We believe DexCom stock (NASDAQ

NDAQ

DXCM

ISRG

Interestingly, ISRG and DXCM have had a Sharpe Ratio of 0.7 since early 2017, higher than 0.6 for the S&P 500 Index over the same period. Still, they fall short of the Sharpe of 1.3 for the Trefis Reinforced Value portfolio. Sharpe is a measure of return per unit of risk, and high-performance portfolios can provide the best of both worlds.

Looking at stock returns, ISRG, with 16% returns this year, has fared better than DXCM stock, down 6%. This compares with 16% gains for the broader S&P500 index. There is more to the comparison, and in the sections below, we discuss why we believe DXCM stock will offer better returns than ISRG stock in the next three years. We compare a slew of factors, such as historical revenue growth, returns, and valuation, in an interactive dashboard analysis of Intuitive Surgical vs. DexCom: Which Stock Is A Better Bet? Parts of the analysis are summarized below.

1. DexCom’s Revenue Growth Is Better

- DexCom’s revenue growth has been better, with a 25.5% average annual growth rate in the last three years, compared to 12.4% for Intuitive Surgical.

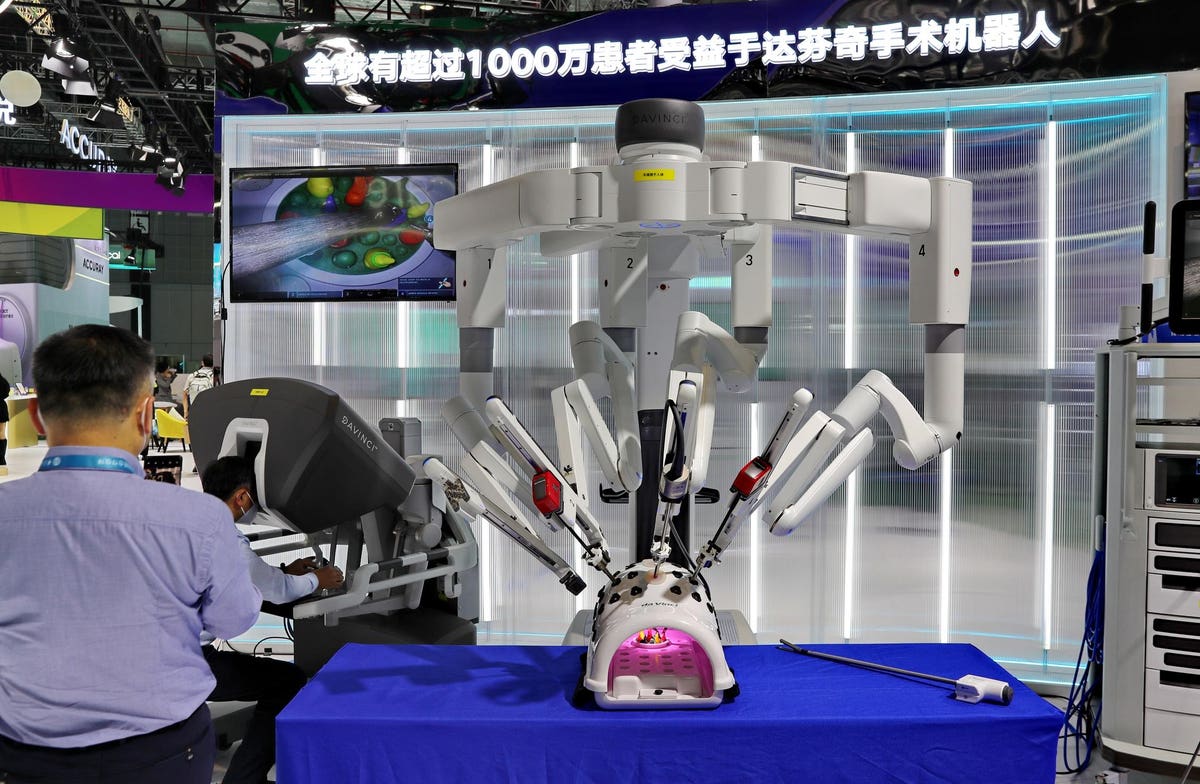

- For Intuitive Surgical, revenue growth over the recent past has been driven by a rebound in procedure volume, which was adversely impacted in the initial phases of the pandemic due to the shelter-in-place restrictions. The company continues to expand its installed base, which results in the growth of recurring revenues, such as consumables.

- Intuitive Surgical’s installed base has increased 35% to over 7,500 in 2022, compared to less than 5,600 in 2019.

- New customer additions are leading the revenue growth for DexCom amid rising awareness of CGM devices. DexCom is among the few players with regulatory approvals for its wearable continuous glucose monitoring device.

