By Lynn Song

Recovery of industrial activity continued to build momentum

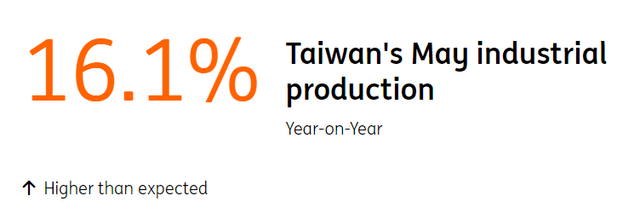

Taiwan’s May industrial production growth rose to 16.1% YoY, up from 14.5% YoY, soundly beating market forecasts (8.5% YoY) as well as our own slightly more upbeat forecasts of 10% YoY. May’s growth rate marked the highest level since July 2021, which was affected by base effects from the pandemic.

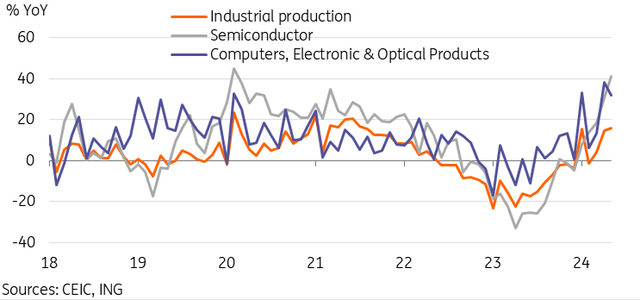

The strength of Taiwan’s industrial production has been concentrated in several sectors. Computers, electronics, and optical products (31.8% YoY) once again led the way in May for the second consecutive month, while electronic parts and components (29.3% YoY) also continued to outperform, driven by the semiconductor (41.0% YoY) subindex. Given semiconductors account for over a third of Taiwan’s total industrial production weight, the strong demand for semiconductors amid the AI boom has been a core pillar of the recent recovery of industrial activity.

Other categories saw considerably less impressive growth, or in some cases continued contraction. Machinery & equipment (-0.3% YoY) as well as motor vehicles & parts (-9.1% YoY) have been in negative growth for most of the year, and this trend continued in May’s data.

Taiwan’s industrial activity boosted by semiconductor demand from AI boom

Strong industrial production data signals upside risk to our forecasts

Recent data in Taiwan has largely been in line with or stronger than forecasts, and May’s industrial production adds another positive data point to this equation. External demand, particularly from North and Central America, has bolstered Taiwan’s growth year-to-date, and export orders data indicates that this will likely continue into the second half of the year. The slight tightening of monetary policy in the form of a 12.5bp March rate hike and the 25bp June RRR cut so far this year is not expected to substantively hinder momentum. A pivot to easing before the end of the year remains on the table if the Federal Reserve rate cut scenario plays out in line with our house view for three cuts starting in September.

While domestic demand has been lacklustre as shown by low retail sales growth and will likely continue to be suppressed by an unfavourable base effect in May and June, there are also some positive signals emerging in recent confidence and earnings data that could facilitate a modest recovery in the second half of the year.

In sum, recent developments have added to the upside risks to our 2024 GDP forecast, currently set at 3.7% YoY.

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply