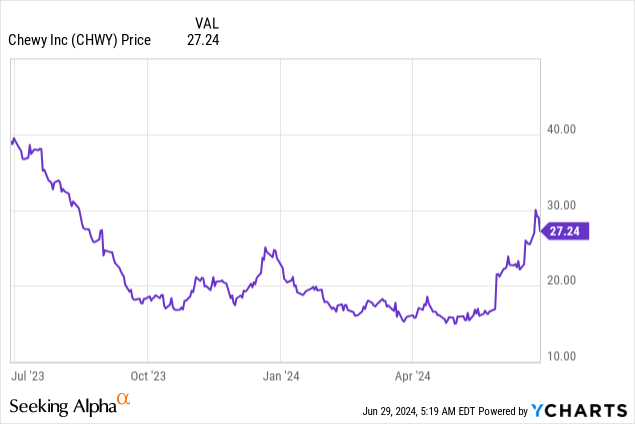

After more than a year in the penalty box for slower growth and weaker consumer spending, Chewy (NYSE:CHWY) has been on a recent tear. Driven by both a combination of well-received earnings prints as well as being talked up by the meme stock pundit “Roaring Kitty,” Chewy is now up ~15% year to date.

Yet amid the sharp recent rise, we do have to ask ourselves: how much strength has already been priced in, and can the rally keep going?

I last wrote a bullish article on Chewy in March, when the stock was still trading at a mere ~$18 per share. I had argued at the time that a reasonable valuation, share buybacks, and expanding margins would help drive the stock toward a rebound. Since then, Chewy has skyrocketed more than 70%, obliging me to re-assess my previous thesis on this company.

Yes – it’s true that Chewy’s recent Q1 earnings print, released in late May, showed a very positive margin story. Higher gross margins helped to feed substantial growth in adjusted EBITDA and free cash flow, which prompted the company to raise its full-year outlook. But now we do have to ask ourselves: how much of this strength is already priced in?

At current levels, I see a more balanced bull and bear thesis for this company, and I’m downgrading the stock to a neutral rating.

Here are the positives I still see for Chewy:

- Beloved consumer brand that is a clear category leader. Chewy has built up quite a lot of brand equity around being a very customer service-oriented company. This has helped the company build up a base of more than 20 million active customers, many of whom have their orders on autoship plans.

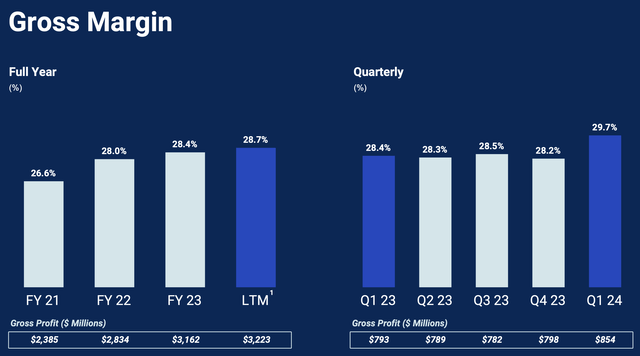

- Margin expansion was driven by expanding product categories. Chewy’s push to grow its own brand (Tylee’s), plus focus more on selling higher-margin hardgoods, has proven very effective at producing margin expansion. Gross margins have recently expanded to ~29%, vs. low-20s at the onset of the pandemic. In addition, Chewy’s success at passing on price increases to its customers has allowed it to preserve this gross margin progress even in the current inflationary environment.

- Nascent opportunities in pet telehealth and pet insurance. The craze in telehealth and doctor consultations via your mobile device is spilling over into the pet world, too. The company’s “Chewy Health” offering has built out a “Connect With A Vet” service, and it also has rolled out a pet pharmacy as well. In August, the company rolled out its “CarePlus” pet insurance plan, which was recently bolstered through a new partnership with Lemonade’s (LMND) pet insurance vertical. This is a broad, new opportunity for Chewy that can both accelerate its growth and grow its margins.

And yet now, I do see a number of risks as well:

- Commoditized product. While Chewy has certainly built up a following with autoship and its reputation for excellent customer service, at the end of the day the company is not selling differentiated goods and competes with brick and mortar pet outlets, both local shops and national chains.

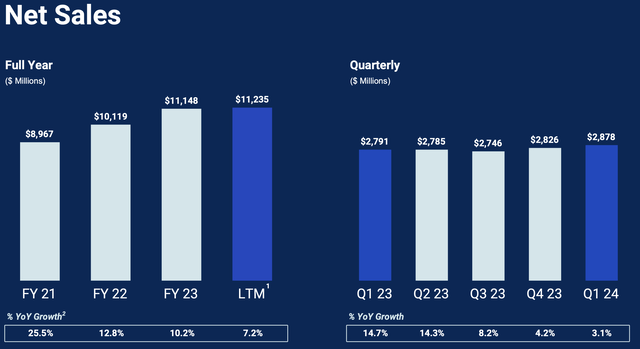

- Decelerating growth. Despite the shift in focus to the margin story, Chewy is still ultimately a low-margin retailer that requires economies of scale; and it hasn’t been able to slow its pace of deceleration.

We can also no longer quite make the argument that Chewy is cheap. At current share prices near $27, the company trades at a market cap of $11.87 billion. And after we net off the $1.14 billion in cash off the company’s latest balance sheet (much of which is earmarked for buybacks), the company’s resulting enterprise value is $10.73 billion.

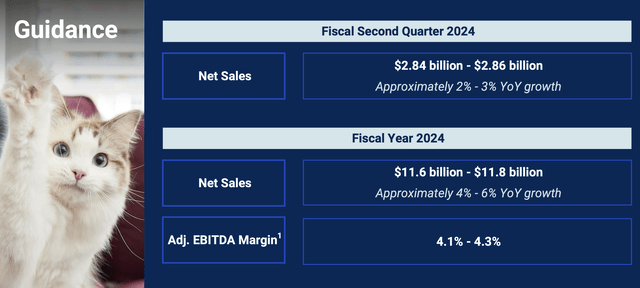

Meanwhile, as shown in the chart below, the company has updated its guidance to $11.6-$11.8 billion in revenue (4-6% y/y growth) and a 4.1-4.3% adjusted EBITDA margin, compared to a prior outlook of 3.8% adjusted EBITDA margins on the same revenue profile.

Chewy outlook (Chewy Q1 earnings deck)

The midpoint of Chewy’s latest outlook calls for $491.4 million in adjusted EBITDA. This puts the stock’s valuation multiple at 21.8x EV/FY24 adjusted EBITDA.

To me, the stock’s rising margin profile is balanced against slower growth, and I’m not willing to pay a >20x multiple of current-year EBITDA. I’m happily locking in gains (especially as “meme stock rallies” can tend to be shorter-lived in nature) and moving to the sidelines for a better entry point down the road.

Q1 download

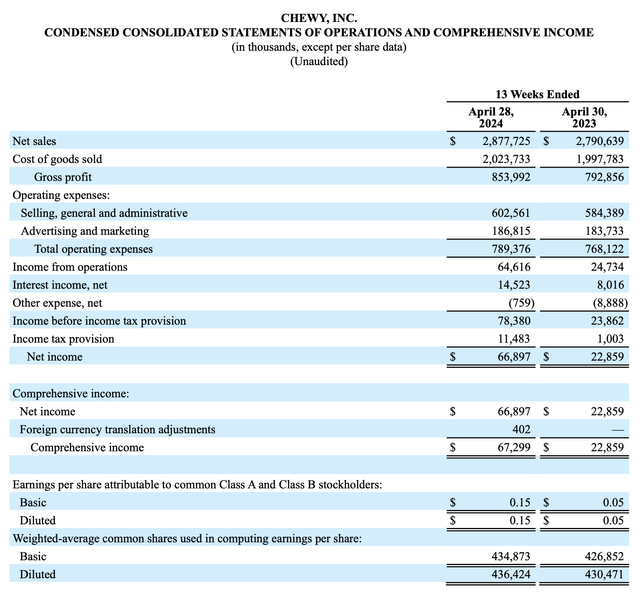

Let’s now go through the company’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Chewy Q1 results (Chewy Q1 earnings deck)

Revenue grew just 3.1% y/y to $2.88 billion, ahead of Wall Street’s $2.85 billion expectations (2.1% growth). But as can be seen in the chart below, growth has been decelerating sharply over the past few quarters, and fell 120bps sequentially from 4.3% growth in Q4. Only a year ago, Chewy had been growing revenue in the mid-teens.

Chewy trended revenue (Chewy Q1 earnings deck)

The good news: despite weaker macro conditions for discretionary pet spending, Chewy notes that it has been able to retain customers as well as reactivate lapsed customers at a better rate than expected. Per CEO Sumit Singh’s remarks on the Q1 earnings call:

Our Autoship customer base remains healthy and is continuing to grow. Further, on the topic of customers this quarter, we saw some encouraging customer trends. The work we have been doing to sharpen our already strong value proposition, for example, through pet type personalization began to pay off this quarter. Our efforts are driving higher response rates and had a positive effect on net new customers as well as reactivated customers, which were particularly strong in the quarter and up mid-teens relative to the prior year period.

Notably for the first time since 2022, both new customer acquisition and reactivations modestly exceeded our internal expectations in Q1.”

Additionally encouraging was a continued trend in rising gross margins. As shown below, gross margins rose 130bps y/y and 150bps sequentially to an all time record of 29.7%. The boost in margins was primarily driven by revenue mix, as the company’s sponsored ads and insurance sales have become a slightly more meaningful percentage of company revenue.

Chewy gross margins (Chewy Q1 earnings deck)

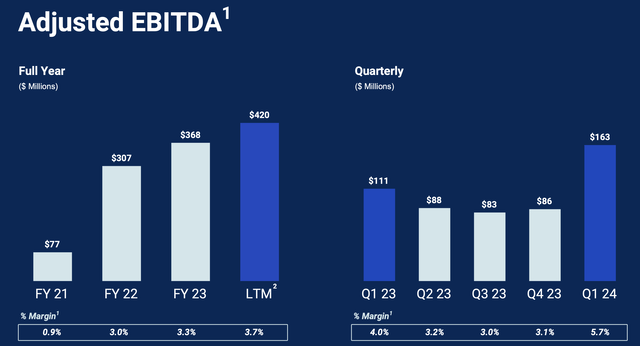

Opex cost controls have also helped to push Adjusted EBITDA up to $163 million: up 47% y/y and also representing an EBITDA margin record of 5.7%, up 170bps y/y.

Chewy adjusted EBITDA (Chewy Q1 earnings deck)

Key takeaways

In my view, the market has already given Chewy plenty of credit for its goody in profits and margin expansion. With its higher valuation, I’d prefer to de-risk my position and move to the sidelines.

Read the full article here

Leave a Reply