Compagnie Financière Richemont SA (OTCPK:CFRHF)(OTCPK:CFRUY), owner of Cartier, Van Cleef & Arpels, Buccellati, Montblanc, and multiple other renowned jewelry brands, is in its own unique category within the luxury sector.

Primarily focused on jewelry and watches, Richemont is a conglomerate that’s viewed by the market as being mediocre, as reflected by its relative multiple compared to peers.

Let’s see if the discount is justified following a decent FY24.

Introduction

I’ve been covering Richemont on Seeking Alpha for almost a year now, and it’s been quite an eventful period.

Following several years of severe underperformance which culminated in takeover rumors, it seems like ownership and management got the train back on track.

Still, the company continues to deal with multiple underperforming brands and a YNAP asset that bleeds money, with no white knight in sight. In addition, there’s still a lot to improve in terms of margin stability, and footprint optimization.

That’s why throughout the length of my coverage I maintained a cautious Buy rating. On the one hand, I viewed Richemont as inferior to peers like LVMH Moët Hennessy – Louis Vuitton, Société Européenne (OTCPK:LVMHF), but on the other hand, the company’s valuation already reflects that, and unlike struggling peers like Kering SA (OTCPK:PPRUF), I see significant progress from Richemont towards fixing its problems.

Richemont’s Is In Its Own Luxury Tier

Generally speaking, we can divide the luxury sector into three categories.

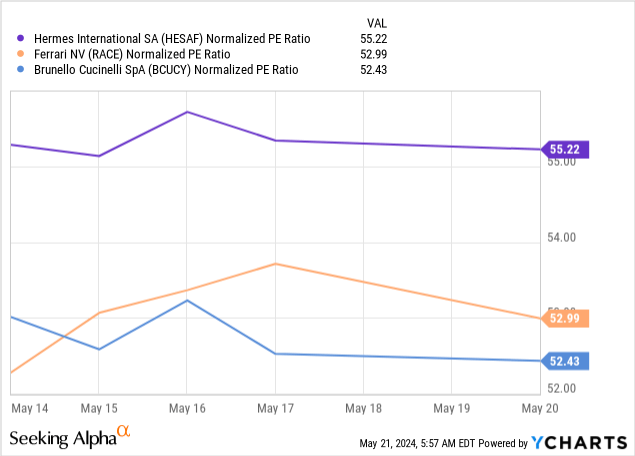

We’ll call the top-tier ultra-luxury. This category includes Hermès International Société en commandite par actions (OTCPK:HESAF), Brunello Cucinelli S.p.A. (OTCPK:BCUCF), and Ferrari N.V. (RACE). What these companies have in common is relatively low exposure to aspirational customers, as well as an intentional mismatch between supply and demand. Presumably, all three of those could double their sales immediately if they decided to increase supply.

The ultra-luxury tier trades in the 50x and above P/E range:

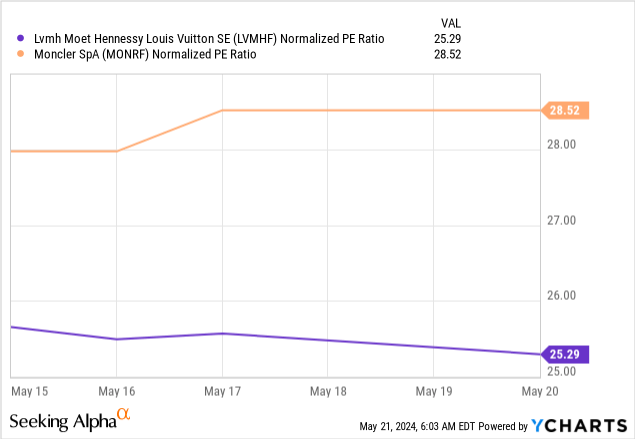

The second tier consists of Prada S.p.A. (OTCPK:PRDSY), LVMH, and Moncler S.p.A. (OTCPK:MONRF). We’ll call this group high-luxury. Broadly speaking, these companies cater to both aspirational customers and ultra-lux, with the mix somewhere in the 50/50 range. These companies performed exceptionally well over the last decade in terms of steady profitable growth, resulting in a very positive view of their leadership teams.

The high-luxury category trades in the 25x-28x P/E range (Prada is not on the graph but is currently at 27x):

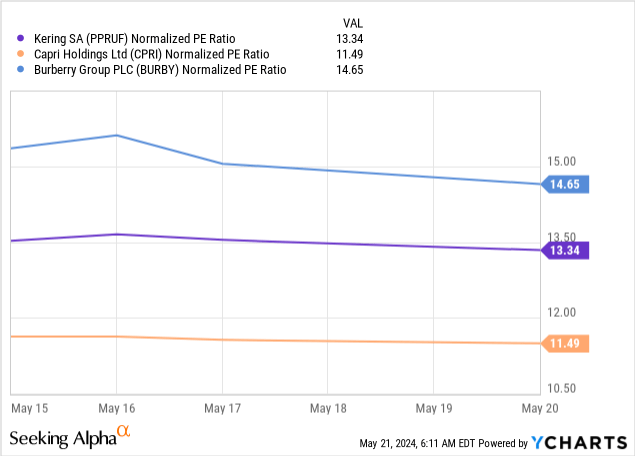

The third category is luxury laggards, under which I put Kering, Burberry Group plc (OTCPK:BURBY), and Capri Holdings Limited (CPRI). All these companies own very well-known brands, like Kering with Gucci, and Capri with Versace. However, due to different reasons such as inferior management, design and marketing failures, or high dependency on declining wholesalers, these companies haven’t been able to keep up with the industry.

As a result, these companies trade in the low teens in terms of P/E:

At last, we arrive at Richemont. The company is a serial acquirer, just like LVMH and Kering, and it is also owned by a controlling family. However, Richemont is primarily focused on jewelry and watches, whereas the rest of the names we discussed view these categories as another layer of their respective brands’ offerings.

Richemont had a much shakier decade compared to the high-lux category, growing revenues and EPS in single-digit CAGRs compared to the category’s high-teens.

In addition, it made several questionable decisions, including acquiring YNAP, and it still operates online second-hand marketplaces which don’t seem very synergistic or successful.

On the flip side, Richemont has performed much better than the laggards.

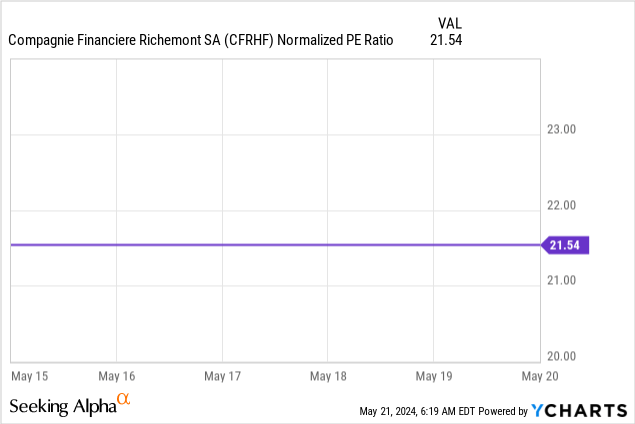

As a result, Richemont trades in its own sphere, somewhere in the 18x-22x P/E range. The question is whether it will catch up to high-lux, fall down to the laggards, or maybe it’s just in the right place. Before answering, let’s go over the FY24 results.

Fiscal 2024 Highlights

Richemont had a decent year, generating revenues of €20.6 billion, up 3% Y/Y on a reported basis, and 8% in constant currency. This compares to 4% reported growth, or 10% organic growth from LVMH, which operates at 4x the scale.

Looking at the recent quarter alone, revenues for Richemont grew 2% organically, compared to LVMH’s 3%. However, LVMH’s Watches & Jewelry segment, which mostly overlaps with Richemont, declined by 2%.

In terms of profitability, gross margins slightly declined from 68.8% to 68.0%, but remained at near record highs. Operating margins were more problematic, declining by 196 bps, although according to the company, the entirety of the decline is attributed to constant currency. Despite the decline in profits, cash flows grew, as cash conversion improved due to better-aligned working capital.

Now, Let’s take a look at individual segments.

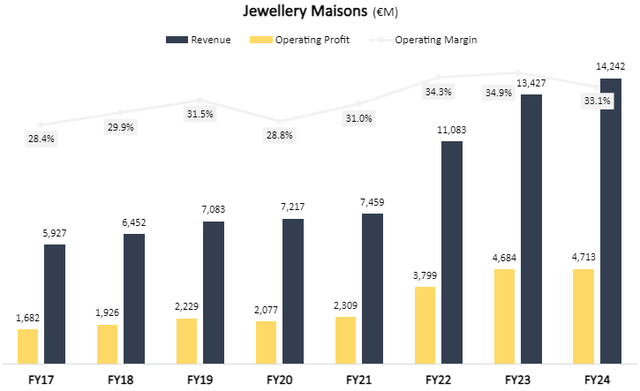

Created and calculated by the author using data from Richemont financial reports.

Jewellery Maisons, the company’s most important segment which includes Cartier, Van Cleef & Arpels, and Buccellati, saw revenue grow by 6% for the year and 3% in the quarter. Importantly, the company wasn’t able to sustain the margin levels of the last two years, unlike the high-lux group, which converted their Covid-driven cost cuts into a structural margin benefit.

