The iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO) is holding strong, and we think that it’s because of the news that markets initially did not take a liking to, which was the OPEC+ supply cut timelines issued about a month ago. With supply considerations less volatile now, and demand mostly stabilized and proven many months into a higher rate environment, the situation for oil prices (CL1:COM) isn’t that bad. Moreover, there are geopolitical concerns on the horizon that create upside optionality. While we pass on the IEO, we are overweight some select oil picks.

IEO Breakdown

In our last coverage, we were focused on the supply dynamics and how OPEC+ might be gaming things around scheduled stockpiling of oil by the US. The idea is that since the US would have to stockpile, it would be the best time to relax some of the supply cut pressures for members that were a bit more desperate to put oil into the market to give them relief. The big players like Saudi Arabia were going to continue with cuts even though they’d become voluntary.

We thought that may have been temporary, but instead it was actually reflecting a change in direction where at the behest particularly of the UAE, some end to supply cuts needed to be delineated. With some internal conflicts in OPEC+, they decided to delineate their overall timeline, which will see oil return to the market in steps. The deep cuts would continue into 2025, but other cuts would be allowed to start expiring imminently.

This initially caused a rout in the oil market, which did not like that some strata of the cuts were coming to an end almost right away, but after a week or so, markets became more comfortable with it and now oil has made net headway to above $80 per barrel in Western indices.

The IEO ETF follows a bit of an idiosyncratic index that is, of course, levered to the commodity situation in oil. There is no Exxon Mobil (XOM), and there are 46 holdings. This more complex index means expense ratios are a little bit high for our liking at 0.4%.

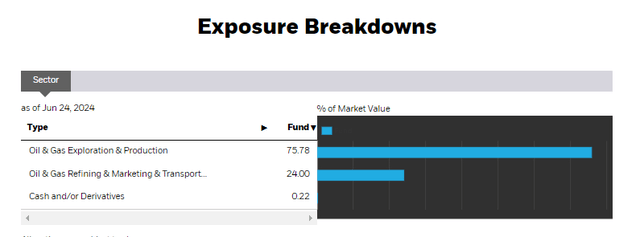

Sectors (iShares.com)

The other picks are a mix of non-commodity related exposures, and stocks like refineries that are levered to crack spreads, which are subject to supply dynamics of the industrial capacity to refine more than the underlying commodities, although with exposure to dislocations in different grades of crude. Nonetheless, 76% of the ETF is exposed to the price of oil.

Bottom Line

With a defined supply situation, that means demand changes are the only thing that will be new to the information set, outside of possible geopolitical effects that might come from Russia. There is upside optionality in the developments in Russia. The Russians are protesting that US missiles were used by the Ukrainians to attack targets in Crimea. These are pretty important strategic targets whose destruction could degrade the performance of precision munitions guided by satellites. Moreover, terrorist attacks in Dagestan are being blamed on Western subversion. This could be the prelude to some sort of escalation that may see some oil market dislocations. Even a more concerted effort by the Russians to keep their resources from the West in an oil and resource market that is not perfectly integrated could be enough to raise prices and put some further inflationary pressure on the West.

Of course, there is also the continued threat on the Strait of Hormuz and the impact that can have on the orderly function of the global oil markets.

With a less than 10x P/E for iShares U.S. Oil & Gas Exploration & Production ETF, there are clearly some good deals in the market. However, we prefer to be selective in these markets because there are usually ways to get some additional margin of safety to insulate from the inevitability that oil will move cyclically and somewhat unpredictably, even if a more defined supply situation from OPEC+ has been helpful to reduce uncertainty. Our pick remains Aker ASA (OTCPK:AKAAF) which is mostly exposed to oil but also has an industrial technology angle and is an example of one of our high conviction ideas that are now almost all exclusive to the Value Lab investing group.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply