and management hasn’t yet launched an official strategic review.

Regarding Gevo, after decades as a development-stage company, management is likely looking to be recognized as a serious player in the renewable fuels market with real revenue-generating assets while at the same time derisking its sustainable aviation fuel commercialization efforts.

Company Presentation

Given the lack of tangible progress over the past decades, I remain skeptical regarding Gevo’s ability to “become a self-sustaining and profitable business” as envisioned by management, anytime soon, if ever.

In addition, investors need to be wary of renewed dilution from potential open market sales under the company’s $500 million ATM agreement.

Pro forma for the proposed transaction, Gevo’s enterprise value has increased to approximately $300 million, which is 50% above Alto Ingredients’ valuation despite its much larger total production capacity.

Bottom Line

The proposed acquisition of Red Trail Energy’s ethanol plant and CCS assets will transform Gevo from a development stage entity to a business with an estimated $150 million in annual revenues.

However, management’s expectation of near-term Adjusted EBITDA profitability appears overly ambitious, thus setting Gevo up for renewed disappointment next year.

In addition, I wouldn’t be surprised to see the company selling new shares into the open market to capitalize on the massive rally and finance the equity portion of the transaction.

Going forward, Gevo investors will need to have a close eye on ethanol crush margins as the prime determiner of future profitability and cash flow.

Given the company’s high valuation relative to much larger competitor Alto Ingredients, investors should consider using the most recent rally in Gevo’s shares to exit existing positions.

While Alto Ingredients certainly isn’t flawless either, the company represents an inexpensive bet on a lucrative sale of its Western assets, a speculation that might be fueled by the substantial price offered by Gevo for Red Trail Energy’s assets.

Read the full article here

Leave a Reply