Key News

Asian equities were lower overnight, except for India and Thailand.

The Fed pause narrative is struggling as the US economy’s strength, and higher oil prices decrease the odds of a pause, sending the US 10-year Treasury yields higher. This also sent the dollar higher, which weighed on risk assets globally.

The common narrative that people will tell you on Apple

AAPL

Bloomberg News got in on the fun, stating that the ban would be extended to “government-backed agencies and state owned companies.” Bloomberg News’ source for the story was “people familiar with the matter.” Again, is a rumor worth $106 billion in market cap? The “news” whacked Apple’s supply chain across Asia, including Taiwan Semiconductor, which fell -2.47%, losing $12 billion in market cap.

Huawei’s successful new phone launch has folks in DC fired up, which was also blamed for the weakness in Asian stocks overnight. One needs to remember anyone in DC can say anything they want, though it doesn’t make it a law. This doesn’t seem to be widely understood in the US and is less understood outside the US. Due to its veto power, communication from the White House is essential. Alternatively, what if Apple is down because Huawei’s phone is a legitimate challenge to an iPhone?

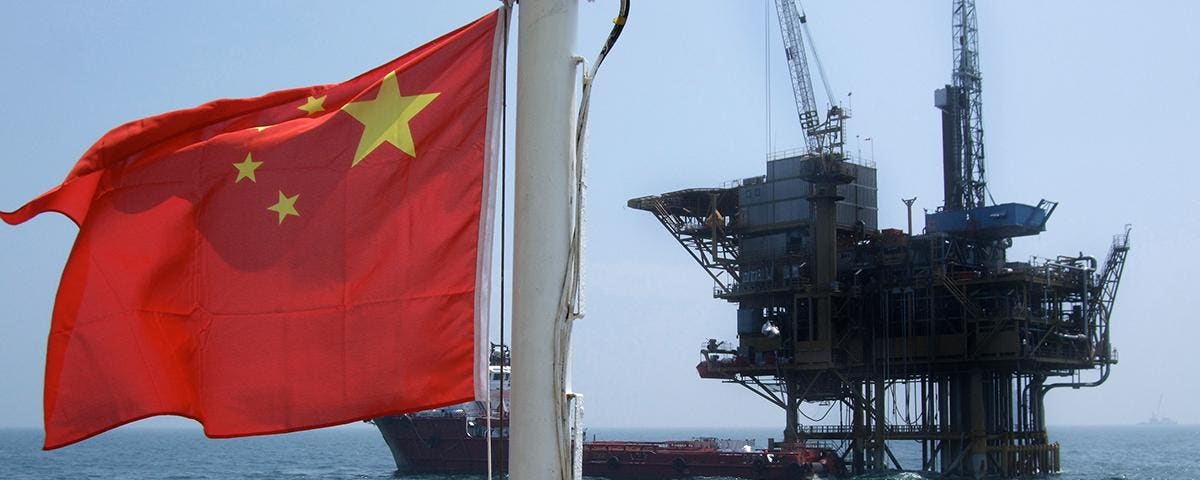

China’s August trade data release beat expectations. Headlines referencing big declines are quoting the US dollar figures. In Renminbi, the numbers were down year-over-year (exports -3.2% and imports -1.6%) but down significantly less than July’s exports, which fell -9.2%, and imports, which fell -6.9%. The trade data in US dollars showed that exports declined -8.8% and imports declined -7.3%, though the US dollar’s strength/renminbi weakness over the last month -2.6%. While many commodity imports were down in percentage terms, exports of oil and steel were up in tons, similar to those of coal, oil, iron ore, copper, etc. There was very little single stock news as advance/decline breath was very weak, as foreign investors sold Mainland stocks via Northbound Stock Connect.

The Hong Kong government created a task force to study the Hong Kong market’s liquidity and “recommend solutions to the city’s leader as soon as possible.” Cutting the stamp tax is an obvious no-brainer as Hong Kong is a global outlier for its transaction tax, which leads to wider bid-ask spreads and disincentivizes trading. The elimination will not solve the market’s issues. An examination of Hong Kong’s very high short turnover would also benefit shareholders.

Today, 21% of Hong Kong’s Main Board, which is comprised of large caps stocks, was short turnover. From 12/31/2010 to 12/31/2021, Main Board turnover averaged 12%, with only two days (8/26/2019 and 5/29/2020) when short turnover was 20% or more. Since 12/31/2021, there have been 69 days of short turnover at 20% or more of total, with the average since 12/31/2021 at 17% of total turnover. If you want to solve a real issue, solve that one.

The Hang Seng and Hang Seng Tech fell -1.34% and -2.04%, respectively, on volume that decreased -6.56% from yesterday, which is 75% of the 1-year average. 94 stocks advanced, while 399 fell. Main Board short turnover increased +17.07% from yesterday, 96% of the 1-year average, as 21% of turnover was short turnover. The value factor “outperformed” the growth factor as large caps fell less than small caps. Energy and utilities were the only positive sectors +1.09% and 1%, while real estate -2.48%, materials -1.81%, and discretionary -1.73% were the worst performers. The top sub-sectors were energy, telecom services, and utilities, while semis, real estate, and food were the worst. Southbound Stock Connect volumes were moderate/high as Mainland investors bought a healthy $898mm of Hong Kong stocks and ETFs, with the Hang Seng Tracker seeing a very large net buy, CNOOC, ICBC, PetroChina, Sunac, SMIC and Country Garden all small net buys while Tencent and Meituan were small net sells.

Shanghai, Shenzhen, and the STAR Board fell -1.13%, -1.76%, and -3.72%, respectively, on volume that decreased -0.46% from yesterday, which is 87% of the 1-year average. 473 stocks advanced, while 4,321 declined. The value factor fell less than the growth factor, while large caps fell less than small caps. Energy was the only positive sector, while tech -3.07%, industrials -2%, and healthcare -1.73% were the worst performers. The top sub-sectors were education, oil, and highways, while semis, computer hardware, and fine chemical industry were the worst. Northbound Stock Connect volumes were light as foreign investors sold a healthy -$965mm of Mainland stocks with CATL and BYD moderate/small net buy while Kweichow Moutai was a moderate net sell, LXJM and Longi small net sells. CNY and the Asia dollar index fell versus the US dollar. Treasury bonds were bought while copper and steel were off.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.32 versus 7.30 yesterday

- CNY per EUR 7.84 versus 7.84 yesterday

- Yield on 10-Year Government Bond 2.63% versus 2.63% yesterday

- Yield on 10-Year China Development Bank Bond 2.77% versus 2.77% yesterday

- Copper Price -0.55% overnight

- Steel Price -0.50% overnight

Read the full article here

Leave a Reply