- Looking at the last twelve-month period, DexCom’s 19.6% sales growth fares better than 11.7% for Intuitive Surgical.

- Our Intuitive Surgical Revenue Comparison and DexCom’s Revenue Comparison dashboards provide more insight into the companies’ sales.

- Looking forward, DexCom’s revenue is expected to grow faster than Intuitive Surgical’s over the next three years. The table below summarizes our revenue expectations for the two companies over the next three years. It points to a CAGR of 13.7% for Intuitive Surgical, compared to a 20.5% CAGR for DexCom, based on Trefis Machine Learning analysis.

- While Intuitive Surgical will likely continue to benefit from a rise in total procedure volume, DexCom’s sales growth will likely be bolstered by its G7 CGM system in the U.S., which secured regulatory approval in December 2022.

- Note that we have different methodologies for companies negatively impacted by Covid and those not impacted or positively impacted by Covid while forecasting future revenues. For companies negatively affected by Covid, we consider the quarterly revenue recovery trajectory to forecast recovery to the pre-Covid revenue run rate. Beyond the recovery point, we apply the average annual growth observed three years before Covid to simulate a return to normal conditions. For companies registering positive revenue growth during Covid, we consider yearly average growth before Covid with a certain weight to growth during Covid and the last twelve months.

2. Intuitive Surgical Is More Profitable, And It Comes With Lower Risk

- Intuitive Surgical’s reported operating margin slid from 30.7% in 2019 to 25.3% in 2022, while DexCom’s operating margin expanded from 9.4% to 13.5% over the same period.

- Looking at the last twelve-month period, Intuitive Surgical’s operating margin of 24.3% fares better than 14.0% for DexCom.

- Our Intuitive Surgical Operating Income Comparison and DexCom Operating Income Comparison dashboards have more details.

- Looking at financial risk, Intuitive Surgical is much better placed than DexCom. Its <1% debt as a percentage of equity is lower than 8% for the latter, while its 51% cash as a percentage of assets is much higher than 18% for the latter, implying that Intuitive Surgical has a better debt position and has more cash cushion.

3. The Net of It All

- Intuitive Surgical is more profitable and offers lower financial risk. On the other hand, DexCom has demonstrated better revenue growth and is available at a comparatively lower valuation.

- Now, looking at prospects, using P/S as a base, due to high fluctuations in P/E and P/EBIT, we believe DexCom will likely offer better returns despite its higher valuation.

- If we compare the current valuation multiples to the historical averages, DexCom fares better. Intuitive Surgical stock trades at 16x revenues compared to its last five-year average of 21x, and DexCom stock trades at 13x revenues vs. the last five-year average of 21x.

- Our Intuitive Surgical Valuation Ratios Comparison and DexCom Valuation Ratios Comparison have more details.

- Both ISRG and DXCM have recently seen a decline after Novo Nordisk’s success with its obesity drugs in reducing the risk of cardiovascular events. Investors are concerned that this may result in lower demand for CGM devices in the long run, while Intuitive Surgical is already seeing a decline in demand for robot-assisted bariatric surgeries as patients opt for weight-loss drugs. [1]

- That said, the impact of declining bariatric surgeries is expected to be limited for Intuitive Surgical. Less than 300,000 bariatric surgeries are performed annually in the U.S., making its total instruments market size around $600 million.

- Looking at DexCom, a CGM device will likely be a helpful tool to monitor the effectiveness of the drugs on a patient.

- The table below summarizes our revenue and return expectations for Intuitive Surgical and DexCom over the next three years and points to an expected return of 45% for ISRG over this period vs. a 98% expected return for DXCM stock, implying that both stocks offer excellent buying opportunity at current levels. Still, if one has to pick among the two, DXCM appears to be a better bet, based on Trefis Machine Learning analysis – Intuitive Surgical vs. DexCom – which also provides more details on how we arrive at these numbers.

- The 98% returns figure for DXCM appears significant, but it makes sense in our view. DexCom’s last twelve months’ sales stood at $3.2 billion, and it expects 2025 sales to be around $5 billion. We forecast sales to be $5.6 billion three years from now, rising at 20% annually. DexCom’s P/S multiple has declined to 13x now (the last five-year average is 21x), and it should expand slightly to 15x in the next three years, resulting in a market capitalization of $82 billion vs. $41 billion now, implying 2x returns.

While DXCM may outperform ISRG in the next three years, it is helpful to see how Intuitive Surgical’s Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

Despite higher inflation and the Fed raising interest rates, ISRG stock has risen 16% this year. But can it drop from here? See how low Intuitive Surgical stock can go by comparing its decline in previous market crashes. Here is a performance summary of all stocks in previous market crashes.

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here

Leave a Reply