A Hold Rating for shares of Centerra Gold

This article assigns another Hold recommendation on the stock of Centerra Gold Inc. (NYSE:CGAU) (TSX:CG:CA), a Toronto, Canada-based exploration and mining company for gold and copper properties in British Columbia, Canada, and Turkey, confirming the same rating indicated in the previous analysis.

The Öksüt mine involves simultaneous mining of the two pits of the main Keltepe mine and the small Güneytepe satellite mine, both of are mining since the beginning of the third quarter of 2019. The whole metal mine will be in operation until 2029 and will have produced 895,000 ounces of gold as of 2019 until 2029.

The Mount Milligan Mine is currently authorized to operate at an average throughput pace of 60,000 tonnes per day over a calendar year. The mine life has been extended by two years to 2035 as the aim is to strengthen the mine in exploiting 510 million tonnes of mineral resources including reserves. The two-year mine life extension is part of an additional agreement with Royal Gold recently signed, which includes a strategy to unlock the further potential of these assets through further exploration drilling and optimization programs.

The Reasons for the previous Hold rating

The previous rating was given for the following reasons: an expected upward trend in gold and copper prices coupled with continued improvement in the company’s operations, namely the recovery of Turkish gold doré bar production at the Öksüt Mine following the mercury contamination at the facility in 2022 and the good performance of the assets in British Columbia. The combination of these positive corporate and metal price factors was viewed as a basis for improving Centerra Gold Inc.’s operating cash flow and liquidity. With operating cash flow and cash on hand grabbing the headlines in Centerra Gold’s quarterly reports, any change in these two metrics would reasonably have caught the stock market’s attention. Therefore, the previous article argued that holding shares was encouraged by the promising prospects for “operating cash flow and liquidity” key drivers of the Centerra Gold stock market.

Centerra Gold Stock Since the previous Hold rating

The company’s cash flow and cash on hand have demonstrated their potential as a driving force, but there have also been short-term, sometimes significant, headwinds that have attempted to hamper the share price performance, resulting in the following picture: Since the previous analysis, investing in Centerra Gold stock has returned 24.59% (or 28.02% including dividends), compared to the 16.52% change in the S&P 500 (a measure of the overall performance of the US stock market), based on a linear return, i.e., excluding fluctuations in between. The clarification of the linearity of the returns is because an even greater benefit to the investor could come from taking advantage of lower stock prices as they form, consistent with a “Hold” stance.

My last analysis was followed by strong stock price rallies, each time neutralizing fears of a postponement or a much less sharp rate cut than expected by the Federal Reserve. Higher interest rates, or the expectation that they will remain quite high for longer than expected, tend to hurt Centerra Gold’s stock price because they are associated with lower prospects for Centerra’s cash flow, the profitability metric that drives the company’s stock prices. Let’s delve a little deeper into this dynamic. High interest rates increase the opportunity cost of holding gold instead of U.S. bonds because gold pays no income while U.S. bonds pay interest income at a fixed rate. Higher interest rates are also slowing industrial projects that use copper, as borrowing to finance growth projects tends to be more expensive than before. As demand for gold declines and copper consumption is affected, the prices of these metals will most likely come under negative pressure as well. Expectations for Centerra Gold’s profitability cannot improve as prices and demand for these two metals come under pressure, and with profitability being a driving force behind the share price, the market for the shares of Centerra Gold, which produces and sells gold and copper, is likely to become pessimistic.

2 Big Drops for Centerra Gold shares along the way, but just Short-Term

Indeed, as hopes of a Fed rate cut faded due to more stubborn than expected inflation or a robust economy despite the Fed’s hawkish stance, shares of Centerra Gold experienced temporary but strong headwinds in late September and mid-February.

- On September 21, 2023, gold prices “fell by the most in two months”, also ending a five-day winning streak as the Federal Reserve hinted at the possibility of even higher interest rates and unlikely rate cuts in 2024, as the market had instead predicted and hoped.

- Gold prices hit a near two-month low on February 15, 2024, as higher-than-expected inflation numbers in January dampened hopes of quick and deeper interest rate cuts this year. Similar to late September, the headwind for Centerra shares came from record low gold prices – gold accounts for 80% of Centerra Gold’s cash flow (a measure of profitability) – while copper prices instead remained robust over the period, supported by a pullback in the US Dollar Index (DXY) and hopes for better demand prospects for China’s largest metals consumer thanks to Beijing’s efforts to stimulate its economy and real estate sector.

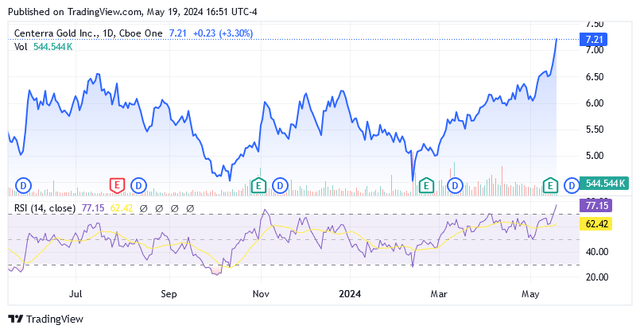

In the wake of the above two major headwinds, Centerra Gold shares were in a steep downtrend until bottoming out, evidenced by the strong bearish sentiment in stock prices and RSI oversold levels in late September/early October 2023 and mid-February 2024.

CGAU stock on the NYSE compared to the 14-Day Relative Strength Indicator (or “RSI”) Over the Past Year:

Source: Seeking Alpha

CG:CA stock on the TSX (or “Toronto Stock Exchange”) compared to the 14-Day Relative Strength Indicator (or “RSI”) Over the Past Year:

Source: Seeking Alpha

The headwinds ended once fears of higher-for-longer interest rates for gold were erased by renewed optimism around Centerra stock: Market sentiment picked up following Centerra’s quarterly reports, which highlighted a sharp increase in liquidity due to the growth of the operating cash flow, despite persistently expensive loans and tight credit conditions.

The Upside Catalyst for good weather back in Centerra stock: Rising cash

After erasing the headwind for metals from fears of higher-for-longer interest rates, market sentiment returned bullish in the following three sub-periods thanks to the impact of these catalysts, according to Centerra’s quarterly reports:

From Q3 2023

On October 31, 2023, Centerra Gold released its operating and financial results for the third quarter of 2023, which reflected a significant increase in the company’s cash on hand to $492.1 million, a 22.5% sequential jump.

The higher liquidity was primarily due to the following factors: higher gold sales due to increased gold production at the Öksüt mine, and Centerra’s investments in operational and technical improvements at the Mount Milligan mine, which consisted mainly of metallurgical reviews aimed at increasing recovery and unlocking potential. The potential was not there yet, but the conditions were created for growth in the coming quarters. Ultimately, the investments resulted in higher operating costs, but with its strong ramp-up, the Öksüt mine was able to offset these with efficiency.

Backed by the process of high-grade gold ounces and ramp-up following the 2022 mercury incident, Öksüt Mine production of 86,667 ounces of gold, drove Centerra gold production up 133% year-over-year to 126,221 ounces in the third quarter of 2023 including Mount Milligan Mine production of 39,554 ounces of gold. Mount Milligan also produced 15 million pounds of copper in the third quarter of 2023, but metals production was affected by the mining sequence and lower-than-planned gold recoveries, which the company said it was trying to improve. Gold production implied consolidated gold production costs of $643 per ounce and all-in sustaining costs (or “AISC”) on a by-product basis of $827 per ounce, each representing a decrease of 12% year-over-year.

A 133% year-over-year increase in gold volumes sold to 130,973 ounces in the third quarter of 2023 could be accompanied by a 45% higher average realized gold price of $1,741/ounce as favorable market conditions resulted in an average market price of gold rising to $1,929/ounce or up 12% compared to the previous quarter last year.

In anticipation of the aforementioned technical improvements delivering tangible results to Mount Milligan’s operations, Centerra copper sales in the third quarter of 2023 totaled 15.385 million ounces, down 22% year-over-year, with 52% higher copper production costs equal to $2.30/lb. and a 53% higher AISC on a co-product basis of $2.73/lb. However, thanks to favorable pricing conditions in the market, the average market price for copper increased 8% year-over-year to $3.79/lb. in Q3 2023, so Centerra’s lower copper sales volume and higher costs were offset by a 20% increase in the average realized copper price to $2.99/lb.

Waiting for Mount Milligan to find its best form, significantly higher gold margins – they determine 80% of the company’s profitability – thanks to higher gold prices and the recovery of Turkish operations have led to a positive turn in operating cash flow and free cash flows to respectively $167 million from the prior year’s loss of $17 million and to $144.4 million compared to the prior year’s loss of $35.5 million. These results of free cash flow were possible despite a 53% increase in total capital expenditure to $25 million, earmarked for operational and technological improvements at Mount Milligan and to replenish Öksüt inventory of high-grade gold ounces to be mined in the following months.

From Q4 2023

On February 22, 2023, Centerra Gold released its operating and financial results for the final quarter of 2023, which reflected a significant increase in the company’s cash and equivalents to $613 million, a 24.5% sequential jump. The main driver of cash growth was a significant cash flow of $145.4 million – a positive turnaround from a $9.8 million loss in the same quarter of 2023 – still supported by the Öksüt mine’s surge following the 2022 mercury incident and Mount Milligan, which achieved its record mill throughput thanks to the aforementioned improvements. The benchmark to assess whether the plant will run faster or slower in the future is: the plant processed an average throughput of 60,927 tons per day in the fourth quarter of 2023, as this is the highest achieved by Mount Milligan since its start-up in August 2023.

As such, the operation fetched a whopping 163% year-over-year rise in gold sales to 130,281 ounces and a significant 8% year-over-year rise in copper sales to 16.6 million pounds, with volumes encountering a higher average realized gold price, rising 37% to $1,846 /ounce and robust realized copper prices averaging $3/lb. Although the copper price was below the fourth quarter of 2022 $3.43, it was in line with its historical trends and the investor will certainly remember that 2022 was a disruptive year for the copper market due to the unusual upward pressure on commodity prices following the invasion of the Russian Federation troops in Ukraine and the energy crisis. These realized prices include hedging strategies and an agreement with Royal Gold, Inc. (RGLD) having the right to buy 35% of Mount Milligan gold production at $435/oz and 18.75% of Mount Milligan copper production at 15% of the spot price of the delivered copper. These contracts can support the company’s profitability if commodity prices are too bearish in the markets. This is ensured through hedging strategies and less through the agreement with RGLD, it must be said, as actually, the latter implies a very low selling price compared to market trends. But despite all the limitations of various contracts and hedging strategies because they also have some cons and not just pros, obviously a bullish sentiment is preferred, as it can still have a positive impact on average realized metal price. From this perspective, the price outlook for Centerra production appears to be very solid given an uncertain global scenario, enhancing the gold commodity’s safe-haven properties and a bright future for copper as a fundamental input in energy transition projects. More about long-term gold prices: while the World Gold Council highlighted gold’s proven ability since 1971 to be a profitable investment even in peaceful times, it also acknowledged that ongoing political and economic uncertainty, as well as economic concerns, will continue to strengthen gold’s traditional role as a safe-haven good.

In 2023, Centerra Gold Inc. already got a taste of what the price scenario for the gold and copper markets could look like, as signaled in its balance sheet: an average market copper price of $3.85/lb. was just below the $3.99 per pound coming in an unusual 2022 for the commodity market, while the average market price for gold was $1,942/ounce, reflecting a good 8% growth rate from the $1,800/ounce level in 2022.

Higher ounces and pounds were reflected in lower costs as consolidated gold production costs fell 25% year-over-year to $595 per ounce and AISC on a by-product basis fell 16% year-over-year to $831 per ounce in the final quarter of 2023. Copper production costs also fell 8% year-over-year to $1.85/lb, while copper AISC on a co-product basis was nearly flat with the prior quarter at $2.42/lb.

As Mount Milligan increased throughput and Turkish operations processed high-grade gold, supported by significantly higher gold prices (80% of consolidated profitability), the company achieved strong operating cash flow, and despite higher capital expenditures of $36.4 million (versus $25 million in the previous quarter), robust free cash flow as well. Free cash flow turned positive to $111 million in the fourth quarter of 2023, versus a deficit of $25.3 million in the fourth quarter of 2022.

From Q1 2024

On May 14, 2024, Centerra Gold reported operating and financial results for the first quarter of 2024, which showed another increase in cash and equivalents to $647.6 million, a sequential advance of 6%, driven by strong cash flow from operating activities of $99.4 million in Q1 2024 from a deficit of $99.8 million in the same quarter of 2023. This was due to higher metal prices and although the throughput rate at the Mount Milligan processing plant was slightly lower at 56,728 tonnes per day compared to 60,927 tonnes per day in the fourth quarter of 2023.

Optimizing operations at Mount Milligan and Öksüt en route to achieving peak production in 2024 allowed Centerra Gold Inc. to exceed its expectations and deliver 104,313 ounces of gold sold in the first quarter of 2024, an increase of 168% over the same quarter in 2023, coupled with 15.622 million pounds of copper sold, an increase of 2% over the previous year quarter at significantly lower costs. These developed as follows: Gold production costs of $746/ounce fell by 34% year-on-year, and AISC on a by-product basis of $859 fell by 38%. Additionally, copper production costs decreased 28% year-over-year to $1.92/lb. and Copper – AISC on a co-product basis fell 22% year-over-year to $2.09/lb.

As for gold prices, gold posted its highest monthly rise in more than three years in March, driven by central bank purchases and bets on interest rate cuts, providing ample support to the quarterly average market price. As for copper prices, expectations of a “copper market returning to deficit” as the near turning point of monetary policy strengthens demand fundamentals despite an uncertain economic environment, it provided strong support to copper market prices in the first quarter. So that means that despite levels below market prices averaging $4.05/lb. in the first quarter of 2023, the average market price of $3.86/lb. in Q1-2024 remained well above the 5-year average of approximately $3.55/lb., allowing Centerra Gold to achieve $3.12/lb. in the first quarter of 2024. While much lower than the $3.42/lb. in Q1 2023, which was likely still feeling the impact of the spike in commodity prices in the 2021-2022 two-year period, the average realized price for Q1 2024 topped $3/lb. and $2.99/lb. recorded in the previous 2 consecutive quarters. In terms of gold prices, Centerra Gold Inc. achieved a 27% year-over-year growth in the average realized gold price of $1,841/ounce, benefiting from the positive tailwinds of a 10% year-over-year uptrend in the average market gold price of $2,074/ounce.

So, the catalysts of higher ounces and pounds of metals, coupled with higher or robust metal prices, while costs were in line or better than expected, led to the build-up of free cash inflow of $81.2 million, reflecting a positive turnaround from the $105.9 million deficit in the first quarter of 2023.

Production is Supported by a Solid Financial Position

The mineral activity has provided funds for a robust financial condition over time and Centerra Gold therefore boasts total liquidity of $1.05 billion as of March 31, 2024, including $648 million in cash balances and $399.3 million in undrawn cash available under a corporate line of credit. Centerra’s ability to make payments is dependent on the cash flow from its assets in British Columbia and Turkey and is also affected by principal and interest payments on the company’s debt facilities. The latter implied an interest expense of $0.7 million in the trailing twelve months through the first quarter of 2024, compared to an operating income of $158.5 million in the trailing twelve months through the first quarter of 2024. The last entry is 7.14 x the first entry and as a measure of interest coverage ratio, markets usually start at 1.5 to 2 to consider a company’s condition as financially robust and able to meet all obligations due to outstanding debt.

The reason for the Hold rating is that market sentiment becomes more optimistic as internally generated funds increase the company’s liquidity. This is in stark contrast to a context where debt is currently too expensive, or banks are more cautious about lending.

Also, the Altman Z-score of 2.81 indicates that Centerra Gold’s balance sheet is almost in safe zones, implying a very low probability of insolvency problems. The Altman Z-score predicts the likelihood of bankruptcy within two years. A score below 1.8 indicates high bankruptcy risk, while scores above 3 are associated with unlikely bankruptcy.

A solid financial position will be used by Centerra Gold Inc. to meet its full 2024 production and cost guidance through ongoing site-wide optimization of Mount Milligan, affecting management, mining, transport to mill and milling operations, and supporting Öksüt’s higher production going forward.

Supported by Öksüt’s extraction of ounces from high-grade inventories and heap leach areas, as well as Mount Milligan’s complete review of asset optimization leading to productivity and cost efficiency opportunities, Centerra Gold aims to:

- Consolidated gold production of 370,000 to 410,000 ounces in fiscal 2024, an increase of 11% from the midpoint of guidance over last year’s production of 350,317 ounces.

- Copper production of 55 to 65 million pounds, with the mean value of the forecast range close to 61.9 million pounds produced in 2023.

- The 2024 consolidated gold production cost forecast is between $800 and $900 per ounce (versus $733/ounce in 2023) and the forecast of consolidated gold- AISC on a by-product basis is between $1,075 and $1,175 per ounce (versus $1,013/ounce in 2023).

- Total Capital Expenditures of $108 million to $140 million versus $88.3 million in full year 2023.

As mentioned in the analysis, the metal price scenario is expected to be bright, and this will be crucial for Centerra Gold Inc.’s further liquidity enhancement through significant cash flows, so both metrics are expected to act as share price drivers in the coming periods as well. The company could return more money to its shareholders through:

- additional share buyback programs, in addition to a $10 million share repurchase program in the first quarter of 2024, withdrawing nearly 1.8 million common shares from the open market.

- continuing to finance the CA$7-cent/share quarterly cash dividend with the next one scheduled for distribution on June 12, 2024.

These two could add additional upward momentum to Centerra Gold Inc.’s stock price in both North American markets.

The Stock Price: A More Attractive Share Price in the Short Term Seems on the Way

CGAU stock on the NYSE compared to the MA Ribbon and 14-Day Relative Strength Indicator (or “RSI”) Over the Past Year: Shares of Centerra Gold Inc. under the CGAU symbol were trading at $7.21 per share on the NYSE as of this writing, for a market capitalization of $1.55 billion. Shares are not currently trading low compared to recent trends as they are very close to the upper limit of the 52-week range of $6.07 and $9.94/share. The shares are also well above the MA Ribbon.

Source: Seeking Alpha

The RSI of 77.15 indicates that shares have trespassed the overbought levels and that the room for additional upside from current levels shouldn’t be ample from current levels. They will likely need to pull back a bit and then recharge the batteries before mounting another strong upward rally, supported by the catalysts highlighted in this analysis. Shares are at the top of the stock price cycle and while that doesn’t mean they can’t offer further upside, with the RSI potentially signaling the start of bearish sentiment by indicating very tight conditions for the shares, rather than still in a rally mode these are seen entering in a bearish phase encouraged by the fact that, like commodities, they move through cycles. According to the next pattern, which is expected to provide the necessary headwinds, the Fed will not cut rates in June or even in late summer/early fall, but later in 2024. Because gold, unlike US Treasuries, does not generate income, its price will suffer from the Federal Reserve’s prolonged higher stance on the Federal Fund rates as investors will reasonably shift from gold to US Treasuries. With the yellow metal accounting for 80% of Centerra Gold’s profitability, negative pressure on the precious metal’s price will also try to dampen Centerra Gold’s stock. Inflation, which is the Fed’s target for the start of interest rate cuts, will soon come under pressure because people are known to spend more money when they are on vacation and the next vacation begins. In addition, people also have to bear various costs when they come back from vacation, such as bills, and school expenses for their children. As Fed Chairman Jerome Powell said, the central bank is in no rush to cut interest rates. There is therefore still room to determine whether the ongoing moderate slowdown in inflation is stronger than holiday spending – the signal the Fed may be waiting for to assess whether or not additional restrictive measures are necessary. Therefore, Centerra Gold investors may want to continue to hold on to their shares as the growth prospects for their investment, which appear to be robust in this analysis, will help the stock reach higher levels, but not before pulling back first under the impact of the scenario just described.

CG:CA stock on the TSX compared to the MA Ribbon and 14-Day RSI Over the Past Year: The same considerations apply to shares of Centerra Gold Inc. under the symbol CG:CA on the TSX: they were trading at CA$9.83/share at the time of writing, for a market capitalization of CA$2.11 billion. The shares are trading well above the level of earlier this year, as well as the MA Ribbon. Shares are also closer to the upper limit than the lower limit of the 52-week range of CA$6.07 to CA$9.94.

Source: Seeking Alpha

The 14-day RSI of 78.10 suggests there is plenty of room for CG:CA shares to pull back from these levels in the near term under downward pressure from the Fed’s “higher for longer” stance impacting gold prices.

Conclusion

The company is expected to pay about $105 million in taxes and annual royalties in Turkey in the second quarter, but its financial position is strong enough to cover the expenses. The company is on track to meet production targets and keep costs at the lower end of the forecast range. Additionally, as mentioned above, the outlook for gold and copper prices is bright. There is a high probability that the stock price will continue to rise due to the generation of robust cash flows. Stocks are not trading low as they are in the upper part of the cycle, and amid downward pressure on Centerra’s primary income commodity (zero-interest income-yielding gold) if the Fed were to delay rate cuts later this year, these stocks could pull back into the lower part for a more convenient level to exploit. For now, investors should continue to hold shares of Centerra Gold Inc.

Read the full article here

Leave a Reply