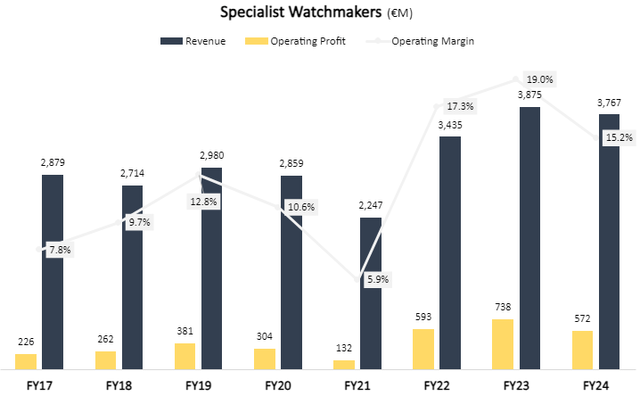

Created and calculated by the author using data from Richemont financial reports.

Specialist Watchmakers, comprised of eight different brands, sells virtually similar products and has the same business model as the Jewellery Maisons segment. The only difference is the brands are weaker. The segment experienced a 2.8% revenue decline for the year, and 1% in the quarter, which was better than expected. That said, margins dropped to 15.2%.

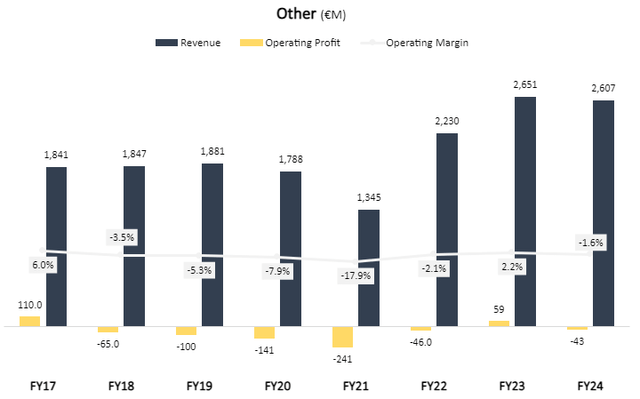

Created and calculated by the author using data from Richemont financial reports.

Lastly, the Other segment, which aggregates the weakest brands, and non-core activities like Watchfinders, experienced a 1.7% decline for the year and stayed flat in the quarter, but turned back to operating loss, after achieving profitability in FY23.

Overall, Richemont had a decent year in terms of growth, which was only a few points behind the high-lux average, but unlike the companies in the category, Richemont’s profitability deteriorated materially. On the contrary, it was significantly better than the laggards.

Bottom line, this was another year and another quarter that supported my thesis for Richemont being in its own tier, somewhere between the laggards and high-lux, slightly leaning more towards the latter.

Valuation & Growth Outlook

Richemont has a discontinued operations account in its P&L, which primarily includes results from YNAP, although there’s no acquisition in plain sight.

Management is determined to get rid of the business, and in my opinion, rightfully so. It’s unclear who would want to buy it though, and since the Farfetch deal broke down, there hasn’t been any news.

Aside from that headwind, Richemont doesn’t have any major catalysts in the near term, aside from much easier comps starting as soon as the next quarter.

The company continues to open new locations whilst getting rid of underperforming stores, the Cartier brand remains atop in terms of popularity, but currency headwinds and profitability questions remain.

Based on current consensus estimates for revenues, which I find reasonable, Richemont is expected to grow revenues by 4.1% in FY23, and 6.7% in FY25.

On the EPS front, excluding the losses of discontinued operations, Richemont is expected to achieve €7.1 in FY24, and €7.82 in FY25. Here, I have a few problems.

Richemont’s adjusted EPS declined in FY23, due to the profitability issues we discussed above, combined with dilution. The second half of the year was worse than the first in terms of margins, albeit it was in line with historical seasonality.

Considering the above, I don’t see how the company will grow EPS by almost 7.6% on revenue growth of 4% this year, and by 10.0% on revenue growth of 6.7% the next year.

Even if we take consensus estimates as they are, Richemont trades at 20.4x times FY24 earnings, whereas LVMH is in the 23x range, but with a much clearer path to beat estimates.

I think the narrower gap from high-lux, combined with the declining profitability, means Richemont isn’t attractive at current levels. However, because its comps become favorable already in the next quarter, the stock might do well in the near term. Therefore, I view it as a hold.

My price target of €142 per share reflects a 20x multiple over FY24 estimates.

Conclusion

Richemont is a unique jewelry-focused conglomerate in the luxury sector. The company owns several top-quality brands, led by Cartier, but has a lot of issues with its weaker brands and non-core activities.

It’s way better than the luxury laggards, but it’s also clearly inferior to high-lux, as reflected by the continued underperformance on growth, and the declining profitability.

I find the shares slightly overvalued at 20.5x FY24 estimates, considering these estimates seem too optimistic in terms of profitability improvements, and disregard the significant losses of the YNAP business, which still has no solution in sight.

However, with comps becoming much easier earlier than the majority of the sector, I see a path for the shares to work despite all of the above.

Therefore, I only downgrade Richemont to a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply