We initiate Universal Health Services (NYSE:UHS) with a buy rating. We like this mid-cap healthcare company for several reasons but improvements in certain areas are still desired. They have grown consistently while maintaining a strong balance sheet and have created value for their shareholders.

The company was established in 1979 and expanded rapidly through acquisitions. They are now one of the country’s largest providers of hospitals and healthcare services through one of its 27 inpatient acute care hospitals, 333 inpatient behavioral health facilities, and other facilities. They treated 3.6 million patients in 2023, revenues reached $14.3bn, and they have approximately 96,700 employees.

Historical Financials

Revenues have grown at a respectable 7% over 10 years and EPS of 8.7% over the same period. Shareholders’ equity has also increased at a stable 6.6%. Share prices have, however, underperformed the SP500.

UHS Price Performance Against SP500 (Seeking Alpha)

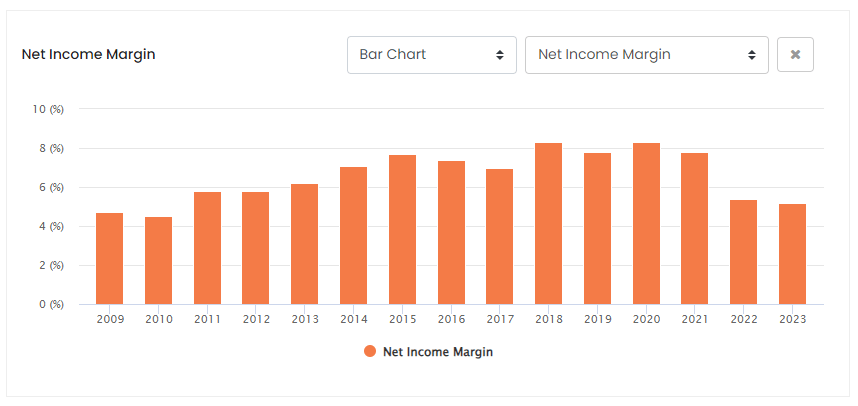

Net income margins grew initially but have declined more recently. FY22 and FY23 saw margins decline and net income fall. FY22 revenues increased by 6% but operating expenses, including salaries, increased by 10%. Operating costs in FY23 increased by 5.7%, and were slower than revenue growth of 6.6%. However, this gain was negated by higher interest costs and the net income margin remained somewhat unchanged.

UHS Net Income Margins (ROCGA Research)

FY23 saw some positive changes and we can see the improvements. Patients served increased from 3.4m to 3.6m, up 5.9% compared to FY22. Similarly, employees increase from 94,000 to 96,700, up 2.9%. Salaries, wages, and benefits increased from $6.8bn to $7.1bn. All these point to a slowing of the pace of wage increase to $73,500 per employee from FY22’s $71,940, an increase of only 2.2%. A revenue increase of 6.6% points to higher revenues per patient and employee.

Even though UHS managed to maintain its top-end growth, over the past two years inflationary wages, and higher costs have weakened profitability.

We think this might be about to change. FY24 Q1 results were more robust and beat consensus estimates with approximately 2% higher revenues and 17.6% higher EPS. Compared to the same quarter last year, revenues grew by 10.8% and operating expenses increased by 8.3%. All else remaining stable, the adjusted EBITDA Margin increased from 12.1% to 13.7%, and the net income margin clocked in higher at 6.6% compared to 4.8% over the same period last year.

UHS’s two reportable segments are acute care and behavioral health. Acute care amounts to approximately 55% of the revenues and behavioral health approximately 43%. Behavioral health, however, enjoys a significantly higher margin and contributes more to net income.

The acute care market size is forecast to grow at 5.62% CAGR till 2030. The report also indicates that changing lifestyles, unhealthy habits, and increased consumption of alcohol and tobacco, and the lack of physical activities will drive growth in the industry. These will be non-Covid related diseases impacting positively on the industry.

Similarly, a study on the behavioral health market indicates a CAGR of 5.1% till 2032. The study describes behavioral health care as:

diagnosing, preventing, and treating these conditions. It includes the services provided by psychiatrists, neurologists, social workers, counselors, and physicians.

The drivers for this segment of the industry are very similar to acute care, including increasing substance abuse and ADHD. Depression and anxiety are the largest segments within the behavioral health industry and these are brought on by pressures from relationships, work, and academic. With wider recognition of mental health issues, governments are looking to fund and improve the infrastructure around the behavioral health market. Greater funding will bring improved and new procedures for psychological treatment and an expansion of the industry.

Technological advances will contribute to the industry, and the use of online applications powered by advancements in artificial intelligence will expand. More powerful software driven by AI will increase market penetration, but with the additional risk of cannibalizing into inpatient or outpatient treatment.

A large portion of revenues is generated in Texas, Nevada, and California, making the company susceptible to changes in the state’s regulatory competitive environment. Increasing wage inflation, as in FY22, and higher interest rates, as in FY23 could adversely affect future earnings.

The increasing cost of living may result in more uninsured and underinsured patients walking through the doors of UHS treatment centers.

The company has been prudent and conservative with its excess cash and returned to shareholders via repurchases. They have repurchased over $3.5bn over the past five years from FY18 to FY23 and reduced the shares outstanding from 93m to 67m.

The company also has a very modest dividend yield of 0.4%.

The company has managed to grow while keeping its net debt-to-EBITDA stable. These have dipped over the past couple of years, but we can expect them to recover with margins improving. The cash

Value, Growth, Quality, And Momentum

UHS is a high-quality company and should perform well over the medium to long term. They are well entrenched in the communities they serve and are committed to expanding further by building and acquiring hospitals in rapidly growing markets.

UHS’s management is optimistic about continued growth and improving margins. Management projects FY24 revenues between $15.41bn to $15.71bn, representing a midpoint increase of 8.95%. The EPS is expected to be in the range of $13.0 to $14.0 representing an increase of 28%

With a consensus EPS of $13.8 and revenues of $15.58bn, the FY24 PE ratio is 13.4x and PS is 0.8x. We can see some improvements in the net income margin, which is expected to be 6%, up from last year’s 5.2%.

UHS scores well on several factor grades, especially in areas of valuation, growth, and momentum.

Apart from dividend yield, UHS has high grades on all valuation metrics. They are trading at a discount to the sector averages on practically all metrics. They have higher grades in profitability as well. With strong growth and momentum, we expect UHS to outperform the industry.

An area we would like to see some changes is the control structure. From the 2023 10K, p 54.

The right to elect the majority of our Board of Directors and the majority of the general shareholder voting power resides with the holders of Class A and C Common Stock, the majority of which is owned by Alan B. Miller, Executive Chairman of our Board of Directors.

Class A and Class C Common Stock constitute 10.3% of the total shares outstanding but have 90.4% of the total voting rights. This lack of control may explain why UHS trades at a discount to the sector.

Conclusion

UHS is a quality company that is undervalued compared to the industry averages. The company is forecast to grow its revenues faster than the sector average and improve margin. We would, however, like to see wider shareholder control. The company should be trading at the sector average PE, giving us a potential upside of up to 40%. We initiate with a buy rating.

Read the full article here

Leave a Reply